This is a Management Accounting question. Can you please answer A, B, C, D & E?

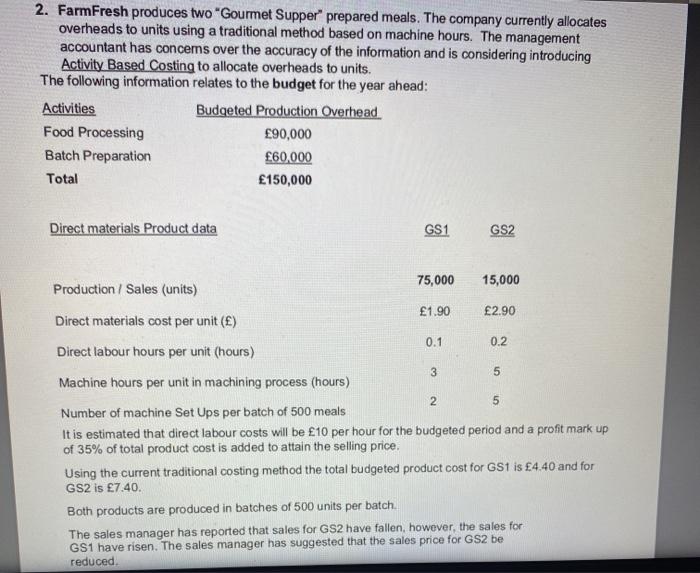

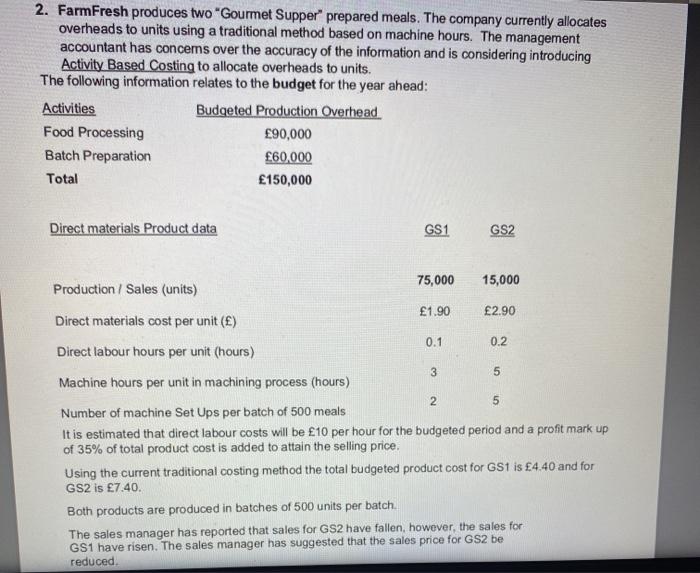

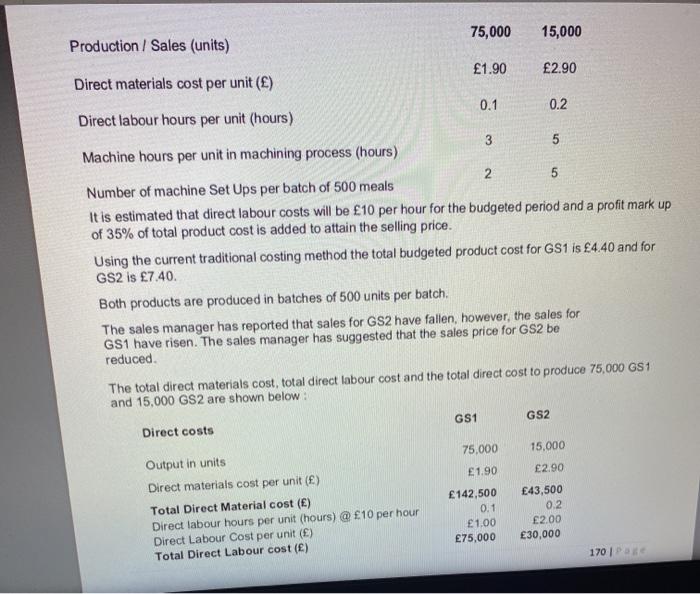

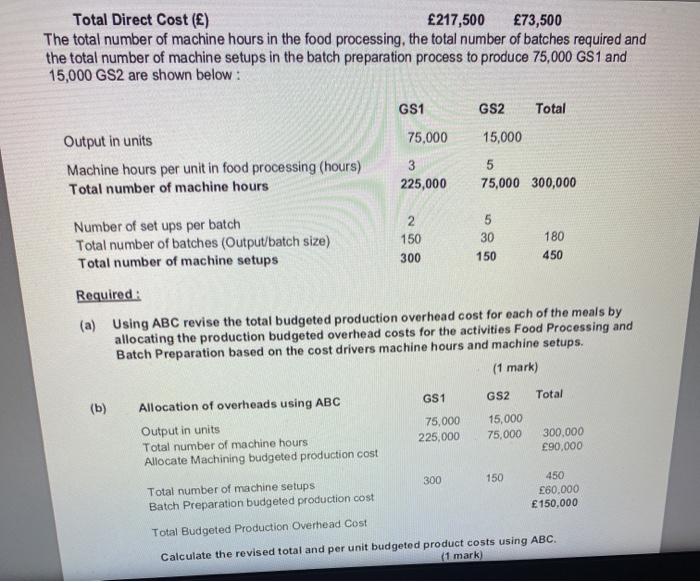

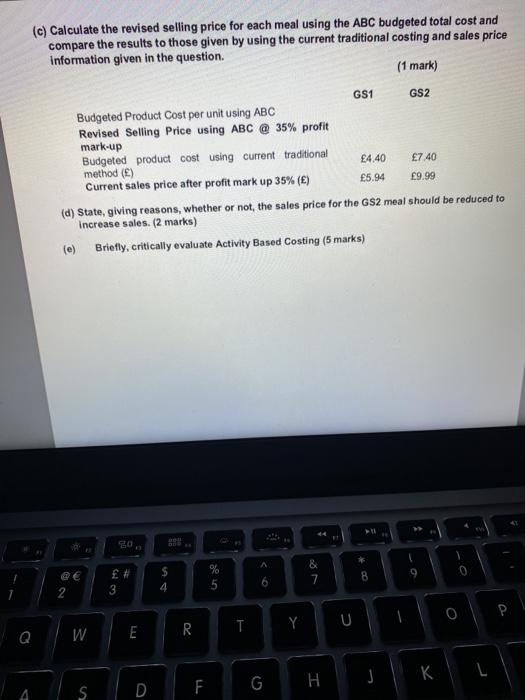

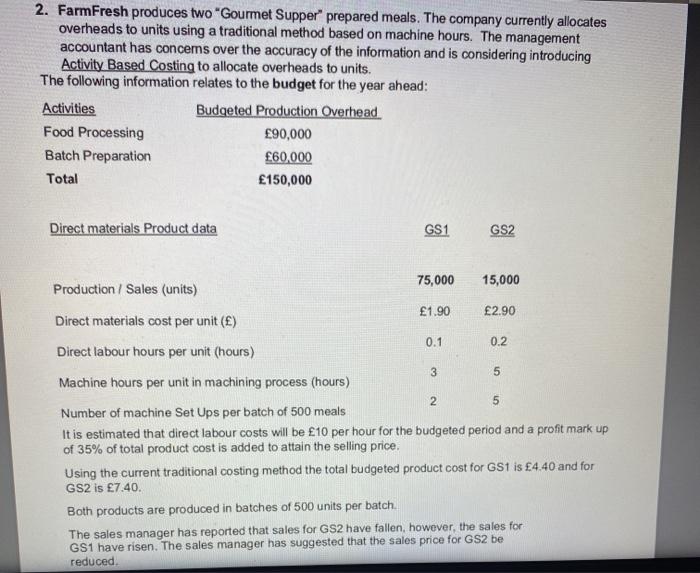

2. FarmFresh produces two "Gourmet Supper" prepared meals. The company currently allocates overheads to units using a traditional method based on machine hours. The management accountant has concems over the accuracy of the information and is considering introducing Activity Based Costing to allocate overheads to units. The following information relates to the budget for the year ahead: Activities Budgeted Production Overhead Food Processing 90,000 Batch Preparation 60,000 Total 150,000 Direct materials Product data GS1 GS2 3 5 2 Production / Sales (units) 75,000 15,000 1.90 Direct materials cost per unit () 2.90 0.1 0.2 Direct labour hours per unit (hours) Machine hours per unit in machining process (hours) 5 Number of machine Set Ups per batch of 500 meals It is estimated that direct labour costs will be 10 per hour for the budgeted period and a profit mark up of 35% of total product cost is added to attain the selling price. Using the current traditional costing method the total budgeted product cost for GS1 is 4.40 and for GS2 is 7.40. Both products are produced in batches of 500 units per batch. The sales manager has reported that sales for GS2 have fallen, however, the sales for GS1 have risen. The sales manager has suggested that the sales price for GS2 be reduced 75,000 15,000 Production / Sales (units) 1.90 2.90 Direct materials cost per unit () 0.1 0.2 Direct labour hours per unit (hours) 3 5 Machine hours per unit in machining process (hours) N Number of machine Set Ups per batch of 500 meals 5 It is estimated that direct labour costs will be 10 per hour for the budgeted period and a profit mark up of 35% of total product cost is added to attain the selling price. Using the current traditional costing method the total budgeted product cost for GS1 is 4.40 and for GS2 is 7.40 Both products are produced in batches of 500 units per batch. The sales manager has reported that sales for GS2 have fallen, however, the