Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a CFA Level 1 Exam sample. Thanks for your effort. Btw you do not need to explain any question. I just need answers.

This is a CFA Level 1 Exam sample. Thanks for your effort.

Btw you do not need to explain any question. I just need answers. It is a multiple choice exam with 20 question.

Do you ask 4 question or 4 page ?

Page 2 Questions: 1,2,3

1) Jason Vasco, CFA, is the director for a major Talia-owned investment management firm branch in Rasen. Talia is known as the world's centre of investment management with securities iaws stricter than the CFA Institute Code and Standards, and Vasco is governed by Talia's laws. In Rasen, an emerging market, the local securities laws and regulations are lenient. They are very vague in the definition of insider trading and have no provision regulating soft-dollars. Which of the following is most accurate? a) Vasco must comply with Talia's law. b) Vasco only has to comply with Rasen's law and therefore can take the fullest advantage of soft-dollar arrangements. c) Vasco should not worry about Rasen's law, it is an early stage emerging market and the law enforcement will be lax, if any at all. 2) Eric Lindt, CFA manages 15 emerging market pension funds. He recently decided to buy 100,000 shares in a publicly listed company whose prospects are considered "above industry norms" by many analysts. The company's shares trade rarely because most managers take a buy-and-hold" strategy due to company's small free float. Before placing the order with his dealer, Lindt aim to allocate the purchased shares according to the weighted value of each of his clients portfolios When it came time to execute the trades, the dealer was only able to buy 50.000 shares. To prevent violating Standard 3B Fair Dealing it would be most appropriate for Lindt to reallocate the 50.000 shares purchased by: a) allocating randomly but giving funds left out priority on the next similar type trade. b) distributing them equally among all pension fund portfolios, c) reducing each pension fund's allocation proportionately. 3) Kevin Dudman, CFA, has just been offered an exciting new position with Walton Asset Management and decides that he will resign from his current position with Trust Asset Management. Before he resigns he decides to ensure that he uses some of the skills and materials he has developed at Trust Asset Management. He is least likely to violate the code and Standards, if he takes: a) stock market analysis prepared by Dudman when he was working at Trust Asset Management b) internal contact information on Trust Asset Management's major clients which is available from other external sources c) experience in pricing unlisted securities which he gained while attending training courses which were paid for by Trust Asset Management. 2/8 4) Joseph Morgon, CFA, is a research analyst covering the Bourgogne Vineyard Corporation Morgon's parents bought $50 worth of Bourgogne Vineyard Corporation shares for his two-year old son on his birthday. Under Standard VI(A), Disclosure of Conflicts, Morgon: a) must sell the shares immediately. b) does not need to disclose the fact that his son owns the shares of Bourgogne Vineyard Corporation. must disclose the ownership of the shares by a member of his immediate family 5) Wimpy Greenback, CFA, is the research analyst responsible for following Brown Appliances Company. This analysis suggests the stock should be rated a "sell because the market outlook for the firm's new products is bleak compared with that of the closest competition. Greenback lives on the same street as the CFO of Brown Appliances. During a recent neighborhood gathering, Greenback's wife overheard the wife of the Chief Financial Officer of Brown Appliances complaining that her husband had been working late due to a hostile takeover threat from a foreign appliances group. This fact has not yet been made public by Brown Appliances. Upon returning to his office, Greenback released a strong "buy" recommendation to the public based on this new information Greenback: a) was in full compliance with the Code and Standards. b) violated the Code and Standards because he did not have a reasonable and adequate basis for his recommendation violated the Code and Standards by failing to distinguish between facts and opinions in his recommendation 6) The fixed-income corporate finance department of Golden Brothers, an investment banking firm, has decided to compete for the advisory and underwriting bond offering of Kia Telcom, a 'hot' telecommunications company. The firm's equity brokerage unit is about to publish a "sell recommendation on Kia Telcom due to an unexpected announcement of cost overruns. The head of fixed-income investment banking has asked the head of the equity brokerage unit to change the recommendation from "sell" to "buy" before distributing the research report to clients. According to the code and Standards, the best course of action for the equity brokerage unit is to: a) place Kia Telcom on a restricted list and publish only factual information about the company. b) immediately re-rate the stock to a "buy" since the firm's overall interest supersedes that of the client c) assign a more senior analyst to decide if the stock deserves a higher rating for the sake of objectivity since less senior analysts may err in judgment 3/8 7) Fiona Griffiths, CFA, is an equity sales manager at a London-based Tiger Securities branch in an emerging market. Initial public offerings are often oversubscribed making it difficult to ensure a fair allocation. Griffiths understands the local environment so she is able to influence the allocation process so that she can personally subscribe to the maximum she can afford and then allocate the rest to her clients. Her clients never complain because they have almost always profited from investing in the emerging market over the last couple of years. Which of the following describes Griffiths' situation? a) Griffiths is in compliance with the Code and Standards since her clients are satisfied. b) Griffiths violates the code and Standards due to the priority she gives to transactions. c) Griffiths violates the code and Standards since she lacks independence and objectivity 8) Edward Tannenbaum, CFA, was recently asked by his employer to submit an updated document providing the history of his employment and qualifications. The existing document on file was submitted when he was hired five years ago. His employer notices the updated version shows Tannenbaum obtained his MBA degree two years ago, whereas the earlier version indicated he had already obtained his MBA. The position Tannenbaum was hired required a minimum qualification of an MBA. When asked about this discrepancy, he said that although he did not have an MBA at the time of hire, he later went back to school and obtained his MBA. He added that he is currently meeting all qualifications, in addition he also holds a CFA, which was not a requirement for the hire. Did he violate CFA Codes and Standards? a) No. b) Yes, with regard to Reference to the CFA Designation. Yes, with regard to Misconduct. 9) Martha Pierpont, CFA, works for the securities custody department of North Pole Trust Bank. She makes a reciprocal referral fee arrangement with Robert Underhill, CFA, an adviser at BestAdvice.com. She does not disclose the referral arrangement but Underhill does so by inserting one clause in BestAdvice.com's investment advisory agreement that includes .. from time to time referral fees may be arranged with a number of selected securities custodians. Clients of BestAdvice regularly use North Pole's services and pay referral fees. Which of the following is most accurate? a) Only Pierpont complies with the Code and Standards. b) Neither Pierpont nor Underhill comply with the code and Standards. c) Both Pierpont and Underhill comply with the Code and Standards 4/8 10) Charles Chaplane, who is not a member of CFA Institute, is a senior partner of a small brokerage firm, Blue Moon Securities, which recently participated in a large stock offering. The offering company has been given an unfavorable recommendation by his research department in the past two quarters due to lacklustre performance. Chaplane immediately calls his junior analyst John Blumenberg, CFA, and instructs him to upgrade his recommendation. Blumenberg comes up with a more favorable recommendation within a short period of time. Blumenberg is least likely to have violated the Standards because he failed: a) to avoid a conflict of interest. b) to maintain independence and objectivity. c) to make a fair statement of investment performance. 