This is all one question, just separated into sections. I wanted to make sure my answer choices were correct.. Casper's is analyzing a proposed expansion

Answered step by step

Verified Expert Solution

Question

90 users unlocked this solution today!

This is all one question, just separated into sections. I wanted to make sure my answer choices were correct..

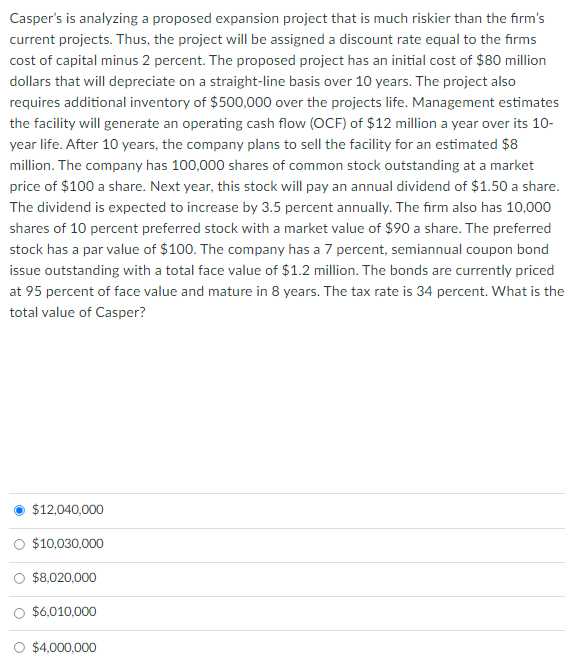

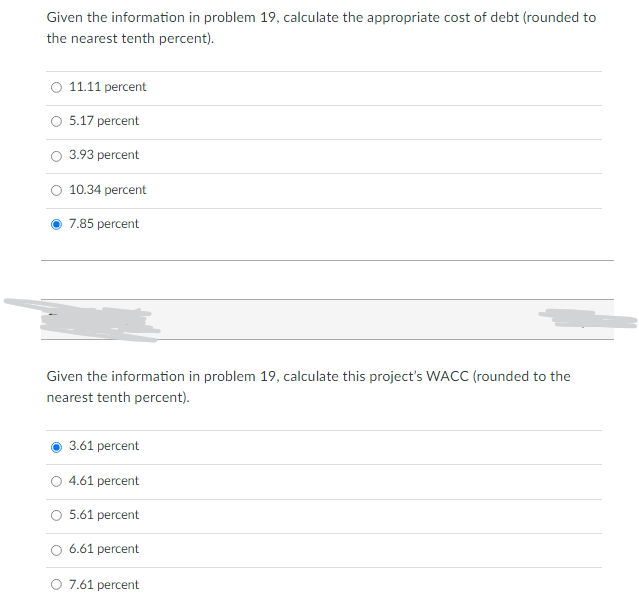

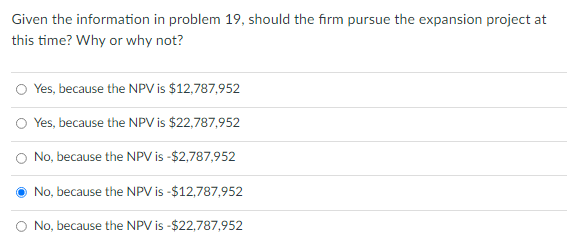

Casper's is analyzing a proposed expansion project that is much riskier than the firm's current projects. Thus, the project will be assigned a discount rate equal to the firms cost of capital minus 2 percent. The proposed project has an initial cost of $80 million dollars that will depreciate on a straight-line basis over 10 years. The project also requires additional inventory of $500,000 over the projects life. Management estimates the facility will generate an operating cash flow (OCF) of $12 million a year over its 10- year life. After 10 years, the company plans to sell the facility for an estimated $8 million. The company has 100,000 shares of common stock outstanding at a market price of $100 a share. Next year, this stock will pay an annual dividend of $1.50 a share. The dividend is expected to increase by 3.5 percent annually. The firm also has 10,000 shares of 10 percent preferred stock with a market value of $90 a share. The preferred stock has a par value of $100. The company has a 7 percent, semiannual coupon bond issue outstanding with a total face value of $1.2 million. The bonds are currently priced at 95 percent of face value and mature in 8 years. The tax rate is 34 percent. What is the total value of Casper? $12,040,000 $10,030,000 O $8,020,000 $6,010,000 $4,000,000 Given the information in problem 19, calculate the appropriate cost of debt (rounded to the nearest tenth percent). 11.11 percent 5.17 percent 3.93 percent 10.34 percent 7.85 percent Given the information in problem 19, calculate this project's WACC (rounded to the nearest tenth percent). 3.61 percent 4.61 percent 5.61 percent 6.61 percent 7.61 percent Given the information in problem 19, should the firm pursue the expansion project at this time? Why or why not? Yes, because the NPV is $12,787,952 Yes, because the NPV is $22,787,952 No, because the NPV is - $2,787,952 No, because the NPV is -$12,787,952 No, because the NPV is - $22,787,952Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards