this is all one question please answer asap

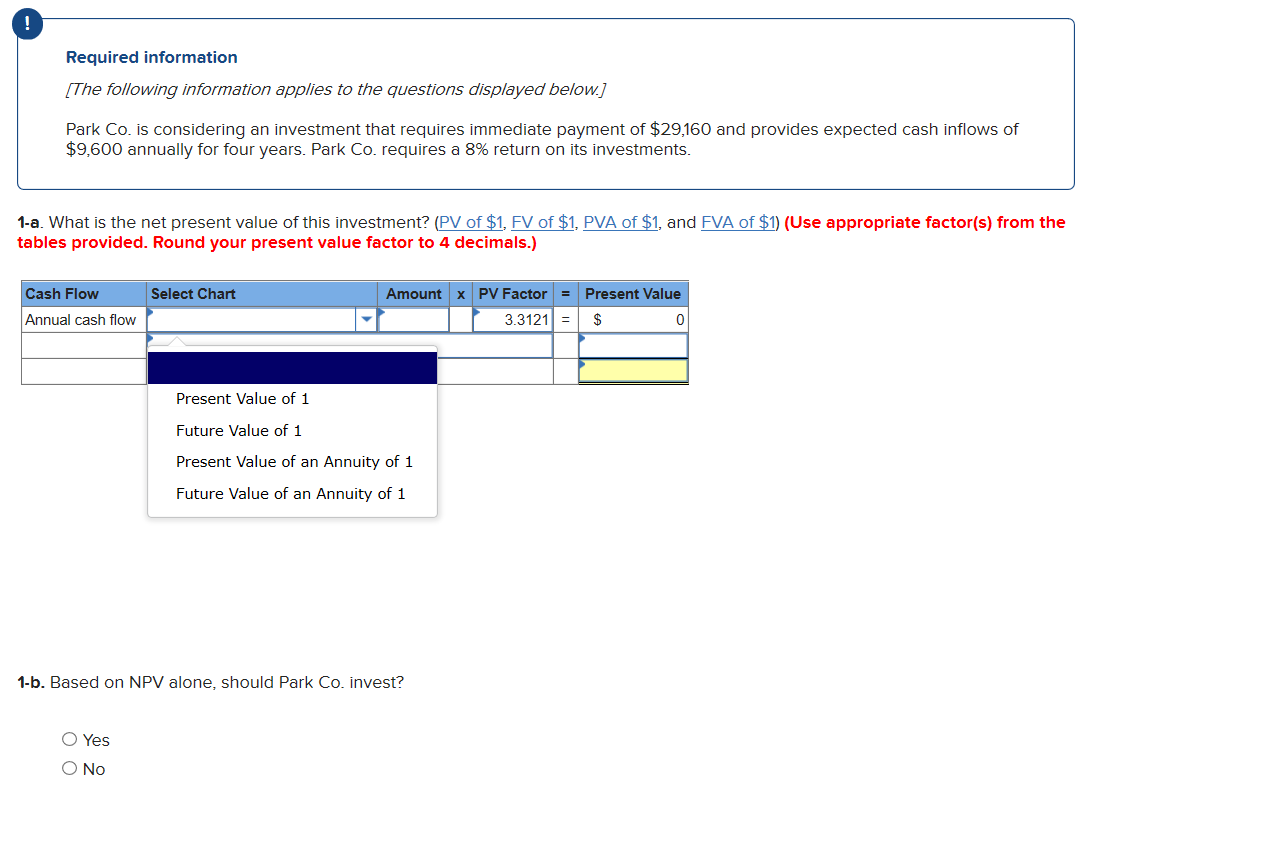

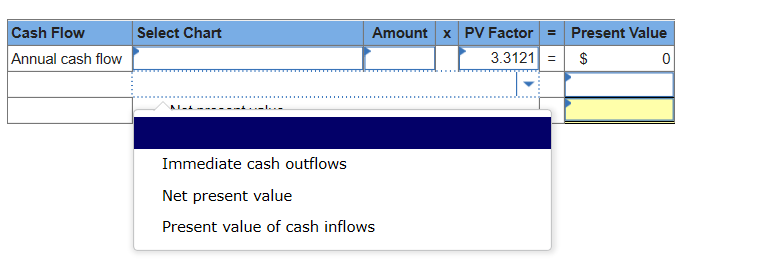

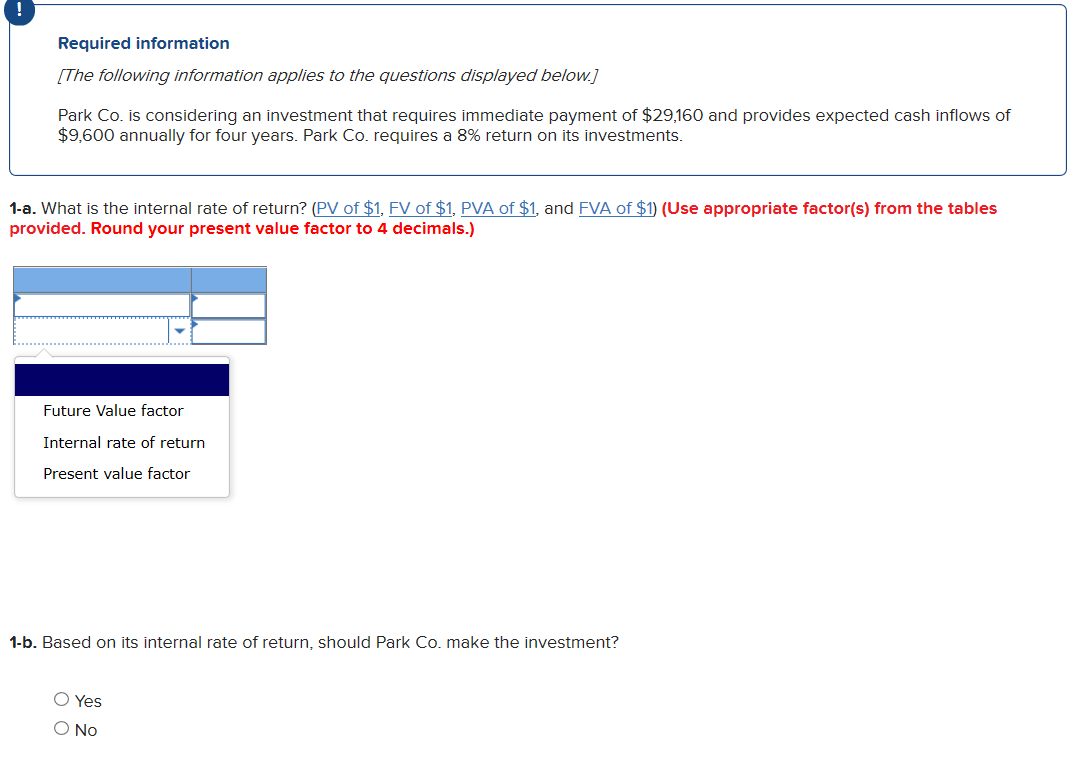

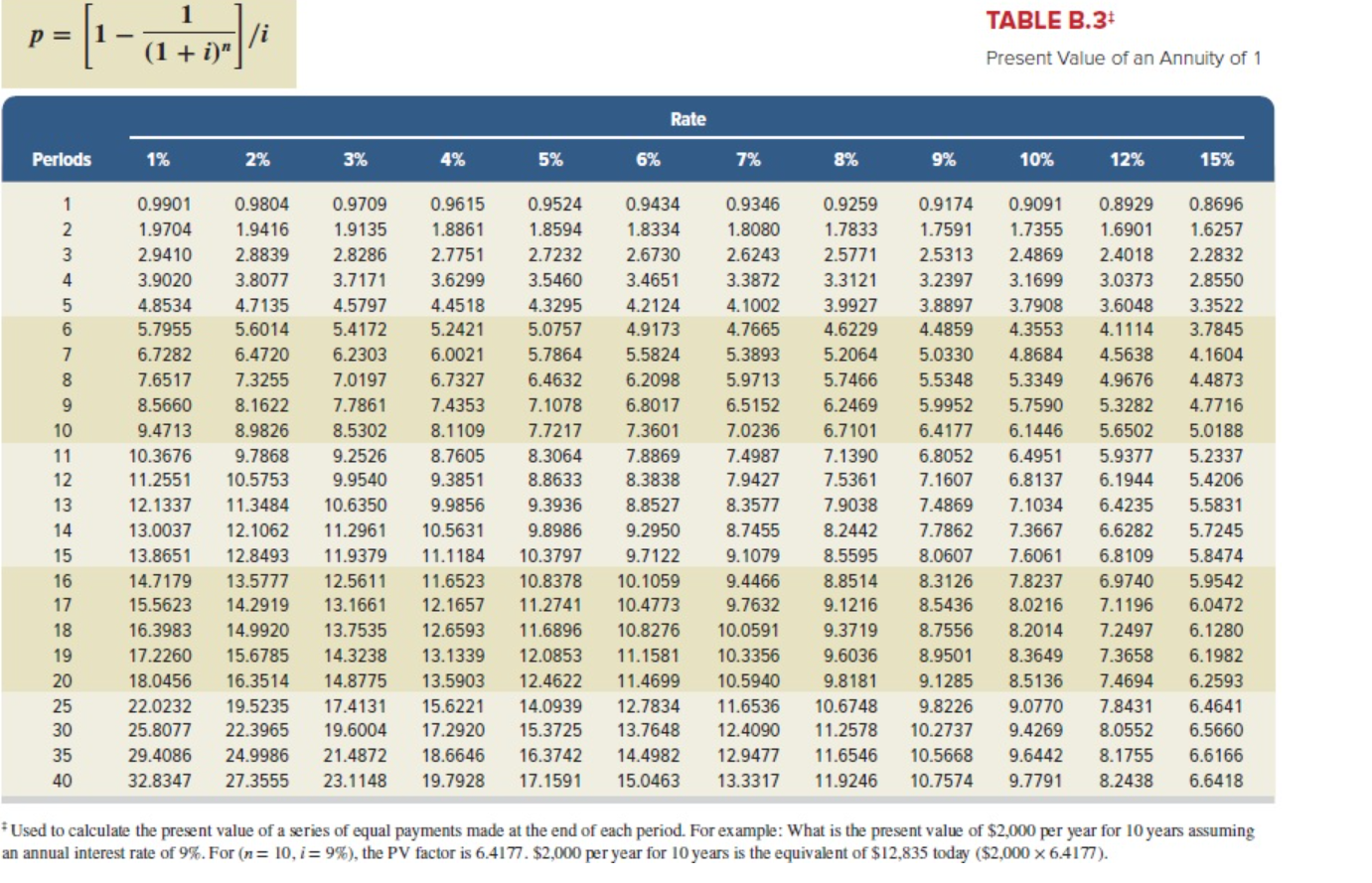

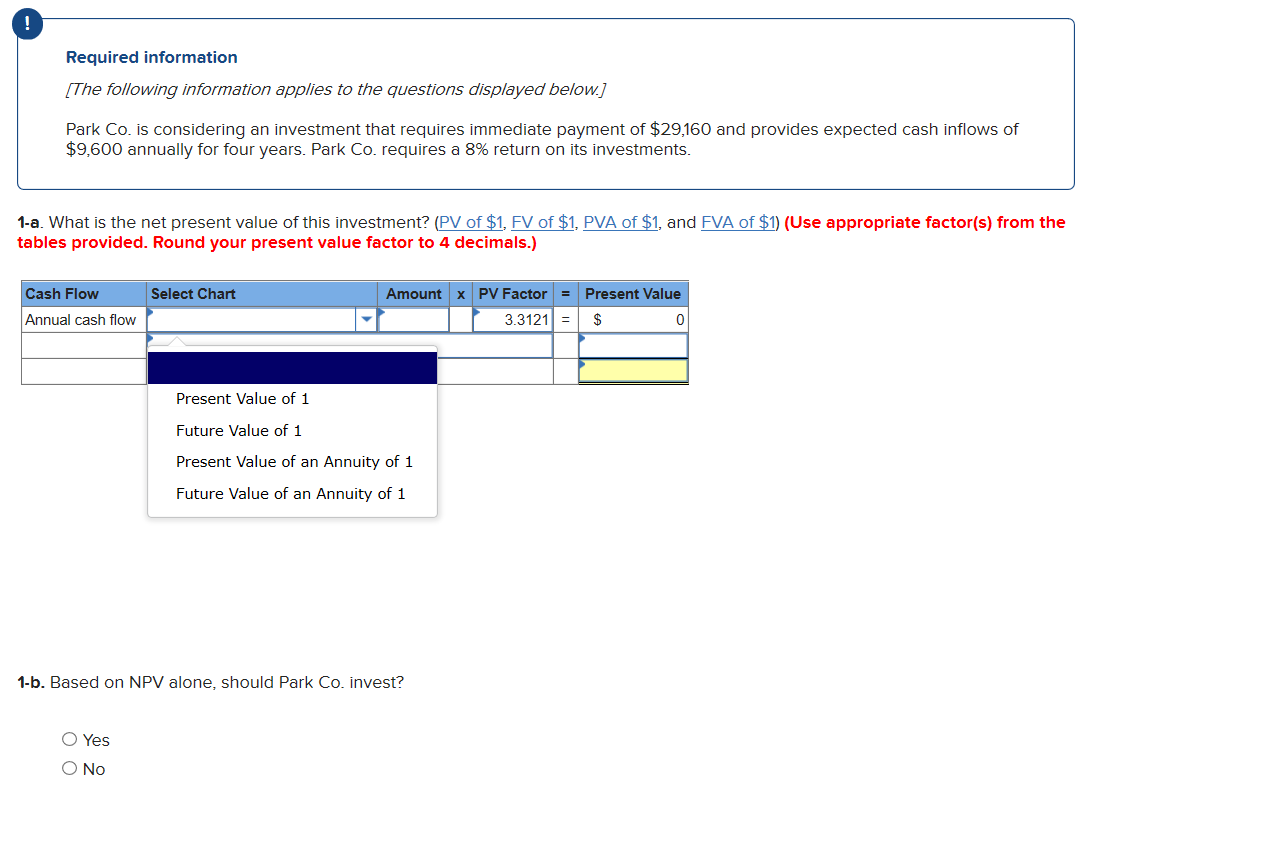

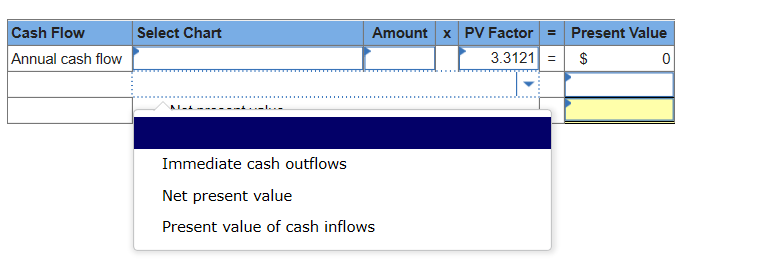

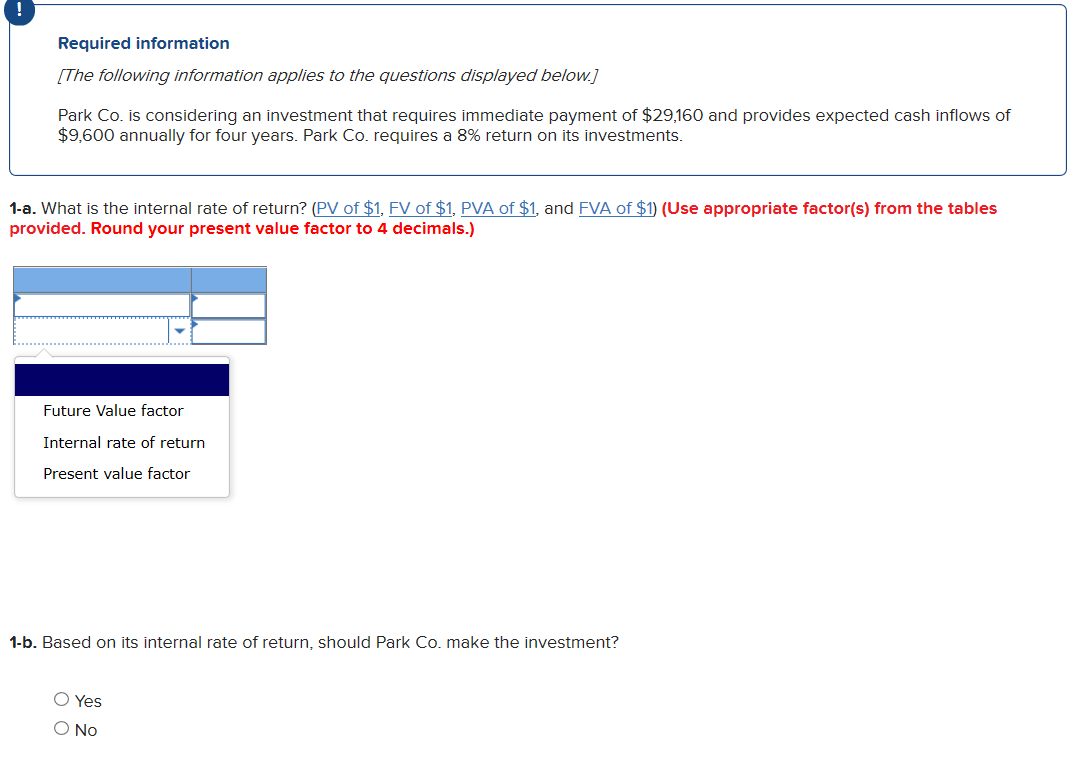

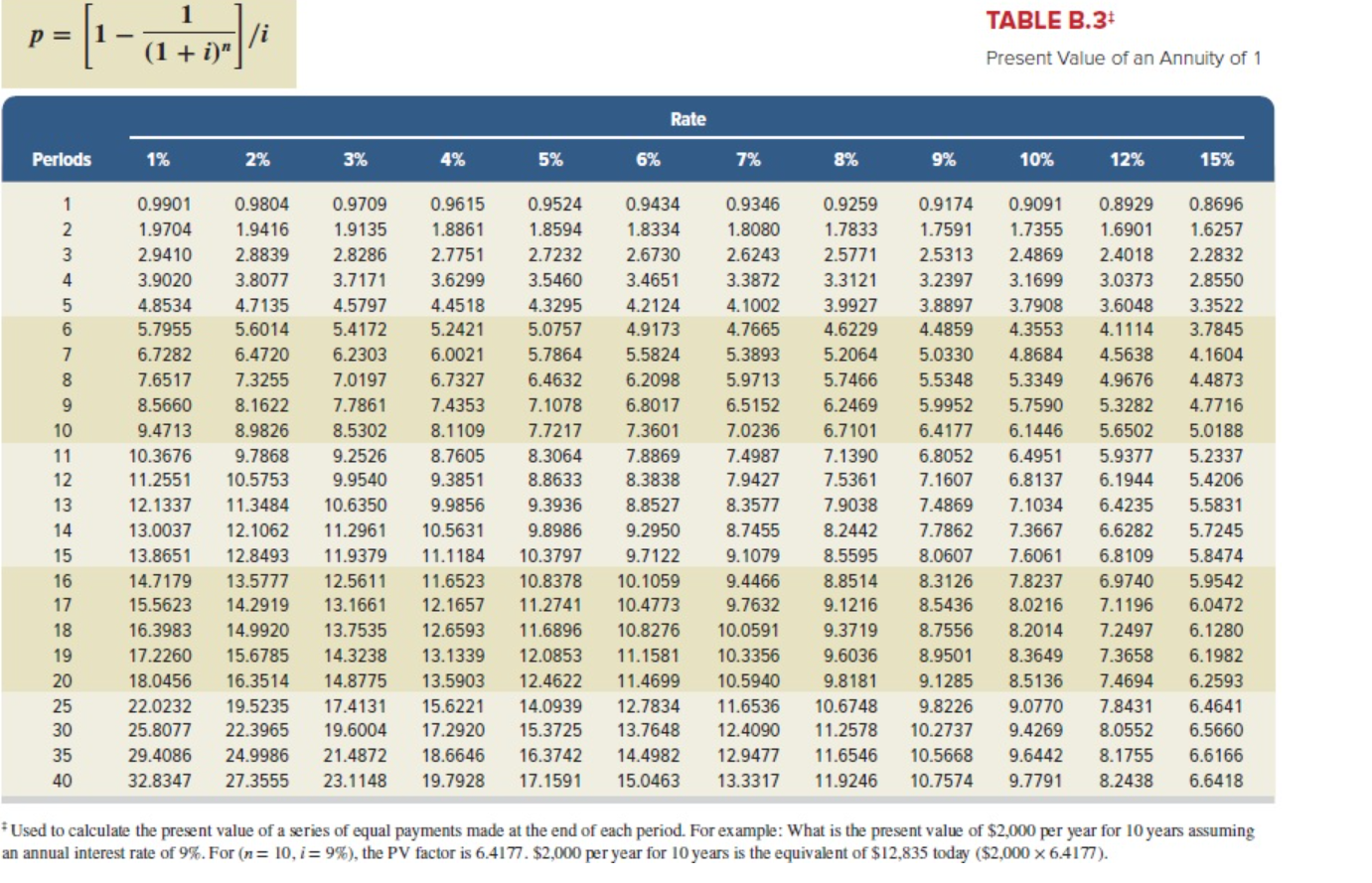

Required information [The following information applies to the questions displayed below.) Park Co. is considering an investment that requires immediate payment of $29,160 and provides expected cash inflows of $9,600 annually for four years. Park Co. requires a 8% return on its investments. 