Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all one problem. It is a a comprehensive problem and I would appreciate some extra help. ac paid its b but on January

This is all one problem. It is a a comprehensive problem and I would appreciate some extra help.

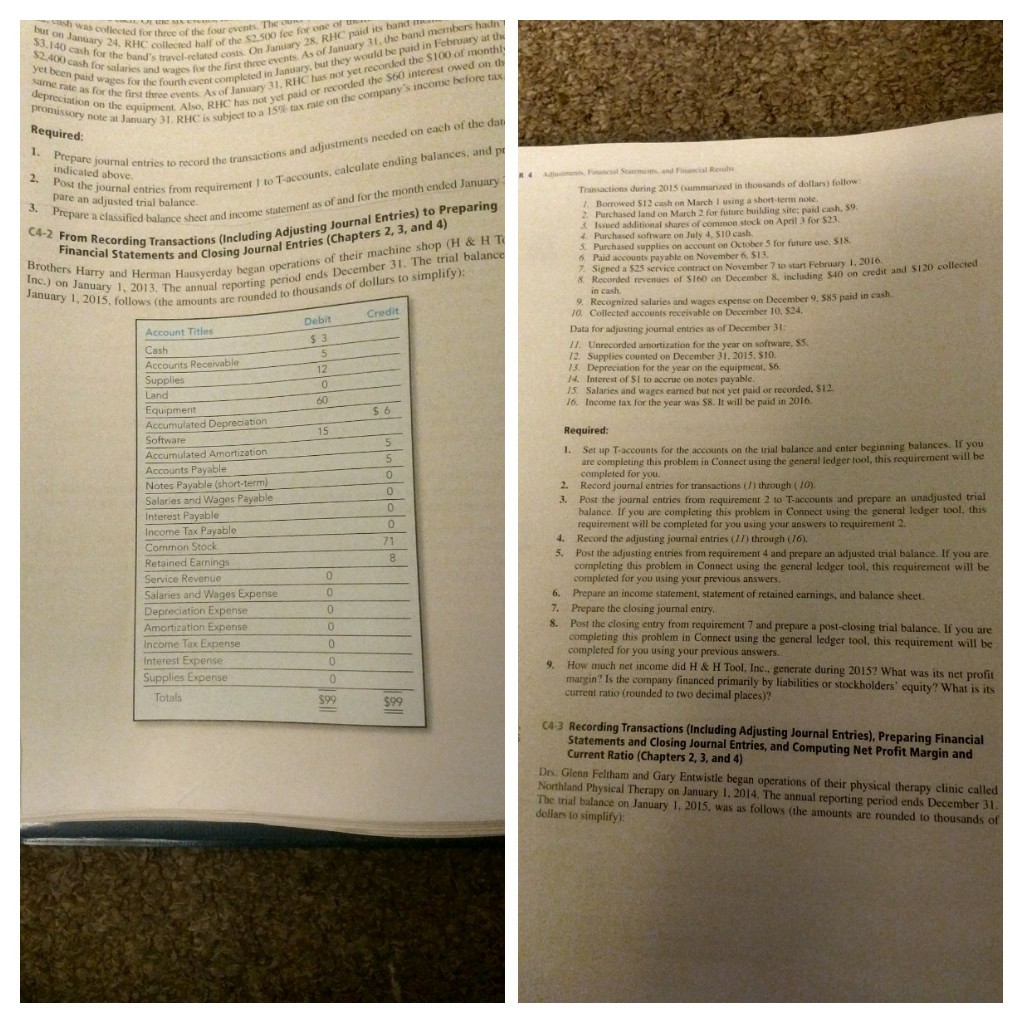

ac paid its b but on January $3.140 cash for $2. ee for ent complcted in January, but they would be puid in February at tdh is subject to a 15% tax nue on the company's income before tax collected for three of the four events 24, RHC colected half of the $2.500 1 r the band's travel-related cosis RHC equireduary 3a not yet paid or recorded the $60 interest owed on Required 400 cash for salaries and wages yet been paid wagesforthc reevents Aue has same rate as for the first three s o s for ther the first three events As of January 31, the band memb promissory note at January 31.RH ''ccquipment Also, RHC l to T-accounts, calculate ending balances, and pr statement as of and for the 1. Prepare journal entries to record indicated above he transactions and adjustments needed on each of the da rournal entries from requirement Transactions during 2015 (summanized in thousands of dollars) follow month ended J pare an adjusted trial balance Prepare a classified balance sheet and income Borrowed $12 cash on March I using a short-term note. 2. 3. . Purchased land on March 2 for future building site; paid cash, 59. Journal Entries) to Preparin d 4) t Issued additional shares of common stock on April 3 for $23 Statements and Closing Journal Entries (Chapters 2, 3, an and Herman Hausyerday operations 4 Purchased software on July 4, $10 cash ecording Transactions (Including Adjusting supplies on account on October 5 for future use. SIS Financial of their machine shop (H & H T trial balance Paid accounts payable on November 6, $13. day began operod ends Decemoiars to simplify) a $25 service contract on November 7 to stant February 1, 2016 7, Signed credit and $120 collected 8 Recorded revenues of $160 on December 8, including $40 on nc.) on January 1, 2013. The annual reporting pe January 1, 2015, follows (the amounts are ousands 9. Recognized salaries and wages expense on December 9, $85 paid in cash. accounts receivable on December 10. 524. Data for adjusting journal entries as of December 31 II. Unrecorded amortization for the year on software, $5, 12. Supplies counted on December 31. 2015. S10. 13. Depreciation for the year on the equipment, S6 /4. Interest of SI to accrue on notes payable S. Salaries and wages earned but not yet paid or recorded, $12 16. Income tax for the year was $8. It will be paid in 2016. Accounts Receivable 12 Accumulated Depreciation Accumulated Amortization Notes Payable (short-term) Interest Payable 15 Required: I. Set up T-accounts for the accounts on the trial balance and enter beginning balances. If you are completing this problem in Connect using the general ledger tool, this requirement will be 2. 3. Record journal entries for transactions ( /) through ( 10). Post the journal entries from requirement 2 to T-accounts and prepare an unadjusted trial balance. If you are compleing this problem in Connect using the genera ledger tool, this requirement will be completed for you using your answers to requirement 2. Record the adjusting journal entries (11) through (16). Post the adjusting entries from requirement 4 and prepare an adjusted trial balance. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed for you using your previous answers. 0 Income Tax Payable 4. 5. Salaries and Wages Expense Amortization Expense Interest Expense 6. Prepare an income statement, statement of retained earnings, and balance sheet. 7. Prepare the closing journal entry 8 Post the closing entry from requirement 7 and prepare a post-closing trial balance. If you are completing this problem in Connect using the general ledger tool, this requirement will be completed for you using your previous answers. How much net income did H & H Tool, Inc., generate during 2015? What was its net profit margin? Is the company financed primarily by liabilities or stockholders' equity? What is its current ratio (rounded to two decimal places)? 0 9. Totals $99 C4-3 Recording Transactions (Including Adjusting Journal Entries), Preparing Financial Statements and dosing lournal Entries, and Computing Net Profit Margin and Current Ratio (Chapters 2,3, and 4) Drs. Glenn Feltham and Gary Entwistle began operations of their physical therapy clinic cal Northland Physical Therapy on January 1, 2014The annual reporting period ends December 31 The trial balance on January 1, 2015, was as follows (the amounts are rounded to thousands dollars to simplify)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started