Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a excel sheet the professor gave me , all he wants is for me to change the numbers on there and make it

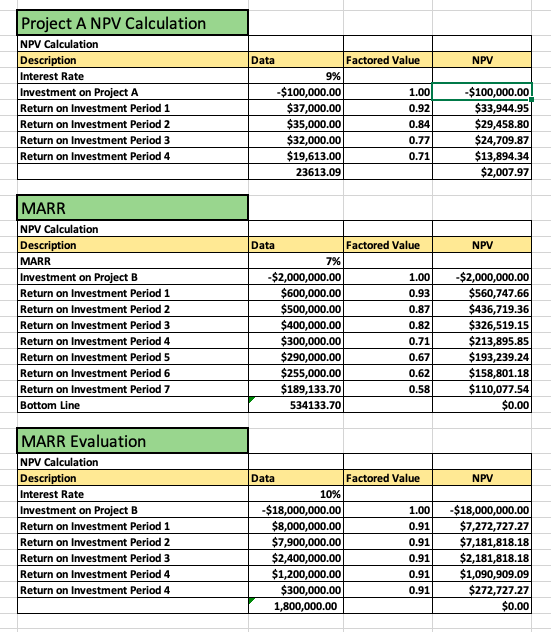

This is a excel sheet the professor gave me all he wants is for me to change the numbers on there and make it work and make sense still. So can you do it for me please.tableProject A NPV Calculation,,,NPV Calculation,,,DescriptionData,Factored Value,NPVInterest Rate,Investment on Project A$$Return on Investment Period $$Return on Investment Period $$Return on Investment Period $$Return on Investment Period $$$

tableMARRNPV CalculationDescriptionData,Factored Value,NPVtableMARRInvestment on Project B$$Return on Investment Period $$tableReturn on Investment Period $$Return on Investment Period $$Return on Investment Period $$Return on Investment Period $$Return on Investment Period $$Return on Investment Period $$Bottom Line,$MARR EvaluationNPV CalculationDescriptionData,Factored Value,NPVInterest Rate,Investment on Project B$$Return on Investment Period $$Return on Investment Period $$epsi Return on Investment Period $$epsi Return on Investment Period $$CReturn on Investment Period $$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started