Answered step by step

Verified Expert Solution

Question

1 Approved Answer

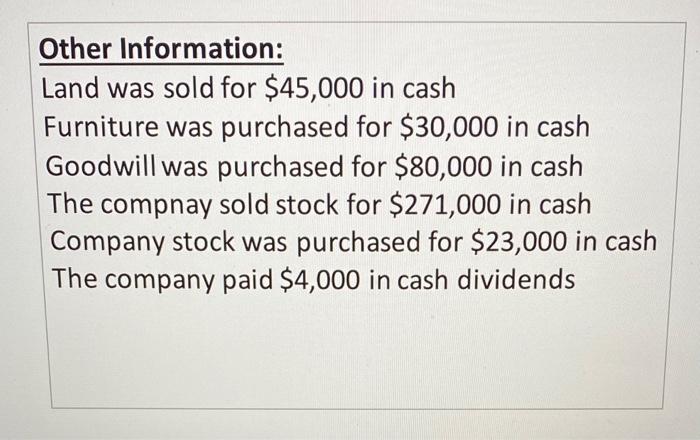

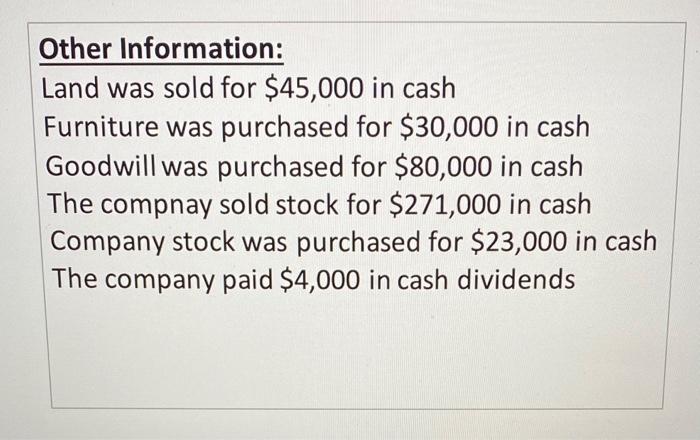

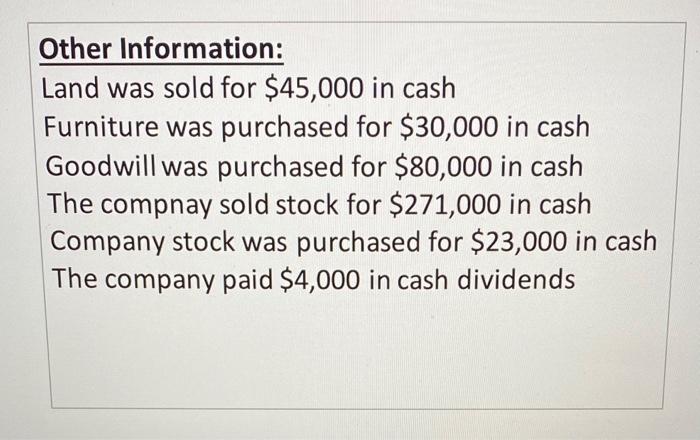

this is all information professor provided. Other Information: Land was sold for $45,000 in cash Furniture was purchased for $30,000 in cash Goodwill was purchased

this is all information professor provided.

