Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is about taxation BACKGROUND INFORMATION - APPLICABLE TO ALL QUESTIONS IN THIS EXAM PAPER Roma Limited (Roma) is a company resident in Country A.

this is about taxation

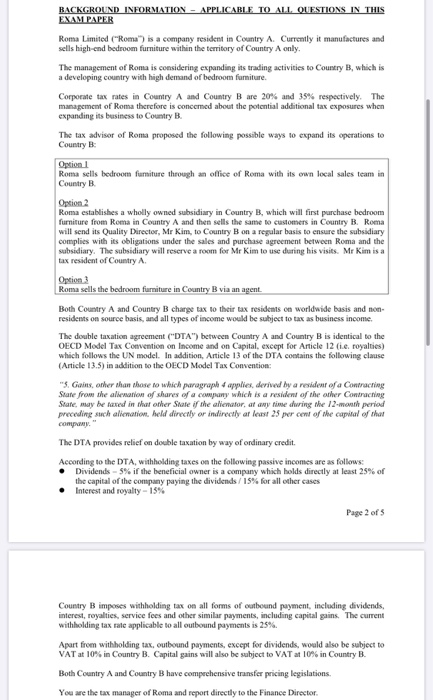

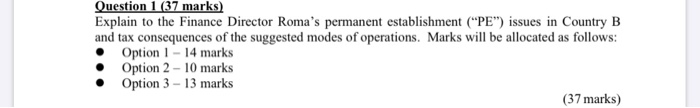

BACKGROUND INFORMATION - APPLICABLE TO ALL QUESTIONS IN THIS EXAM PAPER Roma Limited ("Roma") is a company resident in Country A. Currently it manufactures and sells high-end bedroom furniture within the territory of Country A only. The management of Roma is considering expanding its trading activities to Country B, which is a developing country with high demand of bedroom furniture. Corporate tax rates in Country A and Country Bare 20% and 39% respectively. The management of Roma therefore is concerned about the potential additional tax exposures when expanding its business to Country B. The tax advisor of Roma proposed the following possible ways to expand its operations to Country: Option 1 Roma sells bedroom furniture through an office of Roma with its own local sales team in Country B Option 2 Roma establishes a wholly owned subsidiary in Country B, which will first purchase bedroom furniture from Roma in Country A and then sells the same to customers in Country B. Roma will send its Quality Director, Mr Kim, to Country B on a regular basis to ensure the subsidiary complies with its obligations under the sales and purchase agreement between Roma and the subsidiary. The subsidiary will reserve a room for Mr Kim to use during his visits. Mr Kim is a tax resident of Country A Option 3 Roma sells the bedroom furniture in Country B via an agent. Both Country A and Country B charge tax to their tax residents on worldwide basis and non- residents on source basis, and all types of income would be subject to tax as business income. The double taxation agreement ("DTA") between Country A and Country B is identical to the OECD Model Tax Convention on Income and on Capital, except for Article 12 (1.e. royalties) which follows the UN model. In addition, Article 13 of the DTA contains the following clause (Article 13.5) in addition to the OECD Model Tux Convention: "5. Gains, other than those to which paragraph 4 applies, derived by a resident of a Contracting State from the alienation of shares of a company which is a resident of the other Contracting Stare, may be rased in that other State if the alienafor, at any time during the 12-month period preceding such alienation, held directly or indirectly ar least 25 per cent of the capital of that COR." The DTA provides relief on double taxation by way of ordinary credit According to the DTA, withholding taxes on the following passive incomes are as follows: Dividends -5% if the beneficial owner is a company which holds directly at least 25% of the capital of the company paying the dividends / 15% for all other cases Interest and royalty -15% Page 2 of 3 Country B imposes withholding tax on all forms of outbound payment, including dividends, interest, royalties, service fees and other similar payments, including capital gains. The current withholding tax rate applicable to all outbound payments is 25% Apart from withholding tax, outbound payments, except for dividends, would also be subject to VAT at 10% in Country B. Capital gains will also be subject to VAT at 10% in Country B. Both Country A and Country B have comprehensive transfer pricing legislations You are the tax manager of Roma and report directly to the Finance Director Question 1 (37 marks) Explain to the Finance Director Roma's permanent establishment ("PE") issues in Country B and tax consequences of the suggested modes of operations. Marks will be allocated as follows: Option 1 - 14 marks Option 2 - 10 marks Option 3 - 13 marks (37 marks) BACKGROUND INFORMATION - APPLICABLE TO ALL QUESTIONS IN THIS EXAM PAPER Roma Limited ("Roma") is a company resident in Country A. Currently it manufactures and sells high-end bedroom furniture within the territory of Country A only. The management of Roma is considering expanding its trading activities to Country B, which is a developing country with high demand of bedroom furniture. Corporate tax rates in Country A and Country Bare 20% and 39% respectively. The management of Roma therefore is concerned about the potential additional tax exposures when expanding its business to Country B. The tax advisor of Roma proposed the following possible ways to expand its operations to Country: Option 1 Roma sells bedroom furniture through an office of Roma with its own local sales team in Country B Option 2 Roma establishes a wholly owned subsidiary in Country B, which will first purchase bedroom furniture from Roma in Country A and then sells the same to customers in Country B. Roma will send its Quality Director, Mr Kim, to Country B on a regular basis to ensure the subsidiary complies with its obligations under the sales and purchase agreement between Roma and the subsidiary. The subsidiary will reserve a room for Mr Kim to use during his visits. Mr Kim is a tax resident of Country A Option 3 Roma sells the bedroom furniture in Country B via an agent. Both Country A and Country B charge tax to their tax residents on worldwide basis and non- residents on source basis, and all types of income would be subject to tax as business income. The double taxation agreement ("DTA") between Country A and Country B is identical to the OECD Model Tax Convention on Income and on Capital, except for Article 12 (1.e. royalties) which follows the UN model. In addition, Article 13 of the DTA contains the following clause (Article 13.5) in addition to the OECD Model Tux Convention: "5. Gains, other than those to which paragraph 4 applies, derived by a resident of a Contracting State from the alienation of shares of a company which is a resident of the other Contracting Stare, may be rased in that other State if the alienafor, at any time during the 12-month period preceding such alienation, held directly or indirectly ar least 25 per cent of the capital of that COR." The DTA provides relief on double taxation by way of ordinary credit According to the DTA, withholding taxes on the following passive incomes are as follows: Dividends -5% if the beneficial owner is a company which holds directly at least 25% of the capital of the company paying the dividends / 15% for all other cases Interest and royalty -15% Page 2 of 3 Country B imposes withholding tax on all forms of outbound payment, including dividends, interest, royalties, service fees and other similar payments, including capital gains. The current withholding tax rate applicable to all outbound payments is 25% Apart from withholding tax, outbound payments, except for dividends, would also be subject to VAT at 10% in Country B. Capital gains will also be subject to VAT at 10% in Country B. Both Country A and Country B have comprehensive transfer pricing legislations You are the tax manager of Roma and report directly to the Finance Director Question 1 (37 marks) Explain to the Finance Director Roma's permanent establishment ("PE") issues in Country B and tax consequences of the suggested modes of operations. Marks will be allocated as follows: Option 1 - 14 marks Option 2 - 10 marks Option 3 - 13 marks (37 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started