sales for GS1 have risen. The sales manager has suggested that the sales price for GS2 be reduced. The total direct materials cost, total direct labour cost and the total direct cost to produce 75,000 GS1 and 15,000 GS2 are shown below: GS1 GS2 Direct costs 75,000 1.90 15.000 2.90 Output in units Direct materials cost per unit () Total Direct Material cost (E) Direct labour hours per unit (hours) @ 10 per hour Direct Labour Cost per unit () Total Direct Labour cost (E) 142,500 0.1 1.00 75,000 43,500 0.2 2.00 30,000 170 Total Direct Cost () 217,500 73,500 The total number of machine hours in the food processing, the total number of batches required and the total number of machine setups in the batch preparation process to produce 75,000 GS1 and 15,000 GS2 are shown below: GS1 GS2 Total 75,000 15,000 Output in units Machine hours per unit in food processing (hours) Total number of machine hours 3 225,000 5 75,000 300,000 Number of set ups per batch Total number of batches (Output/batch size) Total number of machine setups 2 150 300 5 30 150 180 450 Required: (a) Using ABC revise the total budgeted production overhead cost for each of the meals by allocating the production budgeted overhead costs for the activities Food Processing and Batch Preparation based on the cost drivers machine hours and machine setups. (1 mark) (b) Allocation of overheads using ABC GS1 GS2 Total Output in units 75,000 15,000 Total number of machine hours 225,000 75,000 300.000 Allocate Machining budgeted production cost 90,000 Total number of machine setups 300 150 450 Batch Preparation budgeted production cost 60.000 150,000 Total Budgeted Production Overhead Cost Calculate the revised total and per unit budgeted product costs using ABC. (1 mark) (c) Calculate the revised selling price for each meal using the ABC budgeted total cost and compare the results to those given by using the current traditional costing and sales price information given in the question. (1 mark) GS1 GS2 Budgeted Product Cost per unit using ABC Revised Selling Price using ABC @ 35% profit mark-up Budgeted product cost using current traditional 4.40 7.40 method (E) Current sales price after profit mark up 35% (E) 5.94 9.99 (d) State, giving reasons, whether or not, the sales price for