this is a continuation question. each quention is connected to the next. please answer all.

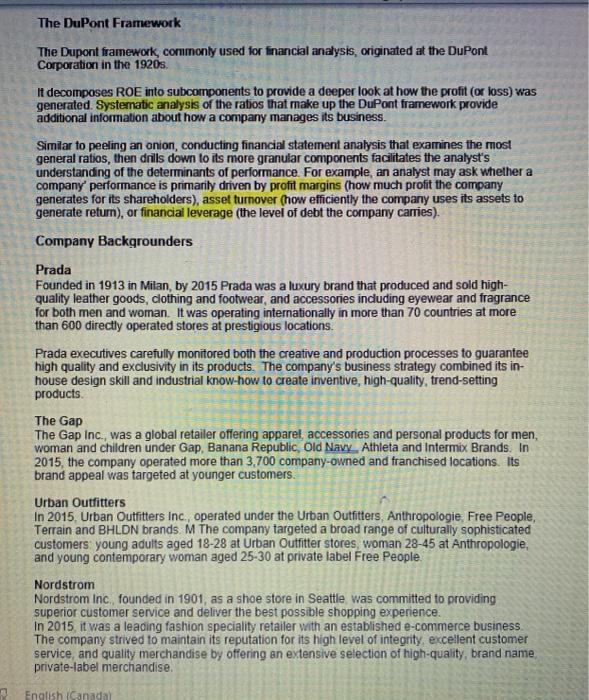

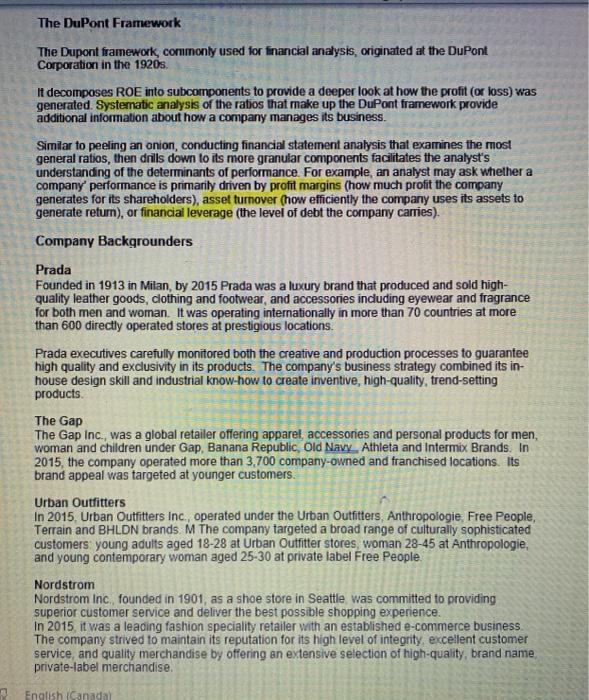

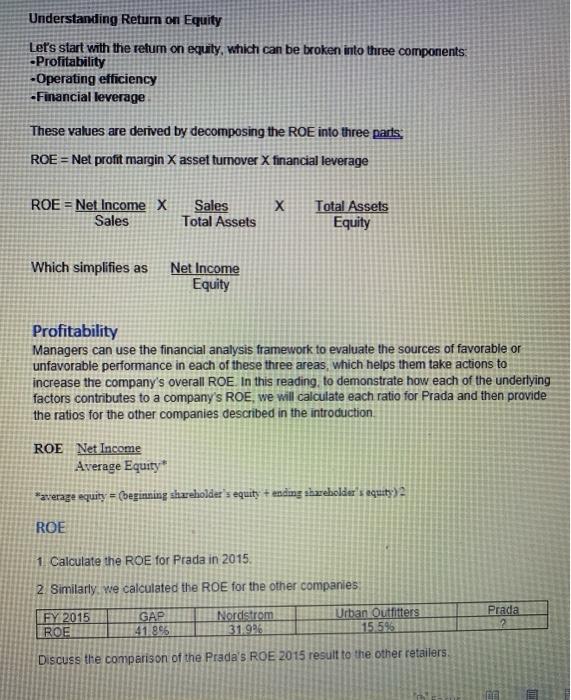

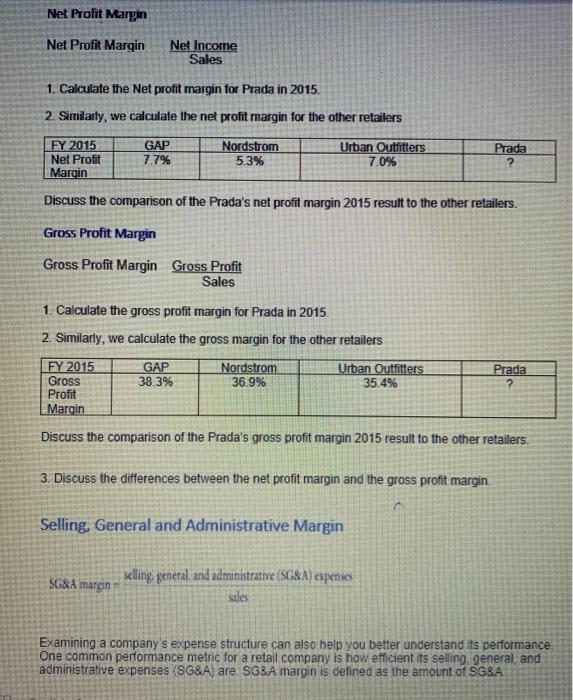

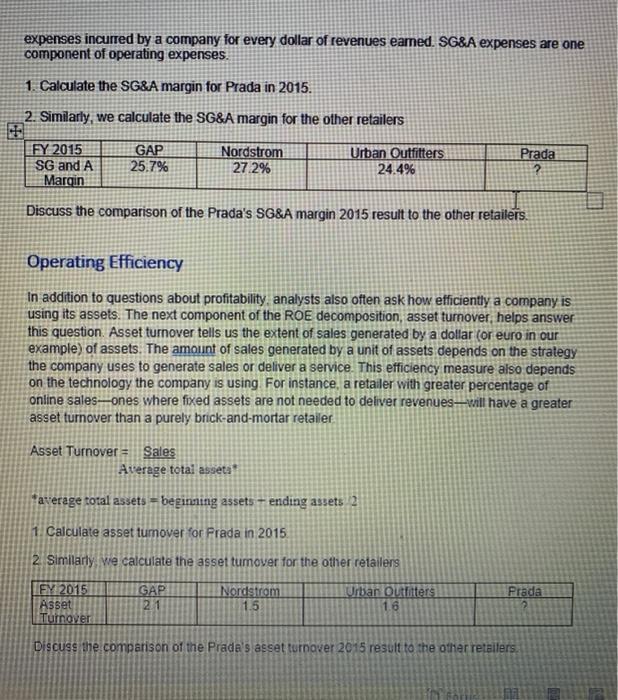

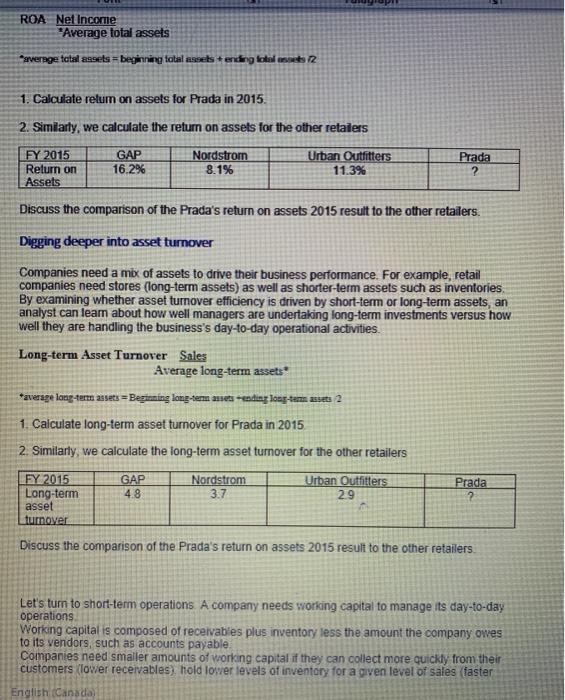

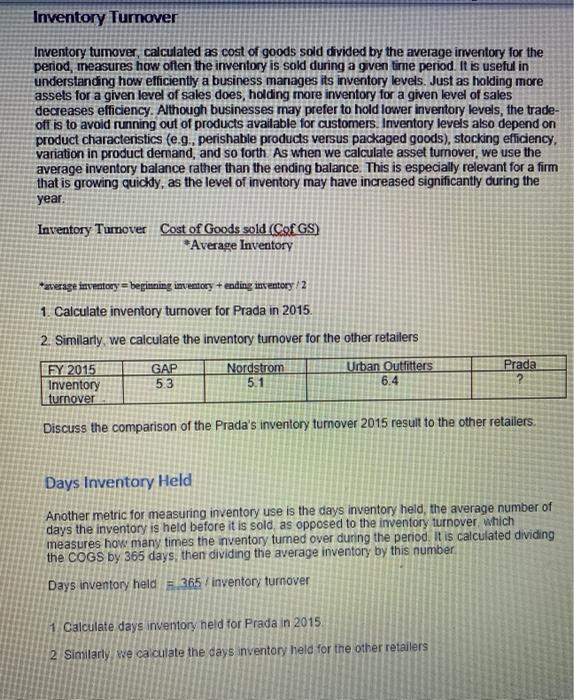

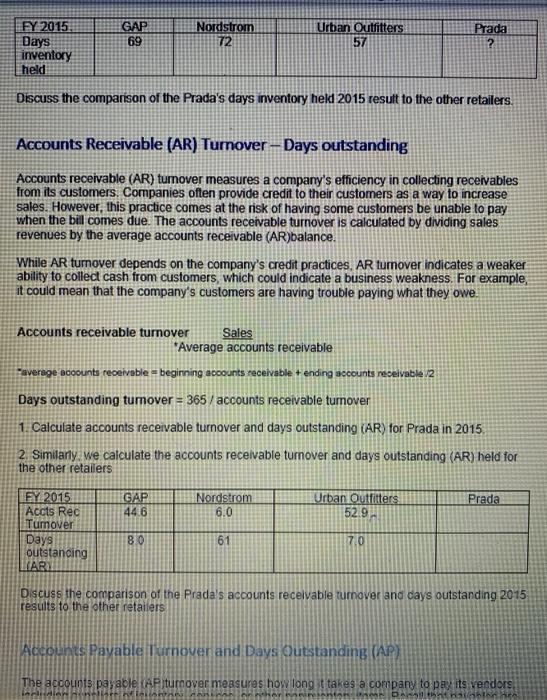

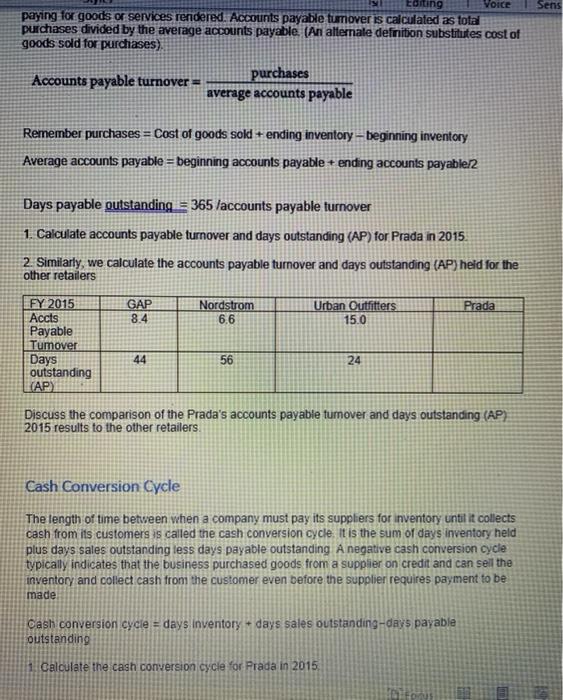

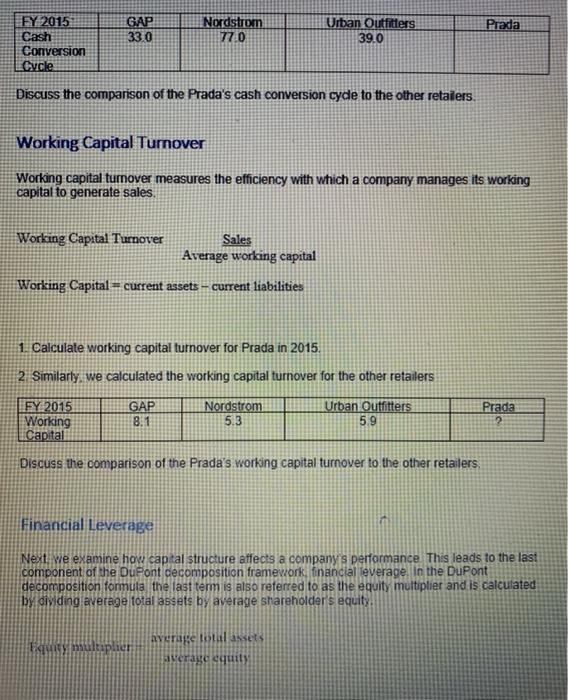

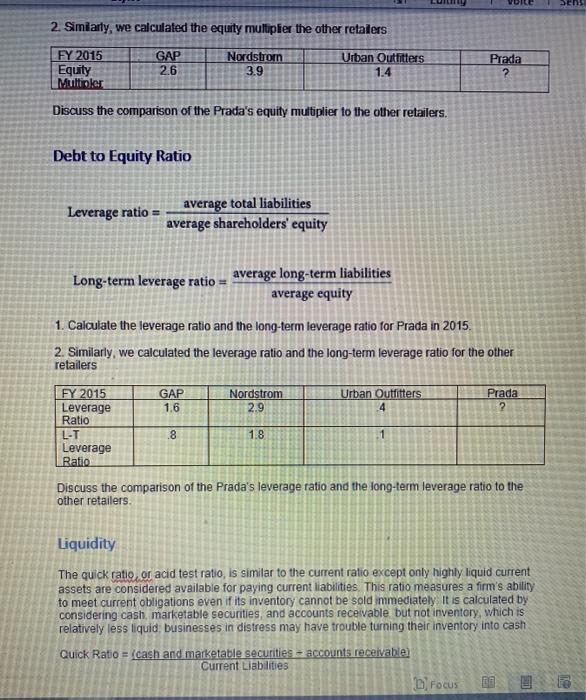

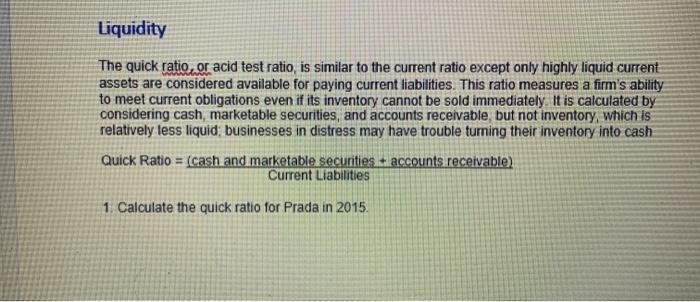

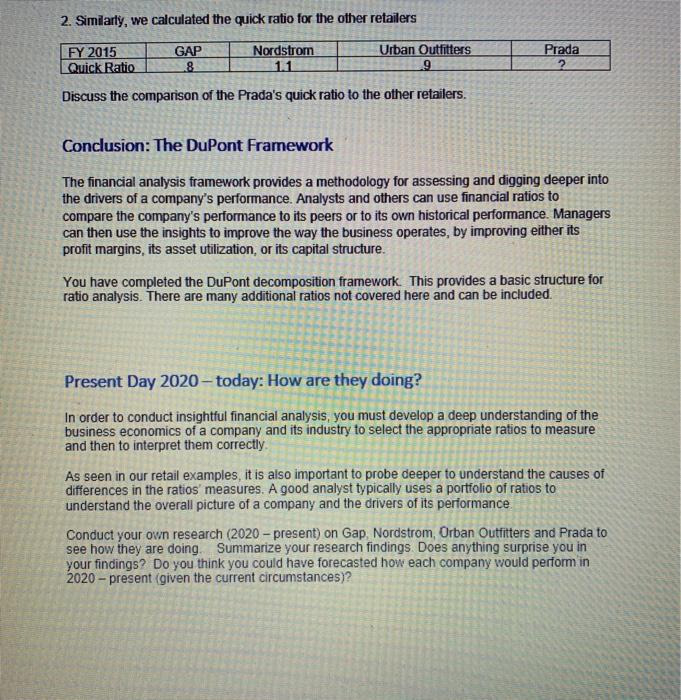

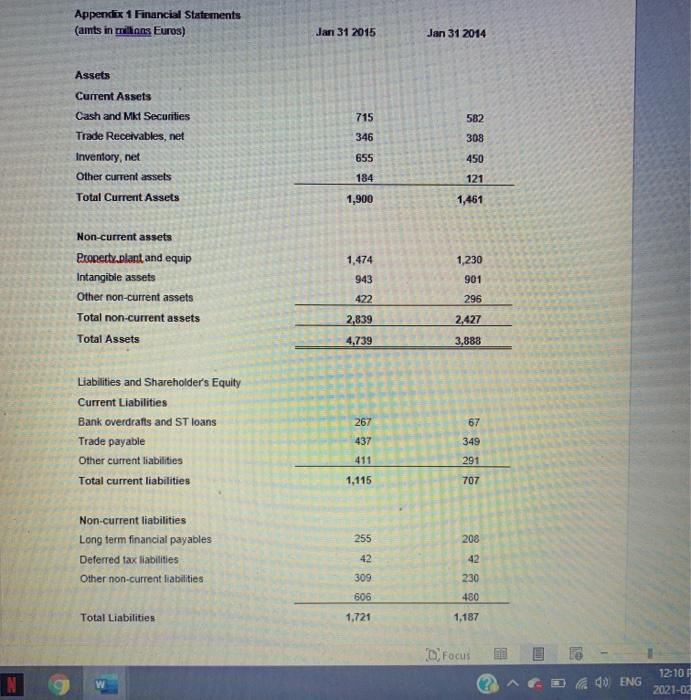

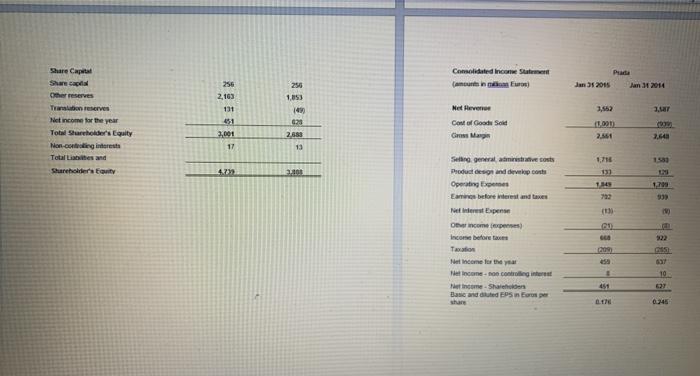

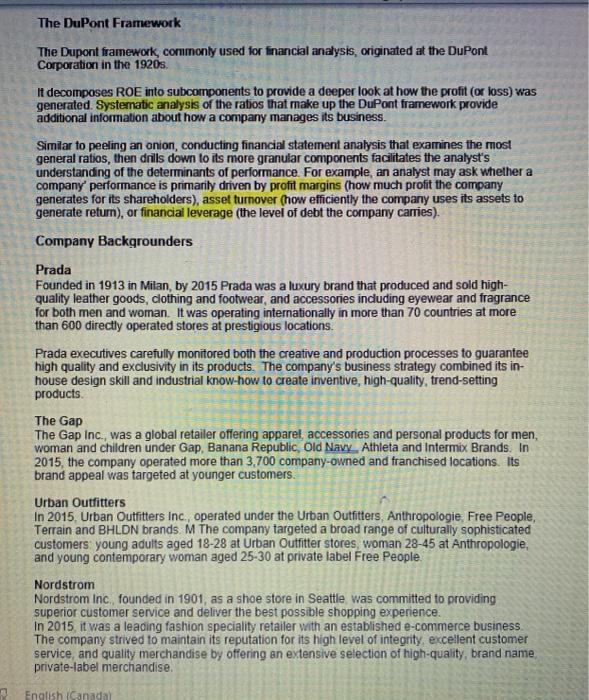

The DuPont Framework The Dupont framework, corumonly used for financial analysis, originated at the DuPont Corporation in the 1920s. It decomposes ROE into subcomponents to provide a deeper look at how the profit (or loss) was generated. Systernatic analysis of the ratios that make up the DuPont framework provide additional information about how a company manages its business. Similar to peeling an onion, conducting financial statement analysis that examines the most general ratios, then drills down to its more granular components facilitates the analyst's understanding of the determinants of performance. For example, an analyst may ask whether a company' performance is primarily driven by profit margins (how much profit the company generates for its shareholders), asset turnover (how efficiently the company uses its assets to generate return), or financial leverage (the level of debt the company carries). Company Backgrounders Prada Founded in 1913 in Milan, by 2015 Prada was a luxury brand that produced and sold high- quality leather goods, clothing and footwear, and accessories including eyewear and fragrance for both men and woman. It was operating internationally in more than 70 countries at more than 600 directly operated stores at prestigious locations. Prada executives carefully monitored both the creative and production processes to guarantee high quality and exclusivity in its products. The company's business strategy combined its in- house design skill and industrial know-how to create inventive, high-quality, trend-setting products The Gap The Gap Inc., was a global retailer offering apparel, accessories and personal products for men, woman and children under Gap, Banana Republic, Old Navy Athleta and Intermix Brands. In 2015, the company operated more than 3,700 company-owned