this is a multipart question so please help with all the parts

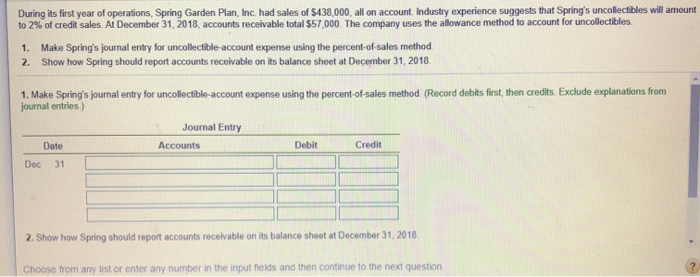

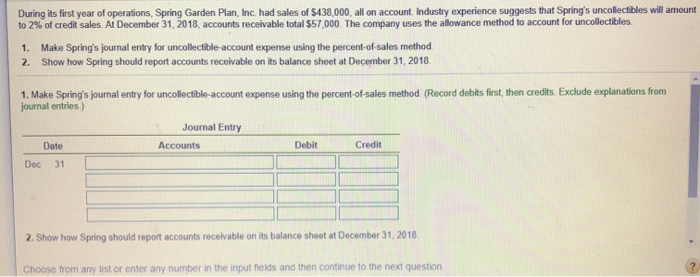

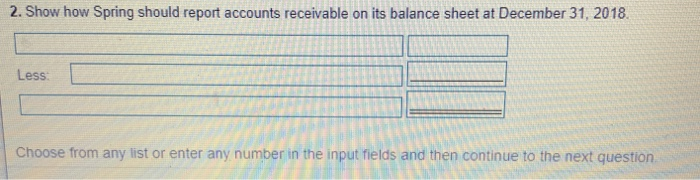

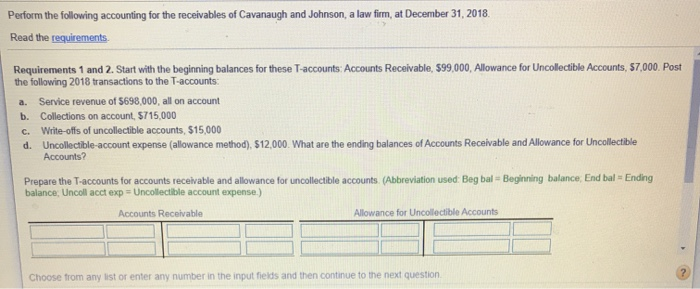

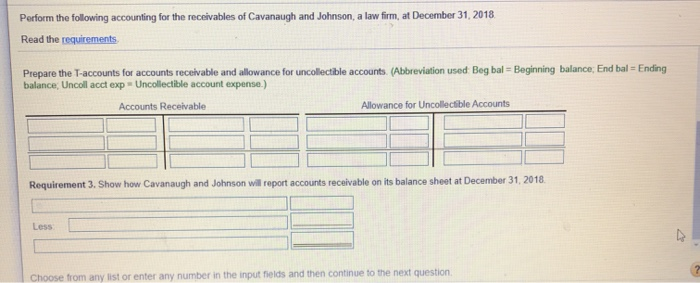

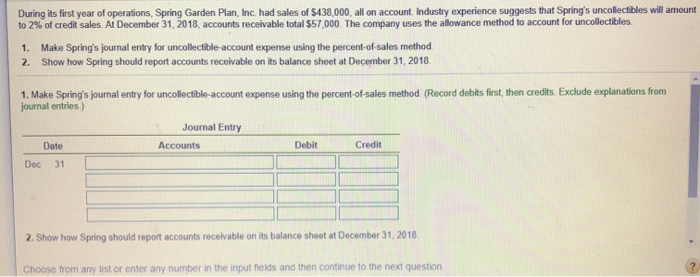

During its first year of operations, Spring Garden Plan, Inc. had sales of $438,000, all on account. Industry experience suggests that Spring's uncollectibles will amount to 2% of credit sales. Al December 31, 2018, accounts receivable total $57,000. The company uses the allowance method to account for uncollectibles 1. Make Spring's journal entry for uncollectible-account expense using the percent of sales method 2. Show how Spring should report accounts receivable on its balance sheet at December 31, 2018 1. Make Spring's journal entry for uncollectible-account expense using the percent-of-sales method. (Record debits first, then credits. Exclude explanations from journal entries) Journal Entry Date Accounts Debit Credit Dec 31 2. Show how Spring should report accounts receivable on its balance sheet at December 31, 2018 Choose from any list or enter any number in the input fields and then continue to the next question 2. Show how Spring should report accounts receivable on its balance sheet at December 31, 2018 Less: Choose from any list or enter any number in the input fields and then continue to the next question Perform the following accounting for the receivables of Cavanaugh and Johnson, a law firm, at December 31, 2018 Read the requirements Requirements 1 and 2. Start with the beginning balances for these T-accounts: Accounts Receivable. $99.000. Allowance for Uncollectible Accounts, 57,000. Post the following 2018 transactions to the T-accounts: a. Service revenue of $698,000, all on account b. Collections on account, $715,000 c. Write-offs of uncollectible accounts, $15,000 d. Uncollectible-account expense (allowance method) $12,000. What are the ending balances of Accounts Receivable and Allowance for Uncollectible Accounts? Prepare the T-accounts for accounts receivable and allowance for uncollectible accounts (Abbreviation used: Beg bal=Beginning balance, End bal = Ending balance, Uncollacct exp Uncollectible account expense) Accounts Receivable Allowance for Uncollectible Accounts Choose from any list or enter any number in the input fields and then continue to the next question Perform the following accounting for the receivables of Cavanaugh and Johnson, a law firm, at December 31, 2018 Read the requirements Prepare the T-accounts for accounts receivable and allowance for uncollectible accounts (Abbreviation used. Beg bal = Beginning balance, End bal = Ending balance Uncall acct exp - Uncollectible account expense.) Accounts Receivable Allowance for Uncollectible Accounts Requirement 3. Show how Cavanaugh and Johnson will report accounts receivable on its balance sheet at December 31, 2018 Choose from any list or enter any number in the input fields and then continue to the next