Question

This is a portfolio analysis problem. You value the remaining bonds and find that DBPFs assets have also a value of 850m. You compute that

This is a portfolio analysis problem. You value the remaining bonds and find that DBPFs assets have also a value of 850m. You compute that a small upward shift of todays term structure would imply an approximate modified duration of 4.6 for DBPFs bond portfolio, but of 10.5 for DBPFs obligations to policyholders.

All information needed is provided in the picture, please answer:

1. What is the exact business of DBPF? 2. What is the funding position and why is it important? 3. While I understand what bonds are and why their value depends on interest rates, I do not understand what DBPFs obligations towards their policyholders are. 4. I could not follow the computations of the values for the three bonds. Could you please explain it to me and give me the correct values? 5. I also have no clue about the modified duration. What is it and why is it useful for portfolio risk management of the DBPF? In particular, are the modified durations of 4.6 for DBPFs bond portfolio and of 10.5 for DBPFs obligations to policyholders of concern and why? 6. Finally, what can be done if the durations are of concern?

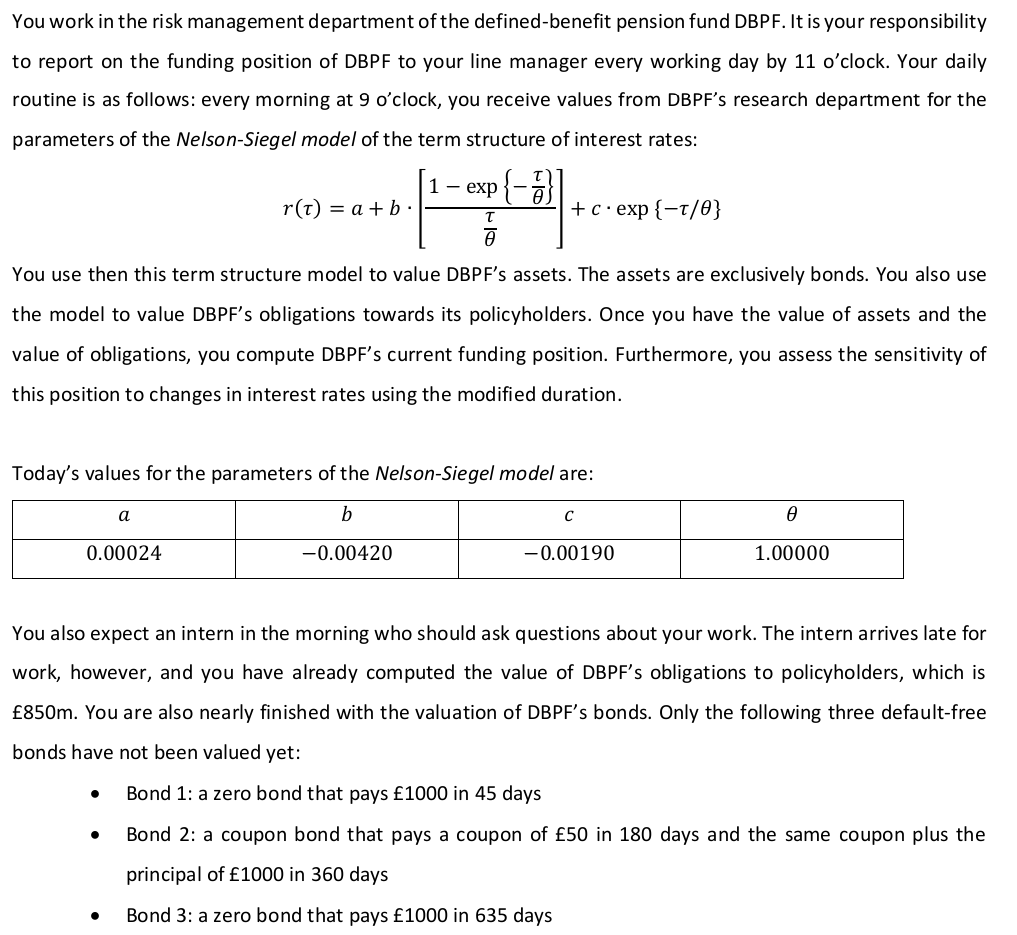

You work in the risk management department of the defined benefit pension fund DBPF. It is your responsibility to report on the funding position of DBPF to your line manager every working day by 11 o'clock. Your daily routine is as follows: every morning at 9 o'clock, you receive values from DBPF's research department for the parameters of the Nelson-Siegel model of the term structure of interest rates: {-} r(t) = a + b +c.exp{-1/0} o 1- exp -H2). You use then this term structure model to value DBPF's assets. The assets are exclusively bonds. You also use the model to value DBPF's obligations towards its policyholders. Once you have the value of assets and the value of obligations, you compute DBPF's current funding position. Furthermore, you assess the sensitivity of this position to changes in interest rates using the modified duration. Today's values for the parameters of the Nelson-Siegel model are: a b 0.00024 -0.00420 -0.00190 1.00000 You also expect an intern in the morning who should ask questions about your work. The intern arrives late for work, however, and you have already computed the value of DBPF's obligations to policyholders, which is 850m. You are also nearly finished with the valuation of DBPF's bonds. Only the following three default-free bonds have not been valued yet: Bond 1: a zero bond that pays 1000 in 45 days Bond 2: a coupon bond that pays a coupon of 50 in 180 days and the same coupon plus the . principal of 1000 in 360 days . Bond 3: a zero bond that pays 1000 in 635 days You work in the risk management department of the defined benefit pension fund DBPF. It is your responsibility to report on the funding position of DBPF to your line manager every working day by 11 o'clock. Your daily routine is as follows: every morning at 9 o'clock, you receive values from DBPF's research department for the parameters of the Nelson-Siegel model of the term structure of interest rates: {-} r(t) = a + b +c.exp{-1/0} o 1- exp -H2). You use then this term structure model to value DBPF's assets. The assets are exclusively bonds. You also use the model to value DBPF's obligations towards its policyholders. Once you have the value of assets and the value of obligations, you compute DBPF's current funding position. Furthermore, you assess the sensitivity of this position to changes in interest rates using the modified duration. Today's values for the parameters of the Nelson-Siegel model are: a b 0.00024 -0.00420 -0.00190 1.00000 You also expect an intern in the morning who should ask questions about your work. The intern arrives late for work, however, and you have already computed the value of DBPF's obligations to policyholders, which is 850m. You are also nearly finished with the valuation of DBPF's bonds. Only the following three default-free bonds have not been valued yet: Bond 1: a zero bond that pays 1000 in 45 days Bond 2: a coupon bond that pays a coupon of 50 in 180 days and the same coupon plus the . principal of 1000 in 360 days . Bond 3: a zero bond that pays 1000 in 635 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started