and franchised locations. Its brand appeal was targeted at younger customers. Urban Outfitters In 2015. Urban Outfitters Inc., operated under the Urban Outfitters, Anthropologie, Free People, Terrain and BHLDN brands. M The company targeted a broad range of culturally sophisticated customers young adults aged 18-28 at Urban Outfitter stores, woman 28-45 at Anthropologie, and young contemporary woman aged 25-30 at private label Free People, Nordstrom Nordstrom Inc., founded in 1901, as a shoe store in Seattle was committed to providing superior customer service and deliver the best possible shopping experience. In 2015, it was a leading fashion speciality retailer with an established e-commerce business The company strived to maintain its reputation for its high level of integrity, excellent customer service, and quality merchandise by offering an extensive selection of high-quality, brand name private-label merchandise English Canadal Understanding Return on Equity Let's start with the relum on equity, which can be broken into three components: -Profitability -Operating efficiency -Financial leverage These values are derived by decomposing the ROE into three parts: ROE = Net profit margin X asset tumover X financial leverage ROE = Net Income X Sales Sales Total Assets Total Assets Equity Which simplifies as Net Income Equity Profitability Managers can use the financial analysis framework to evaluate the sources of favorable or unfavorable performance in each of these three areas, which helps them take actions to increase the company's overall ROE In this reading, to demonstrate how each of the underlying factors contributes to a company's ROE, we will calculate each ratio for Prada and then provide the ratios for the other companies described in the introduction ROE Net Income Average Equity average equity = (beginning shareholder's equity + ending shareholder's equity) 2 ROE 1 Calculate the ROE for Prada in 2015. 2 Similarly, we calculated the ROE for the other companies FY 2015 ROE GAP 41995 Nordstrom 31926 Urban Outfitters 15 595 Prada 2 Discuss the comparison of the Prada's ROE 2015 result to the other retailers. Net Profit Margin Net Profit Margin Net Income Sales 1. Calculate the Net profit margin for Prada in 2015. 2. Similarly, we calculate the net profit margin for the other retailers FY 2015 Net Profit Margin GAP 7.7% Nordstrom 5.3% Urban Outfitters 7.0% Prada ? Discuss the comparison of the Prada's net profit margin 2015 result to the other retailers. Gross Profit Margin Gross Profit Margin Gross Profit Sales 1. Calculate the gross profit margin for Prada in 2015 2. Similarly, we calculate the gross margin for the other retailers GAP 38.3% FY 2015 Gross Profit Marcin Nordstrom 36.9% Urban Outfitters 35.4% Prada ? Discuss the comparison of the Prada's gross profit margin 2015 result to the other retailers. 