Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a 3 part question here are all the options for general journal this is part 2 of the question pls answer both parts

This is a 3 part question

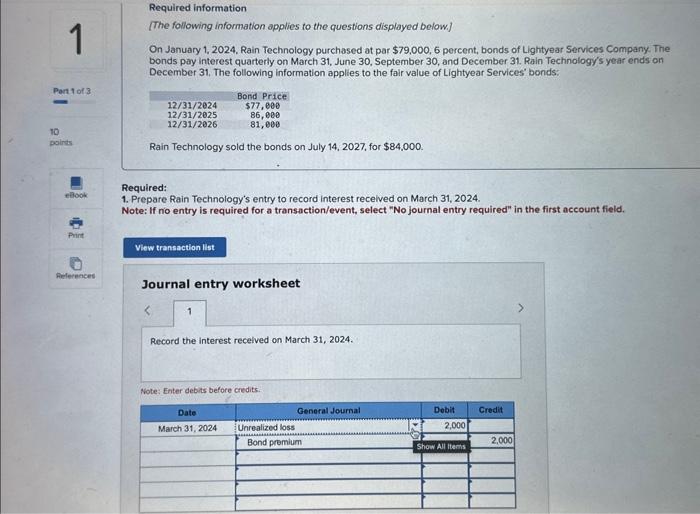

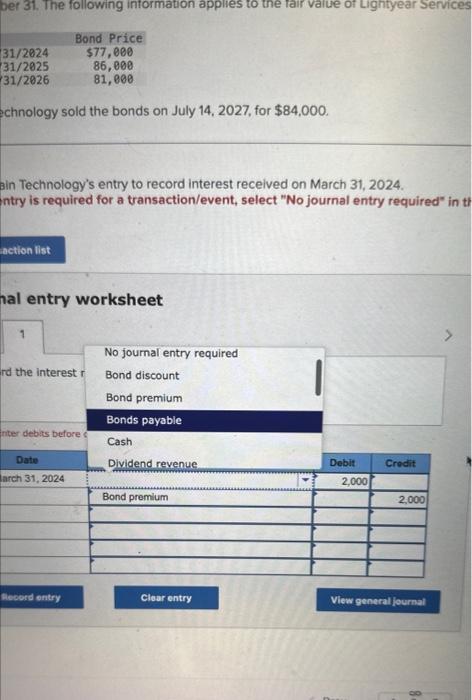

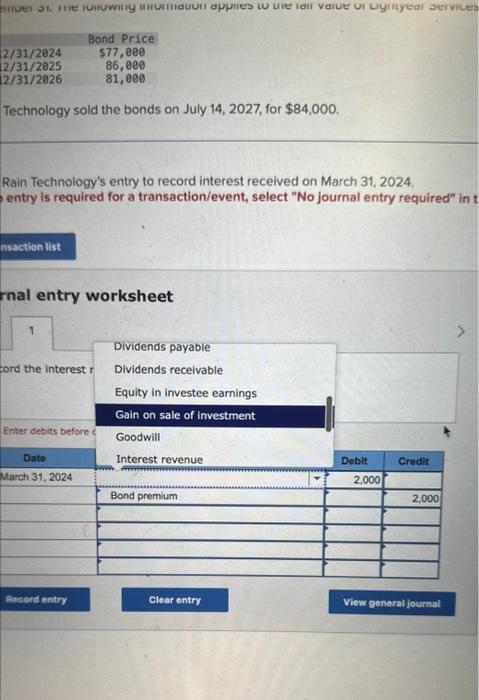

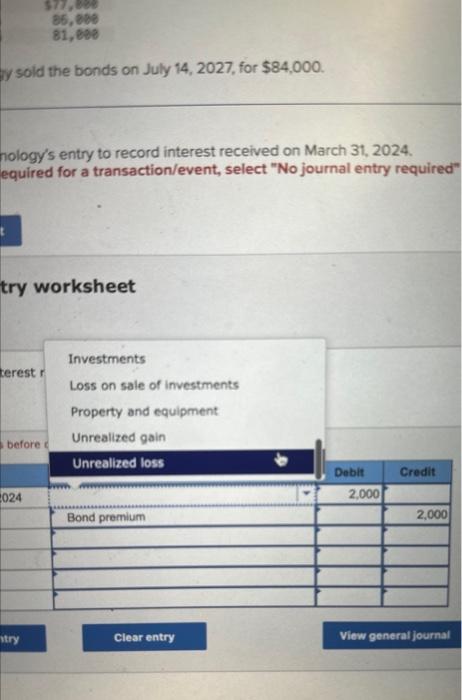

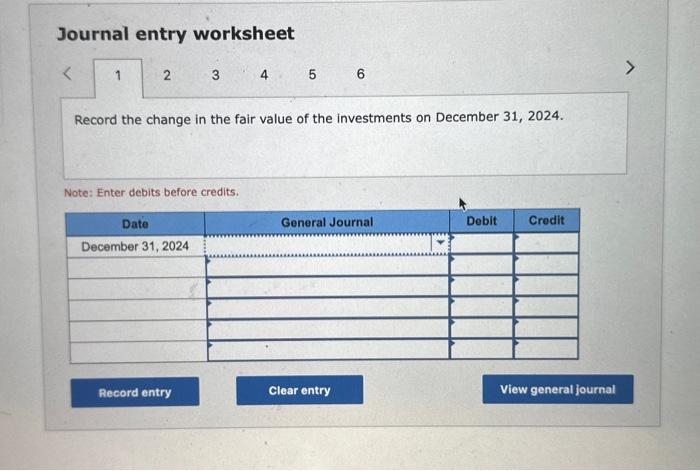

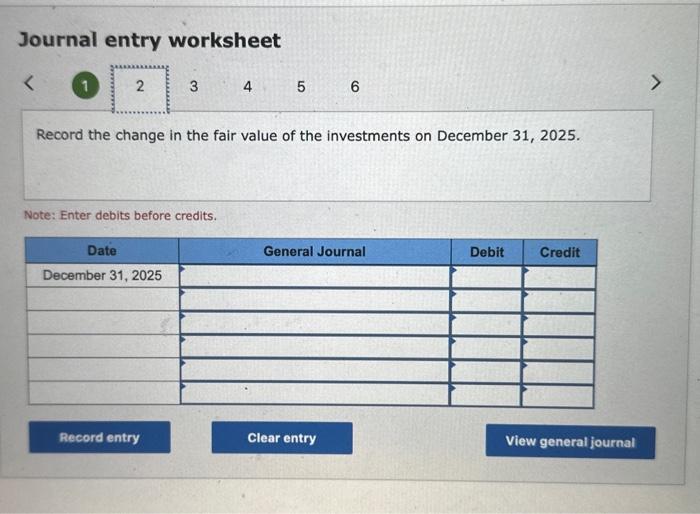

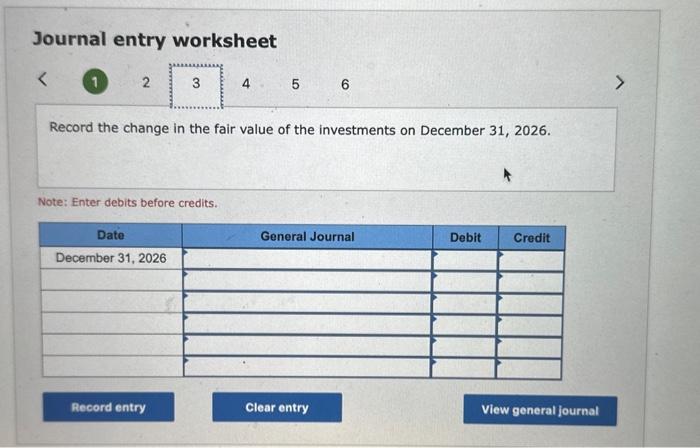

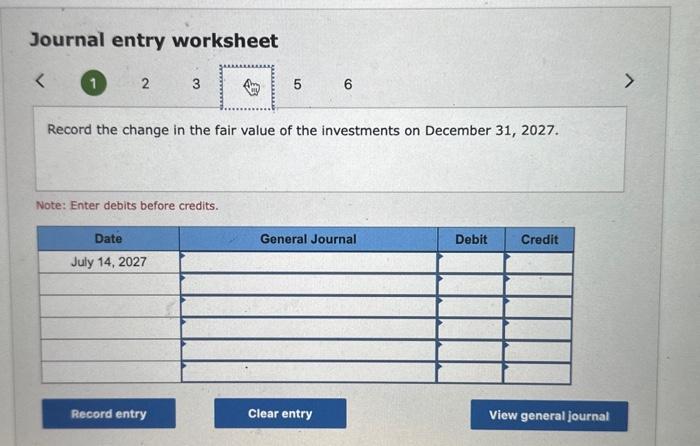

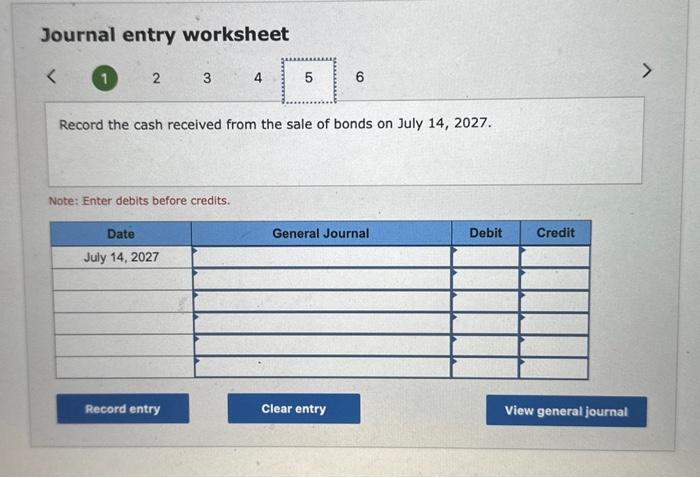

