Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This input is based on another Chegg answer, however, as seen, part of the answers are wrong. The answer on Chegg also had inputs such

This input is based on another Chegg answer, however, as seen, part of the answers are wrong.

This input is based on another Chegg answer, however, as seen, part of the answers are wrong.

The answer on Chegg also had inputs such as "Loss on sale of inventory, Bad debt expense, Loss on sale of fixed assets", however, there are no entries with this name.

The journal entries available are:

No journal entry required

Accounts payable

Accounts receivable

April, Capital

April, Withdrawals

Cash

Inventory

Land, building and equipment

Liabilities

Liquidation expenses

March, Capital

March, Withdrawals

May, Capital

May, Withdrawals

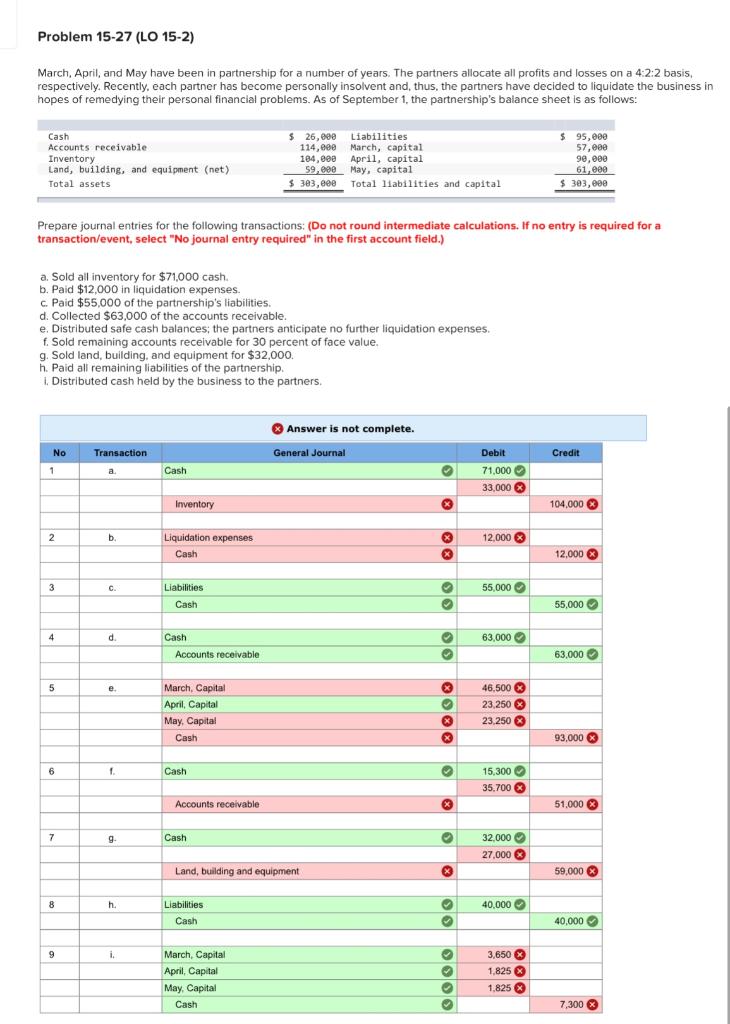

Problem 15-27 (LO 15-2) ) March April, and May have been in partnership for a number of years. The partners allocate all profits and losses on a 4:2:2 basis, respectively. Recently, each partner has become personally insolvent and, thus, the partners have decided to liquidate the business in hopes of remedying their personal financial problems. As of September 1, the partnership's balance sheet is as follows: Cash Accounts receivable Land, building, and equipment (net) Total assets $ 26,800 Liabilities 114,00 March, capital 184,eee April, capital 59, eee May, capital $ 383,eee Total liabilities and capital $ 95, eee 57.ee 90,000 61 000 $ 303, eee Prepare journal entries for the following transactions: (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. Sold all inventory for $71,000 cash. b. Paid $12,000 in liquidation expenses. c. Paid $55,000 of the partnership's liabilities d. Collected $63,000 of the accounts receivable. e. Distributed safe cash balances; the partners anticipate no further liquidation expenses. f. Sold remaining accounts receivable for 30 percent of face value. g. Sold land, building, and equipment for $32,000. h. Paid all remaining liabilities of the partnership. Distributed cash held by the business to the partners Answer is not complete. No Transaction General Journal Credit 1 a Cash Debit 71,000 33,000 X Inventory 104,000 2 b. 12,000 Liquidation expenses Cash 12.000 3 3 c 55,000 Liabilities Cash 55,000 4 d. 63.000 Cash Accounts receivable 63,000 5 e. March, Capital April, Capital May, Capital Cash 46.500 23.250 3 23.250 X X 93,000 X 6 1. Cash 15,300 35.700 Accounts receivable 3 51.000 & 7 g Cash 32,000 27,000 $ Land, building and equipment X 59,000 X 8 h. 40,000 Llabilities Cash 40,000 9 i. March, Capital April, Capital May Capital Cash 3,650 X 1.825 X 1.825 7,300 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started