Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is a question about investment research method, this table combined high value with high momentum and high value with low momentum, etc. I want

this is a question about investment research method, this table combined high value with high momentum and high value with low momentum, etc. I want to know hoot understand this table and what strategies are the best?

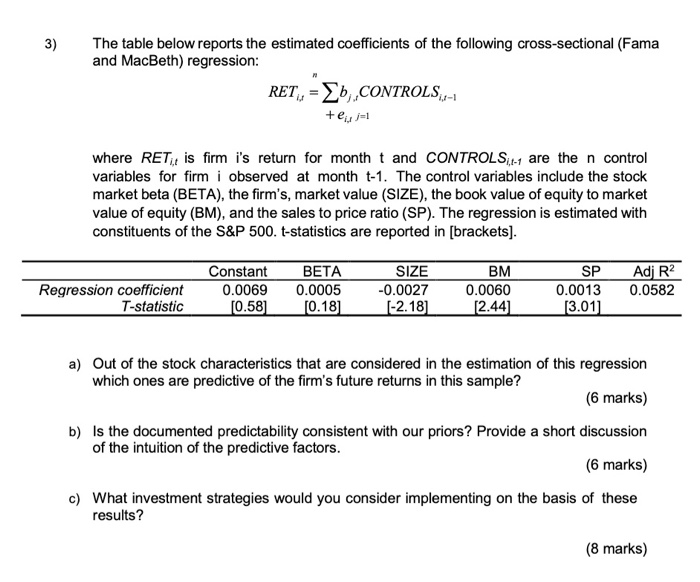

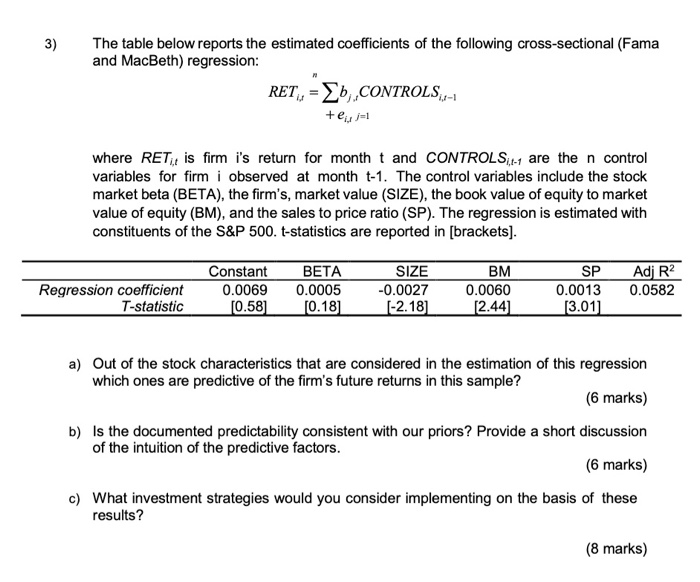

3) The table below reports the estimated coefficients of the following cross-sectional (Fama and MacBeth) regression: RET, = {b.CONTROLS,- + ej=1 where RET, is firm i's return for month t and CONTROLS 1-1 are the n control variables for firm i observed at month t-1. The control variables include the stock market beta (BETA), the firm's, market value (SIZE), the book value of equity to market value of equity (BM), and the sales to price ratio (SP). The regression is estimated with constituents of the S&P 500. t-statistics are reported in [brackets). Constant 0.0069 [0.58] Regression coefficient T-statistic BETA 0.0005 (0.18] SIZE -0.0027 [-2.18] BM 0.0060 (2.44) SP 0.0013 (3.01] Adj R2 0.0582 1 a) Out of the stock characteristics that are considered in the estimation of this regression which ones are predictive of the firm's future returns in this sample? (6 marks) b) is the documented predictability consistent with our priors? Provide a short discussion of the intuition of the predictive factors. (6 marks) c) What investment strategies would you consider implementing on the basis of these results? (8 marks) 3) The table below reports the estimated coefficients of the following cross-sectional (Fama and MacBeth) regression: RET, = {b.CONTROLS,- + ej=1 where RET, is firm i's return for month t and CONTROLS 1-1 are the n control variables for firm i observed at month t-1. The control variables include the stock market beta (BETA), the firm's, market value (SIZE), the book value of equity to market value of equity (BM), and the sales to price ratio (SP). The regression is estimated with constituents of the S&P 500. t-statistics are reported in [brackets). Constant 0.0069 [0.58] Regression coefficient T-statistic BETA 0.0005 (0.18] SIZE -0.0027 [-2.18] BM 0.0060 (2.44) SP 0.0013 (3.01] Adj R2 0.0582 1 a) Out of the stock characteristics that are considered in the estimation of this regression which ones are predictive of the firm's future returns in this sample? (6 marks) b) is the documented predictability consistent with our priors? Provide a short discussion of the intuition of the predictive factors. (6 marks) c) What investment strategies would you consider implementing on the basis of these results? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started