Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a continuation of my previous question. 2. What is the average annual return on Susan's fund? 3. What is the average annual return

This is a continuation of my previous question.

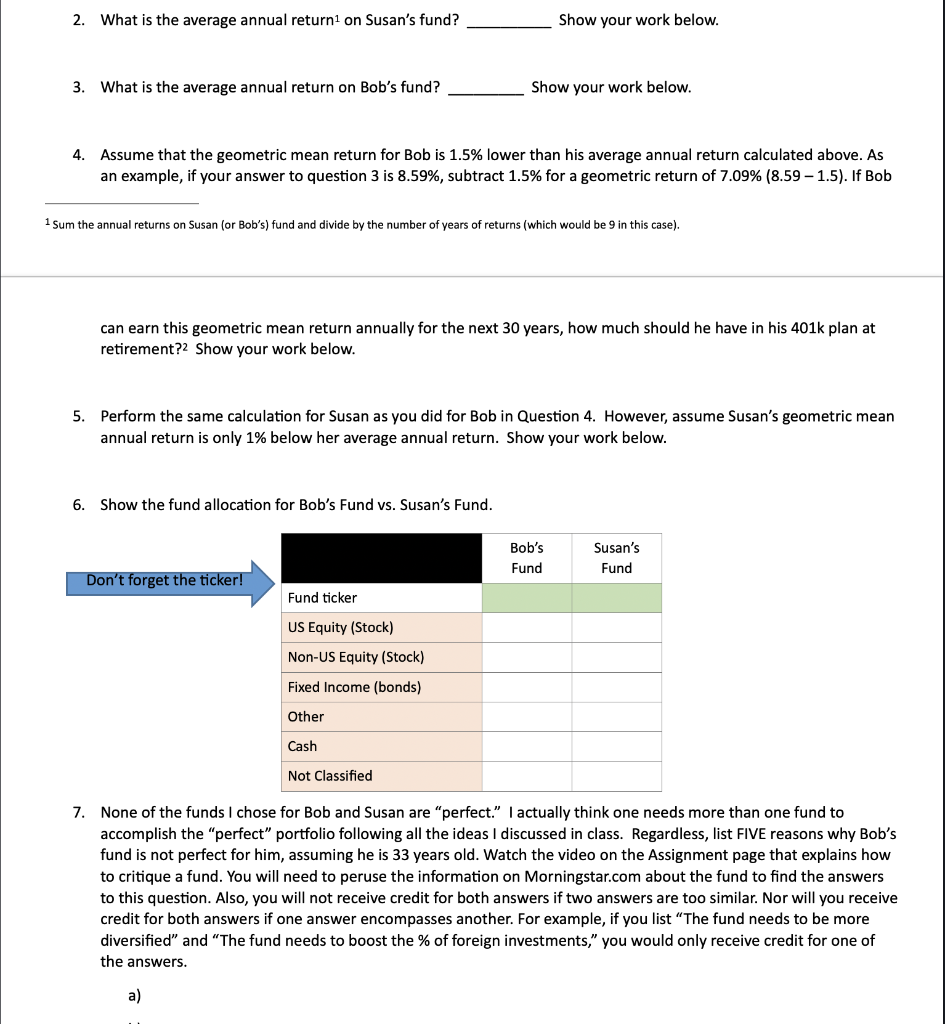

2. What is the average annual return on Susan's fund? 3. What is the average annual return on Bob's fund? Show your work below. 4. Assume that the geometric mean return for Bob is 1.5% lower than his average annual return calculated above. As an example, if your answer to question 3 is 8.59%, subtract 1.5% for a geometric return of 7.09% (8.59 -1.5). If Bob 1 Sum the annual returns on Susan (or Bob's) fund and divide by the number of years of returns (which would be 9 in this case). can earn this geometric mean return annually for the next 30 years, how much should he have in his 401k plan at retirement? Show your work below. 5. Perform the same calculation for Susan as you did for Bob in Question 4. However, assume Susan's geometric mean annual return is only 1% below her average annual return. Show your work below. 6. Show the fund allocation for Bob's Fund vs. Susan's Fund. Bob's Fund Susan's Fund Don't forget the ticker! Fund ticker US Equity (Stock) Non-US Equity (Stock) Fixed Income (bonds) Other Cash Not Classified 7. None of the funds I chose for Bob and Susan are "perfect." I actually think one needs more than one fund to accomplish the "perfect" portfolio following all the ideas I discussed in class. Regardless, list FIVE reasons why Bob's fund is not perfect for him, assuming he is 33 years old. Watch the video on the Assignment page that explains how to critique a fund. You will need to peruse the information on Morningstar.com about the fund to find the answers to this question. Also, you will not receive credit for both answers if two answers are too similar. Nor will you receive credit for both answers if one answer encompasses another. For example, if you list "The fund needs to be more diversified" and "The fund needs to boost the % of foreign investments," you would only receive credit for one of the answers. a) Show your work below. 2. What is the average annual return on Susan's fund? 3. What is the average annual return on Bob's fund? Show your work below. 4. Assume that the geometric mean return for Bob is 1.5% lower than his average annual return calculated above. As an example, if your answer to question 3 is 8.59%, subtract 1.5% for a geometric return of 7.09% (8.59 -1.5). If Bob 1 Sum the annual returns on Susan (or Bob's) fund and divide by the number of years of returns (which would be 9 in this case). can earn this geometric mean return annually for the next 30 years, how much should he have in his 401k plan at retirement? Show your work below. 5. Perform the same calculation for Susan as you did for Bob in Question 4. However, assume Susan's geometric mean annual return is only 1% below her average annual return. Show your work below. 6. Show the fund allocation for Bob's Fund vs. Susan's Fund. Bob's Fund Susan's Fund Don't forget the ticker! Fund ticker US Equity (Stock) Non-US Equity (Stock) Fixed Income (bonds) Other Cash Not Classified 7. None of the funds I chose for Bob and Susan are "perfect." I actually think one needs more than one fund to accomplish the "perfect" portfolio following all the ideas I discussed in class. Regardless, list FIVE reasons why Bob's fund is not perfect for him, assuming he is 33 years old. Watch the video on the Assignment page that explains how to critique a fund. You will need to peruse the information on Morningstar.com about the fund to find the answers to this question. Also, you will not receive credit for both answers if two answers are too similar. Nor will you receive credit for both answers if one answer encompasses another. For example, if you list "The fund needs to be more diversified" and "The fund needs to boost the % of foreign investments," you would only receive credit for one of the answers. a) Show your work belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started