Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a three part question. You may want to jot down details of this case or screenshot it to help you on the next

This is a three part question. You may want to jot down details of this case or

screenshot it to help you on the next two parts of the question.

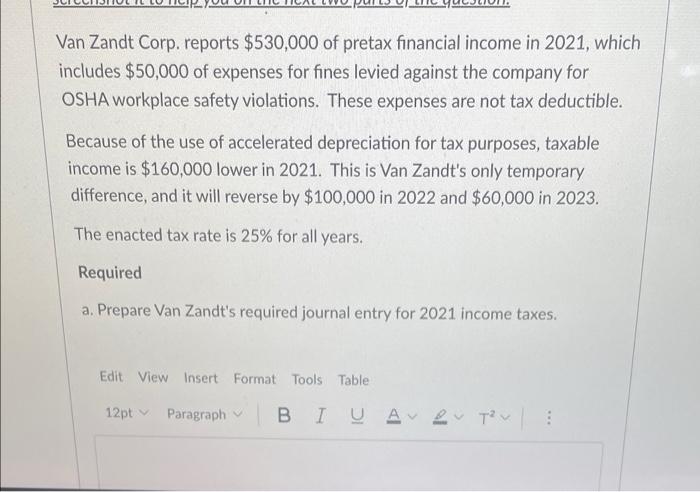

Van Zandt Corp. reports $530,000 of pretax financial income in 2021, which

includes $50,000 of expenses for fines levied against the company for

OSHA workplace safety violations. These expenses are not tax deductible.

Because of the use of accelerated depreciation for tax purposes, taxable

income is $160,000 lower in 2021. This is Van Zandt's only temporary

difference, and it will reverse by $100,000 in 2022 and $60,000 in 2023.

The enacted tax rate is 25% for all years.

Required

a. Prepare Van Zandt's required journal entry for 2021 income taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started