the GS2 meal should be reduced to increase sales. (2 marks) Briefly, critically evaluate Activity Based Costing (5 marks) an & 7 0 2 3 8 4 5 2 P . R Y U Q W E F G H S D 2. FarmFresh produces two "Gourmet Supper" prepared meals. The company currently allocates overheads to units using a traditional method based on machine hours. The management accountant has concems over the accuracy of the information and is considering introducing Activity Based Costing to allocate overheads to units. The following information relates to the budget for the year ahead: Activities Budgeted Production Overhead Food Processing 90,000 Batch Preparation 60,000 Total 150,000 Direct materials Product data GS1 GS2 3 5 2 Production / Sales (units) 75,000 15,000 1.90 Direct materials cost per unit () 2.90 0.1 0.2 Direct labour hours per unit (hours) Machine hours per unit in machining process (hours) 5 Number of machine Set Ups per batch of 500 meals It is estimated that direct labour costs will be 10 per hour for the budgeted period and a profit mark up of 35% of total product cost is added to attain the selling price. Using the current traditional costing method the total budgeted product cost for GS1 is 4.40 and for GS2 is 7.40. Both products are produced in batches of 500 units per batch. The sales manager has reported that sales for GS2 have fallen, however, the sales for GS1 have risen. The sales manager has suggested that the sales price for GS2 be reduced 75,000 15,000 Production / Sales (units) 1.90 2.90 Direct materials cost per unit () 0.1 0.2 Direct labour hours per unit (hours) 3 5 Machine hours per unit in machining process (hours) N Number of machine Set Ups per batch of 500 meals 5 It is estimated that direct labour costs will be 10 per hour for the budgeted period and a profit mark up of 35% of total product cost is added to attain the selling price. Using the current traditional costing method the total budgeted product cost for GS1 is 4.40 and for GS2 is 7.40 Both products are produced in batches of 500 units per batch. The sales manager has reported that sales for GS2 have fallen, however, the sales for GS1 have risen. The sales manager has suggested that the sales price for GS2 be reduced. The total direct materials cost, total direct labour cost