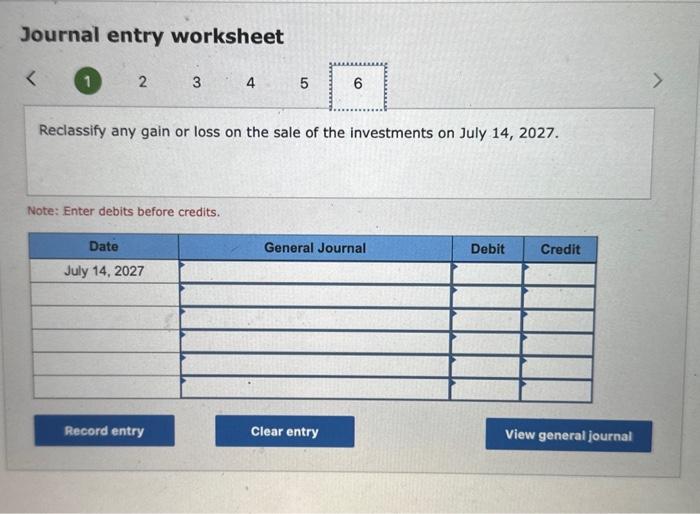

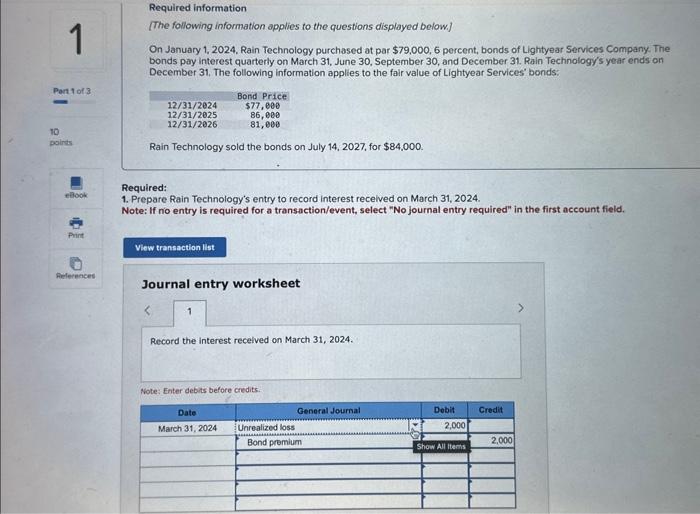

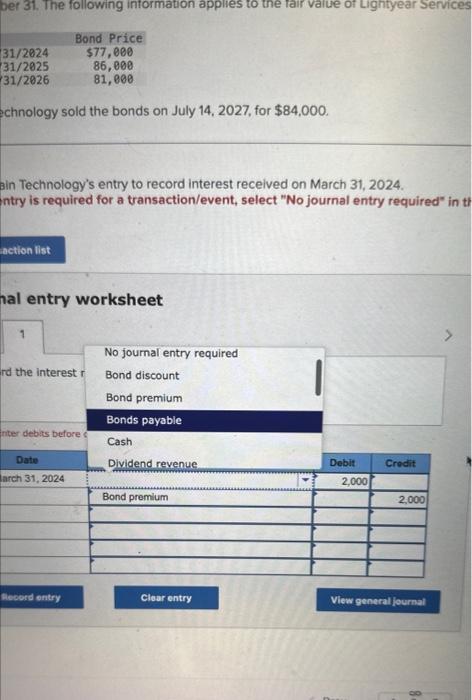

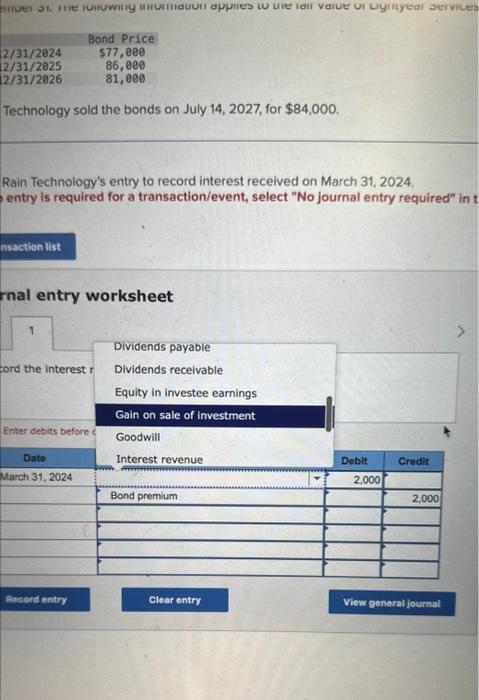

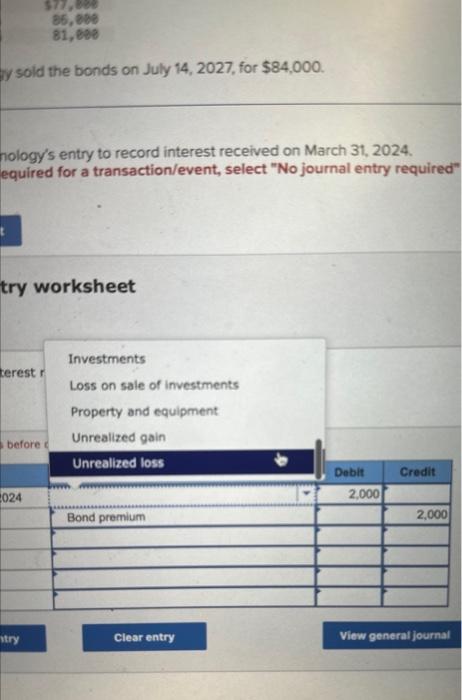

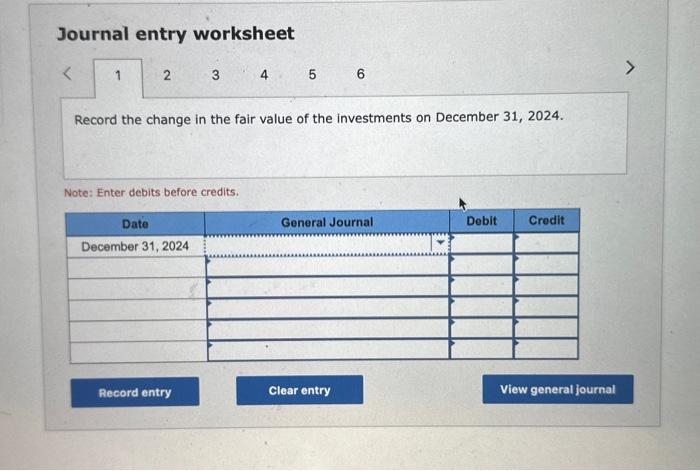

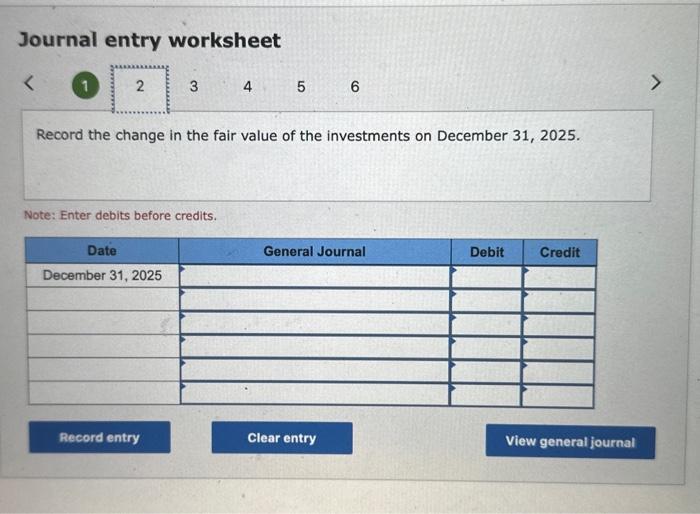

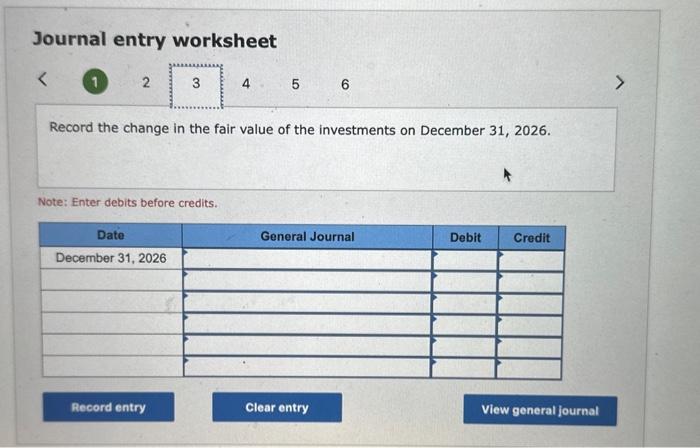

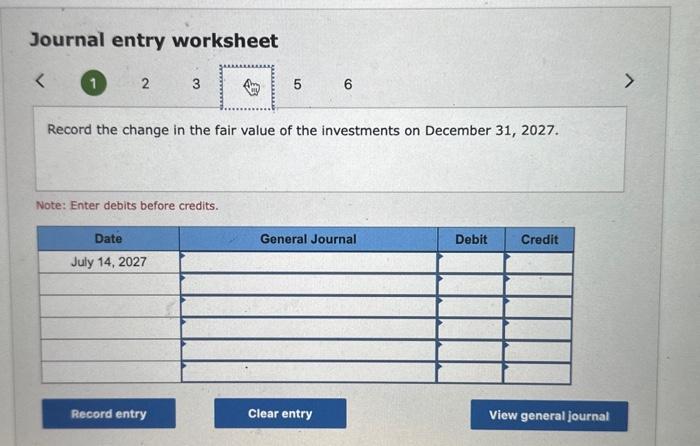

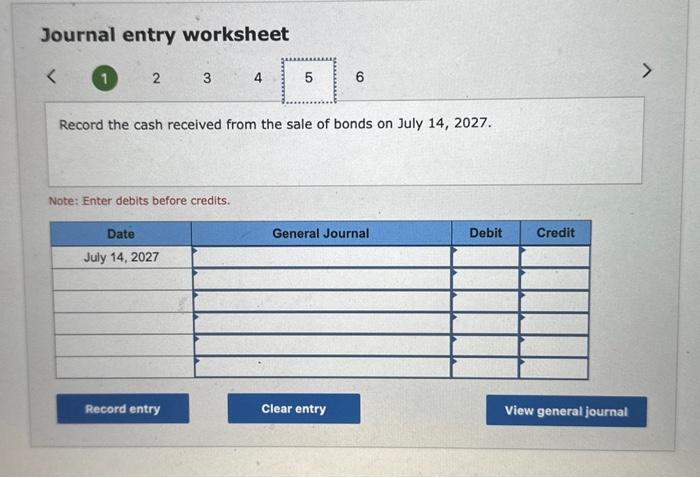

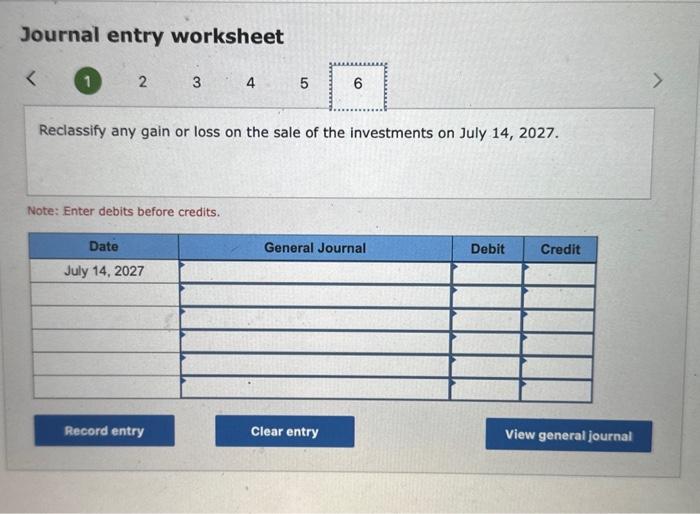

Required information [The following information applies to the questions displayed below.] On