3. Discuss the differences between the net profit margin and the gross profit margin Selling, General and Administrative Margin SGSA margin selling general and administrative (SG&A) expenses sales Examining a company's expense structure can also help you better understand its performance One common performance metric for a retail company is how efficient its selling, general and administrative expenses (SG8A) are SG&A margin is defined as the amount of SGSA expenses incurred by a company for every dollar of revenues eamed. SG&A expenses are one component of operating expenses. 1. Calculate the SG&A margin for Prada in 2015. 2. Similarly, we calculate the SG&A margin for the other retailers FY 2015 SG and A Margin GAP 25.7% Nordstrom 27.2% Prada Urban Outfitters 24.4% Discuss the comparison of the Prada's SG&A margin 2015 result to the other retailers Operating Efficiency In addition to questions about profitability, analysts also often ask how efficiently a company is using its assets. The next component of the ROE decomposition, asset turnover helps answer this question Asset turnover tells us the extent of sales generated by a dollar (or euro in our example) of assets. The amount of sales generated by a unit of assets depends on the strategy the company uses to generate sales or deliver a service. This efficiency measure also depends on the technology the company is using For instance, a retailer with greater percentage of online sales ones where fixed assets are not needed to deliver revenues will have a greater asset turnover than a purely brick-and- mortar retailer Asset Turnover Sales Average total assets *average total assets = beginning assets + ending assets 2 1. Calculate asset tumover for Prada in 2015 2. Similarly, we calculate the asset tumover for the other retailers FY 2015 Asset Turnover GAP 21 Nordstrom 1.5 Prada Urban Outfitters 1.6 Discuss the comparison of the Prade's asset turnover 2015 result to the other retailers. ROA Net Income *Average total assets "average total assets = beginning total assetsending totalt 2 1. Calculate retum on assets for Prada in 2015. 