Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a financial reporting question. I do not understand where the where the 0.3 and 6/117 came from in part b. I also do

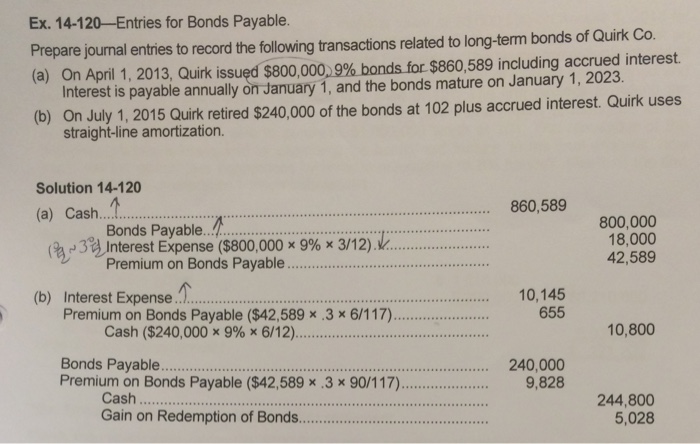

This is a financial reporting question. I do not understand where the where the 0.3 and 6/117 came from in part b. I also do not understand why they did 240000x 9% x 6/12. I do not understand the calculations for the premium on bonds payable of the second journal entry in part b. Can someone explain all the steps in part b and why they did so?? I am so confused. The answers are given. Can somone explain please??  Ex. 14-120-Entries for Bonds Payable. Prepare journal entries to record the following transactions related to long-term bonds of Quirk Co (a) On April 1, 2013, Quirk issued $800,000.9% bondsfor $860,589 including accrued interest. Interest is payable annually on January 1, and the bonds mature on January 1, 2023. (b) On July 1, 2015 Quirk retired $240,000 of the bonds at 102 plus accrued interest. Quirk uses straight-line amortization. Solution 14-120 (a) Cash.. 860,589 Bonds Payable.. Premium on Bonds Payable. .. 800,000 18,000 42,589 (B"Interest Expense ($800,0009%3/12) 10,145 655 (b) Interest Expense Premium on Bonds Payable ($42,589 x .3 x 6/117).... Cash ($240,000 x 9% x 6/12). 10,800 Bonds Payable.. Premium on Bonds Payable ($42,589 x.3 x 90/117). . 240,000 9,828 Cash Gain on Redemption of Bonds... 244,800 5,028

Ex. 14-120-Entries for Bonds Payable. Prepare journal entries to record the following transactions related to long-term bonds of Quirk Co (a) On April 1, 2013, Quirk issued $800,000.9% bondsfor $860,589 including accrued interest. Interest is payable annually on January 1, and the bonds mature on January 1, 2023. (b) On July 1, 2015 Quirk retired $240,000 of the bonds at 102 plus accrued interest. Quirk uses straight-line amortization. Solution 14-120 (a) Cash.. 860,589 Bonds Payable.. Premium on Bonds Payable. .. 800,000 18,000 42,589 (B"Interest Expense ($800,0009%3/12) 10,145 655 (b) Interest Expense Premium on Bonds Payable ($42,589 x .3 x 6/117).... Cash ($240,000 x 9% x 6/12). 10,800 Bonds Payable.. Premium on Bonds Payable ($42,589 x.3 x 90/117). . 240,000 9,828 Cash Gain on Redemption of Bonds... 244,800 5,028

This is a financial reporting question. I do not understand where the where the 0.3 and 6/117 came from in part b. I also do not understand why they did 240000x 9% x 6/12. I do not understand the calculations for the premium on bonds payable of the second journal entry in part b. Can someone explain all the steps in part b and why they did so?? I am so confused. The answers are given. Can somone explain please??

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started