this is a management account course for HR. kindly solve on an excel sheet. thank you

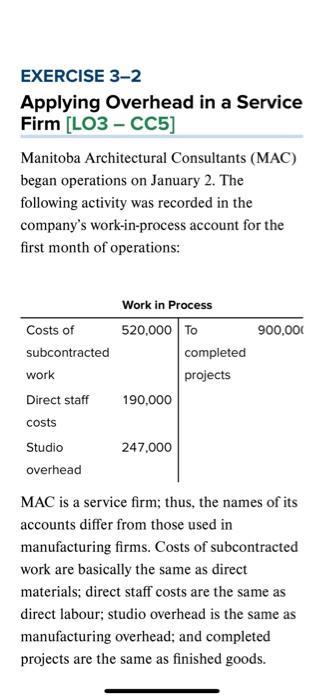

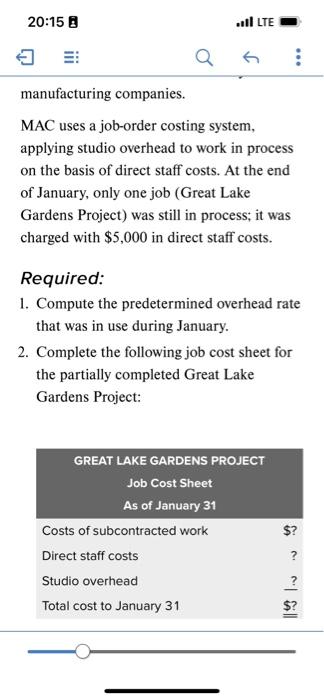

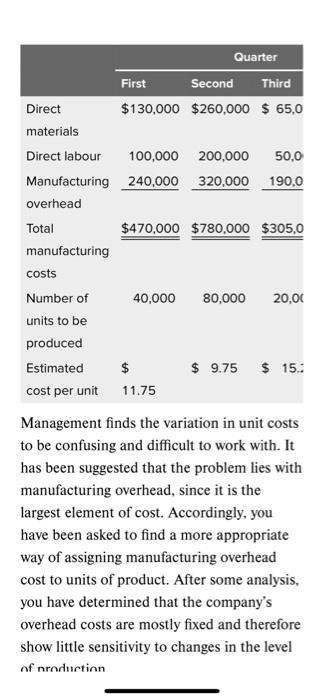

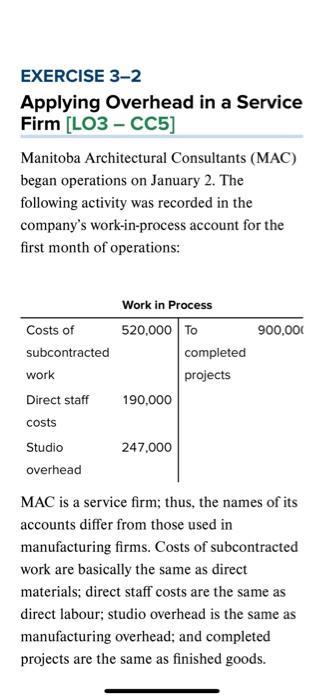

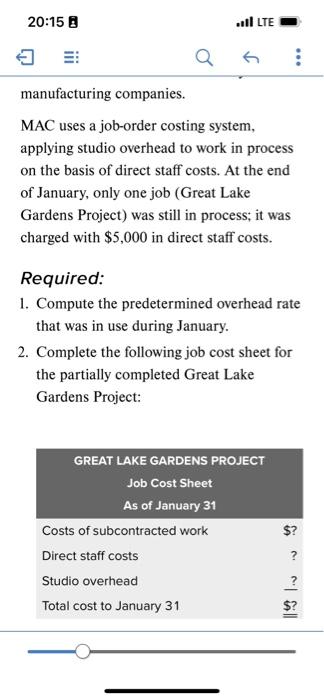

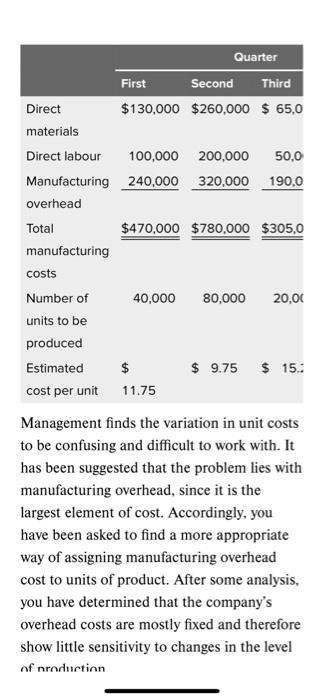

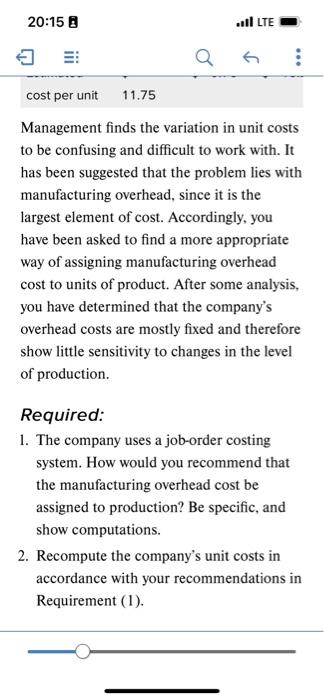

Management finds the variation in unit costs to be confusing and difficult to work with. It has been suggested that the problem lies with manufacturing overhead, since it is the largest element of cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product. After some analysis, you have determined that the company's overhead costs are mostly fixed and therefore show little sensitivity to changes in the level of nroduction Using Varying Predetermined Overhead Rates [LO3 - CC5] Big Drums Ltd. (located in Trinidad) experiences wide variation in demand for the 800 -litre steel drums it fabricates. The leakproof, rustproof steel drums have a variety of uses, from storing liquids and bulk materials to serving as makeshift musical instruments. The drums are made to order and are painted according to the customer's specifications-often in bright patterns and designs. The company is well known for the artwork that appears on its drums. Unit costs are computed on a quarterly basis by dividing each quarter's manufacturing costs (materials, labour, and overhead) by the quarter's production in units. The company's estimated costs, by quarter, for the coming year are as follows: manufacturing companies. MAC uses a job-order costing system, applying studio overhead to work in process on the basis of direct staff costs. At the end of January, only one job (Great Lake Gardens Project) was still in process; it was charged with $5,000 in direct staff costs. EXERCISE 3-2 Applying Overhead in a Service Firm [LO3 - CC5] Manitoba Architectural Consultants (MAC) began operations on January 2 . The following