2. Simiarty, we calculate the return on assets for the other retailers FY 2015 Return on Assets GAP 16.2% Nordstrom 8.1% Urban Outfitters 11.3% Prada ? Discuss the comparison of the Prada's return on assets 2015 result to the other retailers. Digging deeper into asset turnover Companies need a mix of assets to drive their business performance. For example, retail companies need stores (long-term assets) as well as shorter-term assets such as inventories By examining whether asset turnover efficiency is driven by short-term or long-term assets, an analyst can leam about how well managers are undertaking long-term investments versus how well they are handling the business's day-to-day operational activities Long-term Asset Turnover Sales Average long-term assets *average long-term assets = Beginning long-term assets -ending long-term avets 2 1. Calculate long-term asset turnover for Prada in 2015 2. Similarly, we calculate the long-term asset turnover for the other retailers FY 2015 GAP Nordstrom Urban Outfitters Prada Long-term 4.8 3.7 2.9 2 asset turnover Discuss the comparison of the Prada's return on assets 2015 result to the other retailers Let's turn to short-term operations A company needs working capital to manage its day-to-day operations Working capital is composed of receivables plus inventory less the amount the company owes to its vendors, such as accounts payable Companies need smaller amounts of working capital if they can collect more quickly from their customers (Tower receivables) hold lower levels of inventory for a given level of sales (faster English (Canada Inventory Tumover Inventory tumover, calculated as cost of goods sold divided by the average inventory for the period, measures how often the inventory is sold during a given time period. It is useful in understanding how efficiently a business manages its inventory levels. Just as holding more assets for a given level of sales does, holding more inventory for a given level of sales decreases efficiency. Although businesses may prefer to hold lower inventory levels, the trade- off is to avoid running out of products available for customers. Inventory levels also depend on product characteristics (e.g.. perishable products versus packaged goods), stocking efficiency. variation in product demand, and so forth. As when we calculate asset tumover, we use the average inventory balance rather than the ending balance. This is especially relevant for a firm that is growing quickly, as the level of inventory may have increased significantly during the year Inventory Turnover Cost of Goods sold (Cof GS) *Average Inventory * average inventory = beginning inventory + ending intentory / 2 1. Calculate inventory turnover for Prada in 2015. 