Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a group assignment and I am responsible for question 2 and 3. I cant get past question 1 so I am unable to

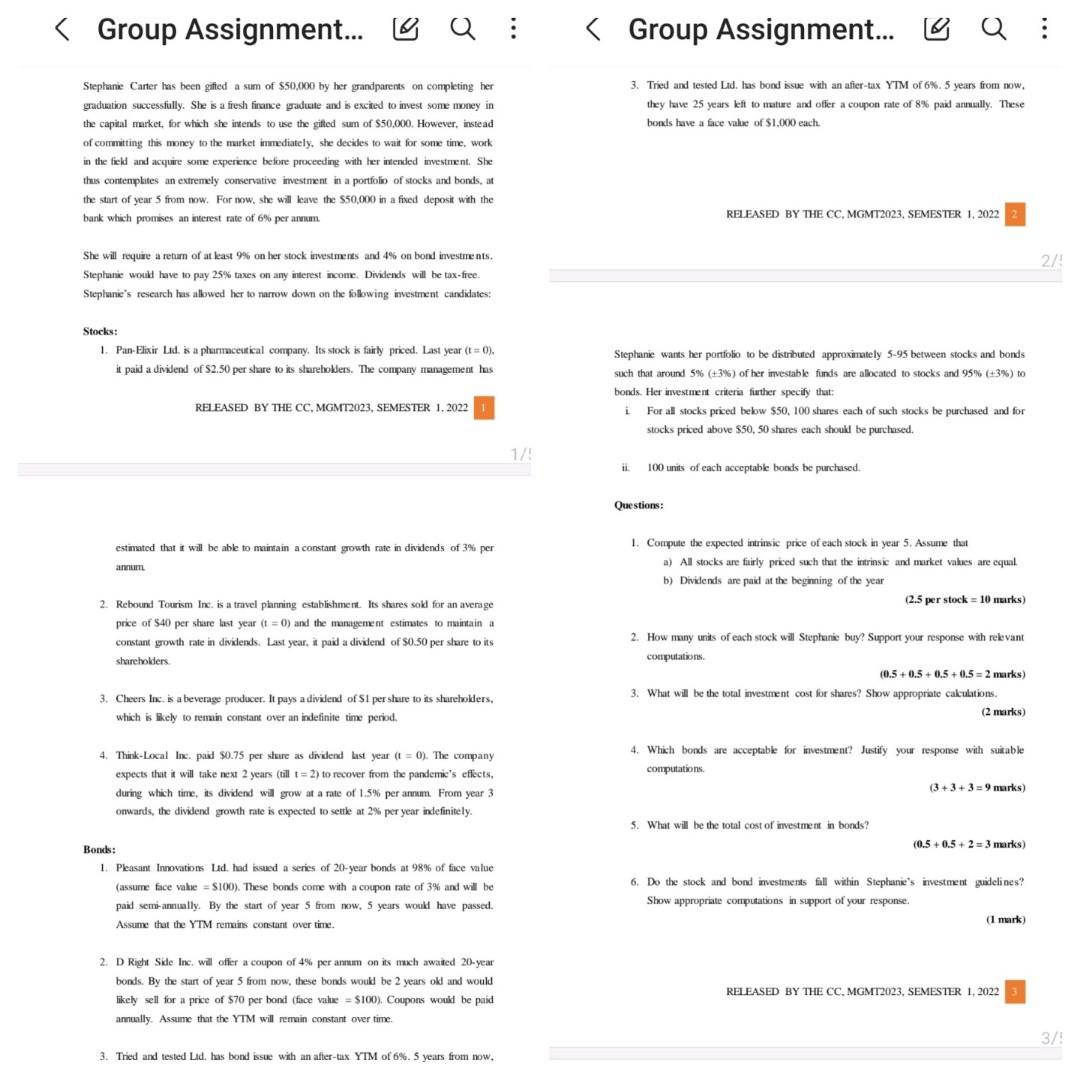

This is a group assignment and I am responsible for question 2 and 3. I cant get past question 1 so I am unable to answer the rest questions. I dont understand what the question is asking for, whether future value or present value of the stocks

She will require a return of at kast 9% on her stock investmenes and 4% on bond investments. Stephanie would have to pay 25% taxes on any interest incone. Dividends will be tax-free. Stephanie's research has allowed her to narrow down on the following investment candidates: Stocks: 1. Pleasant Innovations Lud, had issued a series of 20 -year bonds at 98% of fice value (assume face valie =$100 ). These bonds come with a coupon rate of 3% and will be 6. Do the stock and bond investments fall within Stephanie's investment guidelines? Show appropriate computations in support of your response. (I mark) paid semi-annually. By the start of year 5 from now, 5 years would have passed. Assume that the YTM remains constant over time. 2. D Right Side Inc, will offer a coupon of 4% per anmam on its much awaited 20-year bonds. By the start of year 5 from now, these bonds woukl be 2 years old and would likely sell for a price of $70 per bond (fice value =$100 ). Coupons would be paid RELEASED BY THE CC, MGMT2023, SEMESTER 1, 2022 annually. Assume that the YTM will remain constant over time. 3. Tried and tested Lid. has bond issue with an after-tax YTM of 6%.5 years from now, She will require a return of at kast 9% on her stock investmenes and 4% on bond investments. Stephanie would have to pay 25% taxes on any interest incone. Dividends will be tax-free. Stephanie's research has allowed her to narrow down on the following investment candidates: Stocks: 1. Pleasant Innovations Lud, had issued a series of 20 -year bonds at 98% of fice value (assume face valie =$100 ). These bonds come with a coupon rate of 3% and will be 6. Do the stock and bond investments fall within Stephanie's investment guidelines? Show appropriate computations in support of your response. (I mark) paid semi-annually. By the start of year 5 from now, 5 years would have passed. Assume that the YTM remains constant over time. 2. D Right Side Inc, will offer a coupon of 4% per anmam on its much awaited 20-year bonds. By the start of year 5 from now, these bonds woukl be 2 years old and would likely sell for a price of $70 per bond (fice value =$100 ). Coupons would be paid RELEASED BY THE CC, MGMT2023, SEMESTER 1, 2022 annually. Assume that the YTM will remain constant over time. 3. Tried and tested Lid. has bond issue with an after-tax YTM of 6%.5 years from nowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started