Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume it is 15 February 2021. You are engaged as a tax associate of GoodTax & Co. Your firm has been appointed as the

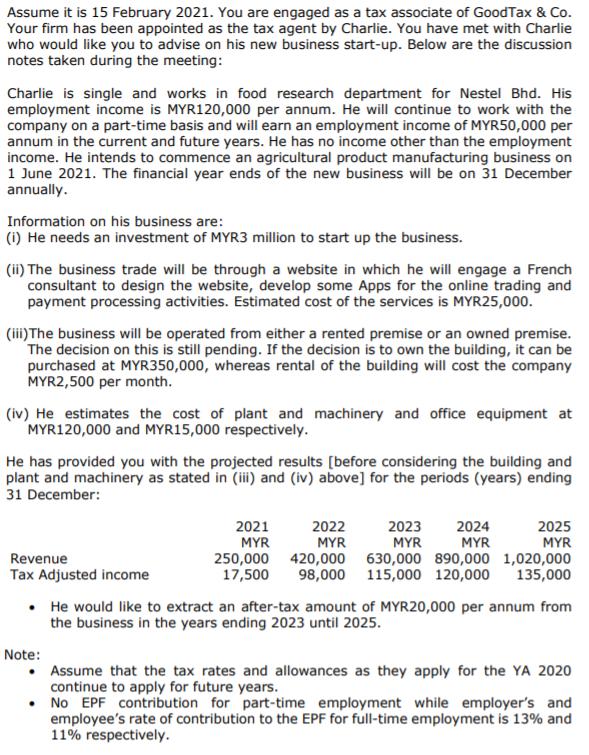

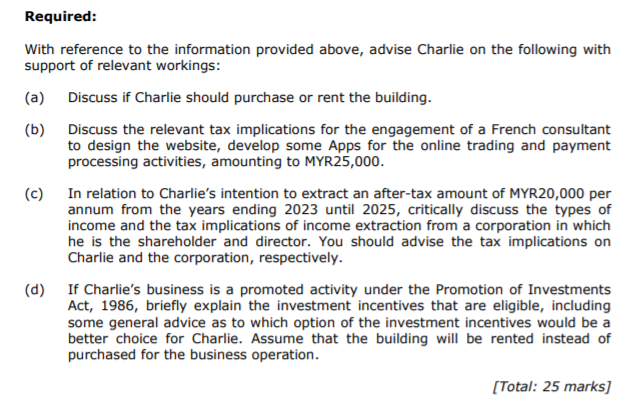

Assume it is 15 February 2021. You are engaged as a tax associate of GoodTax & Co. Your firm has been appointed as the tax agent by Charlie. You have met with Charlie who would like you to advise on his new business start-up. Below are the discussion notes taken during the meeting: Charlie is single and works in food research department for Nestel Bhd. His employment income is MYR120,000 per annum. He will continue to work with the company on a part-time basis and will earn an employment income of MYR50,000 per annum in the current and future years. He has no income other than the employment income. He intends to commence an agricultural product manufacturing business on 1 June 2021. The financial year ends of the new business will be on 31 December annually. Information on his business are: (i) He needs an investment of MYR3 million to start up the business. (ii) The business trade will be through a website in which he will engage a French consultant to design the website, develop some Apps for the online trading and payment processing activities. Estimated cost of the services is MYR25,000. (iii) The business will be operated from either a rented premise or an owned premise. The decision on this is still pending. If the decision is to own the building, it can be purchased at MYR350,000, whereas rental of the building will cost the company MYR2,500 per month. (iv) He estimates the cost of plant and machinery and office equipment at MYR120,000 and MYR15,000 respectively. He has provided you with the projected results [before considering the building and plant and machinery as stated in (iii) and (iv) above] for the periods (years) ending 31 December: Revenue Tax Adjusted income 2025 2023 2024 MYR MYR MYR 630,000 890,000 1,020,000 98,000 115,000 120,000 135,000 2022 2021 MYR MYR 250,000 420,000 17,500 He would like to extract an after-tax amount of MYR20,000 per annum from the business in the years ending 2023 until 2025. Note: Assume that the tax rates and allowances as they apply for the YA 2020 continue to apply for future years. No EPF contribution for part-time employment while employer's and employee's rate of contribution to the EPF for full-time employment is 13% and 11% respectively. Required: With reference to the information provided above, advise Charlie on the following with support of relevant workings: Discuss if Charlie should purchase or rent the building. Discuss the relevant tax implications for the engagement of a French consultant to design the website, develop some Apps for the online trading and payment processing activities, amounting to MYR25,000. (a) (b) (c) In relation to Charlie's intention to extract an after-tax amount of MYR20,000 per annum from the years ending 2023 until 2025, critically discuss the types of income and the tax implications of income extraction from a corporation in which he is the shareholder and director. You should advise the tax implications on Charlie and the corporation, respectively. (d) If Charlie's business is a promoted activity under the Promotion of Investments Act, 1986, briefly explain the investment incentives that are eligible, including some general advice as to which option of the investment incentives would be a better choice for Charlie. Assume that the building will be rented instead of purchased for the business operation. [Total: 25 marks]

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Discuss if Charlie should purchase or rent the building In this case Charlie needs to consider the longterm implications of buying or renting the building for his new business The purchase of the bu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started