11) Patricia Lualua, CFA, is a portfolio manager of Raven Asset Management. Recently she won a mandate from the Flemish Widows pension fund trustees to manage the investments of the fund. One of the Flemish Widows trustees privately mentions that Lualua should direct her trades to Churner Securities, which is owned by a relative of one of the trustees. Lualua, for fear of losing the account, directs 50% of the trades to Churner Securities. She is pleased to find that Churner's quality of execution is good and the emerging market research quality is excellent Although Flemish Widows does not invest in emerging markets, Lualua finds the research useful for the other funds she manages. Lualua decides not to inform anyone regarding the situation. According to the Code and Standards: a) Lualua should stop trading with Churner Securities. b) Lualua may continue trading with Churners Securities. c) Lualua should disclose this arrangement to Flemish Widows. 12) Muhammad Taqdir, CFA, is an investment manager whose clients are high-net worth individuals. Taqdir is a member of a local charity organization that supports children with asthma. During a meeting at the charity, Taqdir recommends that the organization sends a letter to Xara Corporation requesting they make a donation to the charity. Taqdir knows of Xara Corporation's involvement in this cause from previous discussions with a colleague in the office. The chief executive and owner of Xara Corporation is a client of the firm. The charity, citing Taqdir's recommendation, sent the letter and received a substantial donation. According to the CFA Institute Code and Standards: a) Taqdir has done his best since the organisation received a substantial donation b) Taqdir should not have disclosed the identity of the chief executive without his prior approval. c) Taqdir should have informed the chief executive of Xara that he is going to receive a letter from the organization 5/8 13) Marco Maggio, CFA, is scheduled to visit the corporate headquarters of Venus Industries. Maggio expects to use the information obtained there to complete his research report on Venus stock. The location of Venus Industries is within a 15-minute drive of a prestigious golf course. On arrival at the Venus premises, Marco Maggio learns that Venus is offering Maggio an extension of his stay that weekend and invites him for a day of golf with all expenses pald. Venus Industries also offers to pay for all the expenses for the trip, including the cost of meals, hotel room, and air transportation back to Venus Industries. The total cost for the weekend is about $2,000 Which of the following actions would be the best course for Maggio to take under the Code and Standards? a) Pay for all travel expenses, including costs of meats and incidental items and politely reject the golf outing offer. b) Reject the golf outing offer but accept the reimbursement of the travel expenses since they are legitimate business-related expenses. c) Accept both the expenses-paid trip and the golf outing as more information can often be extracted from the company in a more leisurely environment. 14) Simon Freud, CFA, is a private-client investment manager at Super Echo investment firm based in Vienna, Austria. One of his clients in Monaco offers him bonus compensation beyond that provided by his firm if the portfolio performance exceeds the agreed benchmark. To make it more attractive to Freud, his client will send the bonus compensation to a tax-free account in a tax haven. Freud a) should report the situation to the compliance officer of the CFA institute according to Standard 1(B) Independence and Objectivity b) should turn down the additional compensation offer because it violates Standard IV(8) Additional Compensation Arrangements. c) may accept the additional compensation subject to the approval of his employer as required by Standard IV(B) Additional Compensation Arrangements. 15) Joseph Luny, CFA, is a bank analyst with London Fog Securities. On a recent trip to see a bank that he covers, he was presented with a rosy outlook for the bank's earnings in the next two years which is above the consensus expectations. When probed further about the assumptions, the CFO inadvertently mentioned that serious discussions are taking place for a tender offer of a smaller well-managed bank that Luny also covers. This information has not been made public. Luny feels very lucky to receive this unexpected tip and rushes back to his office to revise his projections and advise his major clients to buy the smaller bank's stock. What should Luny have done instead? a) Luny should request his supervisor's approval. b) Luny is entitled to take advantage of the information as he did not misappropriate it. c) Luny should refrain from taking any action on the smaller bank's stock until the bank has made the tender offer information public 6/8 16) Simon Sasserman is a trust investment officer at a bank in a small affluent town. He enjoys lunching every day with friends at the country club, where his clients have observed him having numerous drinks. Back at work after lunch, he clearly is intoxicated while making investment decisions. His colleagues make a point of handling any business with Sasserman in the morning because they distrust his judgment after lunch. a) Sasserman violates the Code and Standards as his conduct raises questions about his professionalism and competence b) Sasserman does not violate the code and Standards as he can always use his judgement in the morning c) Warner does not violate the code and Standards as his company and his all clients know his habit. 17) The Professional Conduct staff under the direction of CFA Institute are least likely to make an enquiry into a member's conduct when: a) they perform random checks on members' professional conduct. b) members self-disclose on their professional Conduct Statement that they are involved in litigation regarding their investment advice c) the media reports on a member whose professional conduct appears to have been unethical. 18) Jonathan Seller, CFA, works for an investment bank that is acting as the principal underwriter for an issue of stock of a large tire manufacturer Seller found out that the prospectus has concealed an impending product recall due to a quality control error. Since the number of items affected is relatively small, the product recall is planned to be a quiet affair. However Seller is aware that recently a competitor's product recall received a large amount of adverse publicity. The preliminary prospectus has been distributed. According to the Code and Standards: a) Seller should do nothing as it may jeopardize the success of the issue. b) Seller should revise the preliminary prospectus to include the omitted information to avoid any possible misrepresentation. c) Seller should inform CFA Institute of the violation of the Code and Standards so he can clear himself of the possible misrepresentation. 7/8 19) Tamara Deneuve, CFA, is an investment manager in charge of Asian equity portfolios. Together with her colleagues, she has developed a new proprietary valuation model for emerging markets in Asia. Back testing using 12-month earnings data, the valuation model produces favorable results particularly when applied to certain industries, but not to others. Deneuve has decided to implement the new model to those industries but use the usual model for the others. According to the code and Standards: a) Deneuve must inform her clients prior to implementing the model. b) Deneuve has the sole right to any proprietary model she has developed c) Deneuve should not implement the model since it can only be applied to certain industries. 20) Which of the following is not a concept covered by the CFA Institute Code of Ethics? a) Competence b) Integrity and diligence. c) Remuneration levels of investment professionals. 8/8 Page 3 Questions: 4,5,6

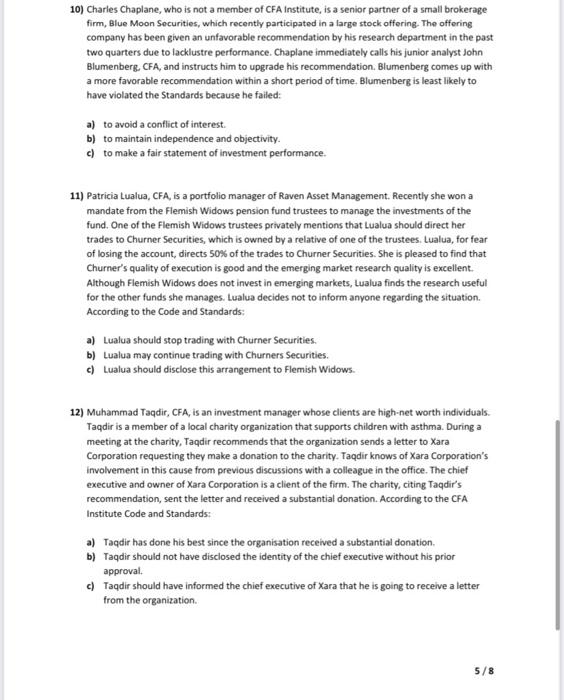

Page 4 Questions: 7,8,9

Page 5 Questions: 10,11,12

No need for explaination. Just choices. Please let me know if it is okay. (I couldn't get what you mean by 4 subparts)