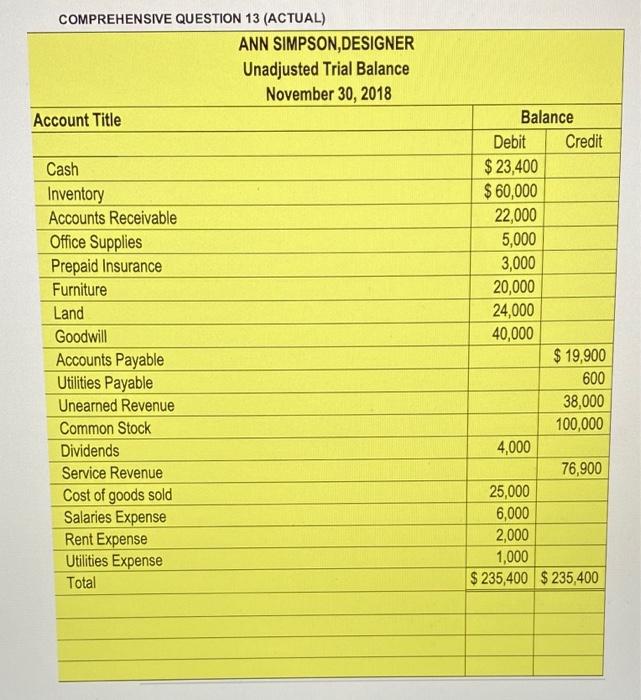

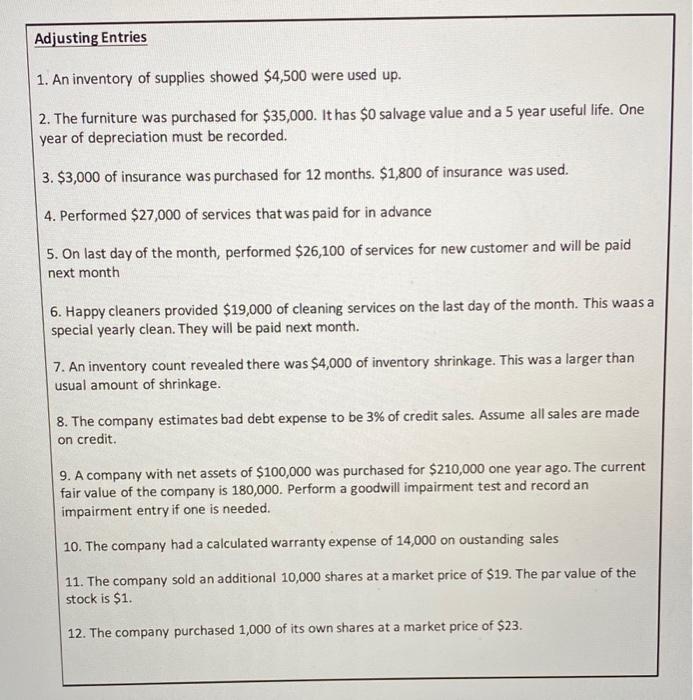

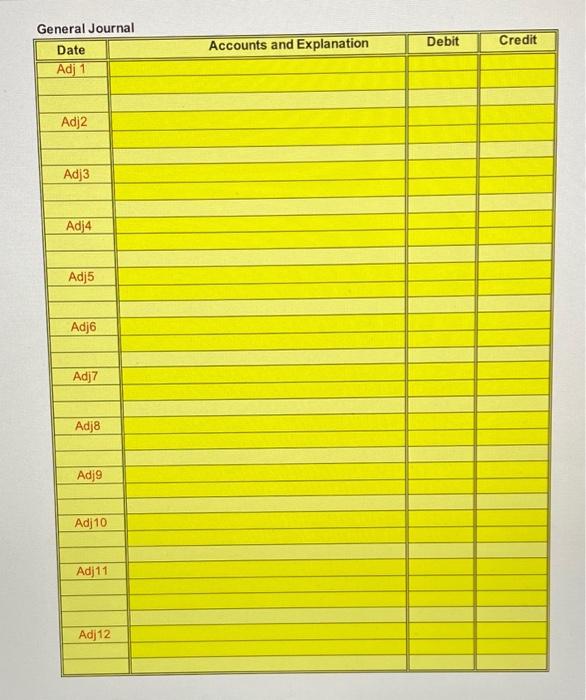

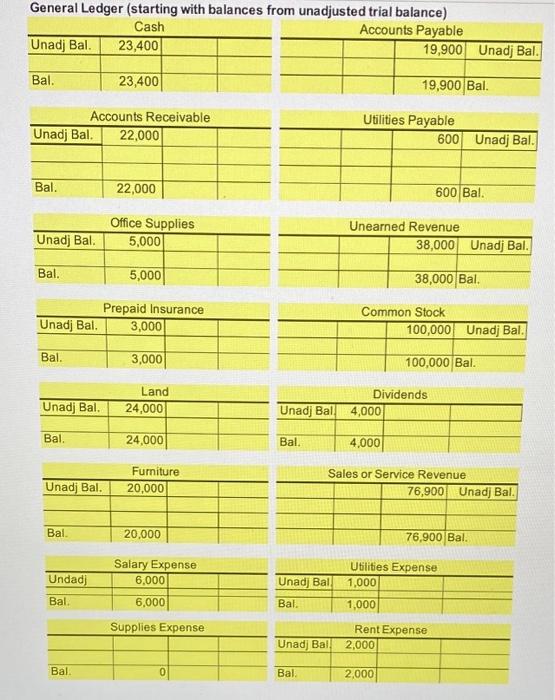

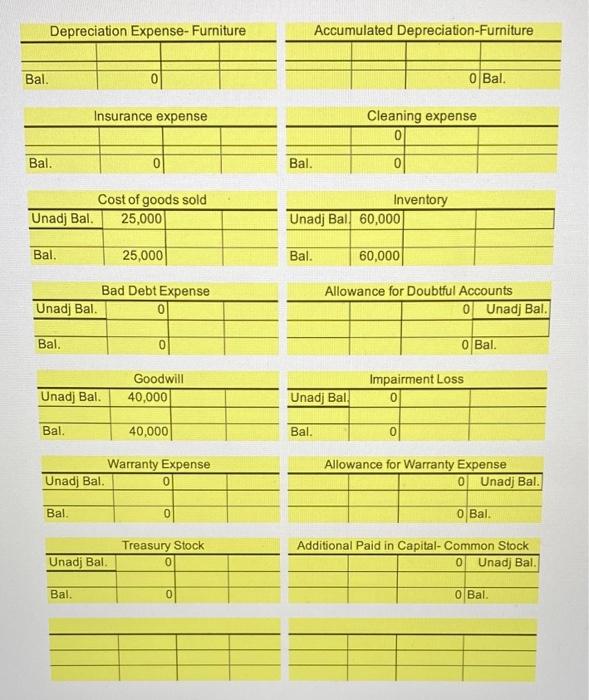

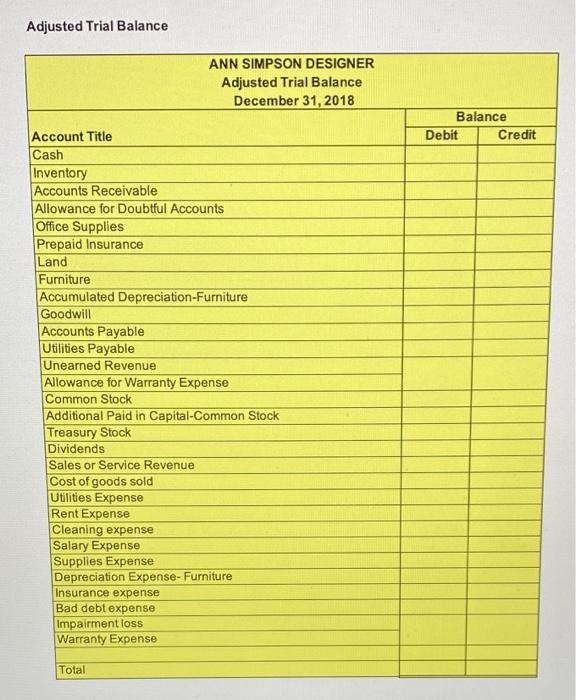

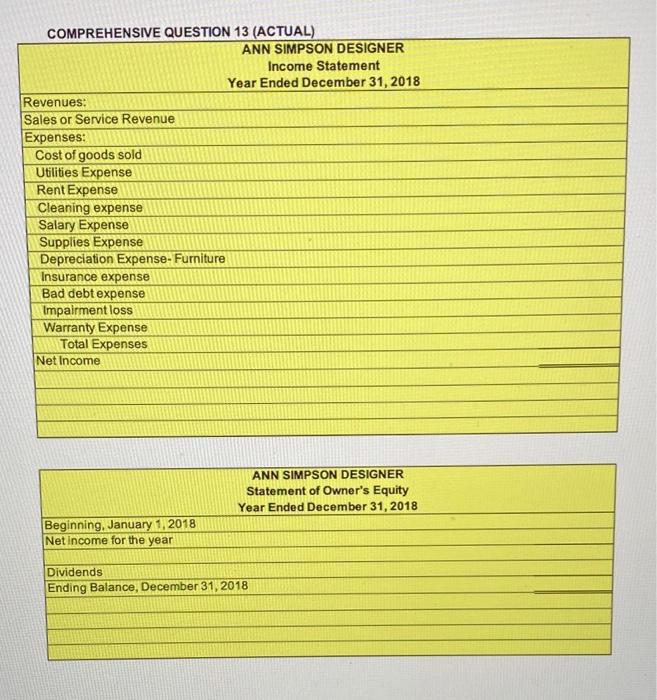

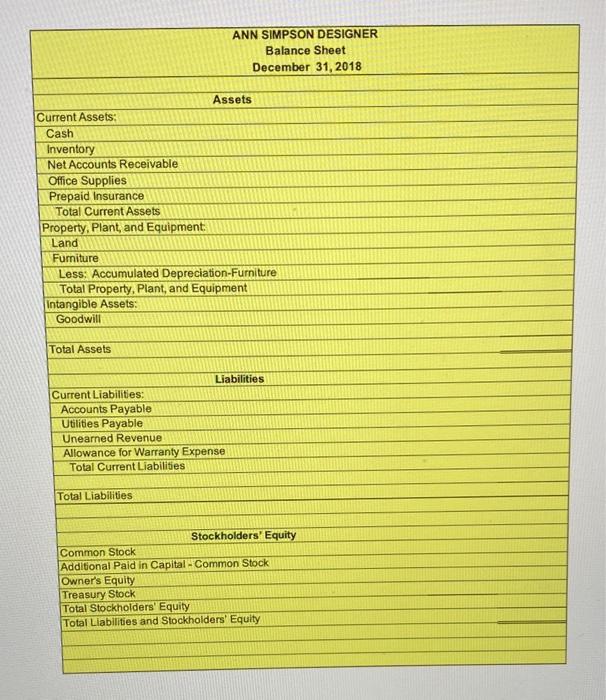

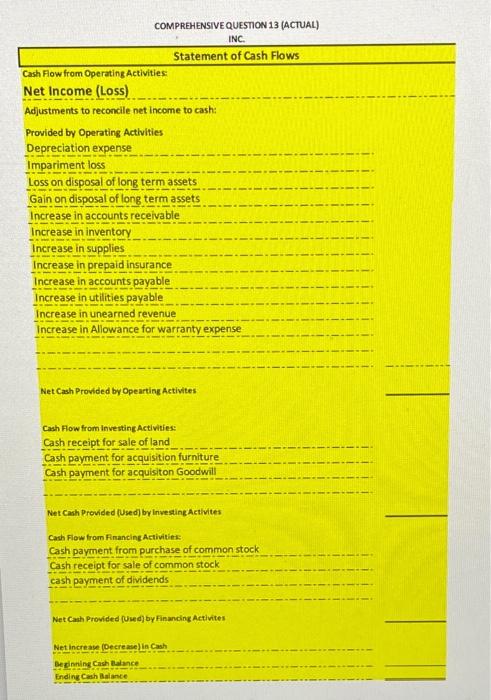

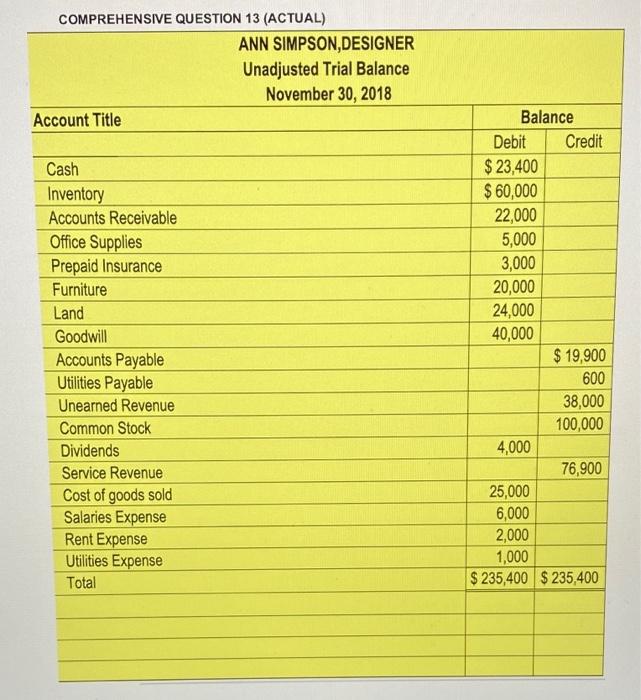

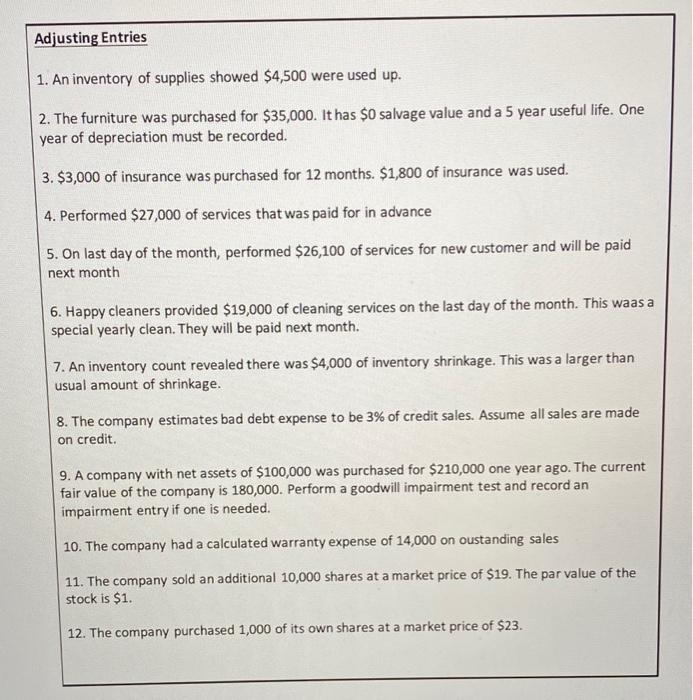

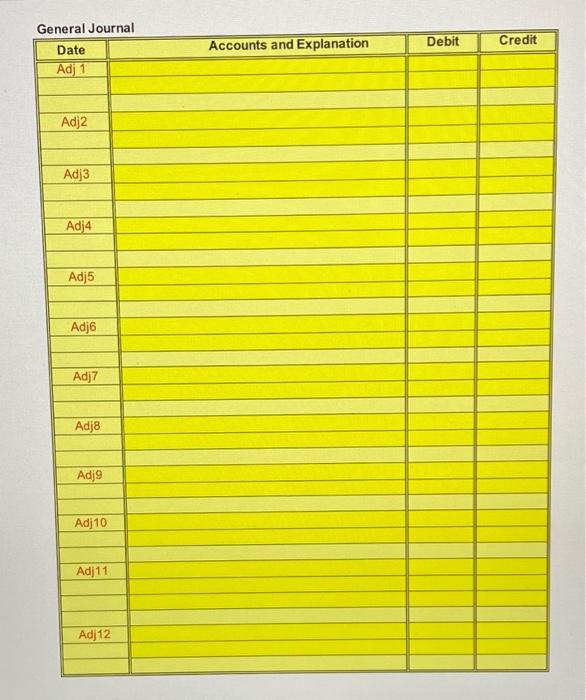

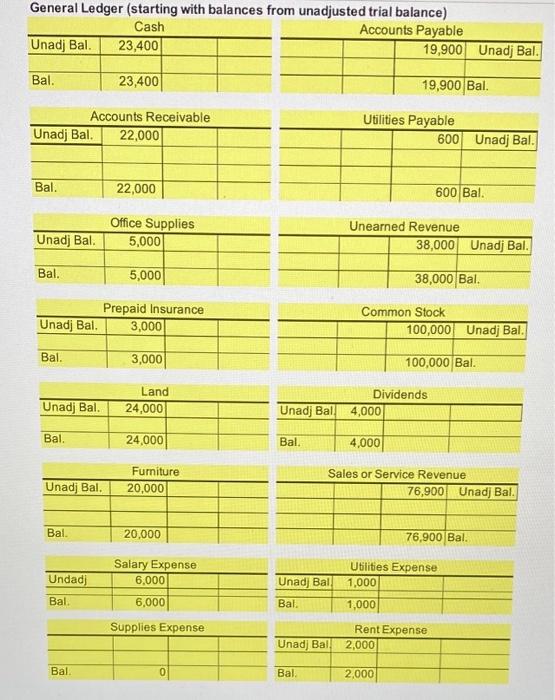

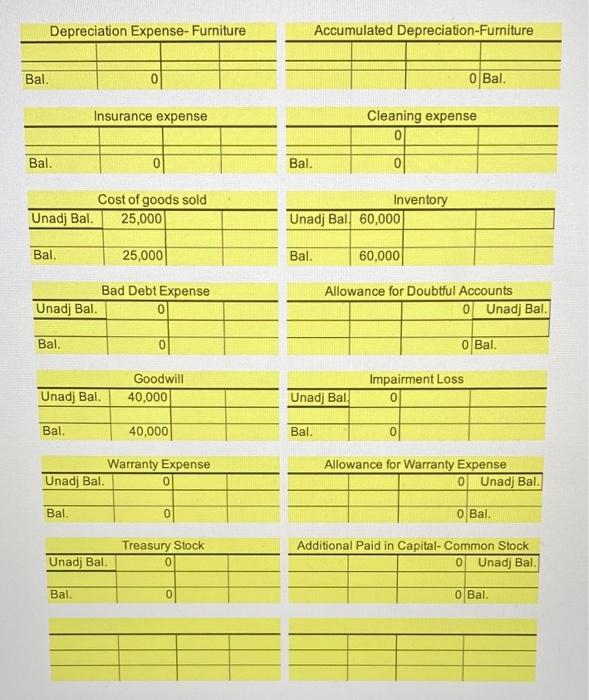

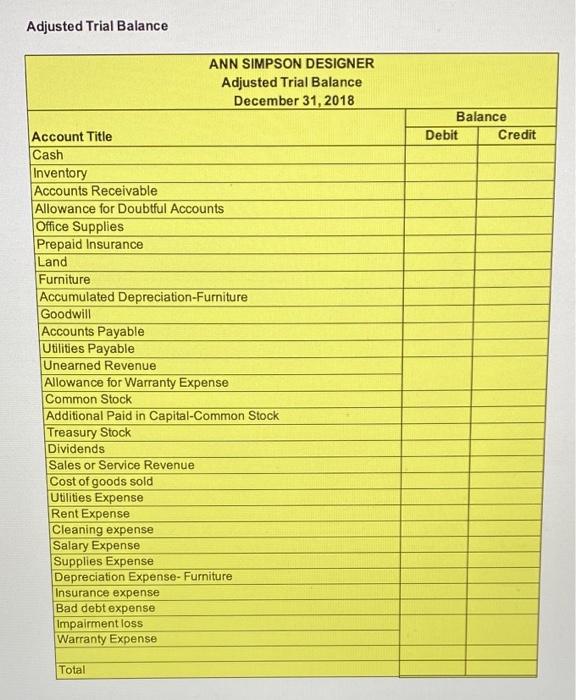

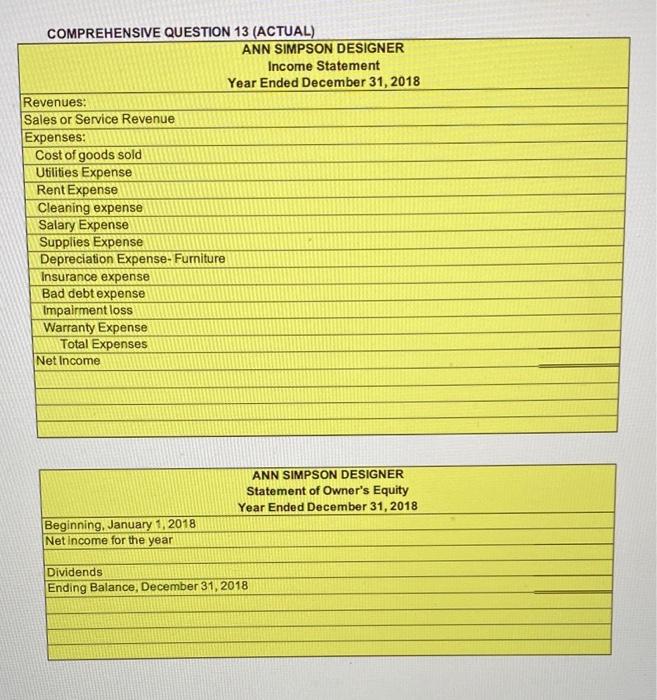

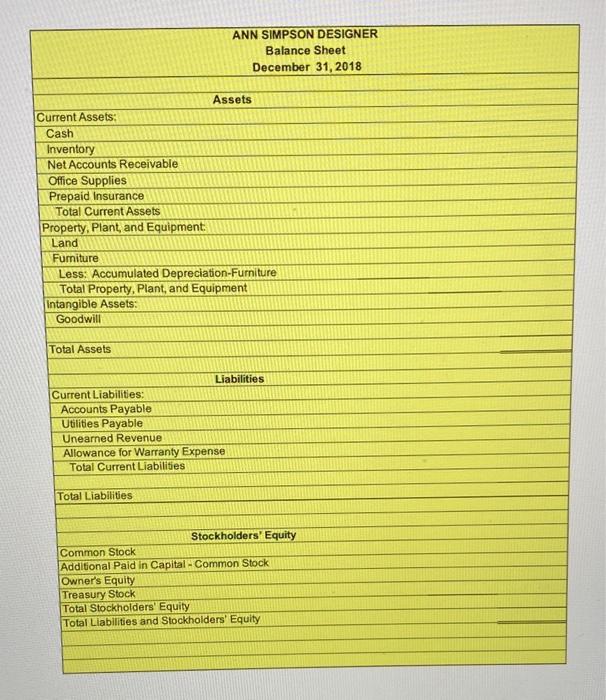

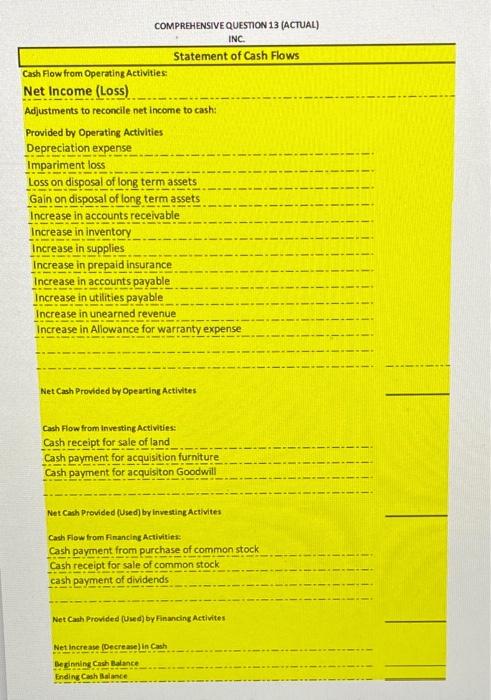

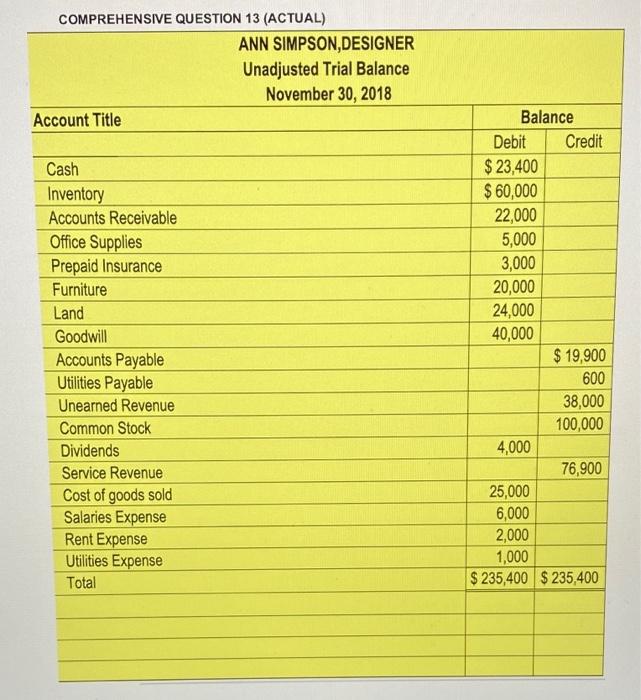

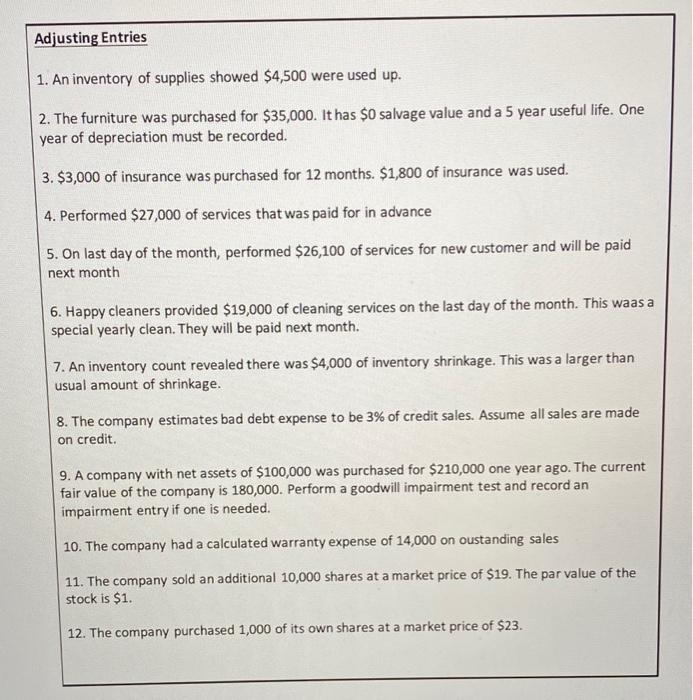

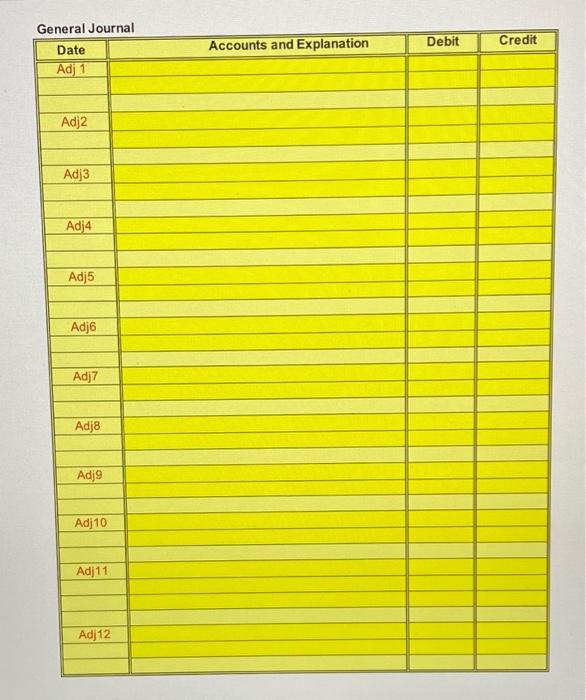

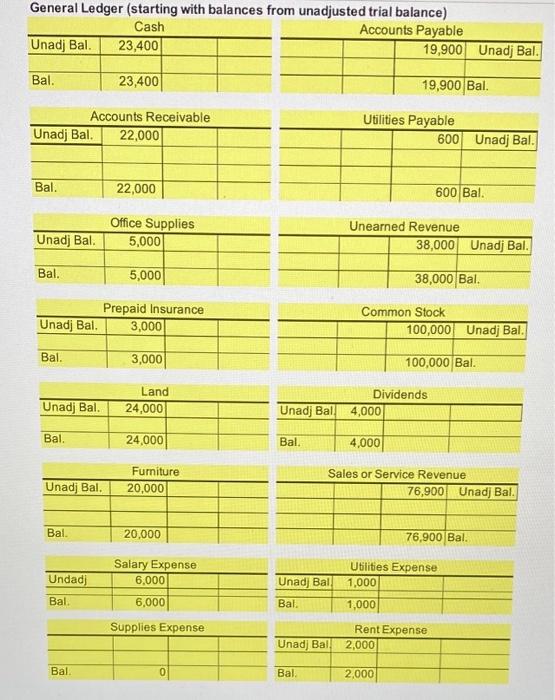

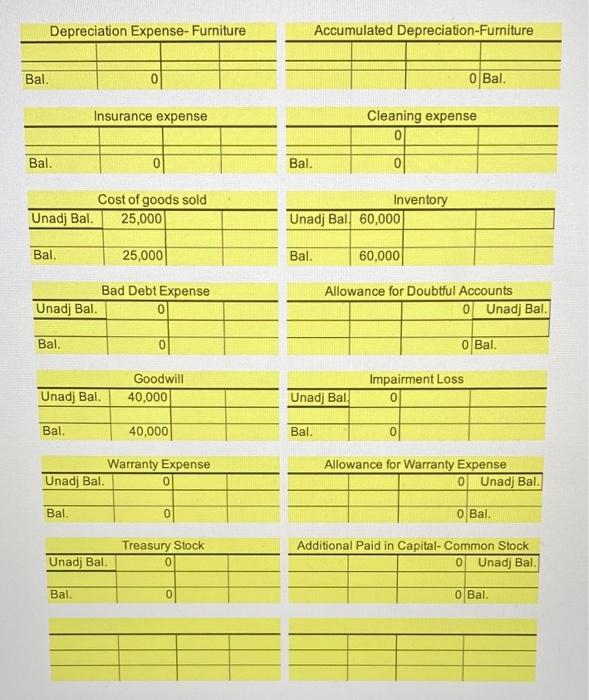

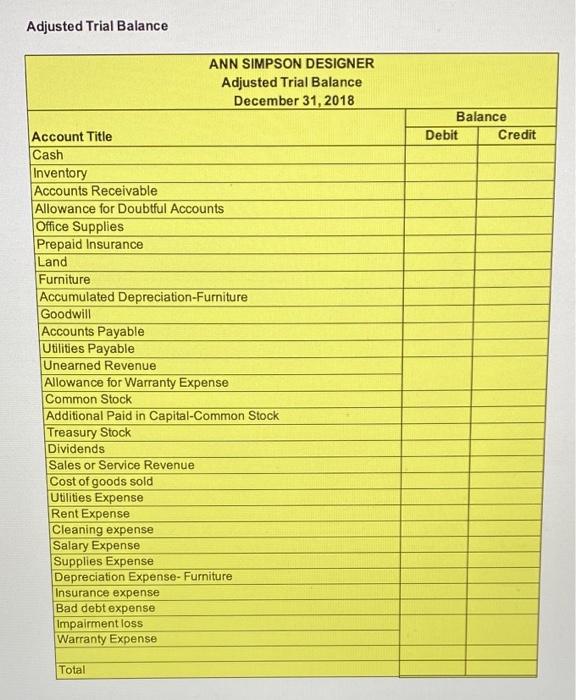

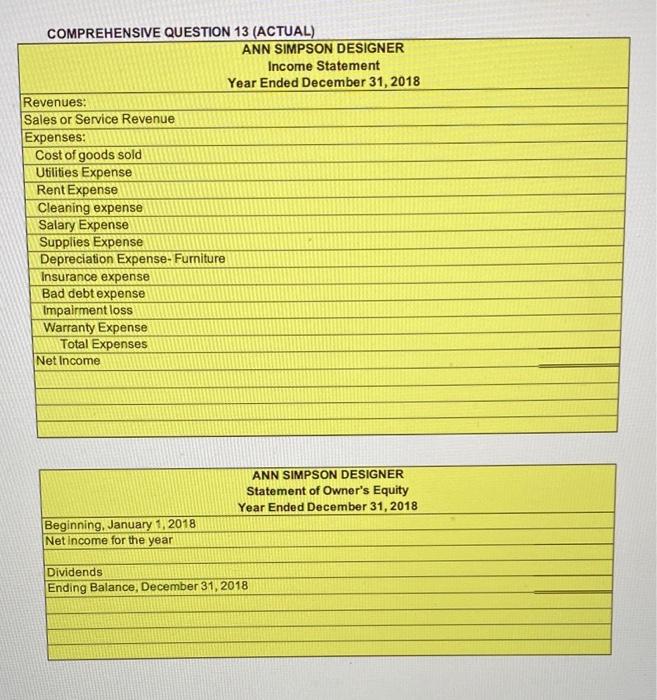

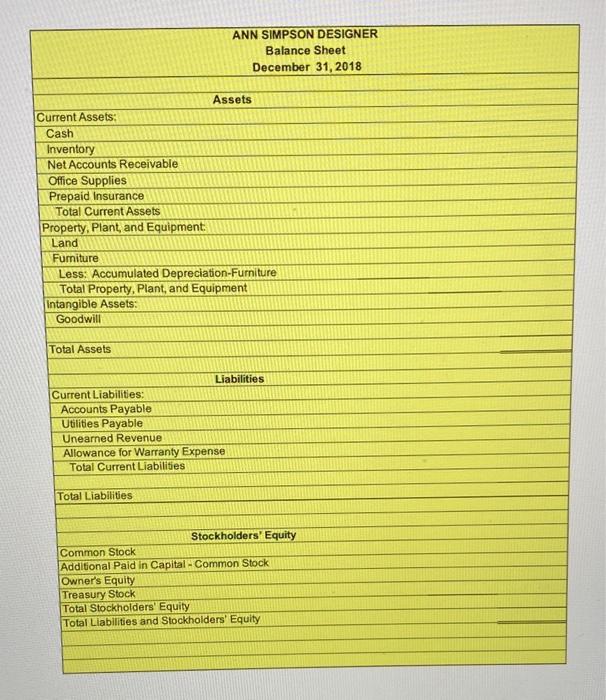

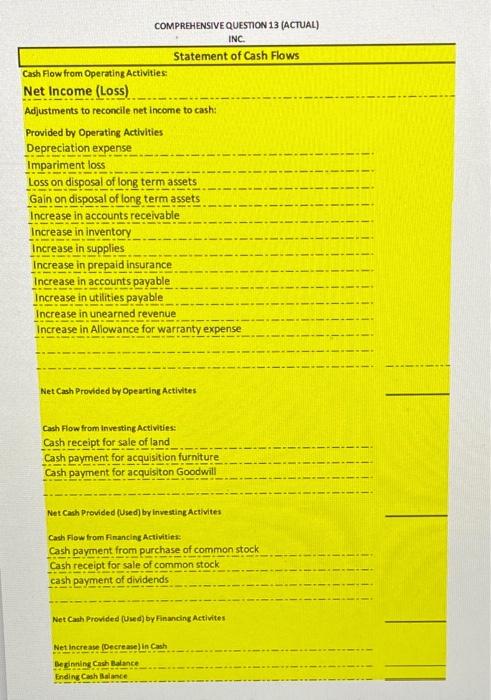

Other Information: Land was sold for $45,000 in cash Furniture was purchased for $30,000 in cash Goodwill was purchased for $80,000 in cash The compnay sold stock for $271,000 in cash Company stock was purchased for $23,000 in cash The company paid $4,000 in cash dividends COMPREHENSIVE QUESTION 13 (ACTUAL) Adjusting Entries 1. An inventory of supplies showed $4,500 were used up. 2. The furniture was purchased for $35,000. It has $0 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,800 of insurance was used. 4. Performed $27,000 of services that was paid for in advance 5. On last day of the month, performed $26,100 of services for new customer and will be paid next month 6. Happy cleaners provided $19,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,000 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 3% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $210,000 one year ago. The current fair value of the company is 180,000 . Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 14,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $19. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $23. 1 General Ledger (starting with balances from unadjusted trial balance) \begin{tabular}{c|c|c|c|c|c|c} \multicolumn{3}{c}{ Furniture } & & \multicolumn{3}{c}{ Sales or Service Revenue } \\ \hline Unadj Bal. & 20,000 & & \\ \hline & & & \\ \hline & & & & 76,900 & Unadj Bal. \\ \hline & 20,000 & & & & & \\ \hline Bal. & & & & \\ \hline & & 76,900 Bal. \end{tabular} \begin{tabular}{l|r|r|r|r|r|r} \multicolumn{3}{c}{ Insurance expense } & & \multicolumn{3}{c}{ Cleaning expense } \\ \cline { 1 - 3 } & & & & 0 & & \\ \cline { 1 - 7 } & & & & 0 & & \\ \hline Bal. & 0 & & & 0 & & \end{tabular} \begin{tabular}{l|l|l|l|l|l|c} \multicolumn{5}{c}{ Warranty Expense } & & \multicolumn{3}{c}{ Allowance for Warranty Expense } \\ \cline { 1 - 7 } & & & & 0 & Unadj Bal. \\ \hline Unadj Bal. & 0 & & & & \\ \hline & & & & & Bal. \end{tabular} \begin{tabular}{l|l|l|l|l|l|l} \multicolumn{5}{c}{ Treasury Stock } & \multicolumn{3}{c}{ Additional Paid in Capital- Common Stock } \\ \cline { 1 - 7 } Unadj Bal. & 0 & & & 0 & Unadj Bal. \\ \hline Bal. & 0 & & & & \\ \hline & & & & & \\ \hline \end{tabular} 1 COMPREHENSIVE QUESTION 13 (ACTUAL) ANN SIMPSON DESIGNER Statement of Owner's Equity Year Ended December 31, 2018 Beginning, January 1, 2018 Net income for the year Dividends Ending Balance, December 31, 2018 COMPREHENSIVE QUESTION 13 (ACTUAL) INC. Statement of Cash Flows Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: Provided by Operating Activities Depreciation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid insurance Increase in accounts payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense Net Cash Provided by Opearting Activites Cash Flow from Investing Activities: Cash receipt for sale of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by Investing Activites Cach Flow from Financing Activities: Cash payment