This is a Canadian Tax question

please assist by showing calculations/formulas

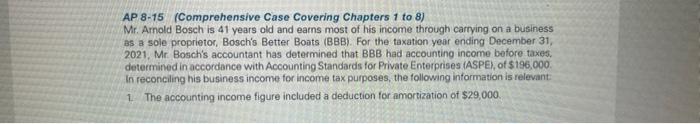

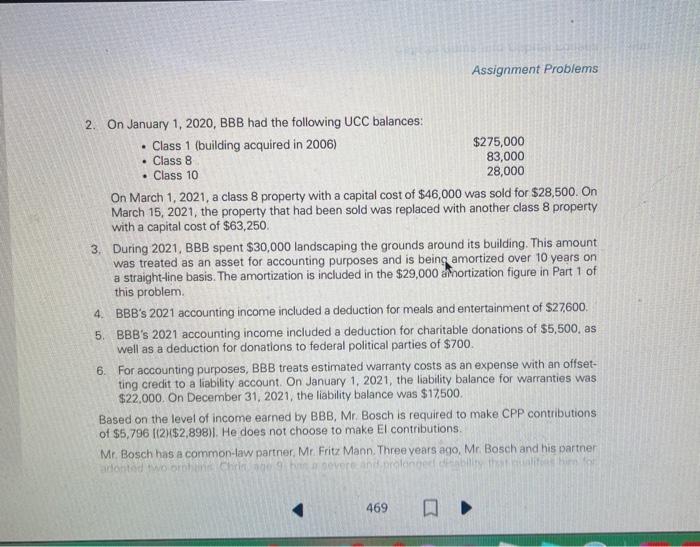

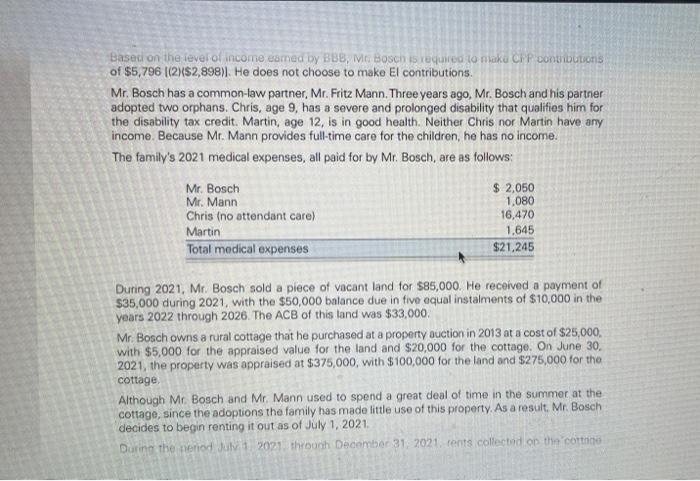

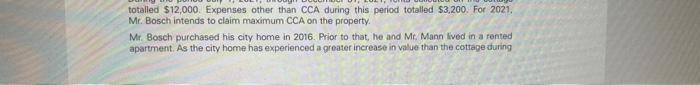

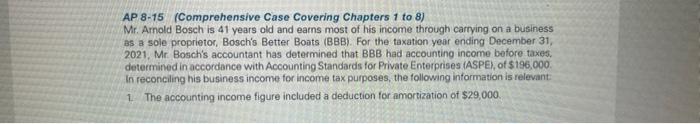

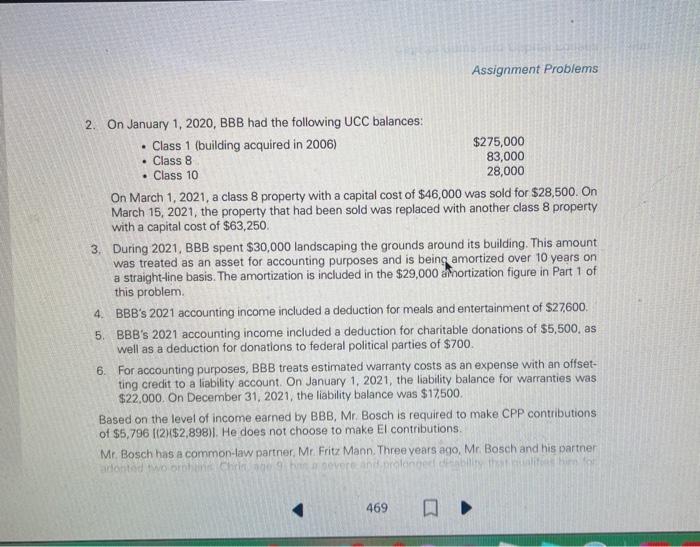

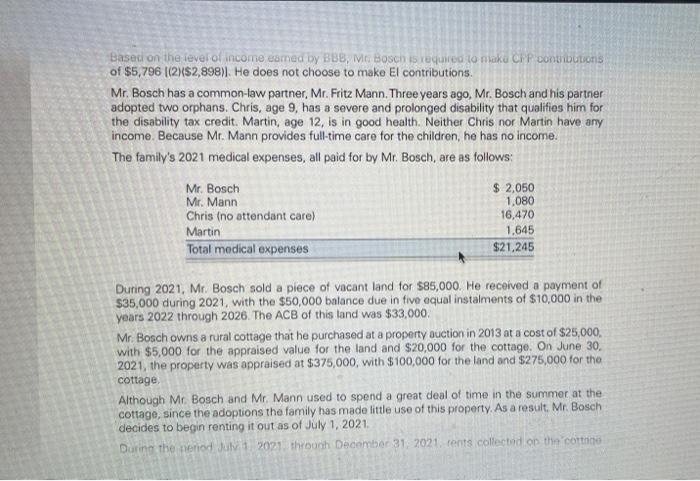

AP 8-15 (Comprehensive Case Covering Chapters 1 to 8) Mr. Arnold Bosch is 41 years old and earns most of his income through carrying on a business as a sole proprietor, Bosch's Better Boats (BBB). For the taxation year ending December 31, 2021, Mr. Bosch's accountant has determined that BBB had accounting income before taxes, determined in accordance with Accounting Standards for Private Enterprises (ASPE), of $196,000. In reconciling his business income for income tax purposes, the following information is relevant 1. The accounting income figure included a deduction for amortization of $29,000. 2. On January 1, 2020, BBB had the following UCC balances: Class 1 (building acquired in 2006) Class 8 . Class 10 . Assignment Problems $275,000 83,000 28,000 On March 1, 2021, a class 8 property with a capital cost of $46,000 was sold for $28,500. On March 15, 2021, the property that had been sold was replaced with another class 8 property with a capital cost of $63,250. 3. During 2021, BBB spent $30,000 landscaping the grounds around its building. This amount was treated as an asset for accounting purposes and is being amortized over 10 years on a straight-line basis. The amortization is included in the $29,000 amortization figure in Part 1 of this problem. 4. BBB's 2021 accounting income included a deduction for meals and entertainment of $27,600. 5. BBB's 2021 accounting income included a deduction for charitable donations of $5,500, as well as a deduction for donations to federal political parties of $700. 6. For accounting purposes, BBB treats estimated warranty costs as an expense with an offset- ting credit to a liability account. On January 1, 2021, the liability balance for warranties was $22,000. On December 31, 2021, the liability balance was $17,500. Based on the level of income earned by BBB, Mr. Bosch is required to make CPP contributions of $5,796 [12H$2,898)1. He does not choose to make El contributions. 469 Mr. Bosch has a common-law partner, Mr. Fritz Mann. Three years ago, Mr. Bosch and his partner adonted two orphans Chris, age 9 has a severe and pility that cualifies hin Based on the level of income eamed by BBB, Mr. Bosch is required to make CPP contributions of $5,796 [(2)$2,898)]. He does not choose to make El contributions. Mr. Bosch has a common-law partner, Mr. Fritz Mann. Three years ago, Mr. Bosch and his partner adopted two orphans. Chris, age 9, has a severe and prolonged disability that qualifies him for the disability tax credit. Martin, age 12, is in good health. Neither Chris nor Martin have any income. Because Mr. Mann provides full-time care for the children, he has no income. The family's 2021 medical expenses, all paid for by Mr. Bosch, are as follows: Mr. Bosch Mr. Mann Chris (no attendant care) Martin Total medical expenses $ 2,050 1,080 16,470 1,645 $21,245 During 2021, Mr. Bosch sold a piece of vacant land for $85,000. He received a payment of $35,000 during 2021, with the $50,000 balance due in five equal instalments of $10,000 in the years 2022 through 