this is a investment banking question in major Banking and Finance

this is a investment banking question in major Banking and Finance

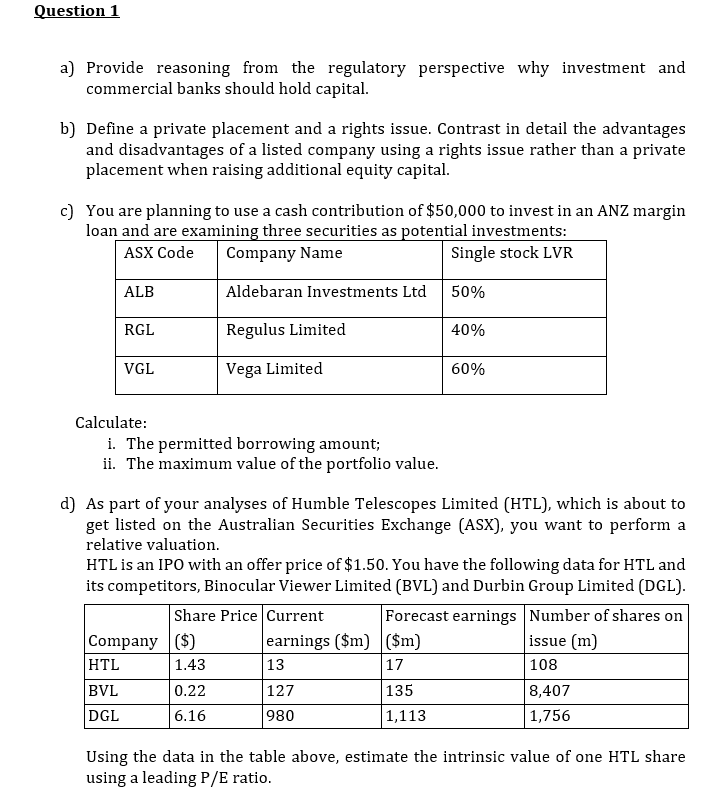

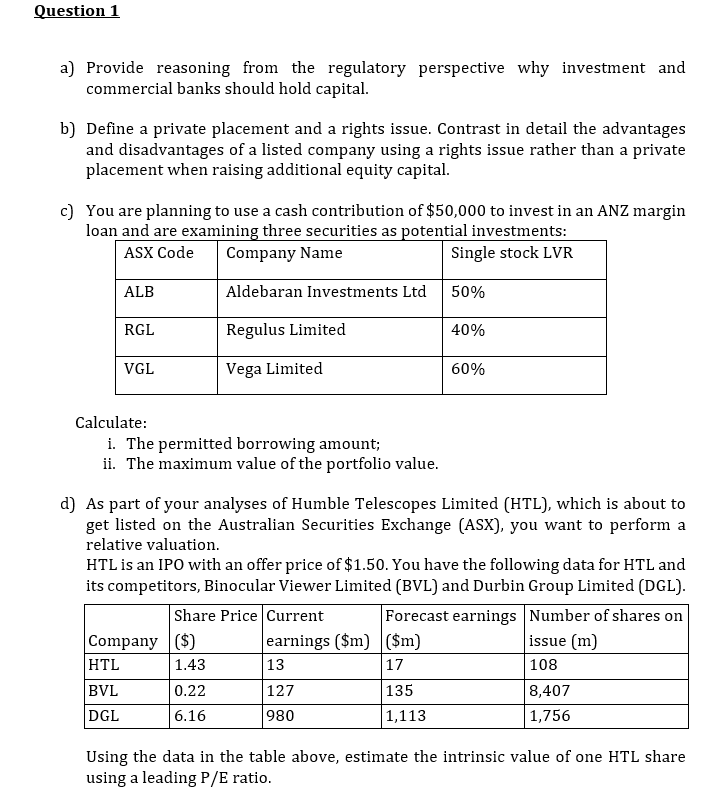

Question 1 a) Provide reasoning from the regulatory perspective why investment and commercial banks should hold capital. b) Define a private placement and a rights issue. Contrast in detail the advantages and disadvantages of a listed company using a rights issue rather than a private placement when raising additional equity capital. c) You are planning to use a cash contribution of $50,000 to invest in an ANZ margin loan and are examining three securities as potential investments: ASX Code Company Name Single stock LVR ALB Aldebaran Investments Ltd 50% RGL Regulus Limited 40% VGL Vega Limited 60% Calculate: i. The permitted borrowing amount; ii. The maximum value of the portfolio value. d) As part of your analyses of Humble Telescopes Limited (HTL), which is about to get listed on the Australian Securities Exchange (ASX), you want to perform a relative valuation. HTL is an IPO with an offer price of $1.50. You have the following data for HTL and its competitors, Binocular Viewer Limited (BVL) and Durbin Group Limited (DGL). Share Price Current Forecast earnings Number of shares on Company ($) earnings ($m) ($m) issue (m) HTL 1.43 13 17 108 BVL 0.22 127 135 8,407 DGL 6.16 980 1,113 1,756 Using the data in the table above, estimate the intrinsic value of one HTL share using a leading P/E ratio. Question 1 a) Provide reasoning from the regulatory perspective why investment and commercial banks should hold capital. b) Define a private placement and a rights issue. Contrast in detail the advantages and disadvantages of a listed company using a rights issue rather than a private placement when raising additional equity capital. c) You are planning to use a cash contribution of $50,000 to invest in an ANZ margin loan and are examining three securities as potential investments: ASX Code Company Name Single stock LVR ALB Aldebaran Investments Ltd 50% RGL Regulus Limited 40% VGL Vega Limited 60% Calculate: i. The permitted borrowing amount; ii. The maximum value of the portfolio value. d) As part of your analyses of Humble Telescopes Limited (HTL), which is about to get listed on the Australian Securities Exchange (ASX), you want to perform a relative valuation. HTL is an IPO with an offer price of $1.50. You have the following data for HTL and its competitors, Binocular Viewer Limited (BVL) and Durbin Group Limited (DGL). Share Price Current Forecast earnings Number of shares on Company ($) earnings ($m) ($m) issue (m) HTL 1.43 13 17 108 BVL 0.22 127 135 8,407 DGL 6.16 980 1,113 1,756 Using the data in the table above, estimate the intrinsic value of one HTL share using a leading P/E ratio

this is a investment banking question in major Banking and Finance

this is a investment banking question in major Banking and Finance