January 1, 2024, Rain Technology purchased at par $79,000,6 percent, bonds of Lightyear Services Company. The bonds pay interest quarterly on March 31, June 30, September 30, and December 31. Rain Technology's year ends on December 31. The following information applies to the fair value of Lightyear Services' bonds: Rain Technology sold the bonds on July 14,2027 , for $84,000. Required: 1. Prepare Rain Technology's entry to record interest recelved on March 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. chnology sold the bonds on July 14,2027 , for $84,000. Bin Technology's entry to record interest recelved on March 31, 2024. intry is required for a transaction/event, select "No journal entry required" in th entry worksheet Technology sold the bonds on July 14,2027 , for $84,000. Rain Technology's entry to record interest received on March 31, 2024. entry is required for a transaction/event, select "No journal entry required" in t rnal entry worksheet sold the bonds on July 14,2027 , for $84,000. nology's entry to record interest received on March 31, 2024. equired for a transaction/event, select "No journal entry required" worksheet Journal entry worksheet 2 Record the change in the fair value of the investments on December 31,2024. Note: Enter debits before credits. Journal entry worksheet Record the change in the fair value of the investments on December 31,2025. Note: Enter debits before credits. Journal entry worksheet Record the change in the fair value of the investments on December 31,2026 . Note: Enter debits before credits. Journal entry worksheet Record the change in the fair value of the investments on December 31,2027. Note: Enter debits before credits. Journal entry worksheet Record the cash received from the sale of bonds on July 14,2027. Note: Enter debits before credits. Journal entry worksheet 1 2 Reclassify any gain or loss on the sale of the investments on July 14, 2027. Note: Enter debits before credits

here are all the options for general journal

this is part 2 of the question pls answer both parts its clear they're connected as seen in the top left corner i have seperated part 3 in a different question. All general journal options are the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started