2. Similarly, we calculate the inventory turnover for the other retailers Nordstrom Prada FY 2015 Inventory tumover GAP 5.3 Urban Outfitters 6.4 5.1 Discuss the comparison of the Prada's inventory tumover 2015 result to the other retailers Days Inventory Held Another metric for measuring inventory use is the days inventory held, the average number of days the inventory is held before it is sold as opposed to the inventory turnover which measures how many times the inventory turned over during the period. It is calculated dividing the COGS by 365 days, then dividing the average inventory by this number Days inventory held = 365/inventory turnover 1 Calculate days inventory held for Prada in 2015 2 Similarly, we calculate the days inventory held for the other retailers GAP 69 Nordstrom 72 Urban Outfitters 57 Prada 2 FY 2015 Days inventory held Discuss the comparison of the Prada's days inventory held 2015 result to the other retailers. Accounts Receivable (AR) Turnover-Days outstanding Accounts receivable (AR) tumover measures a company's efficiency in collecting receivables from its customers. Companies often provide credit to their customers as a way to increase sales. However, this practice comes at the risk of having some customers be unable to pay when the bill comes due. The accounts receivable turnover is calculated by dividing sales revenues by the average accounts receivable (AR)balance. While AR turnover depends on the company's credit practices. AR tumover indicates a weaker ability to collect cash from customers, which could indicate a business weakness. For example, it could mean that the company's customers are having trouble paying what they owe. Accounts receivable turnover Sales *Average accounts receivable Faverage accounts receivable = beginning accounts receivable + ending accounts receivable 12 Days outstanding tumover = 365 / accounts receivable tumover 1. Calculate accounts receivable turnover and days outstanding (AR) for Prada in 2015 2. Similarly, we calculate the accounts receivable turnover and days outstanding (AR) held for the other retailers Nordstrom GAP 446 Urban Outfitters Prada 6.0 52.9 FY 2015 Acots Red Turnover Days outstanding LAR 80 61 7.0 Discuss the comparison of the Prada's accounts receivable turnover and days outstanding 2015 results to the other retailers Accounts Payable Turnover and Days Outstanding (AP) The accounts payable (AP turnover measures how long it takes a company to pay its vendors To * na Sens Editing Voice paying for goods or services rendered Accounts payable tumover