1-a. What is the net present value of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) Select Chart Cash Flow Annual cash flow Amount * PV Factor = Present Value 3.3121 = $ Present Value of 1 Future Value of 1 Present Value of an Annuity of 1 Future Value of an Annuity of 1 1-b. Based on NPV alone, should Park Co. invest? Yes Select Chart Cash Flow Annual cash flow Amount * PV Factor = Present Value 3.3121 = $ Immediate cash outflows Net present value Present value of cash inflows Required information (The following information applies to the questions displayed below.] Park Co. is considering an investment that requires immediate payment of $29,160 and provides expected cash inflows of $9,600 annually for four years. Park Co. requires a 8% return on its investments. 1-a. What is the internal rate of return? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) Future Value factor Internal rate of return Present value factor 1-b. Based on its internal rate of return, should Park Co. make the investment? Yes p = 1 - - TABLE B.3 Present Value of an Annuity of 1 Rate Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% 0.9901 0.9804 0.9709 1.9704 1.9416 1.9135 2.9410 2.8839 2.8286 3.9020 3.8077 3.7171 4.8534 4.7135 4.5797 5.7955 5.6014 5.4172 6.7282 6.4720 6.2303 7.6517 7.3255 7.0197 8.5660 8.1622 7.7861 9.4713 8.9826 8.5302 10.3676 9.7868 9.2526 11.2551 10.5753 9.9540 12.1337 11.3484 10.6350 13.0037 12.1062 