Question

This is a complete question from instructor. The Earnings per share footnote for Procter and Gamble Company is on page 2. Use this information to

This is a complete question from instructor.

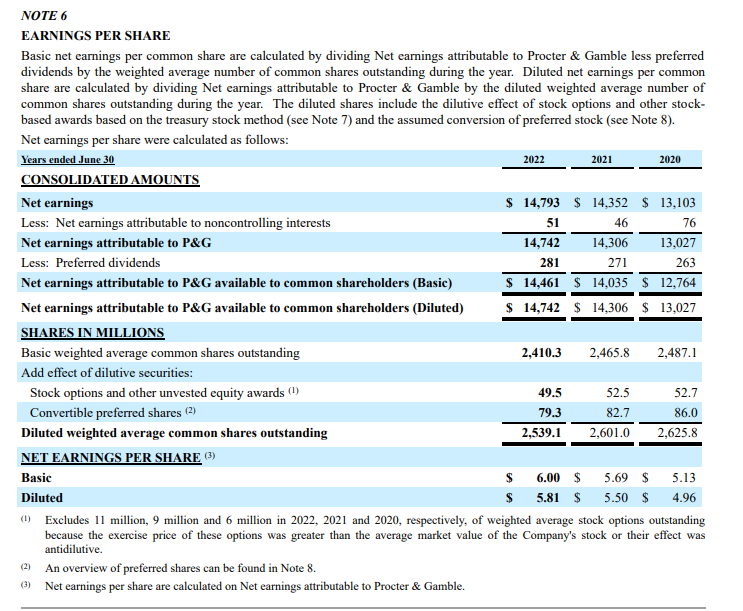

The Earnings per share footnote for Procter and Gamble Company is on page 2. Use this information to answer the following 3v questions worth 5 points each. If you are not familiar with P&G, here is a brief description:

The Procter & Gamble Company (the Company) is focused on providing branded products of superior quality and value to improve the lives of the world's consumers, now and for generations to come. The Company was incorporated in Ohio in 1905, having first been established as a New Jersey corporation in 1890, and was built from a business founded in Cincinnati in 1837 by William Procter and James Gamble. Today, our products are sold in approximately 180 countries and territories.

1. Preferred dividends are subtracted from earnings to compute basic earnings per share, but not diluted earnings per share. Explain why.

2. The footnote explains that some stock options outstanding were not included in the denominator in computing diluted earnings per share because they were anti-dilutive. Explain what anti-dilutive meansin your own words, do not google and copy/paste.

3. Diluted weighted average common share outstanding includes unvested equity awards. We learned about Restricted Stock Units in Chapter 19 which would be considered unvested equity awards. Explain what restricted stock unit and why they could be unvested.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started