Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is advanced financial accounting this is consolidation for chapter 5 consolidation for less than wholly owned subsidiaries acquired at more than book value this

this is advanced financial accounting this is consolidation for chapter 5 consolidation for less than wholly owned subsidiaries acquired at more than book value this is a trial balance

yes

I cant add any more information I already said everything related to the question

you have parts from A to G you cant solve any ?

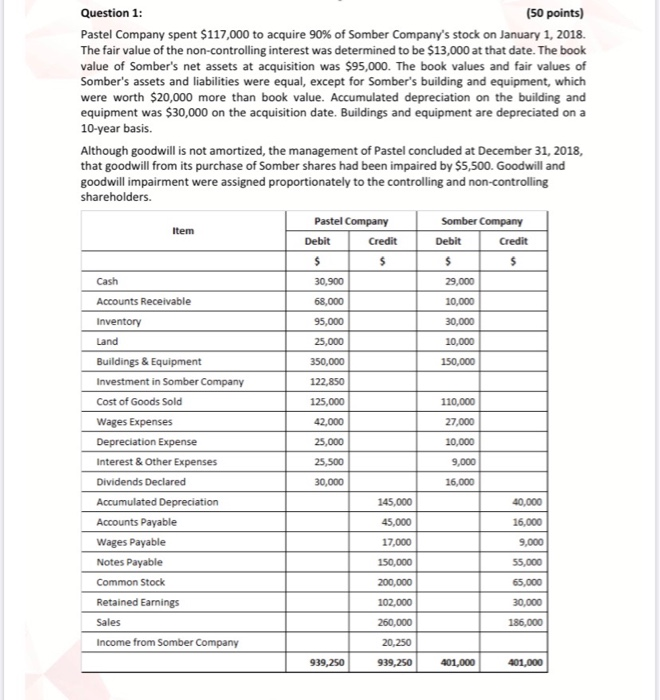

Question 1: (50 points) Pastel Company spent $117,000 to acquire 90% of Somber Company's stock on January 1, 2018. The fair value of the non-controlling interest was determined to be $13,000 at that date. The book value of Somber's net assets at acquisition was $95,000. The book values and fair values of Somber's assets and liabilities were equal, except for Somber's building and equipment, which were worth $20,000 more than book value. Accumulated depreciation on the building and equipment was $30,000 on the acquisition date. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Pastel concluded at December 31, 2018, that goodwill from its purchase of Somber shares had been impaired by $5,500. Goodwill and goodwill impairment were assigned proportionately to the controlling and non-controlling shareholders. Pastel Company Somber Company Item Debit Credit Debit Credit $ $ $ $ Cash 30,900 29,000 Accounts Receivable 68,000 10,000 Inventory 95,000 30,000 Land 25,000 10,000 Buildings & Equipment 350,000 150,000 Investment in Somber Company 122,850 Cost of Goods Sold 125,000 110,000 Wages Expenses 42,000 27,000 Depreciation Expense 25,000 10,000 Interest & Other Expenses 25,500 9,000 Dividends Declared 30,000 16,000 Accumulated Depreciation 145,000 40,000 Accounts Payable 45,000 16.000 Wages Payable 17,000 9,000 Notes Payable 150,000 55.000 Common Stock 200,000 65,000 Retained Earnings 102,000 30,000 Sales 260,000 186,000 Income from Somber Company 20,250 939,250 939,250 401,000 401,000 Required: A. Give the equity method journal entries recorded by Pastel. (10 points) B. Prepare the book value calculation table in order to prepare consolidated financial statements at December 31, 2018. (10 points) C. Give the basic consolidation entry at December 31, 2018. (10 points) D. Prepare the excess value (differential) calculation table in order to prepare consolidated financial statements at December 31, 2018. (5 points) E. Give excess value (differential) reclassification entries at December 31, 2018. (5 points) F. Give amortized excess value reclassification entry at December 31, 2018 (5 points) G. Prepare the accumulated depreciation consolidation entry needed at December 31, 2018. (5 points) Question 1: (50 points) Pastel Company spent $117,000 to acquire 90% of Somber Company's stock on January 1, 2018. The fair value of the non-controlling interest was determined to be $13,000 at that date. The book value of Somber's net assets at acquisition was $95,000. The book values and fair values of Somber's assets and liabilities were equal, except for Somber's building and equipment, which were worth $20,000 more than book value. Accumulated depreciation on the building and equipment was $30,000 on the acquisition date. Buildings and equipment are depreciated on a 10-year basis. Although goodwill is not amortized, the management of Pastel concluded at December 31, 2018, that goodwill from its purchase of Somber shares had been impaired by $5,500. Goodwill and goodwill impairment were assigned proportionately to the controlling and non-controlling shareholders. Pastel Company Somber Company Item Debit Credit Debit Credit $ $ $ $ Cash 30,900 29,000 Accounts Receivable 68,000 10,000 Inventory 95,000 30,000 Land 25,000 10,000 Buildings & Equipment 350,000 150,000 Investment in Somber Company 122,850 Cost of Goods Sold 125,000 110,000 Wages Expenses 42,000 27,000 Depreciation Expense 25,000 10,000 Interest & Other Expenses 25,500 9,000 Dividends Declared 30,000 16,000 Accumulated Depreciation 145,000 40,000 Accounts Payable 45,000 16.000 Wages Payable 17,000 9,000 Notes Payable 150,000 55.000 Common Stock 200,000 65,000 Retained Earnings 102,000 30,000 Sales 260,000 186,000 Income from Somber Company 20,250 939,250 939,250 401,000 401,000 Required: A. Give the equity method journal entries recorded by Pastel. (10 points) B. Prepare the book value calculation table in order to prepare consolidated financial statements at December 31, 2018. (10 points) C. Give the basic consolidation entry at December 31, 2018. (10 points) D. Prepare the excess value (differential) calculation table in order to prepare consolidated financial statements at December 31, 2018. (5 points) E. Give excess value (differential) reclassification entries at December 31, 2018. (5 points) F. Give amortized excess value reclassification entry at December 31, 2018 (5 points) G. Prepare the accumulated depreciation consolidation entry needed at December 31, 2018. (5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started