Answered step by step

Verified Expert Solution

Question

1 Approved Answer

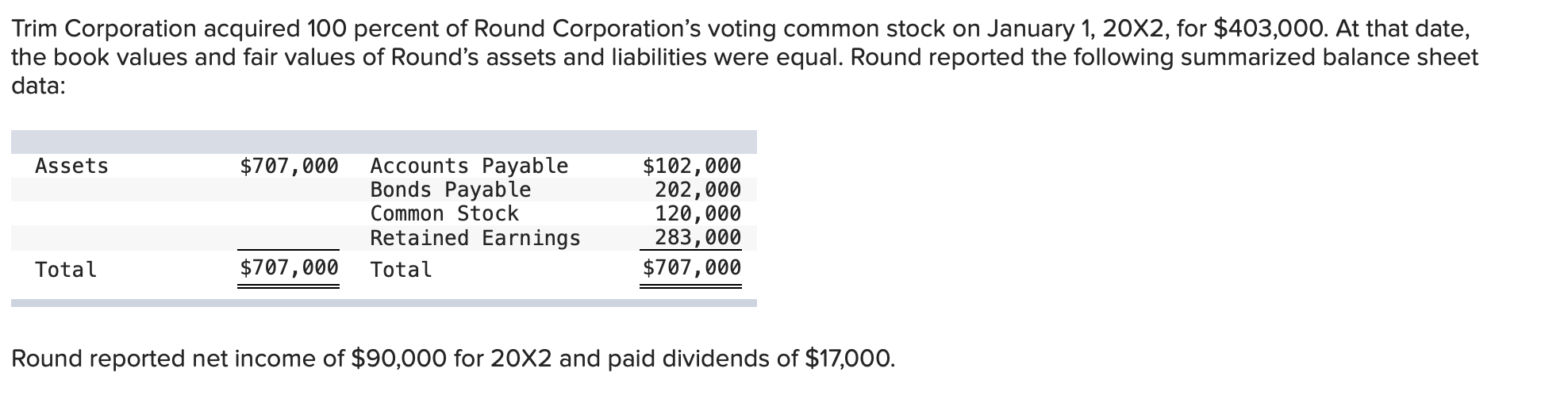

*This is a multi-part question Trim Corporation acquired 100 percent of Round Corporation's voting common stock on January 1, 20X2, for $403,000. At that date,

*This is a multi-part question

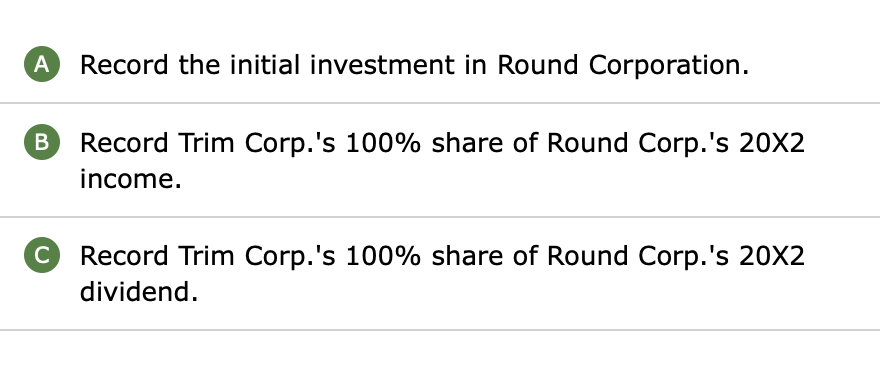

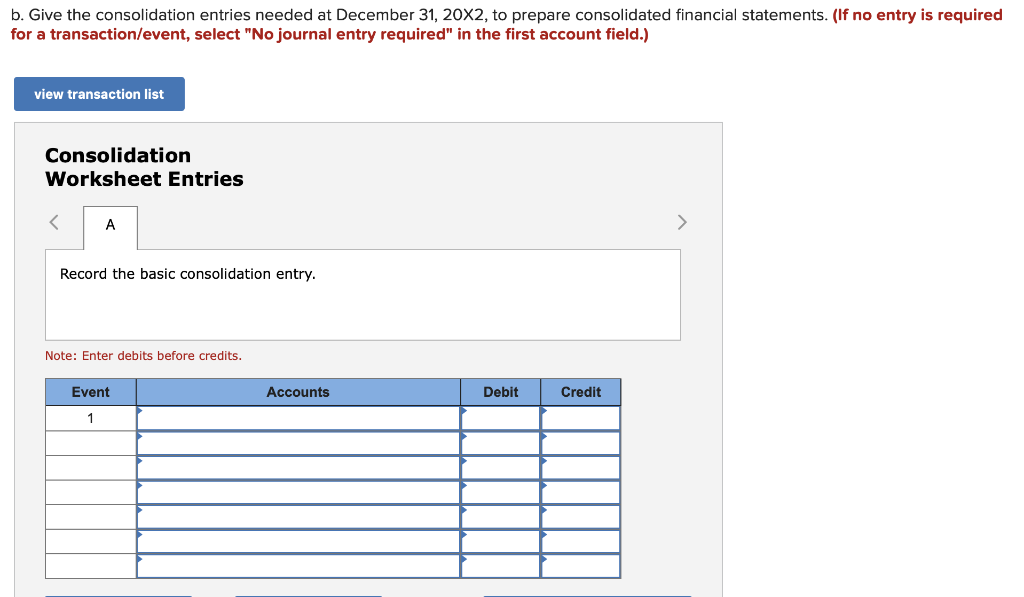

Trim Corporation acquired 100 percent of Round Corporation's voting common stock on January 1, 20X2, for $403,000. At that date, the book values and fair values of Round's assets and liabilities were equal. Round reported the following summarized balance sheet data: Assets $707,000 Accounts Payable Bonds Payable Common Stock Retained Earnings $707,000 Total $102,000 202,000 120,000 283,000 $707,000 Total Round reported net income of $90,000 for 20X2 and paid dividends of $17,000. A Record the initial investment in Round Corporation. B Record Trim Corp.'s 100% share of Round Corp.'s 20x2 income. C Record Trim Corp.'s 100% share of Round Corp.'s 20X2 dividend. b. Give the consolidation entries needed at December 31, 20X2, to prepare consolidated financial statements. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries Record the basic consolidation entry. Note: Enter debits before credits. Event Accounts Debit Credit 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started