2026. The ACB of this land was $33,000. Mr. Bosch owns a rural cottage that he purchased at a property auction in 2013 at a cost of $25,000, with $5,000 for the appraised value for the land and $20,000 for the cottage. On June 30, 2021, the property was appraised at $375,000, with $100,000 for the land and $275,000 for the cottage. Although Mr. Bosch and Mr. Mann used to spend a great deal of time in the summer at the cottage, since the adoptions the family has made little use of this property. As a result, Mr. Bosch decides to begin renting it out as of July 1, 2021. During the period July 1 2021, through December 31, 2021, rents collected on the cottage totalled $12,000. Expenses other than CCA during this period totalled $3,200. For 2021, Mr. Bosch intends to claim maximum CCA on the property. Mr. Bosch purchased his city home in 2016. Prior to that, he and Mr. Mann lived in a rented apartment. As the city home has experienced a greater increase in value than the cottage during the last six years, Mr. Bosch will designate the city home as his principal residence for the years 2016 through 2021. Over the years, Mr. Bosch has made several purchases of the common shares of Low Tech Ltd., a widely held public company. In 2019 he bought 150 shares at $55 per share. In 2020, he bought an additional 125 shares at $75 per share. In February 2021 he bought an additional 300 shares at $95 per share. On November 11, 2021, after the company announced that most of its product claims had been falsified, Mr. Bosch sold 275 shares at $5 per share. No dividends were paid on the shares in 2021. Required: Calculate Mr. Bosch's minimum net income and taxable income for 2021, and his minimum 2021 federal income tax owing, including any CPP contributions payable. Ignote. provincial income taxes, any instalment payments he may have made during the year, and GST/ HST & PST considerations. AP 8-15 (Comprehensive Case Covering Chapters 1 to 8) Mr. Arnold Bosch is 41 years old and earns most of his income through carrying on a business as a sole proprietor, Bosch's Better Boats (BBB). For the taxation year ending December 31, 2021, Mr. Bosch's accountant has determined that BBB had accounting income before taxes, determined in accordance with Accounting Standards for Private Enterprises (ASPE), of $196,000. In reconciling his business income for income tax purposes, the following information is relevant 1. The accounting income figure included a deduction for amortization of $29,000. 2. On January 1, 2020, BBB had the following UCC balances: Class 1 (building acquired in 2006) Class 8 . Class 10 . Assignment Problems $275,000 83,000 28,000 On March 1, 2021, a class 8 property with a capital cost of $46,000 was sold for $28,500. On March 15, 2021, the property that had been sold was replaced with another class 8 property with a capital cost of $63,250. 3. During 2021, BBB spent $30,000 landscaping the grounds around its building. This amount was treated as an asset for accounting purposes and is being amortized over 10 years on a straight-line basis. The amortization is included in the $29,000 amortization figure in Part 1 of this problem. 4. BBB's 2021 accounting income included a deduction for meals and entertainment of $27,600. 5. BBB's 2021 accounting income included a deduction for charitable donations of $5,500, as well as a deduction for donations to federal political parties of $700. 6. For accounting purposes, BBB treats estimated warranty costs as an expense with an offset- ting credit to a liability account. On January 1, 2021, the liability balance for warranties was $22,000. On December 31, 2021, the liability balance was $17,500. Based on the level of income earned by BBB, Mr. Bosch is required to make CPP contributions of $5,796 [12H$2,898)1. He does not choose to make El contributions. 469 Mr. Bosch has a common-law partner, Mr. Fritz Mann. Three years ago, Mr. Bosch and his partner adonted two orphans Chris, age 9 has a severe and pility that cualifies hin Based on the level of income eamed by BBB, Mr. Bosch is required to make CPP contributions of $5,796 [(2)$2,898)]. He does not choose to make El contributions. Mr. Bosch has a common-law partner, Mr. Fritz Mann. Three years ago, Mr. Bosch and his partner adopted two orphans. Chris, age 9, has a severe and prolonged disability that qualifies him for the disability tax credit. Martin, age 12, is in good health. Neither Chris nor Martin have any income. Because Mr. Mann provides full-time care for the children, he has no income. The family's 2021 medical expenses, all paid for by Mr. Bosch, are as follows: Mr. Bosch Mr. Mann Chris (no attendant care) Martin Total medical expenses $ 2,050 1,080 16,470 1,645 $21,245 During 2021, Mr. Bosch sold a piece of vacant land for $85,000. He received a payment of $35,000 during 2021, with the $50,000 balance due in five equal instalments of $10,000 in the years 2022 through 2026. The ACB of this land was $33,000. Mr. Bosch owns a rural cottage that he purchased at a property auction in 2013 at a cost of $25,000, with $5,000 for the appraised value for the land and $20,000 for the cottage. On June 30, 2021, the property was appraised at $375,000, with $100,000 for the land and $275,000 for the cottage. Although Mr. Bosch and Mr. Mann used to spend a great deal of time in the summer at the cottage, since the adoptions the family has made little use of this property. As a result, Mr. Bosch decides to begin renting it out as of July 1, 2021. During the period July 1 2021, through December 31, 2021, rents collected on the cottage totalled $12,000. Expenses other than CCA during this period totalled $3,200. For 2021, Mr. Bosch intends to claim maximum CCA on the property. Mr. Bosch purchased his city home in 2016. Prior to that, he and Mr. Mann lived in a rented apartment. As the city home has experienced a greater increase in value than the cottage during the last six years, Mr. Bosch will designate the city home as his principal residence for the years 2016 through 2021. Over the years, Mr. Bosch has made several purchases of the common shares of Low Tech Ltd., a widely held public company. In 2019 he bought 150 shares at $55 per share. In 2020, he bought an additional 125 shares at $75 per share. In February 2021 he bought an additional 300 shares at $95 per share. On November 11, 2021, after the company announced that most of its product claims had been falsified, Mr. Bosch sold 275 shares at $5 per share. No dividends were paid on the shares in 2021. Required: Calculate Mr. Bosch's minimum net income and taxable income for 2021, and his minimum 2021 federal income tax owing, including any CPP contributions payable. Ignote. provincial income taxes, any instalment payments he may have made during the year, and GST/ HST & PST considerations