this is all one problem so please complete it all, thank you!

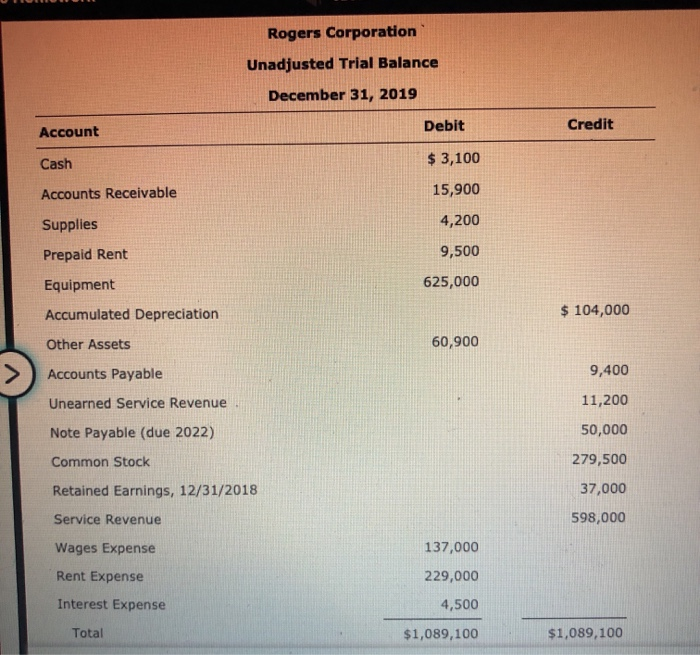

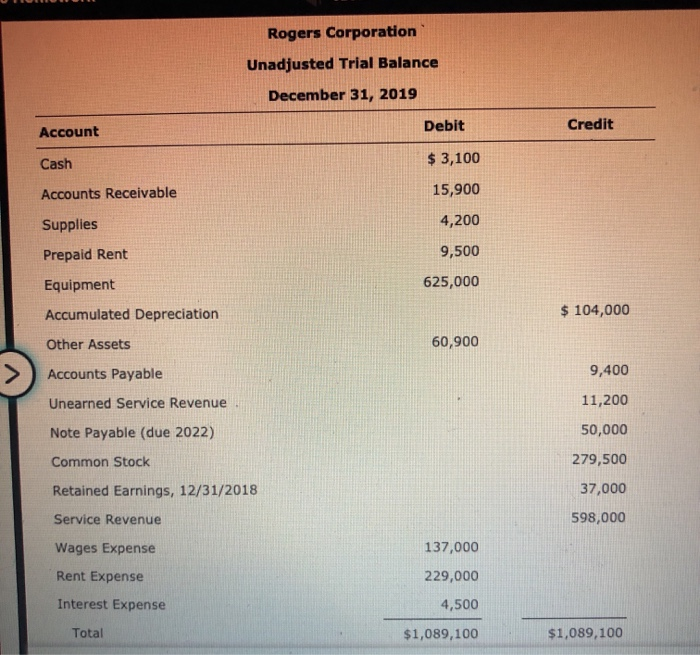

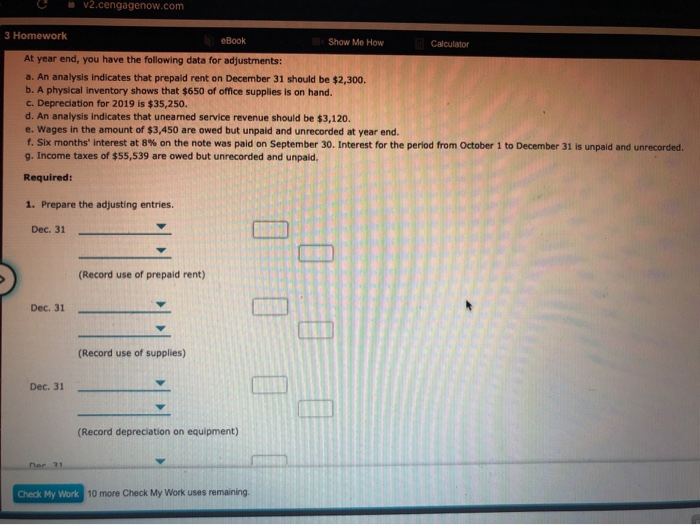

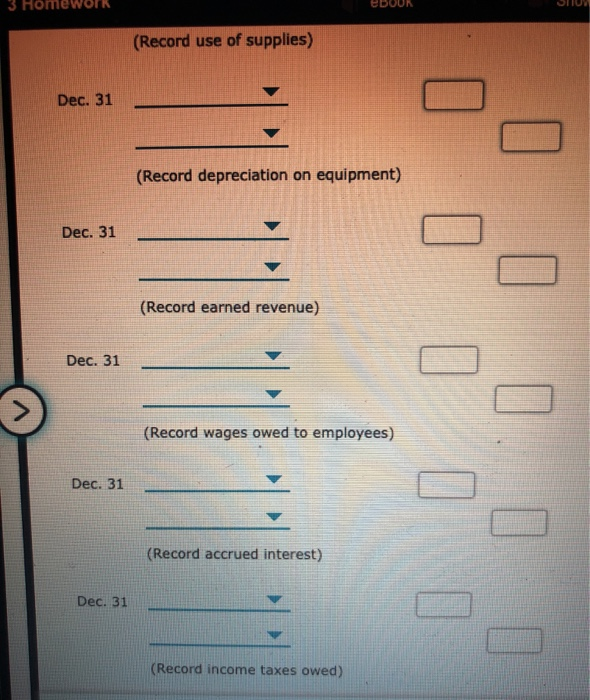

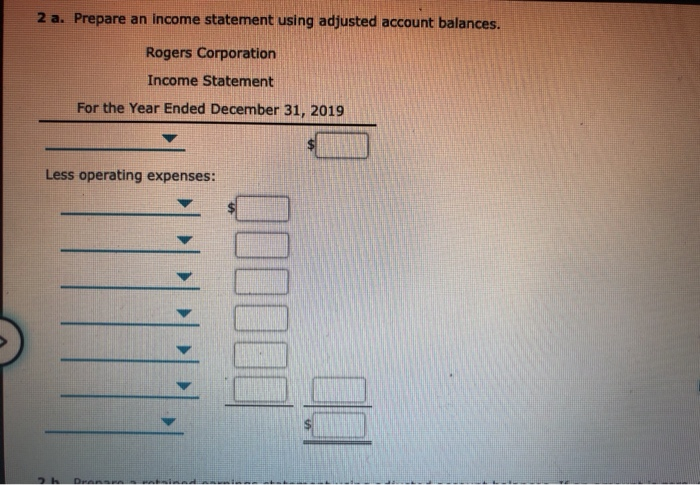

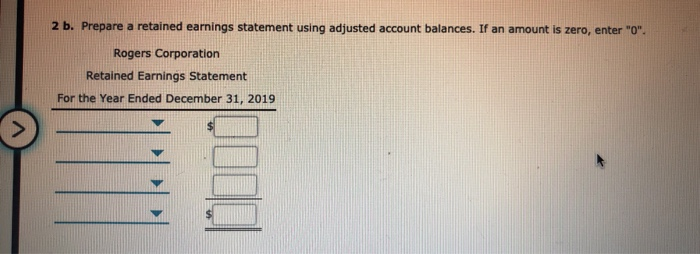

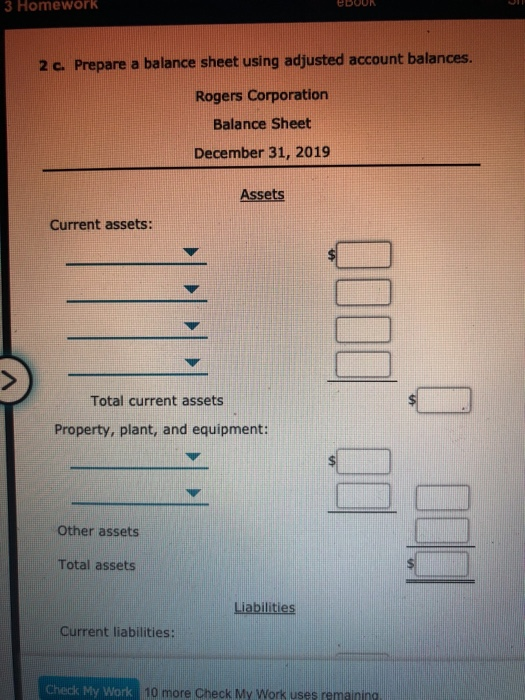

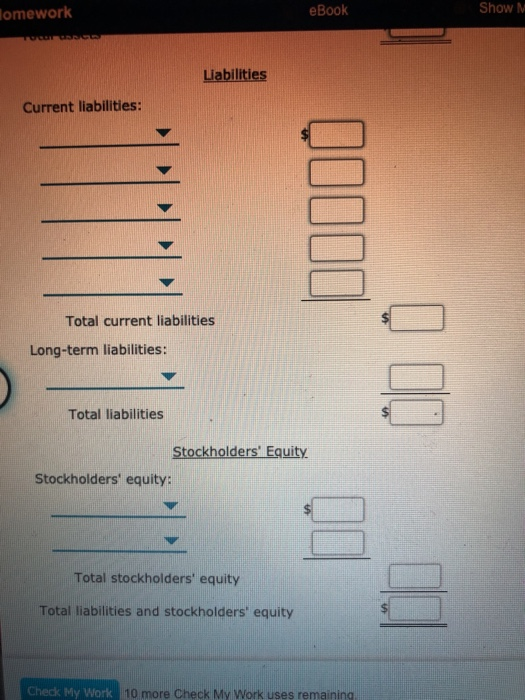

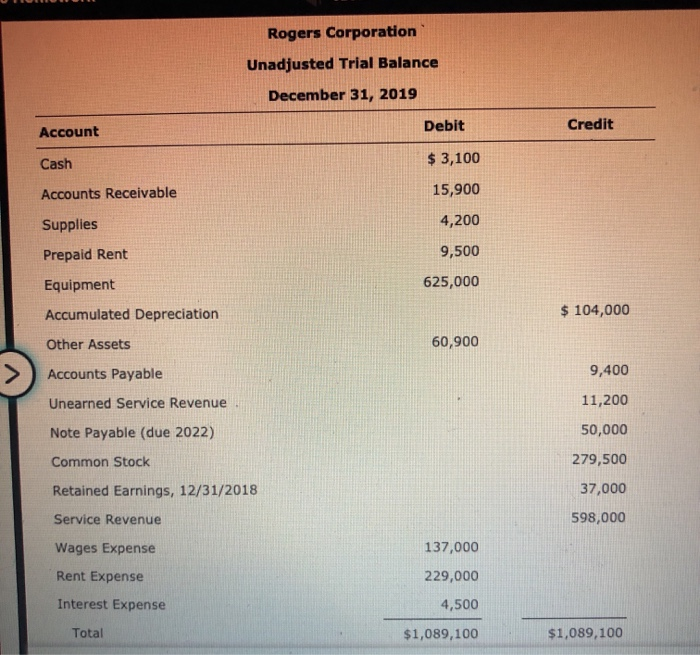

Rogers Corporation Unadjusted Trial Balance December 31, 2019 Account Debit Credit Cash $ 3,100 Accounts Receivable 15,900 4,200 Supplies Prepaid Rent 9,500 Equipment 625,000 Accumulated Depreciation $ 104,000 Other Assets 60,900 Accounts Payable 9,400 Unearned Service Revenue 11,200 Note Payable (due 2022) 50,000 Common Stock 279,500 Retained Earnings, 12/31/2018 37,000 Service Revenue 598,000 Wages Expense 137,000 229,000 Rent Expense Interest Expense 4,500 Total $1,089,100 $1,089,100 V2.cengagenow.com 3 Homework eBook Show Me How Calculator At year end, you