activity was recorded in the company's work-in-process account for the first month of operations: MAC is a service firm; thus, the names of its accounts differ from those used in manufacturing firms. Costs of subcontracted work are basically the same as direct materials; direct staff costs are the same as direct labour; studio overhead is the same as manufacturing overhead; and completed projects are the same as finished goods. Management finds the variation in unit costs to be confusing and difficult to work with. It has been suggested that the problem lies with manufacturing overhead, since it is the largest element of cost. Accordingly, you have been asked to find a more appropriate way of assigning manufacturing overhead cost to units of product. After some analysis, you have determined that the company's overhead costs are mostly fixed and therefore show little sensitivity to changes in the level of production. Required: 1. The company uses a job-order costing system. How would you recommend that the manufacturing overhead cost be assigned to production? Be specific, and show computations. 2. Recompute the company's unit costs in accordance with your recommendations in Requirement (1). work are basically the same as direct materials; direct staff costs are the same as direct labour; studio overhead is the same as manufacturing overhead; and completed projects are the same as finished goods. Apart from the difference in terms, the accounting methods used by the company are identical to the methods used by manufacturing companies. MAC uses a job-order costing system, applying studio overhead to work in process on the basis of direct staff costs. At the end of January, only one job (Great Lake Gardens Project) was still in process; it was charged with $5,000 in direct staff costs. Required: 1. Compute the predetermined overhead rate that was in use during January. 2. Complete the following job cost sheet for the partially completed Great Lake Gardens Project