is calculated as total purchases divided by the average accounts payable. (An alternate defnition substitutes cost of goods sold for purchases) Accounts payable turnover = purchases average accounts payable Remember purchases = Cost of goods sold + ending inventory - beginning inventory Average accounts payable = beginning accounts payable + ending accounts payable/2 Days payable outstanding = 365 /accounts payable turnover 1. Calculate accounts payable turnover and days outstanding (AP) for Prada in 2015. 2. Similarly, we calculate the accounts payable turnover and days outstanding (AP) held for the other retailers GAP 8.4 Nordstrom 66 Prada Urban Outfitters 15.0 FY 2015 Accts Payable Tumover Days outstanding (AP) 44 56 24 Discuss the comparison of the Prada's accounts payable turnover and days outstanding (AP) 2015 results to the other retailers Cash Conversion Cycle The length of time between when a company must pay its suppliers for inventory until it collects cash from its customers is called the cash conversion cycle. It is the sum of days inventory held plus days sales outstanding less days payable outstanding A negative cash conversion cycle typically indicates that the business purchased goods from a supplier on credit and can sell the inventory and collect cash from the customer even before the supplier requires payment to be made Cash conversion cycle = days inventory + days sales outstanding-days payable outstanding Calculate the cash conversion cycle for Prada in 2015 GAP 33 0 FY 2015 Cash Conversion Cycle Nordstrom 770 Urban Outfitters 39.0 Prada Discuss the comparison of the Prada's cash conversion cyde to the other retailers. Working Capital Turnover Working capital tumover measures the efficiency with which a company manages its working capital to generate sales. Working Capital Turnover Sales Average working capital Working Capital = current assets - current liabilities 1. Calculate working capital turnover for Prada in 2015, 2. Similarly, we calculated the working capital turnover for the other retailers FY 2015 Working Capital GAP 8.1 Nordstrom 5.3 Urban Outfitters 5.9 Prada 2 Discuss the comparison of the Prada's working capital turnover to the other retailers, Financial Leverage Next, we examine how captal structure affects a company's performance. This leads to the last component of the DuPont decomposition framework financial Teverage. In the DuPont decomposition formula, the last term is also referred to as the equity multiplier and is calculated by dividing average total assets by average shareholder's