from purchase of common stock Cash receipt for sale of common stock cash payment of dividends Net Cash Provided (Uued) by Finanding Activites Net increave (Decrease) in Cach Bexinning Cash thaiance Ending Cach Balance COMPREHENSIVE QUESTION 13 (ACTUAL) Adjusting Entries 1. An inventory of supplies showed $4,500 were used up. 2. The furniture was purchased for $35,000. It has $0 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,800 of insurance was used. 4. Performed $27,000 of services that was paid for in advance 5. On last day of the month, performed $26,100 of services for new customer and will be paid next month 6. Happy cleaners provided $19,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,000 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 3% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $210,000 one year ago. The current fair value of the company is 180,000 . Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 14,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $19. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $23. 1 General Ledger (starting with balances from unadjusted trial balance) \begin{tabular}{l|r|l|rl|r|r|c} \multicolumn{3}{c}{ Cash } & & \multicolumn{3}{c}{ Accounts Payable } \\ \cline { 1 - 8 } Unadj Bal. & 23,400 & & & & 19,900 & Unadj Bal. \\ \hline & & & & & & \\ \hline Bal. & 23,400 & & & & 19,900 & Bal. \end{tabular} \begin{tabular}{l|r|l|l|l|r|r} \multicolumn{3}{c}{ Furniture } & & & \multicolumn{3}{c}{ Sales or Service Revenue } \\ \hline Unadj Bal. & 20,000 & & \\ \hline & & & \\ \hline & & & & & 76,900 & Unadj Bal. \\ \hline & 20,000 & & & & & \\ \hline \end{tabular} \begin{tabular}{l|r|r|r|r|r|r} \multicolumn{3}{c}{ Insurance expense } & & \multicolumn{3}{c}{ Cleaning expense } \\ \cline { 1 - 4 } & & & & 0 & & \\ \cline { 1 - 7 } & & & & 0 & & \\ \hline & Bal. & 0 & & 0 & & \end{tabular} \begin{tabular}{l|c|c|c|c|c|c} \multicolumn{5}{c}{ Warranty Expense } & & \multicolumn{3}{c|}{ Allowance for Warranty Expense } \\ \cline { 1 - 6 } & & & & Unadj Bal. \\ \hline Unadj Bal. & 0 & & & & \\ \hline & & & & & O Bal. \end{tabular} 1 COMPREHENSIVE QUESTION 13 (ACTUAL) ANN SIMPSON DESIGNER Statement of Owner's Equity Year Ended December 31, 2018 Beginning, January 1, 2018 Net income for the year Dividends Ending Balance, December 31, 2018 COMPREHENSIVE QUESTION 13 (ACTUAL) INC. Statement of Cash Flows Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: Provided by Operating Activities Depreciation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid insurance Increase in accounts payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense Net Cash Provided by Opearting Activites Cash Flow from investing Activities: Cash receipt for sale of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by investing Activites Cach Fiow from financine Activitiets: Cash payment. from purchase of common stock Cash receipt for sale of common stock cash payment of dividends Net Canh Provided (Used) by Finanding Activites Net increave (Decrease) in Cach Bexinning Cash baiance Ending Cash Balance Other Information: Land was sold for $45,000 in cash Furniture was purchased for $30,000 in cash Goodwill was purchased for $80,000 in cash The compnay sold stock for $271,000 in cash Company stock was purchased for $23,000 in cash The company paid $4,000 in cash dividends Other Information: Land was sold for $45,000 in cash Furniture was purchased for $30,000 in cash Goodwill was purchased for $80,000 in cash The compnay sold stock for $271,000 in cash Company stock was purchased for $23,000 in cash The company paid $4,000 in cash dividends COMPREHENSIVE QUESTION 13 (ACTUAL) Adjusting Entries 1. An inventory of supplies showed $4,500 were used up. 2. The furniture was purchased for $35,000. It has $0 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,800 of insurance was used. 4. Performed $27,000 of services that was paid for in advance 5. On last day of the month, performed $26,100 of services for new customer and will be paid next month 6. Happy cleaners provided $19,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,000 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 3% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $210,000 one year ago. The current fair value of the company is 180,000 . Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 14,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $19. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $23. 1 General Ledger (starting with balances from unadjusted trial balance) \begin{tabular}{c|c|c|c|c|c|c} \multicolumn{3}{c}{ Furniture } & & \multicolumn{3}{c}{ Sales or Service Revenue } \\ \hline Unadj Bal. & 20,000 & & \\ \hline & & & \\ \hline & & & & 76,900 & Unadj Bal. \\ \hline & 20,000 & & & & & \\ \hline Bal. & & & & \\ \hline & & 76,900 Bal. \end{tabular} \begin{tabular}{l|r|r|r|r|r|r} \multicolumn{3}{c}{ Insurance expense } & & \multicolumn{3}{c}{ Cleaning expense } \\ \cline { 1 - 3 } & & & & 0 & & \\ \cline { 1 - 7 } & & & & 0 & & \\ \hline Bal. & 0 & & & 0 & & \end{tabular} \begin{tabular}{l|l|l|l|l|l|c} \multicolumn{5}{c}{ Warranty Expense } & & \multicolumn{3}{c}{ Allowance for Warranty Expense } \\ \cline { 1 - 7 } & & & & 0 & Unadj Bal. \\ \hline Unadj Bal. & 0 & & & & \\ \hline & & & & & Bal. \end{tabular} \begin{tabular}{l|l|l|l|l|l|l} \multicolumn{5}{c}{ Treasury Stock } & \multicolumn{3}{c}{ Additional Paid in Capital- Common Stock } \\ \cline { 1 - 7 } Unadj Bal. & 0 & & & 0 & Unadj Bal. \\ \hline Bal. & 0 & & & & \\ \hline & & & & & \\ \hline \end{tabular} 1 COMPREHENSIVE QUESTION 13 (ACTUAL) ANN SIMPSON DESIGNER Statement of Owner's Equity Year Ended December 31, 2018 Beginning, January 1, 2018 Net income for the year Dividends Ending Balance, December 31, 2018 COMPREHENSIVE QUESTION 13 (ACTUAL) INC. Statement of Cash Flows Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: Provided by Operating Activities Depreciation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid insurance Increase in accounts payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense Net Cash Provided by Opearting Activites