Answered step by step

Verified Expert Solution

Question

1 Approved Answer

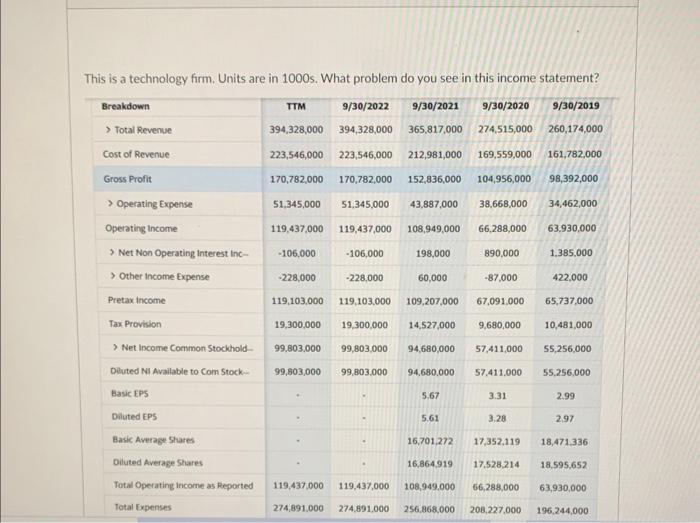

This is a technology firm. Units are in 1000s. What problem do you see in this income statement? Breakdown > Total Revenue Cost of

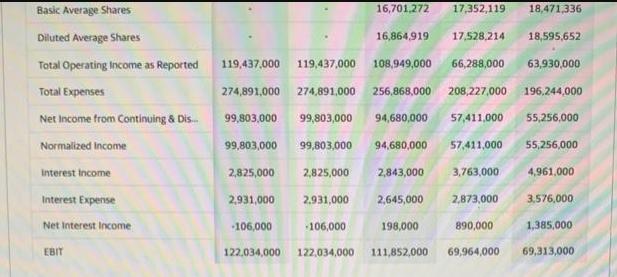

This is a technology firm. Units are in 1000s. What problem do you see in this income statement? Breakdown > Total Revenue Cost of Revenue Gross Profit 9/30/2022 9/30/2021 9/30/2020 9/30/2019 394,328,000 394,328,000 365,817,000 274,515,000 260,174,000 161,782,000 169,559,000 223,546,000 223,546,000 212,981,000 170,782,000 170,782,000 152,836,000 104,956,000 98,392,000 > Operating Expense 51,345,000 51,345,000 34,462,000 Operating Income > Net Non Operating Interest Inc.- > Other Income Expense Pretax Income Tax Provision > Net Income Common Stockhold Diluted NI Available to Com Stock Basic EPS Diluted EPS Basic Average Shares Diluted Average Shares Total Operating Income as Reported Total Expenses TTM 119,437,000 119,437,000 108,949,000 -106,000 198,000 -228,000 60,000 119,103,000 119,103,000 109,207,000 -106,000 43,887,000 -228,000 19,300,000 19,300,000 14,527,000 94,680,000 99,803,000 99,803,000 99,803,000 99,803,000 119,437,000 119,437,000 5.67 38,668,000 66,288,000 890,000 -87,000 67,091,000 16,864.919. 9,680,000 94,680,000 57,411,000 57,411,000 3.31 5.61 16,701,272 17,352,119 3.28 63.930,000 2.99 2.97 18,471,336 17.528,214 18,595,652 108,949,000 66,288,000 63,930,000 274,891,000 274,891,000 256,868,000 208,227,000 196,244,000 1.385,000 422,000 65,737,000 10,481,000 55,256,000 55,256,000 Basic Average Shares Diluted Average Shares Total Operating Income as Reported Total Expenses Net Income from Continuing & Dis... Normalized Income Interest Income Interest Expense Net Interest Income EBIT 119,437,000 119,437,000 16,864,919 17,528,214 18,595,652 108,949,000 66,288,000 63,930,000 274,891,000 256,868,000 208,227,000 196,244,000 94,680,000 57,411,000 55,256,000 -106,000 16,701,272 17,352,119. 18,471,336 274,891,000 99,803,000 99,803,000 99,803,000 99,803,000 94,680,000 57,411,000 2,825,000 2,825,000 2,843,000 2,931,000 2.931,000 2,645,000 -106,000 198,000 122,034,000 122,034,000 111,852,000 3,763,000 2,873,000 890,000 69,964,000 55,256,000 4,961,000 3,576,000 1,385,000 69,313,000

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution One issue with this income statement is that it does not provide any information about the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started