this is all one problem... please help me figure it out. grearly appreciate it ... thankyou

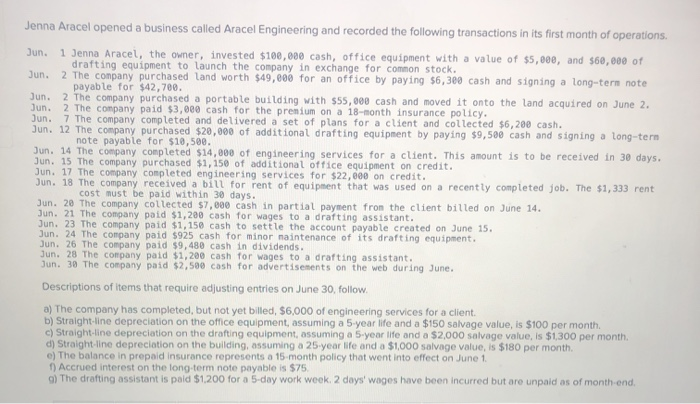

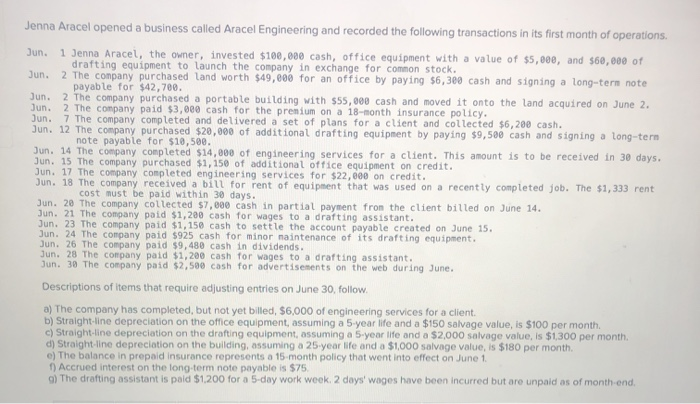

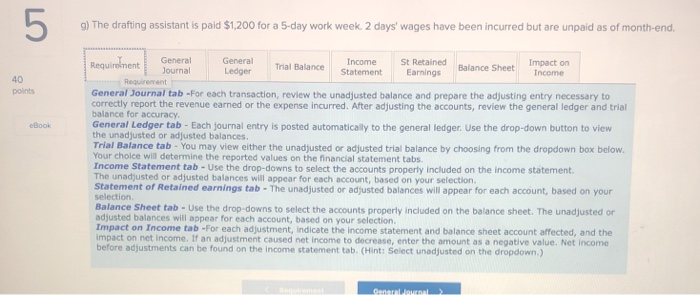

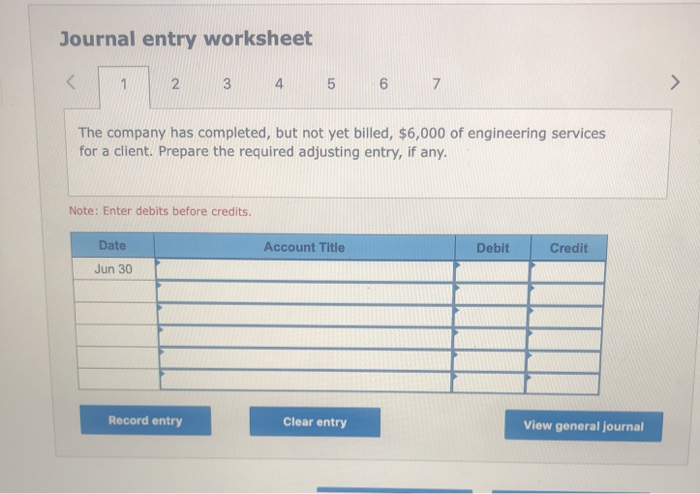

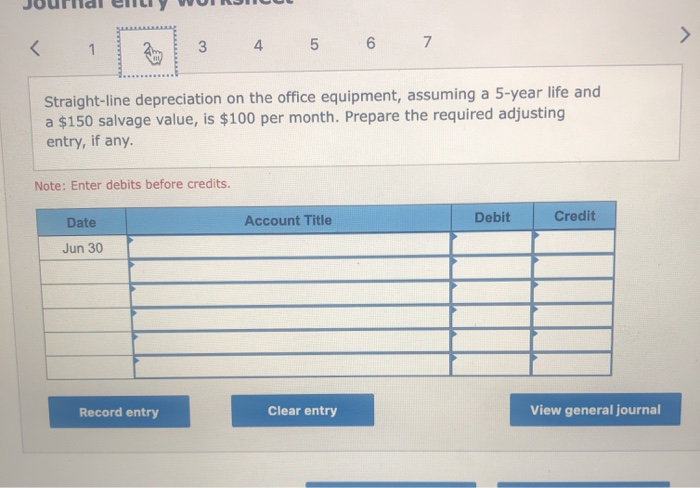

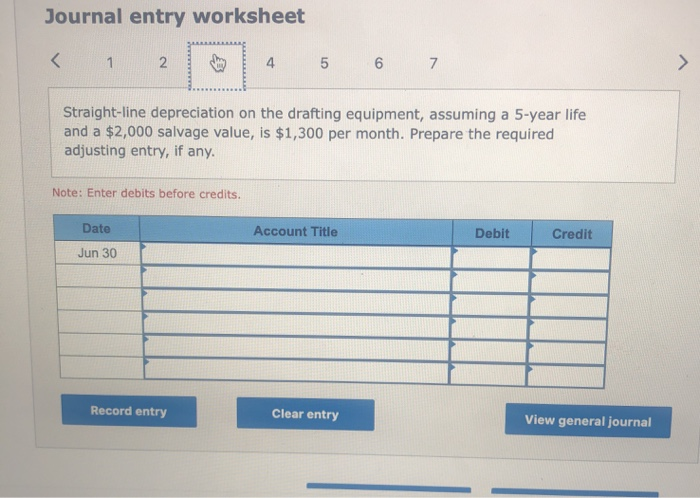

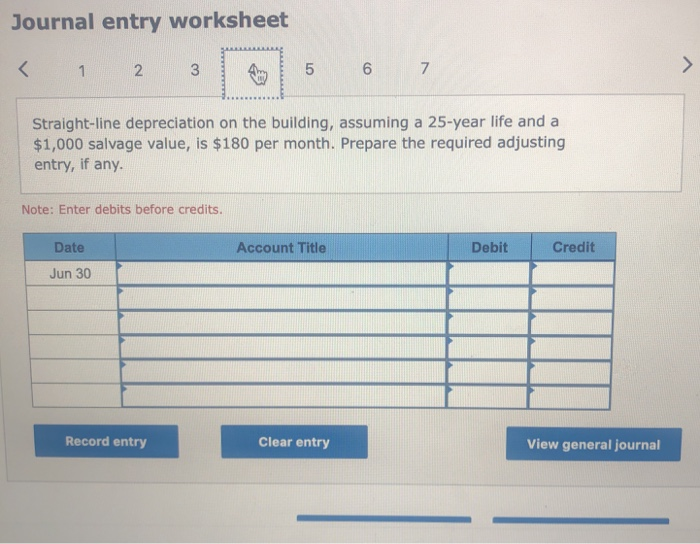

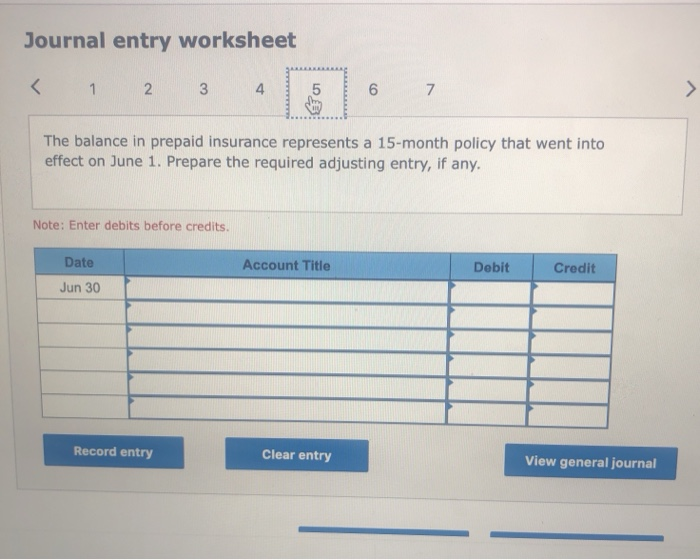

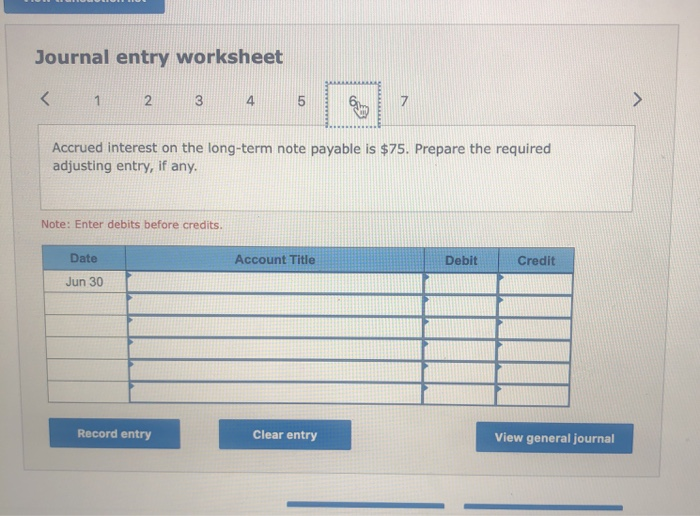

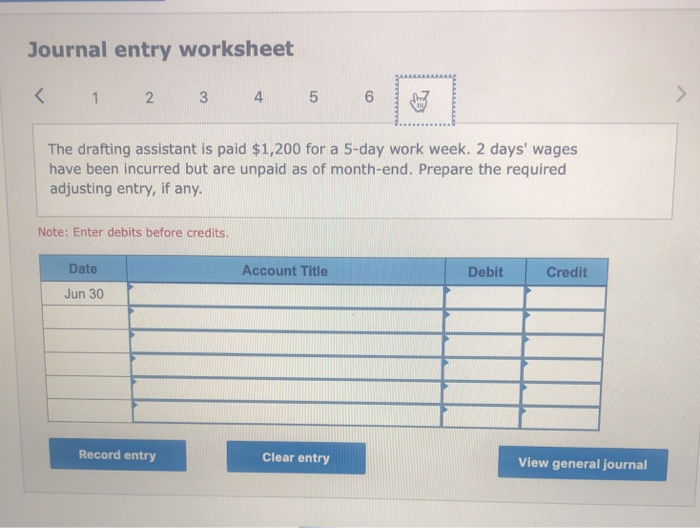

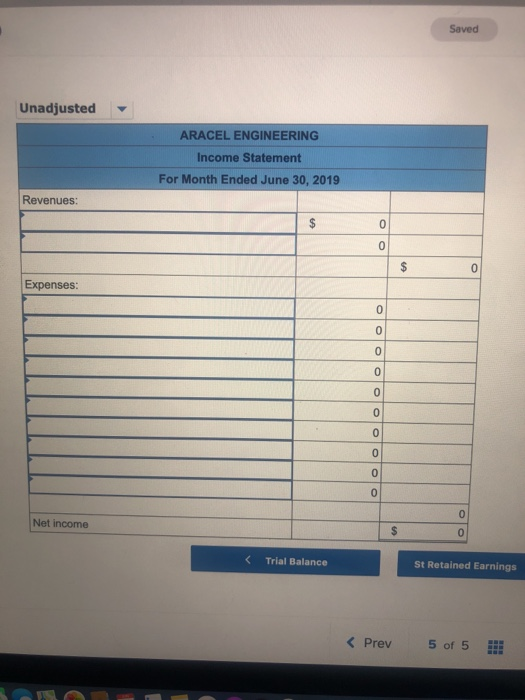

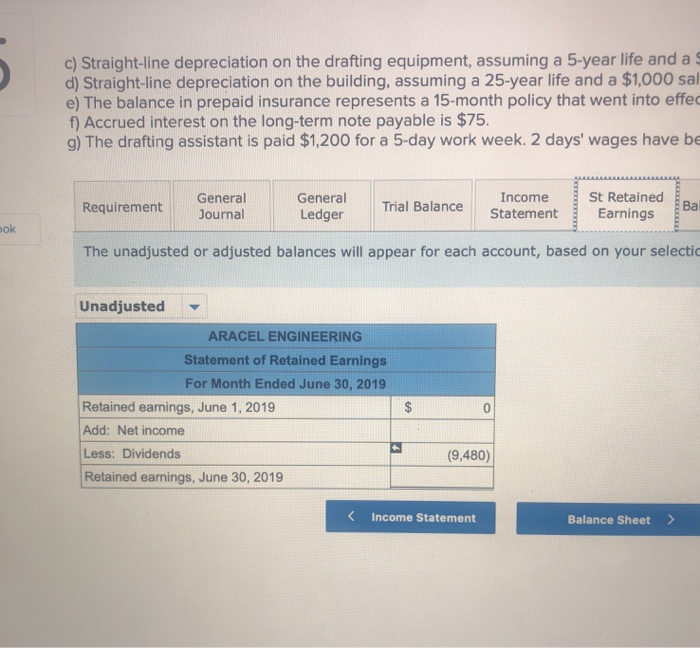

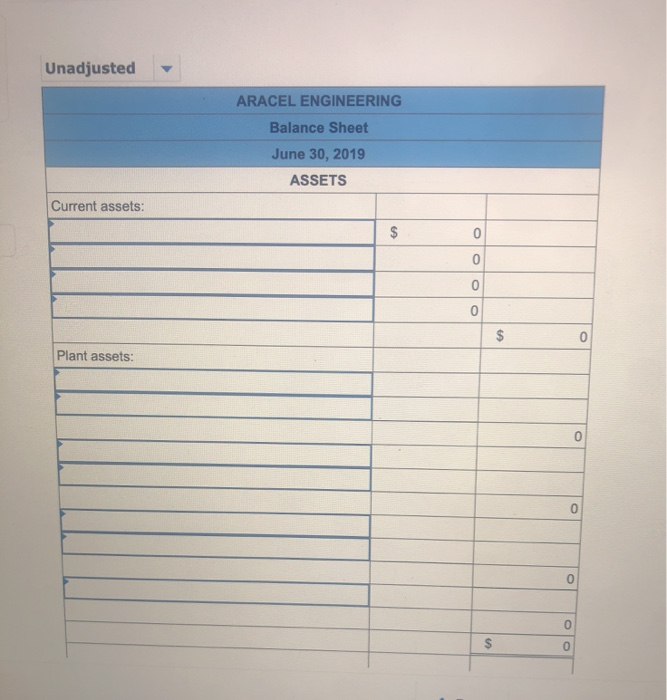

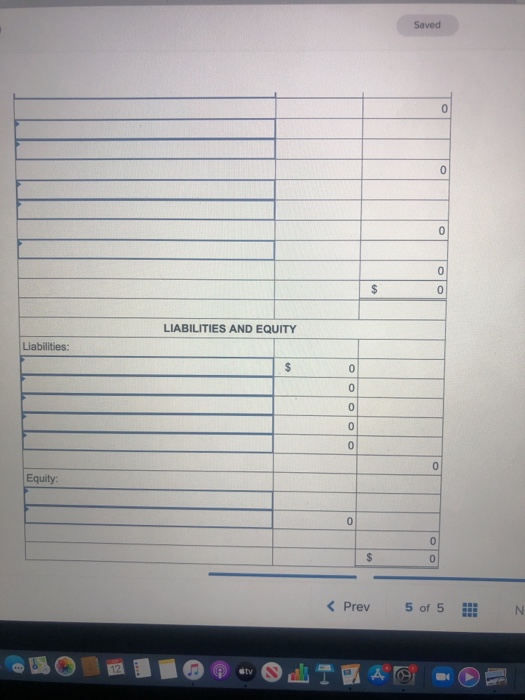

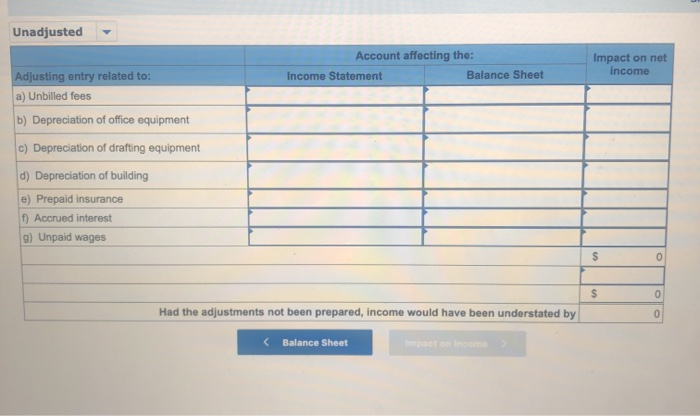

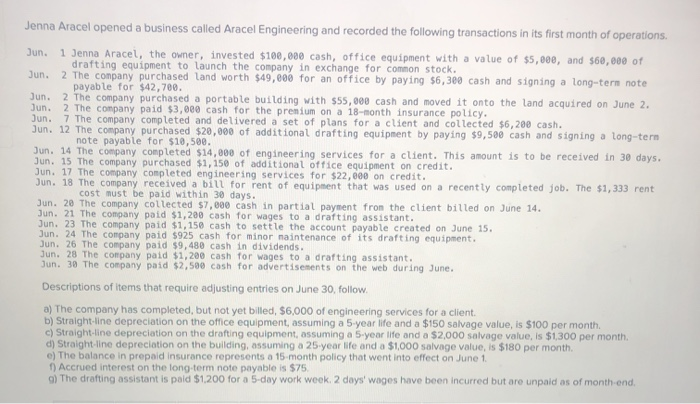

Jenna Aracel opened a business called Aracel Engineering and recorded the following transactions in its first month of operations. Jun. 1 Jenna Aracel, the owner, invested $100,000 cash, office equipment with a value of $5,000, and $60,000 of Jun. 2 The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-tern note Jun. 2 The company purchased a portable building with $55,000 cash and moved it onto the land acquired on June 2. Jun. 2 The company paid $3,000 cash for the premium on a 18-month insurance policy. Jun. 7 The company completed and delivered a set of plans for a client and collected $6,200 cash. Jun. 12 The company purchased $20,000 of additional drafting equipment by paying $9,500 cash and signing a long-tern note payable for $10,500. Jun. 14 The company completed $14,000 of engineering services for a client. This amount is to be received in 30 days. Jun. 15 The company purchased $1,150 of additional office equipment on credit. Jun. 17 The company completed engineering services for $22,600 on credit. Jun. 18 The company received a bill for rent of equipment that was used on a recently completed job. The $1,333 rent cost must be paid within 30 days. Jun. 20 The company collected $7,000 cash in partial payment from the client billed on June 14. Jun. 21 The company paid $1,200 cash for wages to a drafting assistant. Jun. 23 The company paid $1,150 cash to settle the account payable created on June 15. Jun. 24 The company paid $925 cash for minor naintenance of its drafting equipment. Jun. 26 The company paid $9, 480 cash in dividends. Jun. 28 The company paid $1,200 cash for wages to a drafting assistant, Jun. 30 The company paid $2,500 cash for advertisements on the web during June. Descriptions of items that require adjusting entries on June 30, follow. a) The company has completed, but not yet billed, $6,000 of engineering services for a client b) Straight-line depreciation on the office equipment, assuming a 5-year life and a $150 salvage value, is $100 per month c) Straight-line depreciation on the drafting equipment, assuming a 5-year life and a $2,000 salvage value, is $1,300 per month d) Straight line depreciation on the building, assuming a 25-year life and a $1,000 salvage value, is $180 per month c) The balance in prepaid insurance represents a 15-month policy that went into effect on June 1 1) Accrued interest on the long-term note payable is $75 a) The drafting assistant is paid $1.200 for a 5-day work week 2 days' wages have been incurred but are unpaid as of month-end, 5 9) The drafting assistant is paid $1,200 for a 5-day work week. 2 days' wages have been incurred but are unpaid as