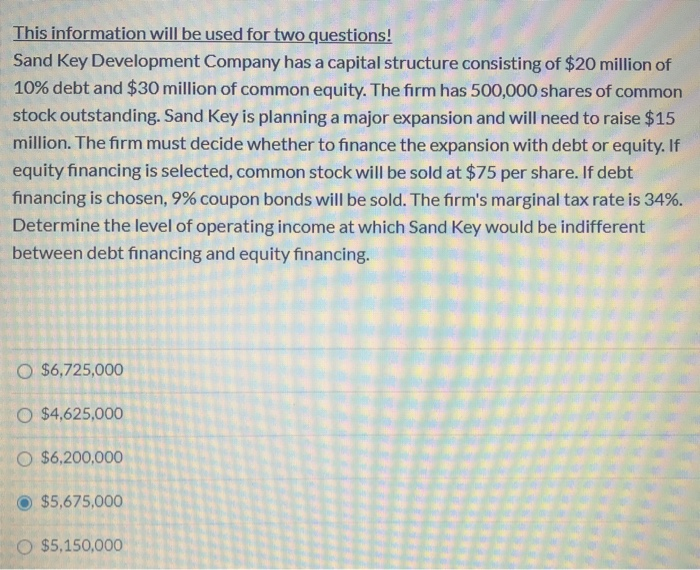

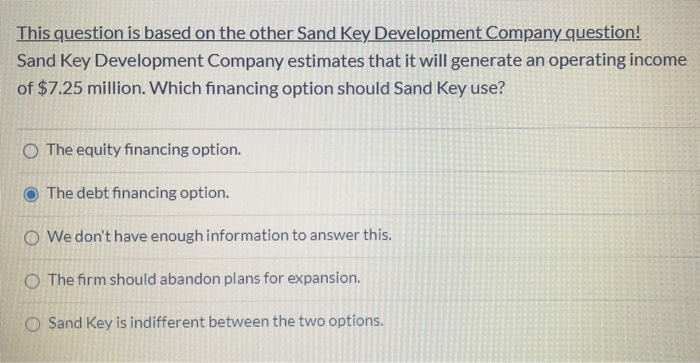

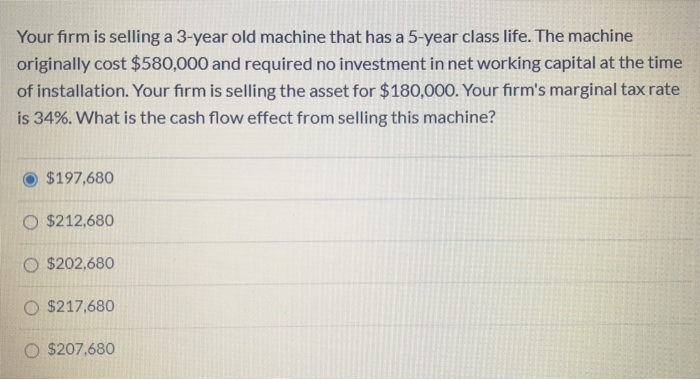

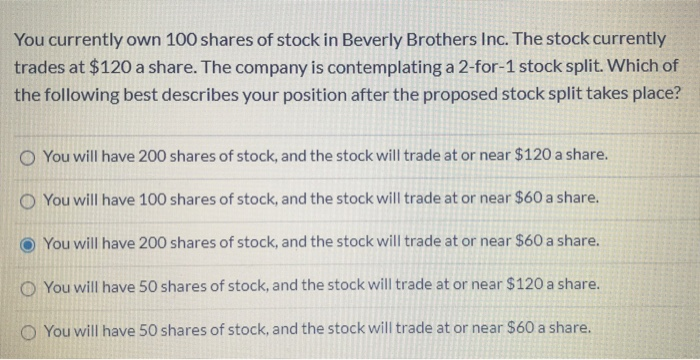

This information will be used for two questions! Sand Key Development Company has a capital structure consisting of $20 million of 10% debt and $30 million of common equity. The firm has 500,000 shares of common stock outstanding. Sand Key is planning a major expansion and will need to raise $15 million. The firm must decide whether to finance the expansion with debt or equity. If equity financing is selected, common stock will be sold at $75 per share. If debt financing is chosen, 9% coupon bonds will be sold. The firm's marginal tax rate is 34%. Determine the level of operating income at which Sand Key would be indifferent between debt financing and equity financing. O $6,725,000 O $4,625,000 O $6,200,000 $5,675,000 O $5,150,000 This question is based on the other Sand Key Development Company question! Sand Key Development Company estimates that it will generate an operating income of $7.25 million. Which financing option should Sand Key use? O The equity financing option. The debt financing option. O We don't have enough information to answer this. The firm should abandon plans for expansion. O Sand Key is indifferent between the two options. Your firm is selling a 3-year old machine that has a 5-year class life. The machine originally cost $580,000 and required no investment in net working capital at the time of installation. Your firm is selling the asset for $180,000. Your firm's marginal tax rate is 34%. What is the cash flow effect from selling this machine? $197,680 $212,680 O $202,680 O $217,680 O $207,680 You currently own 100 shares of stock in Beverly Brothers Inc. The stock currently trades at $120 a share. The company is contemplating a 2-for-1 stock split. Which of the following best describes your position after the proposed stock split takes place? You will have 200 shares of stock, and the stock will trade at or near $120 a share. O You will have 100 shares of stock, and the stock will trade at or near $60 a share. You will have 200 shares of stock, and the stock will trade at or near $60 a share. O You will have 50 shares of stock, and the stock will trade at or near $120 a share. You will have 50 shares of stock, and the stock will trade at or near $60 a share