and the total direct cost to produce 75,000 GS1 and 15,000 GS2 are shown below: GS1 GS2 Direct costs 75,000 1.90 15.000 2.90 Output in units Direct materials cost per unit () Total Direct Material cost (E) Direct labour hours per unit (hours) @ 10 per hour Direct Labour Cost per unit () Total Direct Labour cost (E) 142,500 0.1 1.00 75,000 43,500 0.2 2.00 30,000 170 Total Direct Cost () 217,500 73,500 The total number of machine hours in the food processing, the total number of batches required and the total number of machine setups in the batch preparation process to produce 75,000 GS1 and 15,000 GS2 are shown below: GS1 GS2 Total 75,000 15,000 Output in units Machine hours per unit in food processing (hours) Total number of machine hours 3 225,000 5 75,000 300,000 Number of set ups per batch Total number of batches (Output/batch size) Total number of machine setups 2 150 300 5 30 150 180 450 Required: (a) Using ABC revise the total budgeted production overhead cost for each of the meals by allocating the production budgeted overhead costs for the activities Food Processing and Batch Preparation based on the cost drivers machine hours and machine setups. (1 mark) (b) Allocation of overheads using ABC GS1 GS2 Total Output in units 75,000 15,000 Total number of machine hours 225,000 75,000 300.000 Allocate Machining budgeted production cost 90,000 Total number of machine setups 300 150 450 Batch Preparation budgeted production cost 60.000 150,000 Total Budgeted Production Overhead Cost Calculate the revised total and per unit budgeted product costs using ABC. (1 mark) (c) Calculate the revised selling price for each meal using the ABC budgeted total cost and compare the results to those given by using the current traditional costing and sales price information given in the question. (1 mark) GS1 GS2 Budgeted Product Cost per unit using ABC Revised Selling Price using ABC @ 35% profit mark-up Budgeted product cost using current traditional 4.40 7.40 method (E) Current sales price after profit mark up 35% (E) 5.94 9.99 (d) State, giving reasons, whether or not, the sales price for the GS2 meal should be reduced to increase sales. (2 marks) Briefly, critically evaluate Activity Based Costing (5 marks) an & 7 0 2 3 8 4 5 2 P . R Y U Q W E F G H S D