this is all 1 question. please help me out.

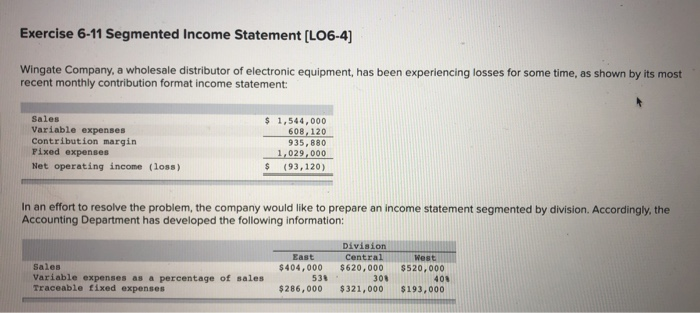

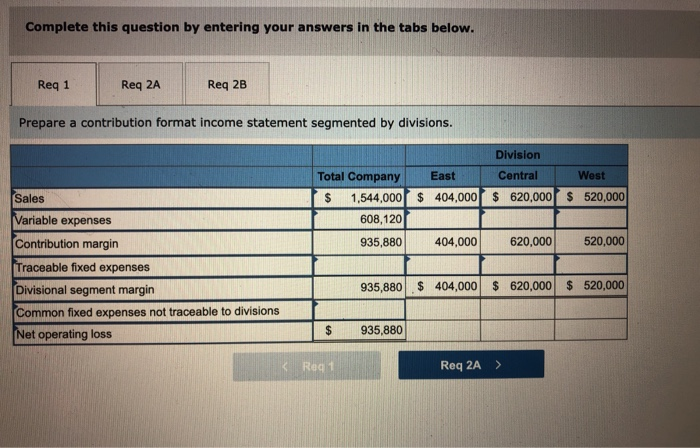

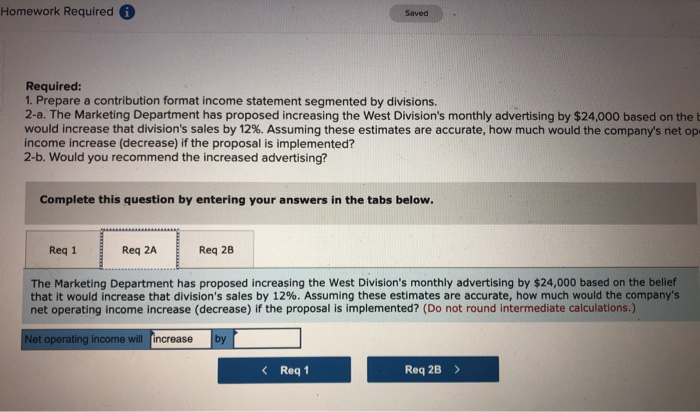

Exercise 6-11 Segmented Income Statement (L06-4) Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) $ 1,544,000 608, 120 935,880 1,029,000 $ (93,120) In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the Accounting Department has developed the following information: East $404,000 Sales Variable expenses as a percentage of sales Traceable fixed expenses Division Central $620,000 304 $321,000 538 West $520,000 405 $ 193,000 $286,000 Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Req 2B Prepare a contribution format income statement segmented by divisions. West Division Total Company East Central $ 1,544,000 $ 404,000 $ 620,000 608,120 935,880 404,000 620,000 $ 520,000 520,000 Sales Variable expenses Contribution margin Traceable fixed expenses Divisional segment margin Common fixed expenses not traceable to divisions Net operating loss 935,880 $ 404,000 $ 620,000 $ 520,000 $ 935,880 Reg 1 Req 2A > Homework Required Saved Required: 1. Prepare a contribution format income statement segmented by divisions. 2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $24,000 based on the would increase that division's sales by 12%. Assuming these estimates are accurate, how much would the company's net op income increase (decrease) if the proposal is implemented? 2-b. Would you recommend the increased advertising? Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Req 2B The Marketing Department has proposed increasing the West Division's monthly advertising by $24,000 based on the belief that it would increase that division's sales by 12%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) if the proposal is implemented? (Do not round intermediate calculations.) Net operating income will increase by