equity, Taylity multiplier Average total assets Average equity 2. Similarly, we calculated the equity multiplier the other retailers FY 2015 Equity Multipler GAP 2.6 Nordstrom 3.9 Urban Outfitters 1.4 Prada 2 Discuss the comparison of the Prada's equity multiplier to the other retailers. Debt to Equity Ratio Leverage ratio average total liabilities average shareholders' equity Long-term leverage ratio average long-term liabilities average equity 1. Calculate the leverage ratio and the long-term leverage ratio for Prada in 2015. 2. Similarly, we calculated the leverage ratio and the long-term leverage ratio for the other retailers GAP 1.6 Nordstrom 2.9 Urban Outfitters 4 Prada ? FY 2015 Leverage Ratio L-T Leverage Ratio 8 1.8 Discuss the comparison of the Prada's leverage ratio and the long-term leverage ratio to the other retailers Liquidity The quick ratio, or acid test ratio, is similar to the current ratio except only highly liquid current assets are considered available for paying current liabilities. This ratio measures a firm's ability to meet current obligations even if its inventory cannot be sold immediately it is calculated by considering cash marketable securities and accounts receivable but not inventory, which is relatively less liquid businesses in distress may have trouble turning their inventory into cash Quick Ratio (cash and marketable securities accounts receivable Current Liabilities D. Focus To Liquidity The quick ratio,or acid test ratio, is similar to the current ratio except only highly liquid current assets are considered available for paying current liabilities. This ratio measures a firm's ability to meet current obligations even if its inventory cannot be sold immediately. It is calculated by considering cash marketable securities, and accounts receivable, but not inventory, which is relatively less liquid, businesses in distress may have trouble turning their inventory into cash Quick Ratio = (cash and marketable securities + accounts receivable) Current Liabilities 1. Calculate the quick ratio for Prada in 2015. 2. Similarly, we calculated the quick ratio for the other retailers Nordstrom Prada FY 2015 Quick Ratio GAP 8 Urban Outfitters 9 Discuss the comparison of the Prada's quick ratio to the other retailers. Conclusion: The DuPont Framework The financial analysis framework provides a methodology for assessing and digging deeper into the drivers of a company's performance. Analysts and others can use financial ratios to compare the company's performance to its peers or to its own historical performance