Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all information 1. 3. Is ongoing anti-fraud training provided to all employees of the organization? Do employees understand what constitutes fraud? Have the

this is all information

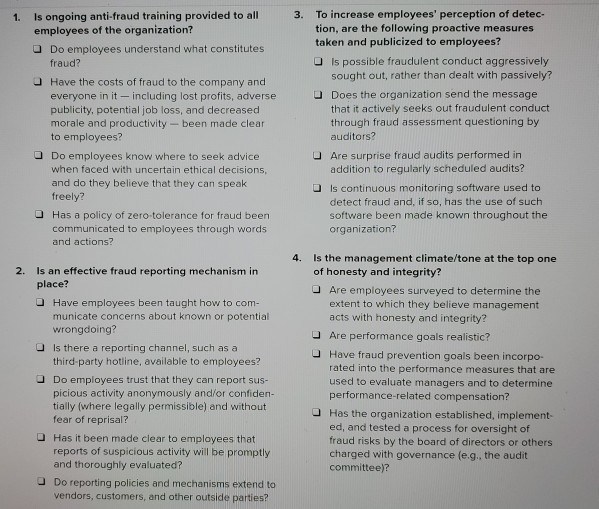

1. 3. Is ongoing anti-fraud training provided to all employees of the organization? Do employees understand what constitutes fraud? Have the costs of fraud to the company and everyone in it - including lost profits, adverse publicity, potential job loss, and decreased morale and productivity - been made clear to employees? Do employees know where to seek advice when faced with uncertain ethical decisions, and do they believe that they can speak freely? Has a policy of zero-tolerance for fraud been communicated to employees through words and actions? To increase employees' perception of detec- tion, are the following proactive measures taken and publicized to employees? is possible fraudulent conduct aggressively sought out, rather than dealt with passively? Does the organization send the message that it actively seeks out fraudulent conduct through fraud assessment questioning by auditors? Are surprise fraud audits performed in addition to regularly scheduled audits? Ils continuous monitoring software used to detect fraud and, if so, has the use of such software been made known throughout the organization? 4. 2. Is an effective fraud reporting mechanism in place? Have employees been taught how to com- municate concerns about known or potential wrongdoing? Is there a reporting channel, such as a third-party hotline, available to employees? Do employees trust that they can report sus- picious activity anonymously and/or confiden- tially (where legally permissible) and without fear of reprisal? Has it been made clear to employees that reports of suspicious activity will be promptly and thoroughly evaluated? Do reporting policies and mechanisms extend to vendors, customers, and other outside parties? Is the management climate/tone at the top one of honesty and integrity? Are employees surveyed to determine the extent to which they believe management acts with honesty and integrity? Are performance goals realistic? Have fraud prevention goals been incorpo- rated into the performance measures that are used to evaluate managers and to determine performance-related compensation? Has the organization established, implement- ed, and tested a process for oversight of fraud risks by the board of directors or others charged with governance (e.g., the audit committee)? 1. 3. Is ongoing anti-fraud training provided to all employees of the organization? Do employees understand what constitutes fraud? Have the costs of fraud to the company and everyone in it - including lost profits, adverse publicity, potential job loss, and decreased morale and productivity - been made clear to employees? Do employees know where to seek advice when faced with uncertain ethical decisions, and do they believe that they can speak freely? Has a policy of zero-tolerance for fraud been communicated to employees through words and actions? To increase employees' perception of detec- tion, are the following proactive measures taken and publicized to employees? is possible fraudulent conduct aggressively sought out, rather than dealt with passively? Does the organization send the message that it actively seeks out fraudulent conduct through fraud assessment questioning by auditors? Are surprise fraud audits performed in addition to regularly scheduled audits? Ils continuous monitoring software used to detect fraud and, if so, has the use of such software been made known throughout the organization? 4. 2. Is an effective fraud reporting mechanism in place? Have employees been taught how to com- municate concerns about known or potential wrongdoing? Is there a reporting channel, such as a third-party hotline, available to employees? Do employees trust that they can report sus- picious activity anonymously and/or confiden- tially (where legally permissible) and without fear of reprisal? Has it been made clear to employees that reports of suspicious activity will be promptly and thoroughly evaluated? Do reporting policies and mechanisms extend to vendors, customers, and other outside parties? Is the management climate/tone at the top one of honesty and integrity? Are employees surveyed to determine the extent to which they believe management acts with honesty and integrity? Are performance goals realistic? Have fraud prevention goals been incorpo- rated into the performance measures that are used to evaluate managers and to determine performance-related compensation? Has the organization established, implement- ed, and tested a process for oversight of fraud risks by the board of directors or others charged with governance (e.g., the audit committee)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started