Cash Flow from Investing Activities: Cash receipt for sale of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by Investing Activites Cach Flow from Financing Activities: Cash payment from purchase of common stock Cash receipt for sale of common stock cash payment of dividends Net Cash Provided (Uued) by Finanding Activites Net increave (Decrease) in Cach Bexinning Cash thaiance Ending Cach Balance COMPREHENSIVE QUESTION 13 (ACTUAL) Adjusting Entries 1. An inventory of supplies showed $4,500 were used up. 2. The furniture was purchased for $35,000. It has $0 salvage value and a 5 year useful life. One year of depreciation must be recorded. 3. $3,000 of insurance was purchased for 12 months. $1,800 of insurance was used. 4. Performed $27,000 of services that was paid for in advance 5. On last day of the month, performed $26,100 of services for new customer and will be paid next month 6. Happy cleaners provided $19,000 of cleaning services on the last day of the month. This waas a special yearly clean. They will be paid next month. 7. An inventory count revealed there was $4,000 of inventory shrinkage. This was a larger than usual amount of shrinkage. 8. The company estimates bad debt expense to be 3% of credit sales. Assume all sales are made on credit. 9. A company with net assets of $100,000 was purchased for $210,000 one year ago. The current fair value of the company is 180,000 . Perform a goodwill impairment test and record an impairment entry if one is needed. 10. The company had a calculated warranty expense of 14,000 on oustanding sales 11. The company sold an additional 10,000 shares at a market price of $19. The par value of the stock is $1. 12. The company purchased 1,000 of its own shares at a market price of $23. 1 General Ledger (starting with balances from unadjusted trial balance) \begin{tabular}{l|r|l|rl|r|r|c} \multicolumn{3}{c}{ Cash } & & \multicolumn{3}{c}{ Accounts Payable } \\ \cline { 1 - 8 } Unadj Bal. & 23,400 & & & & 19,900 & Unadj Bal. \\ \hline & & & & & & \\ \hline Bal. & 23,400 & & & & 19,900 & Bal. \end{tabular} \begin{tabular}{l|r|l|l|l|r|r} \multicolumn{3}{c}{ Furniture } & & & \multicolumn{3}{c}{ Sales or Service Revenue } \\ \hline Unadj Bal. & 20,000 & & \\ \hline & & & \\ \hline & & & & & 76,900 & Unadj Bal. \\ \hline & 20,000 & & & & & \\ \hline \end{tabular} \begin{tabular}{l|r|r|r|r|r|r} \multicolumn{3}{c}{ Insurance expense } & & \multicolumn{3}{c}{ Cleaning expense } \\ \cline { 1 - 4 } & & & & 0 & & \\ \cline { 1 - 7 } & & & & 0 & & \\ \hline & Bal. & 0 & & 0 & & \end{tabular} \begin{tabular}{l|c|c|c|c|c|c} \multicolumn{5}{c}{ Warranty Expense } & & \multicolumn{3}{c|}{ Allowance for Warranty Expense } \\ \cline { 1 - 6 } & & & & Unadj Bal. \\ \hline Unadj Bal. & 0 & & & & \\ \hline & & & & & O Bal. \end{tabular} 1 COMPREHENSIVE QUESTION 13 (ACTUAL) ANN SIMPSON DESIGNER Statement of Owner's Equity Year Ended December 31, 2018 Beginning, January 1, 2018 Net income for the year Dividends Ending Balance, December 31, 2018 COMPREHENSIVE QUESTION 13 (ACTUAL) INC. Statement of Cash Flows Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: Provided by Operating Activities Depreciation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid insurance Increase in accounts payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense Net Cash Provided by Opearting Activites Cash Flow from investing Activities: Cash receipt for sale of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by investing Activites Cach Fiow from financine Activitiets: Cash payment. from purchase of common stock Cash receipt for sale of common stock cash payment of dividends Net Canh Provided (Used) by Finanding Activites Net increave (Decrease) in Cach Bexinning Cash baiance Ending Cash Balance Other Information: Land was sold for $45,000 in cash Furniture was purchased for $30,000 in cash Goodwill was purchased for $80,000 in cash The compnay sold stock for $271,000 in cash Company stock was purchased for $23,000 in cash The company paid $4,000 in cash dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started