Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a Math of finance undergraduate homework packet wroth 40 percent of my grade. Please help. I will upvote if you provide the correct

This is a Math of finance undergraduate homework packet wroth 40 percent of my grade. Please help. I will upvote if you provide the correct answer. Each question should take around 8 mins, give or take. Please help as soon as possible as the packet is due very soon and please explain.

Question 6

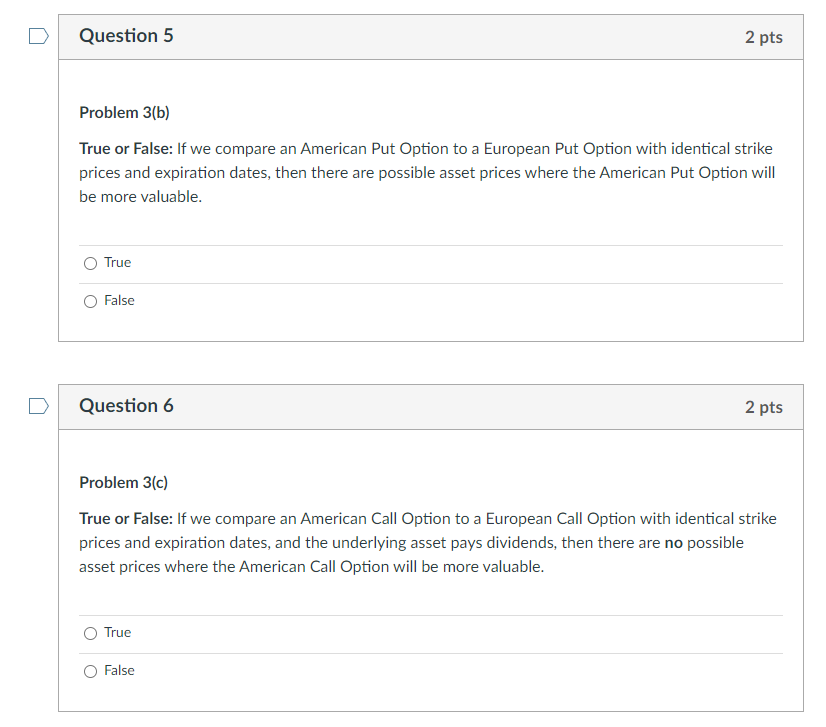

Question 5 2 pts Problem 3(b) True or False: If we compare an American Put Option to a European Put Option with identical strike prices and expiration dates, then there are possible asset prices where the American Put Option will be more valuable. True O False Question 6 2 pts Problem 3(c) True or False: If we compare an American Call Option to a European Call Option with identical strike prices and expiration dates, and the underlying asset pays dividends, then there are no possible asset prices where the American Call Option will be more valuable. True O False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started