Managers can then use the insights to improve the way the business operates, by improving either its profit margins, its asset utilization, or its capital structure. You have completed the DuPont decomposition framework. This provides a basic structure for ratio analysis. There are many additional ratios not covered here and can be included. Present Day 2020-today: How are they doing? In order to conduct insightful financial analysis, you must develop a deep understanding of the business economics of a company and its industry to select the appropriate ratios to measure and then to interpret them correctly As seen in our retail examples, it is also important to probe deeper to understand the causes of differences in the ratios' measures. A good analyst typically uses a portiolio of ratios to understand the overall picture of a company and the drivers of its performance Conduct your own research (2020 - present) on Gap Nordstrom Orban Outfitters and Prada to see how they are doing Summarize your research findings Does anything surprise you in your findings? Do you think you could have forecasted how each company would perform in 2020 - present (given the current circumstances)? Appendix 1 Financial Statements (amts in millions Euros) Jan 31 2015 Jan 31 2014 Assets 715 582 346 308 Current Assets Cash and Met Securities Trade Receivables, net Inventory, net Other current assets Total Current Assets 655 450 184 121 1,900 1,461 1,474 943 1,230 901 Non-current assets Property.plant and equip Intangible assets Other non-current assets Total non-current assets Total Assets 422 296 2,839 2.427 4.739 3.888 267 67 Liabilities and Shareholder's Equity Current Liabilities Bank overdrafts and ST loans Trade payable Other current liabilities Total current liabilities 437 349 291 1,115 707 255 208 Non-current liabilities Long term financial payables Deferred tax liabilities Other non-current fiabilities 42 309 230 606 480 Total Liabilities 1,721 1,187 D. Focus N W 40 ENG 12:10 F 2021-02 Consolidated Income Statement Prade Jan 2015 Jan 31 2014 256 2,163 131 256 1,053 Share Capital Shan Cape Other reserves Tannreserves Net income for the year Tot Sarholder's Equity Non-cong interests Total Les and Shureholders ont 149 024 Het levere Cont of Good Sole Gm Mange 2,001 11.00 2.661 2.65 2.640 13 1,71 4.72 2.100 Selling general administrative costs Product design and develop the Operating Eames before items and taxes racers Expense Other compenses 900 3 CU ca 209 322 Taxis Melcome to the Netcome og interest come - Sharon Basic and led 5 in Europe 10 451 0.245