Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a taxation assessment It is a taxation (10) QUESTION 1 Andile Black, aged 45, is a South African resident. He owns a business

This is a taxation assessment

It is a taxation

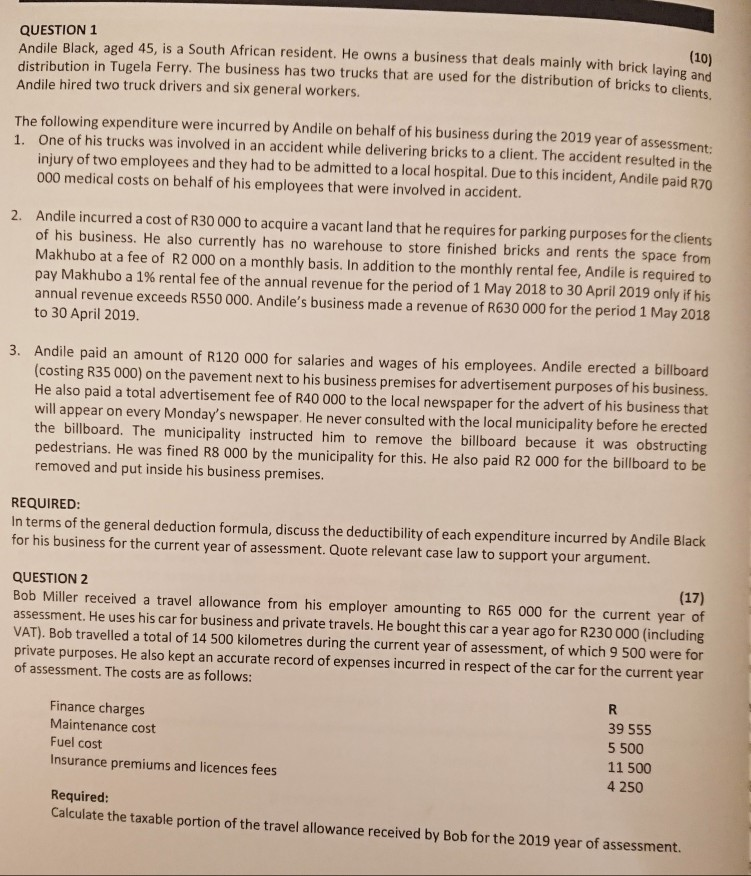

(10) QUESTION 1 Andile Black, aged 45, is a South African resident. He owns a business that deals mainly with brick la distribution in Tugela Ferry. The business has two trucks that are used for the distribution of bricks to Andile hired two truck drivers and six general workers. The following expenditure were incurred by Andile on behalf of his business during the 2019 year of assessme 1. One of his trucks was involved in an accident while delivering bricks to a client. The accident resulted in the injury of two employees and they had to be admitted to a local hospital. Due to this incident, Andile paid R70 000 medical costs on behalf of his employees that were involved in accident. 2. Andile incurred a cost of R30 000 to acquire a vacant land that he requires for parking purposes for the clients of his business. He also currently has no warehouse to store finished bricks and rents the space from Makhubo at a fee of R2 000 on a monthly basis. In addition to the monthly rental fee, Andile is required to pay Makhubo a 1% rental fee of the annual revenue for the period of 1 May 2018 to 30 April 2019 only if his annual revenue exceeds R550 000. Andile's business made a revenue of R630 000 for the period 1 May 2018 to 30 April 2019. 3. Andile paid an amount of R120 000 for salaries and wages of his employees. Andile erected a billboard (costing R35 000) on the pavement next to his business premises for advertisement purposes of his business. He also paid a total advertisement fee of R40 000 to the local newspaper for the advert of his business that will appear on every Monday's newspaper. He never consulted with the local municipality before he erected the billboard. The municipality instructed him to remove the billboard because it was obstructing pedestrians. He was fined R8 000 by the municipality for this. He also paid R2 000 for the billboard to be removed and put inside his business premises. REQUIRED: In terms of the general deduction formula, discuss the deductibility of each expenditure incurred by Andile Black for his business for the current year of assessment. Quote relevant case law to support your argument. QUESTION 2 (17) Bob Miller received a travel allowance from his employer amounting to R65 000 for the current year of assessment. He uses his car for business and private travels. He bought this car a year ago for R230 000 (including VAT). Bob travelled a total of 14 500 kilometres during the current year of assessment, of which 9 500 were for private purposes. He also kept an accurate record of expenses incurred in respect of the car for the current year of assessment. The costs are as follows: Finance charges Maintenance cost Fuel cost Insurance premiums and licences fees 39 555 5500 11 500 4250 Required: Calculate the taxable portion of the travel allowance received by Bob for the 2019 year of assessment. (10) QUESTION 1 Andile Black, aged 45, is a South African resident. He owns a business that deals mainly with brick la distribution in Tugela Ferry. The business has two trucks that are used for the distribution of bricks to Andile hired two truck drivers and six general workers. The following expenditure were incurred by Andile on behalf of his business during the 2019 year of assessme 1. One of his trucks was involved in an accident while delivering bricks to a client. The accident resulted in the injury of two employees and they had to be admitted to a local hospital. Due to this incident, Andile paid R70 000 medical costs on behalf of his employees that were involved in accident. 2. Andile incurred a cost of R30 000 to acquire a vacant land that he requires for parking purposes for the clients of his business. He also currently has no warehouse to store finished bricks and rents the space from Makhubo at a fee of R2 000 on a monthly basis. In addition to the monthly rental fee, Andile is required to pay Makhubo a 1% rental fee of the annual revenue for the period of 1 May 2018 to 30 April 2019 only if his annual revenue exceeds R550 000. Andile's business made a revenue of R630 000 for the period 1 May 2018 to 30 April 2019. 3. Andile paid an amount of R120 000 for salaries and wages of his employees. Andile erected a billboard (costing R35 000) on the pavement next to his business premises for advertisement purposes of his business. He also paid a total advertisement fee of R40 000 to the local newspaper for the advert of his business that will appear on every Monday's newspaper. He never consulted with the local municipality before he erected the billboard. The municipality instructed him to remove the billboard because it was obstructing pedestrians. He was fined R8 000 by the municipality for this. He also paid R2 000 for the billboard to be removed and put inside his business premises. REQUIRED: In terms of the general deduction formula, discuss the deductibility of each expenditure incurred by Andile Black for his business for the current year of assessment. Quote relevant case law to support your argument. QUESTION 2 (17) Bob Miller received a travel allowance from his employer amounting to R65 000 for the current year of assessment. He uses his car for business and private travels. He bought this car a year ago for R230 000 (including VAT). Bob travelled a total of 14 500 kilometres during the current year of assessment, of which 9 500 were for private purposes. He also kept an accurate record of expenses incurred in respect of the car for the current year of assessment. The costs are as follows: Finance charges Maintenance cost Fuel cost Insurance premiums and licences fees 39 555 5500 11 500 4250 Required: Calculate the taxable portion of the travel allowance received by Bob for the 2019 year of assessmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started