Question

This is a case evaluation about Carrefour, the largest retailer in Europe. It is a global retailer and it performs its duties to enable many

This is a case evaluation about Carrefour, the largest retailer in Europe. It is a global retailer and it performs its duties to enable many people to purchase their products as well as sustainable growth and bolster fair trade. The advancement of the company has expanded outside France and acquired large acquisitions. This case highlights and brings forward the effort on how the company financed its advancement in the previous years by analyzing Carrefour’s loss, profit and balance sheet. It also presents topics in international finance such as Eurobond market, currency risk management and interest-rate parity. Carrefour’s management financed the advancement of the company through securities however; investment banks of Carrefour recommended that it consider borrowing loans in British pounds in order to benefit from the borrowing power in pound sterling.

Financial Issue

The company had several cash sources, which include trade notes, accounts payable, short-term liabilities and shareholder’s equity. It also acquired land between 2001 and 2005 along with several current and fixed assets. Moreover, the company’s total sales in the summer of 2002 were (EUR) 53.9 Billion from over 5,200 stores across the globe. The main problem that the company faced was its ability to finance debt that would allow it to obtain funds required to acquire large acquisitions. It had two options: to borrow in British pounds Sterling via the Eurobond market or continue with current financial policy. Investment bank analysts suggested a 10-year bond particularly for financing a 750 (Euros) Million fund. They further noted that the bond could be issued at 5.26% in Euros, 5.376% in British pounds, 3.626% in Swiss Francs and 5.6% in U.S dollars. Although the nominal coupon rate was high and there was significant lack of material business activity in the U.K, the British pound issue appeared to offer the lowest cost of funds.

Current Financial Policy

- The ability of the company to manage Exchange Rate Risk (ERR) was sufficient due to its maintenance of high discipline. The company mainly operates within the local economy to source its products and any foreign-currency risk especially on imported goods, which are hedged through forward contracts on the currency. The forward market involves contracting in present-day for future purchase or sale of foreign exchange to guard against ERR. The interest Rate Parity (IRP) is a condition whereby the relationship between spot and interest rates and foreign currency values of two nations are in equilibrium in the financial market as determined by the Exchange Rate Determination (ERD) model. For instance, if an individual trades currencies between U.K and USA and the IRP theory holds, then the rate of return on dollar deposits equal the expected rate of return in British pounds that is, (RoR$=RoR€). IRP model affects international borrowing in that, an increase in foreign currency interest rate leads to borrowings in that currency to increase and an in increase in investment abroad results into decrease in domestic interest rate. Moreover, if there is an increased supply in foreign in the spot market, sport rates decrease and an increase in foreign currency demand in the forward market causes forward rates to increase.

Multi-Domestic Financing

- The company’s advancement is attributed to foreign securities financing and 90% of Carrefour’s borrowings are in Euros. Additionally, the company’s foreign exposure is mostly hedged through forward contracts. The company needs to borrow €750 million Euros therefore; management should decide what currency the company should borrow and the amount that should be hedged in the forward market. The company operates with high financial leverage with eight billion in equity and total borrowings of thirteen billion therefore, the company should borrow the €750 million Euros through the Eurobond market because the debt ratio is higher compared to the equity ratio.

Assuming the bond is borrowed at par, the following bond alternatives are achieved.

Table 1

Aug-02 | Face Value | 1-(1+i)^-10 | Present Value Annuity | (1+i)^10 | Future Present Value | Present Bond Value |

Euros | 750,000,000 | 0.21114 | 346,400,077 | 1.26765 | 31,061,398 | 377,461,476 |

British Pounds | 750,000,000 | 0.2702 | 332,474,376 | 1.37024 | 28,735,820 | 361,210,196 |

Swiss Francs | 750,000,000 | 0.15513 | 359,305,836 | 1.18361 | 33,266,801 | 392,572,637 |

U.S Dollars | 750,000,000 | 0.15513 | 359,305,836 | 1.18361 | 33,266,801 | 392,572,637 |

Table 2

Forward Rates

Spot Rate | 1.593 | 0.688 | 1.02 |

Year | British Pound | Swiss Franc | U.S Dollar |

1 | 1.37 | 3.38 | 2.32 |

2 | 1.36 | 2.83 | 2.04 |

3 | 1.38 | 2.57 | 1.84 |

4 | 1.4 | 2.43 | 1.73 |

5 | 1.42 | 2.35 | 1.66 |

6 | 1.45 | 2.3 | 1.61 |

7 | 1.47 | 2.25 | 1.58 |

8 | 1.49 | 2.21 | 1.55 |

9 | 1.51 | 2.18 | 1.53 |

10 | 1.52 | 2.16 | 1.51 |

Table 3

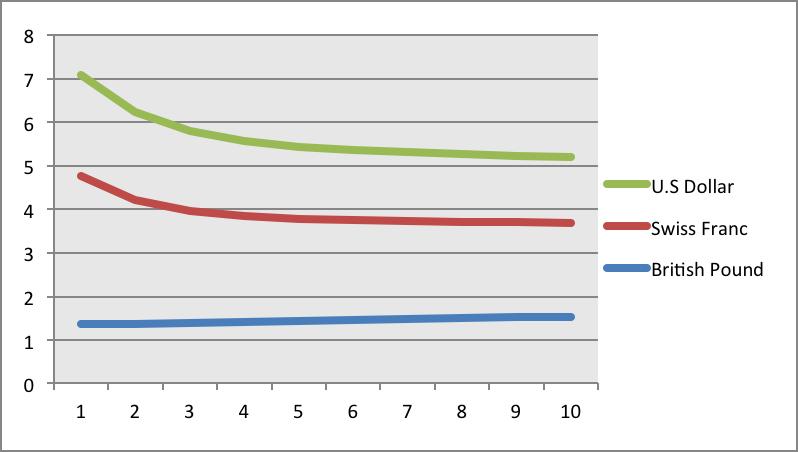

Forward Rates Trend

8 7 6 5 st 4 3 2 1 0 1 2 3 4 5 6 7 8 9 10 U.S Dollar Swiss Franc British Pound

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Introduction This is a case assessment about Carrefour the biggest retailer in Europe It is a worldwide retailer and it performs its obligations to empower several individuals to buy their products an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6298a8f2c4aa2_40921.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started