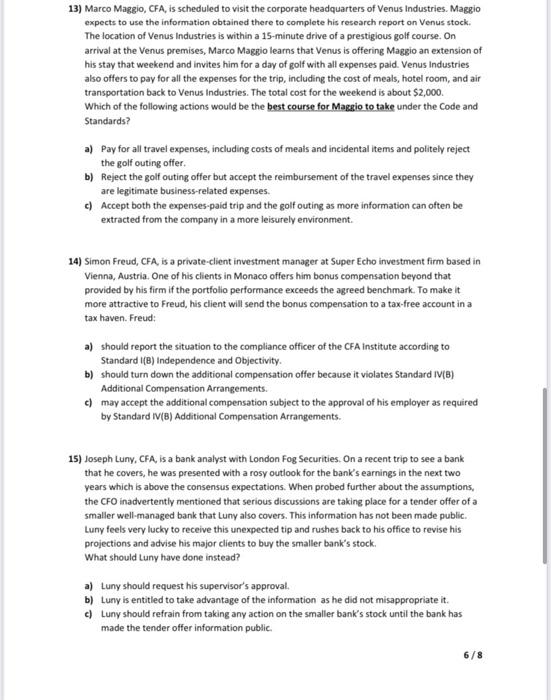

Step by Step Solution

There are 3 Steps involved in it

Step: 1

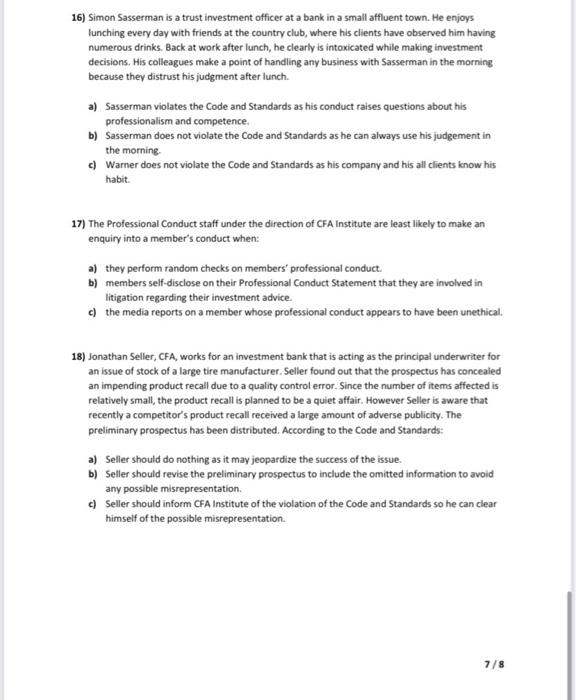

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

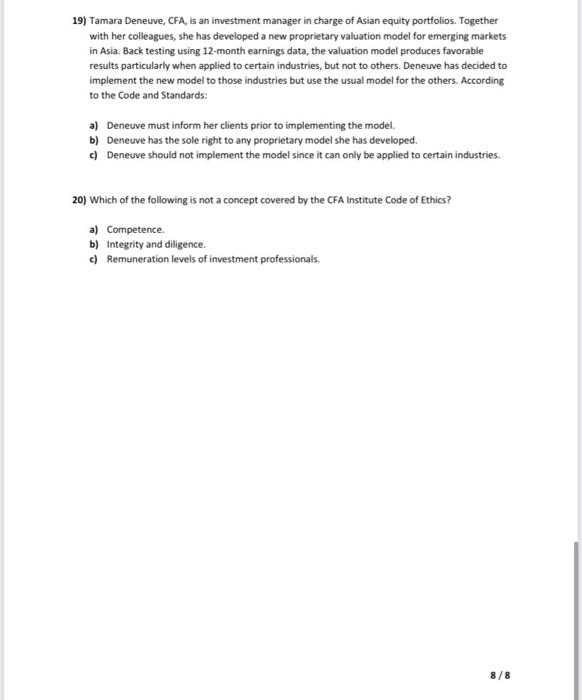

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started