Question: THIS IS A SOCIAL SECURITY BENEFIT PROBLEM. I ONLY NEED TO KNOW HOW WE FIND THE ACUTAL EARNINGS. BOTH MARY AND BROW ARE 30 YEARS

THIS IS A SOCIAL SECURITY BENEFIT PROBLEM. I ONLY NEED TO KNOW HOW WE FIND THE ACUTAL EARNINGS.

BOTH MARY AND BROW ARE 30 YEARS OLD. DAVID MAKES $66,000 A YEAR AND MARY MAKES $26,000 A YEAR.

DAVID'S SALARY INCREASES BY 1.5% A YEAR AND MARY'S SALARY INCREASES BY 1% A YEAR.

SOCIAL SECURITY TAX RATE FOR BOTH THE EMPLOYER AND EMPLOYEE IS 6.2%

BROWN FAMILY'S MARGIANL TAX RATE IS 25%.

BASED ON THIS INFORMATION, HOW DO WE FIND THE ACTUAL EARNINGS?

PLEASE SHOW WORK! THANKS!

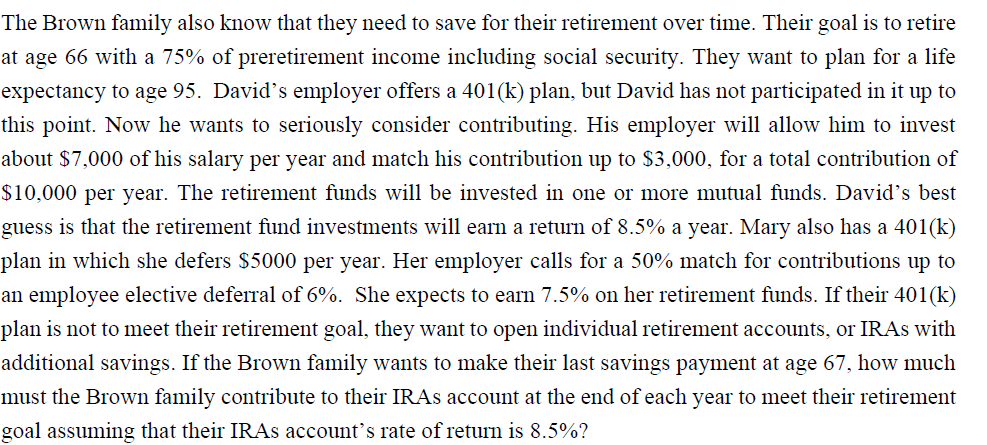

The Brown family also know that they need to save for their retirement over time. Their goal is to retire at age 66 with a 75% of preretirement income including social security. They want to plan for a life expectancy to age 95. David's employer offers a 401(k) plan, but David has not participated in it up to this point. Now he wants to seriously consider contributing. His employer will allow him to invest about $7,000 of his salary per year and match his contribution up to S3,000, for a total contribution of S10,000 per year. The retirement funds will be invested in one or more mutual funds. David's best guess is that the retirement fund investments will earn a return of 8.5% a year. Mary also has a 401(k) plan in which she defers $5000 per year. Her employer calls for a 50% match for contributions up to an employee elective deferral of 6%. She expects to earn 7.5% on her retirement funds. If their 401(k) plan is not to meet their retirement goal, they want to open individual retirement accounts, or IRAs with additional savings. If the Brown family wants to make their last savings payment at age 67, how much must the Brown family contribute to their IRAs account at the end of each year to meet their retirement goal assuming that their IRAs account's rate of return is 8.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts