Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a Finance / Accounting based question . QUESTION 1 Latherman's Company Limited supplies meat, feed and fuel to the Caribbean market. The company

This is a Finance / Accounting based question .

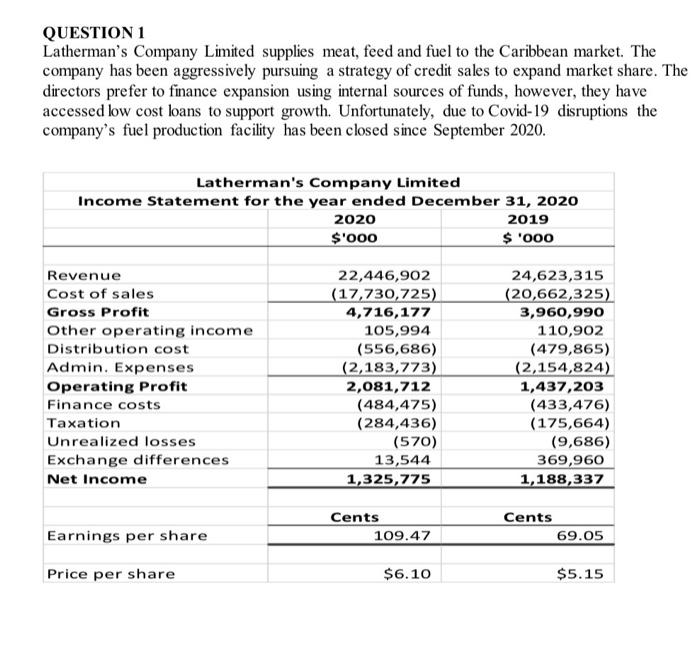

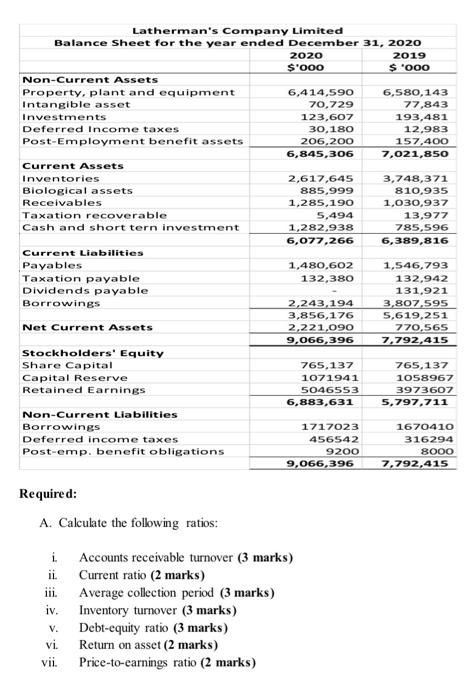

QUESTION 1 Latherman's Company Limited supplies meat, feed and fuel to the Caribbean market. The company has been aggressively pursuing a strategy of credit sales to expand market share. The directors prefer to finance expansion using internal sources of funds, however, they have accessed low cost loans to support growth. Unfortunately, due to Covid-19 disruptions the company's fuel production facility has been closed since September 2020. Latherman's Company Limited Income Statement for the year ended December 31, 2020 2020 2019 $'000 $ '000 Revenue Cost of sales Gross Profit Other operating income Distribution cost Admin. Expenses Operating Profit Finance costs Taxation Unrealized losses Exchange differences Net Income 22,446,902 (17,730,725) 4,716,177 105,994 (556,686) (2,183,773) 2,081,712 (484,475) (284,436) (570) 13,544 1,325,775 24,623,315 (20,662,325) 3,960,990 110,902 (479,865) (2,154,824) 1,437,203 (433,476) (175,664) (9,686) 369,960 1,188,337 Cents 109.47 Cents 69.05 Earnings per share Price per share $6.10 $5.15 Latherman's Company Limited Balance Sheet for the year ended December 31, 2020 2020 2019 s'000 $ '000 Non-Current Assets Property, plant and equipment 6,414,590 6,580,143 Intangible asset 70,729 77,843 Investments 123,607 193,481 Deferred income taxes 30,180 12,983 Post-Employment benefit assets 206,200 157.400 6,845,306 7,021,850 Current Assets Inventories 2,617,645 3,748,371 Biological assets 885,999 810,935 Receivables 1,285,190 1,030,937 Taxation recoverable 5,494 13,977 Cash and short tern investment 1,282,938 785,596 6,077,266 6,389,816 Current Liabilities Payables 1,480,602 1,546,793 Taxation payable 132,380 132,942 Dividends payable 131,921 Borrowings 2,243,194 3,807,595 3,856,176 5,619,251 Net Current Assets 2,221,090 770,565 9,066,396 7,792,415 Stockholders' Equity Share Capital 765,137 765,137 Capital Reserve 1071941 1058967 Retained Earnings 5046553 3973607 6,883,631 5,797,711 Non-Current Liabilities Borrowings 1717023 1670410 Deferred income taxes 456542 316294 Post-emp. benefit obligations 9200 8000 9,066,396 7,792,415 Required: A. Calculate the following ratios: i Accounts receivable turnover (3 marks) ii. Current ratio (2 marks) iii. Average collection period (3 marks) iv. Inventory turnover (3 marks) Debt-equity ratio (3 marks) Return on asset (2 marks) vii. Price-to-earnings ratio (2 marks) V. vi Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started