Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all one question . it just has multiple parts to it, so can someone solve this question step by step pls This is

This is all one question . it just has multiple parts to it, so can someone solve this question step by step pls

This is Engineering Business

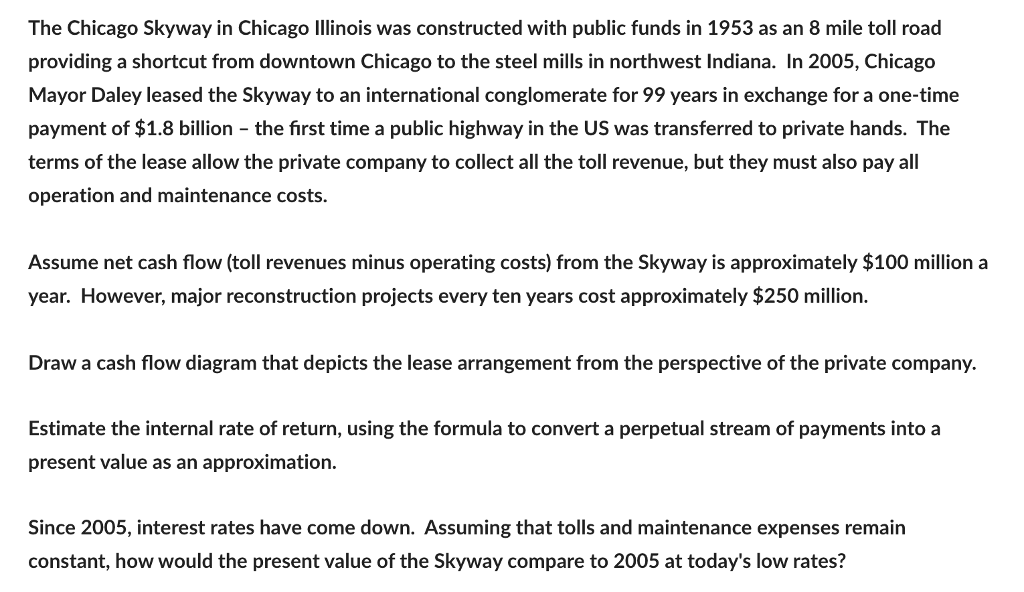

The Chicago Skyway in Chicago Ilinois was constructed with public funds in 1953 as an 8 mile toll road providing a shortcut from downtown Chicago to the steel mills in northwest Indiana. In 2005, Chicago Mayor Daley leased the Skyway to an international conglomerate for 99 years in exchange for a one-time payment of $1.8 billion the first time a public highway in the US was transferred to private hands. The terms of the lease allow the private company to collect all the toll revenue, but they must also pay all operation and maintenance costs. Assume net cash flow (toll revenues minus operating costs) from the Skyway is approximately $100 million a year. However, major reconstruction projects every ten years cost approximately $250 million. Draw a cash flow diagram that depicts the lease arrangement from the perspective of the private company. Estimate the internal rate of return, using the formula to convert a perpetual stream of payments into a present value as an approximation. Since 2005, interest rates have come down. Assuming that tolls and maintenance expenses remain constant, how would the present value of the Skyway compare to 2005 at today's low rates? The Chicago Skyway in Chicago Ilinois was constructed with public funds in 1953 as an 8 mile toll road providing a shortcut from downtown Chicago to the steel mills in northwest Indiana. In 2005, Chicago Mayor Daley leased the Skyway to an international conglomerate for 99 years in exchange for a one-time payment of $1.8 billion the first time a public highway in the US was transferred to private hands. The terms of the lease allow the private company to collect all the toll revenue, but they must also pay all operation and maintenance costs. Assume net cash flow (toll revenues minus operating costs) from the Skyway is approximately $100 million a year. However, major reconstruction projects every ten years cost approximately $250 million. Draw a cash flow diagram that depicts the lease arrangement from the perspective of the private company. Estimate the internal rate of return, using the formula to convert a perpetual stream of payments into a present value as an approximation. Since 2005, interest rates have come down. Assuming that tolls and maintenance expenses remain constant, how would the present value of the Skyway compare to 2005 at today's low ratesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started