of month-end. 40 points Boce Requirement General General Income St Retained Balance Sheet Trial Balance Journal Impact on Ledger Statement Earnings Income Requirement General Journal tab -For each transaction, review the unadjusted balance and prepare the adjusting entry necessary to correctly report the revenue earned or the expense incurred. After adjusting the accounts, review the general ledger and trial balance for accuracy. General Ledger tab - Each journal entry is posted automatically to the general ledger. Use the drop-down button to view Trial Balance tab - You may view either the unadjusted or adjusted trial balance by choosing from the dropdown box below. Your choice will determine the reported values on the financial statement tabs Income Statement tab - Use the drop-downs to select the accounts properly included on the income statement. The unadjusted or adjusted balances will appear for each account, based on your selection. Statement of Retained earnings tab - The unadjusted or adjusted balances will appear for each account, based on your selection Balance Sheet tab - Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted or adjusted balances will appear for each account, based on your selection Impact on Income tab -For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net Income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the dropdown) Gerne Journal entry worksheet 1 2 3 4 5 6 7 The company has completed, but not yet billed, $6,000 of engineering services for a client. Prepare the required adjusting entry, if any. Note: Enter debits before credits. Date Account Title Debit Credit Jun 30 Record entry Clear entry View general journal > Straight-line depreciation on the building, assuming a 25-year life and a $1,000 salvage value, is $180 per month. Prepare the required adjusting entry, if any, Note: Enter debits before credits. Date Account Title Debit Credit Jun 30 Record entry Clear entry View general journal Journal entry worksheet The balance in prepaid insurance represents a 15-month policy that went into effect on June 1. Prepare the required adjusting entry, if any. Note: Enter debits before credits. Date Account Title Debit Credit Jun 30 Record entry Clear entry View general journal Journal entry worksheet