Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a Financial Management class. Chapter 5 is Organizational Costing and Profit Analysis #3. Review the walk-in data presented below. Taxes are assumed to

This is a Financial Management class. Chapter 5 is Organizational Costing and Profit Analysis

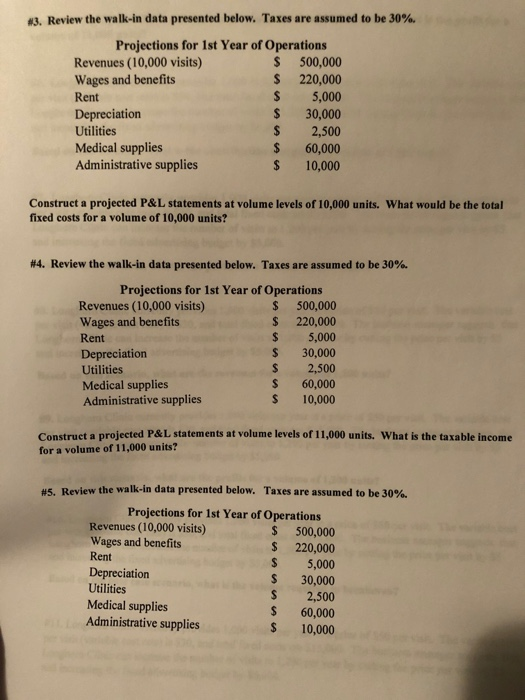

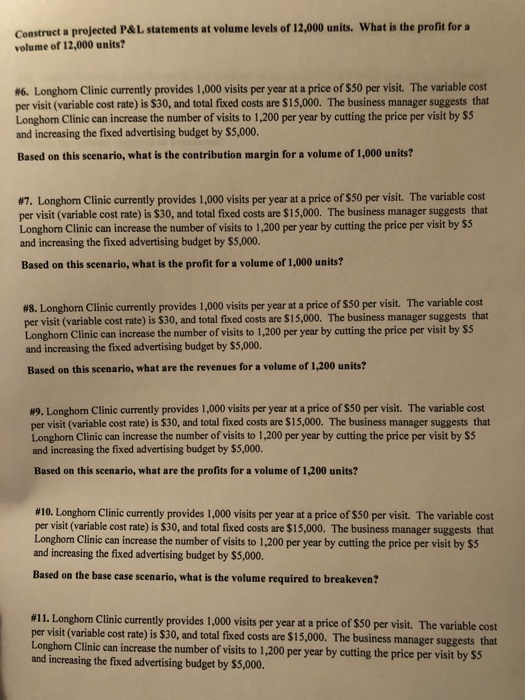

#3. Review the walk-in data presented below. Taxes are assumed to be 30%. Projections for 1st Year of Operations Revenues (10,000 visits) $ 500,000 Wages and benefits $ 220,000 Rent 5,000 Depreciation $ 30,000 Utilities $ 2,500 Medical supplies $ 60,000 Administrative supplies $ 10,000 Construct a projected P&L statements at volume levels of 10,000 units. What would be the total fixed costs for a volume of 10,000 units? #4. Review the walk-in data presented below. Taxes are assumed to be 30%. Projections for 1st Year of Operations Revenues (10,000 visits) $ 500,000 Wages and benefits $ 220,000 Rent $ 5,000 Depreciation $ 30,000 Utilities $ 2,500 Medical supplies $ 60,000 Administrative supplies $ 10,000 Construct a projected P&L statements at volume levels of 11,000 units. What is the taxable income for a volume of 11,000 units? #5. Review the walk-in data presented below. Taxes are assumed to be 30%. Projections for 1st Year of Operations Revenues (10,000 visits) $ 500,000 Wages and benefits $ 220,000 Rent $ 5,000 Depreciation $ 30,000 Utilities S 2,500 Medical supplies $ 60,000 Administrative supplies $ 10,000 Construct a projected P&L statements at volume levels of 12,000 units. What is the profit for a volume of 12,000 units? #6. Longhom Clinic currently provides 1,000 visits per year at a price of $50 per visit. The variable cost per visit (variable cost rate) is $30, and total fixed costs are $15,000. The business manager suggests that Longhom Clinic can increase the number of visits to 1,200 per year by cutting the price per visit by $5 and increasing the fixed advertising budget by $5,000. Based on this scenario, what is the contribution margin for a volume of 1,000 units? #7. Longhorn Clinic currently provides 1,000 visits per year at a price of $50 per visit. The variable cost per visit (variable cost rate) is $30, and total fixed costs are $15,000. The business manager suggests that Longhorn Clinic can increase the number of visits to 1,200 per year by cutting the price per visit by $5 and increasing the fixed advertising budget by $5,000. Based on this scenario, what is the profit for a volume of 1,000 units? #8. Longhorn Clinic currently provides 1,000 visits per year at a price of $50 per visit. The variable cost per visit (variable cost rate) is $30, and total fixed costs are $15,000. The business manager suggests that Longhorn Clinic can increase the number of visits to 1,200 per year by cutting the price per visit by S5 and increasing the fixed advertising budget by $5,000. Based on this scenario, what are the revenues for a volume of 1,200 units? #9. Longhorn Clinic currently provides 1,000 visits per year at a price of $50 per visit. The variable cost per visit (variable cost rate) is $30, and total fixed costs are $15,000. The business manager suggests that Longhorn Clinic can increase the number of visits to 1,200 per year by cutting the price per visit by $5 and increasing the fixed advertising budget by $5,000. Based on this scenario, what are the profits for a volume of 1,200 units? #10. Longhorn Clinic currently provides 1,000 visits per year at a price of $50 per visit. The variable cost per visit (variable cost rate) is $30, and total fixed costs are $15,000. The business manager suggests that Longhorn Clinic can increase the number of visits to 1,200 per year by cutting the price per visit by $5 and increasing the fixed advertising budget by $5,000. Based on the base case scenario, what is the volume required to breakeven? #11. Longhorn Clinic currently provides 1,000 visits per year at a price of $50 per visit. The variable cost per visit (variable cost rate) is $30, and total fixed costs are $15,000. The business manager suggests that Longhom Clinic can increase the number of visits to 1,200 per year by cutting the price per visit by $5 and increasing the fixed advertising budget by $5,000. Based on the proposed changes in this scenario, what is the volume required to breakeven? #12. Charity Hospital, a not-for-profit, has a maximum capacity of 15,000 discharges per year. Variable patient service costs are $390 per discharge. Variable general and administrative costs are $10 per discharge. Fixed hospital overhead costs are $4,200,000 per year. The current reimbursement rate is $1,000 per discharge. What is the volume required to breakeven Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started