11.2961 13.8651 12.8493 11.9379 14.7179 13.5777 12.5611 15.5623 14.291913.1661 16.3983 14.9920 13.7535 17.2260 15.6785 14.3238 18.0456 16.3514 14.8775 22.0232 19.5235 17.4131 25.8077 22.3965 19.6004 29.4086 24.9986 21.4872 32.834727.3555 23.1148 0.9615 0.9524 0.9434 1.8861 1.8594 1.8334 2.7751 2.7232 2.6730 3.6299 3.5460 3.4651 4.4518 4.3295 4.2124 5.2421 5.0757 4.9173 6.0021 5.7864 5.5824 6.7327 6.4632 6.2098 7.4353 7.1078 6.8017 8.1109 7.7217 7.3601 8.7605 8.3064 7.8869 9.3851 8.8633 8.3838 9.9856 9.3936 8.8527 10.5631 9.8986 9.2950 11.1184 10.3797 9.7122 11.6523 10.8378 10.1059 12.1657 11.2741 10.4773 12.6593 11.6896 10.8276 13.1339 12.0853 11.1581 13.5903 15.6221 14.093912.7834 17.2920 15.3725 13.7648 18.664616.3742 14.4982 19.7928 17.1591 15.0463 0.9346 0.9259 1.8080 1.7833 2.6243 2.5771 3.3872 3.3121 4.1002 3.9927 4.7665 4.6229 5.3893 5.2064 5.9713 5.7466 6.5152 6.2469 7.0236 6.7101 7.4987 7.1390 7.9427 7.5361 8.3577 7.9038 8.7455 8.2442 9.1079 8.5595 9.4466 8.8514 9.76329.1216 10.0591 9 .3719 10.3356 9.6036 10.5940 9.8181 11.6536 10.6748 12.4090 11.2578 12.9477 11.6546 13.3317 11.9246 0.9174 0.9091 0.8929 1.7591 1.7355 1.6901 2.5313 2.4869 2.4018 3.2397 3.16993.0373 3.8897 3.7908 3.6048 4.4859 4.3553 4.1114 5.0330 4.8684 4.5638 5.5348 5.33494.9676 5.9952 5.7590 5.3282 6.4177 6.1446 5.6502 6.8052 6.4951 59377 5.9377 7.1607 6.8137 6.1944 7.48697.1034 6.4235 7.7862 7.3667 6.6282 8.0607 7.6061 6.8109 8.3126 7.8237 6.9740 8.54368.0216 7.1196 8.7556 8.2014 7.2497 8.9501 8.36497.3658 9.12858.5136 7.4694 9.8226 9.0770 7.8431 10.2737 9.42698.0552 10.5668 9.6442 8.1755 10.7574 9.77918.2438 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.2337 5.4206 5.5831 5.7245 5.8474 5.9542 6.0472 6.1280 6.1982 6.2593 6.4641 6.5660 6.6166 6.6418 40 *Used to calculate the present value of a series of equal payments made at the end of each period. For example: What is the present value of $2,000 per year for 10 years assuming an annual interest rate of 9%. For (n= 10,i = 9%), the PV factor is 6.4177. $2,000 per year for 10 years is the equivalent of $12,835 today ($2,000 X 6.4177)