Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all of the information given for the problems Please use the following information for Questions 19, 20, 21, and 22. A regional restaurant

this is all of the information given for the problems

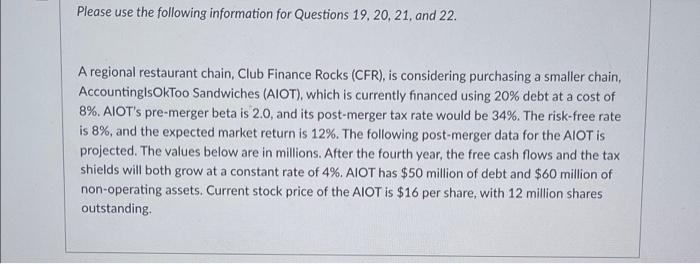

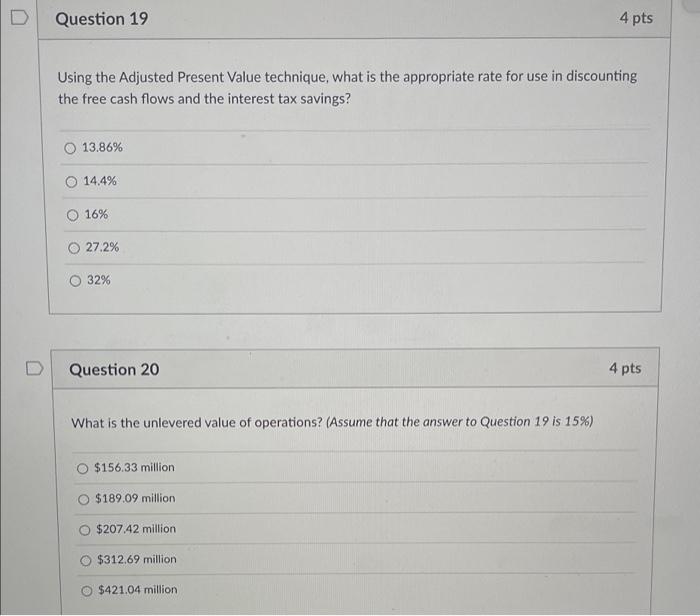

Please use the following information for Questions 19, 20, 21, and 22. A regional restaurant chain, Club Finance Rocks (CFR), is considering purchasing a smaller chain, AccountinglsOkToo Sandwiches (AIOT), which is currently financed using 20% debt at a cost of 8%. AIOT's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8%, and the expected market return is 12%. The following post-merger data for the AIOT is projected. The values below are in millions. After the fourth year, the free cash flows and the tax shields will both grow at a constant rate of 4%. AIOT has $50 million of debt and $60 million of non-operating assets. Current stock price of the AIOT is $16 per share, with 12 million shares outstanding. D Question 19 Using the Adjusted Present Value technique, what is the appropriate rate for use in discounting the free cash flows and the interest tax savings? 13.86% O 14.4% 16% 27.2% 32% Question 20 What is the unlevered value of operations? (Assume that the answer to Question 19 is 15%) $156.33 million $189.09 million $207.42 million. O $312.69 million 4 pts $421.04 million 4 pts D D Question 21 What is the value of the tax shields? (Assume that the answer to Question 19 is 15%) O $51.59 million O $79.13 million. $97.32 million $105.44 million $124.10 million Question 22 $15 Among the choices below, which offer price falls into the range of prices that the target and the acquirer may consider AND will give the MOST of the merger premium to the Acquirer? (Assume that the answer to Question 20 is $150 million and answer to Question 21 is $80 million) $17 $18 $19 4 pts $21 4 pts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started