have the following data for adjustments: a. An analysis indicates that prepaid rent on December 31 should be $2,300. b. A physical Inventory shows that $650 of office supplies is on hand. c. Depreciation for 2019 is $35,250. d. An analysis indicates that uneared service revenue should be $3,120. e. Wages in the amount of $3,450 are owed but unpaid and unrecorded at year end. f. Six months' interest at 8% on the note was paid on September 30. Interest for the period from October 1 to December 31 is unpaid and unrecorded. 9. Income taxes of $55,539 are owed but unrecorded and unpaid Required: 1. Prepare the adjusting entries. Dec. 31 o o o (Record use of prepaid rent) Dec. 31 (Record use of supplies) Dec. 31 (Record depreciation on equipment) Dar 21 Check My Work 10 more Check My Work uses remaining. 3 Home DOUN (Record use of supplies) Dec. 31 (Record depreciation on equipment) Dec. 31 (Record earned revenue) Dec. 31 (Record wages owed to employees) 0 0 0 0 Dec. 31 (Record accrued interest) Dec. 31 (Record income taxes owed) 2 a. Prepare an income statement using adjusted account balances. Rogers Corporation Income Statement For the Year Ended December 31, 2019 Less operating expenses: Danied 2 b. Prepare a retained earnings statement using adjusted account balances. If an amount is zero, enter "O". Rogers Corporation Retained Earnings Statement For the Year Ended December 31, 2019 3 Homework BDOUN 2 c. Prepare a balance sheet using adjusted account balances. Rogers Corporation Balance Sheet December 31, 2019 Assets Current assets: Total current assets Property, plant, and equipment: Other assets Total assets Liabilities Current liabilities: Check My Work 10 more Check My Work uses remaining, lomework eBook Show M TESCO Labilities Current liabilities: 20100 Total current liabilities Long-term liabilities: Total liabilities Stockholders' Equity Stockholders' equity: Total stockholders' equity Total liabilities and stockholders' equity Check My Work 10 more Check My Work uses remaining