This is a question

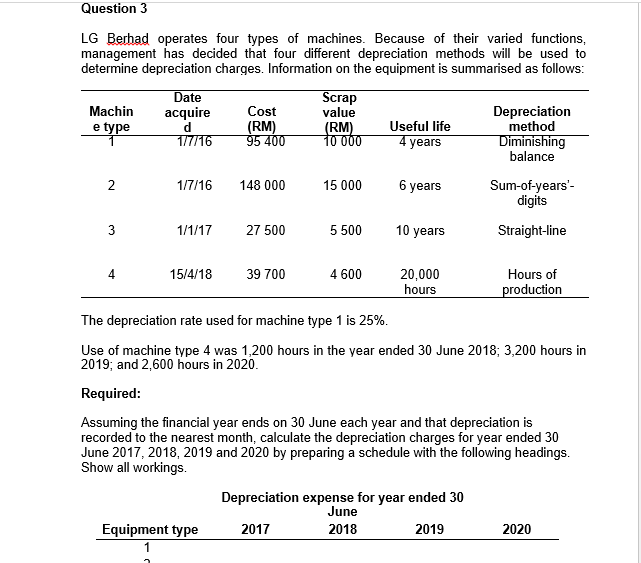

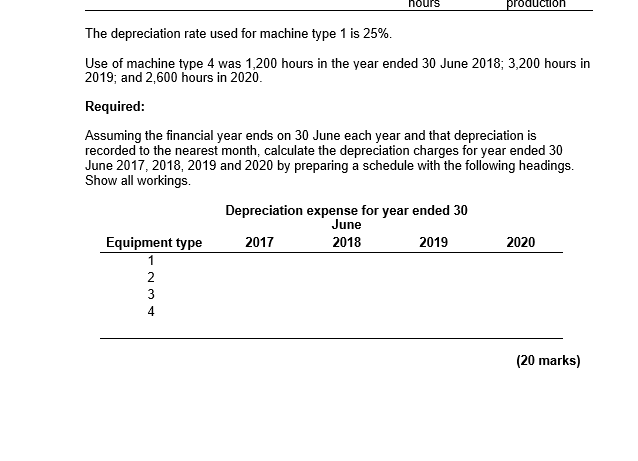

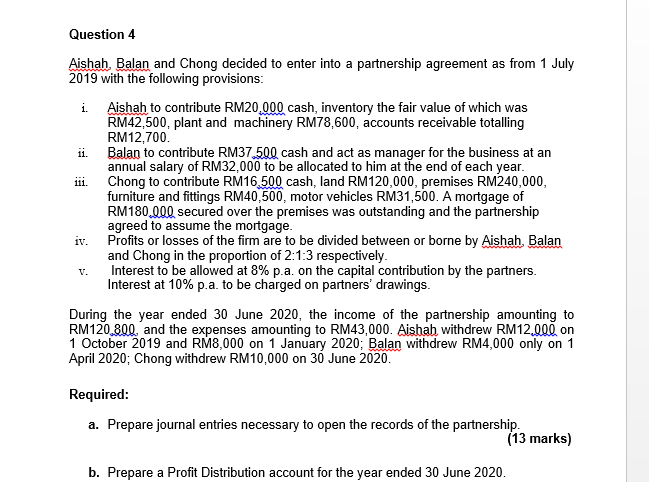

CoursHeroTranscribedText: Question 3 LG Berhad operates four types of machines. Because of their varied functions, management has decided that four different depreciation methods will be used to determine depreciation charges. Information on the equipment is summarised as follows: Date Scrap Machin acquire Cost value Depreciation e type d (RM) (RM) Useful life method 1/7/16 95 400 10 000 4 years Diminishing balance 2 1/7/16 148 000 15 000 6 years Sum-of-years'- digits 3 1/1/17 27 500 5 500 10 years Straight-line 4 15/4/18 39 700 4 600 20,000 Hours of hours production The depreciation rate used for machine type 1 is 25%. Use of machine type 4 was 1,200 hours in the year ended 30 June 2018; 3,200 hours in 2019; and 2,600 hours in 2020. Required: Assuming the financial year ends on 30 June each year and that depreciation is recorded to the nearest month, calculate the depreciation charges for year ended 30 June 2017, 2018, 2019 and 2020 by preparing a schedule with the following headings. Show all workings. Depreciation expense for year ended 30 June Equipment type 2017 2018 2019 2020hours production The depreciation rate used for machine type 1 is 25%. Use of machine type 4 was 1,200 hours in the year ended 30 June 2018; 3,200 hours in 2019; and 2,600 hours in 2020. Required: Assuming the financial year ends on 30 June each year and that depreciation is recorded to the nearest month, calculate the depreciation charges for year ended 30 June 2017, 2018, 2019 and 2020 by preparing a schedule with the following headings. Show all workings. Depreciation expense for year ended 30 June Equipment type 2017 2018 2019 2020 (20 marks)Question 4 Aishah, Balan and Chong decided to enter into a partnership agreement as from 1 July 2019 with the following provisions: i . Aishah to contribute RM20,000 cash, inventory the fair value of which was RM42,500, plant and machinery RM78,600, accounts receivable totalling RM12,700. ii. Balan to contribute RM37 500 cash and act as manager for the business at an annual salary of RM32,000 to be allocated to him at the end of each year. iii. Chong to contribute RM16,500 cash, land RM120,000, premises RM240,000, fumiture and fittings RM40,500, motor vehicles RM31,500. A mortgage of RM180.000 secured over the premises was outstanding and the partnership agreed to assume the mortgage. iv . Profits or losses of the firm are to be divided between or borne by Aishah, Balan and Chong in the proportion of 2:1:3 respectively. V. Interest to be allowed at 8% p.a. on the capital contribution by the partners. Interest at 10% p.a. to be charged on partners' drawings. During the year ended 30 June 2020, the income of the partnership amounting to RM120 800, and the expenses amounting to RM43,000. Aishah withdrew RM12,000 on 1 October 2019 and RM8,000 on 1 January 2020; Balan withdrew RM4,000 only on 1 April 2020; Chong withdrew RM10,000 on 30 June 2020. Required: a. Prepare journal entries necessary to open the records of the partnership. (13 marks) b. Prepare a Profit Distribution account for the year ended 30 June 2020