Question

This is a true or false section. For each question, please clearly state your answer and always justify accordingly. 1. You have reformulated the financial

This is a true or false section. For each question, please clearly state your answer and always justify accordingly.

1. You have reformulated the financial statements of a firm that you are trying to value. A new legislation came out since then forcing companies to change their accounting policies in order to consider a certain type of unrealized gains on debt securities no longer on the income statement but rather as part of the other comprehensive income. As such, the company is expected to issue new financial statements to reflect this correction.

True or False: Following the restatement, your cash flow and value drivers are expected to decline, which will alter the estimate for the value of the firm.

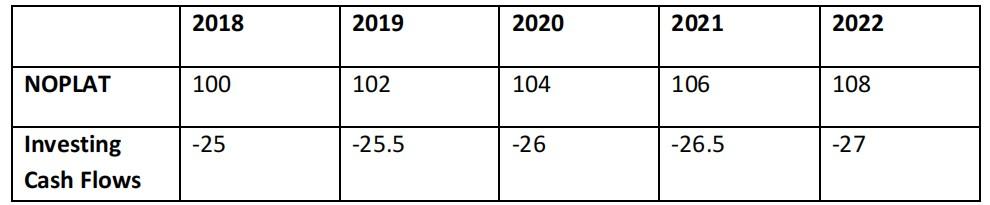

2. A Certain company, which has a cost of capital of 4%, exhibits the following expected cash flows.

You have researched about this company and have concluded that, in the steady state, this company should have a 2% growth rate and a 5% RONIC.

True or False: You can estimate the terminal value of the firm after 2022 based on the information provided.

\begin{tabular}{|l|l|l|l|l|l|} \hline & 2018 & 2019 & 2020 & 2021 & 2022 \\ \hline NOPLAT & 100 & 102 & 104 & 106 & 108 \\ \hline Investing Cash Flows & 25 & 25.5 & 26 & 26.5 & 27 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline & 2018 & 2019 & 2020 & 2021 & 2022 \\ \hline NOPLAT & 100 & 102 & 104 & 106 & 108 \\ \hline Investing Cash Flows & 25 & 25.5 & 26 & 26.5 & 27 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started