This is all one question. Please help.

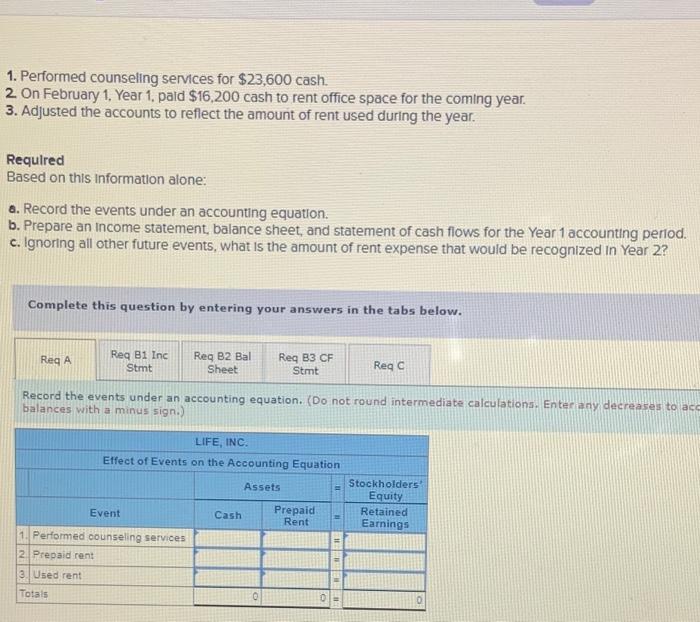

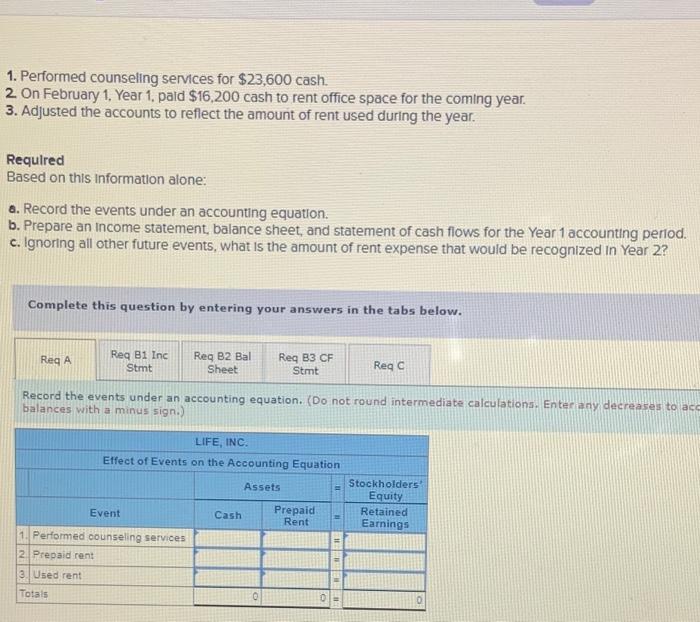

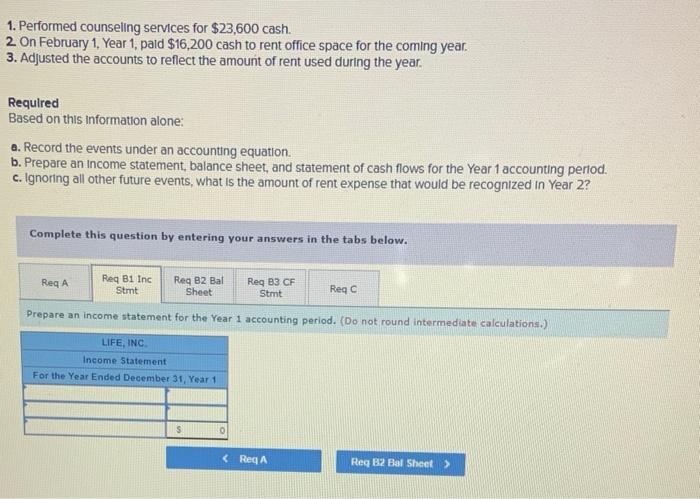

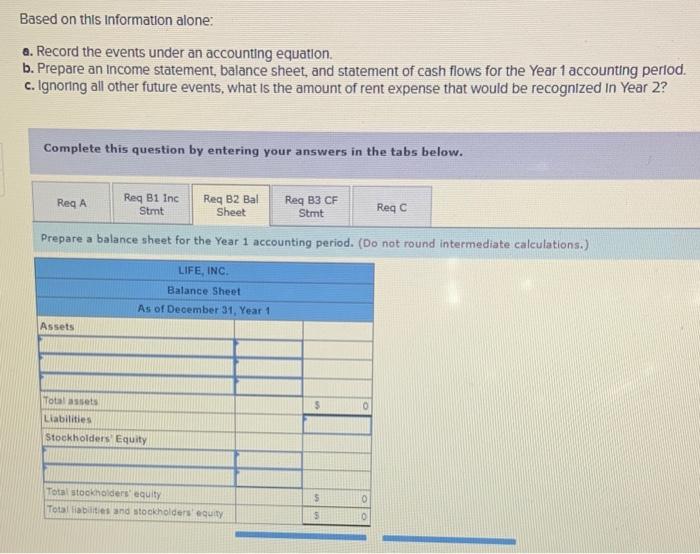

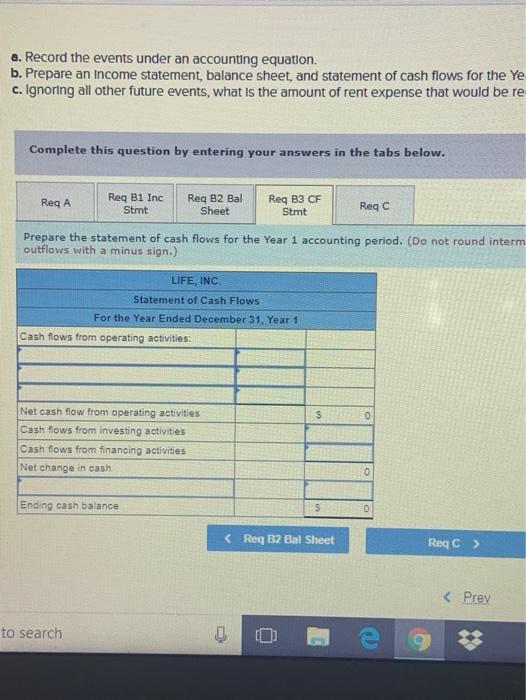

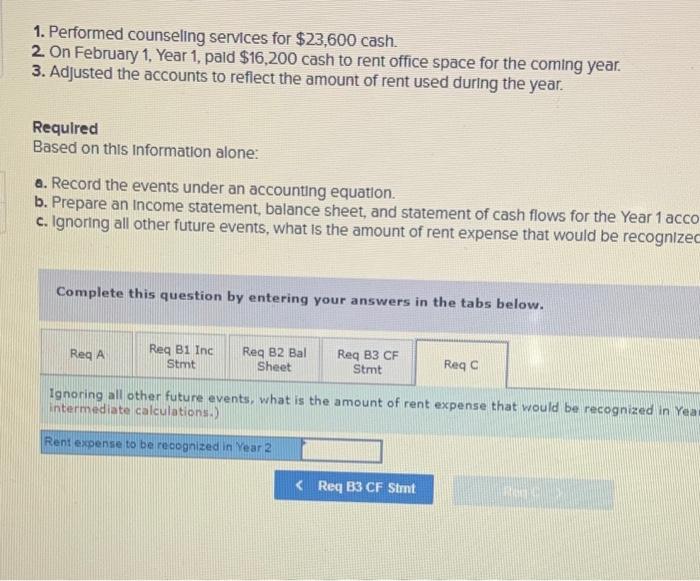

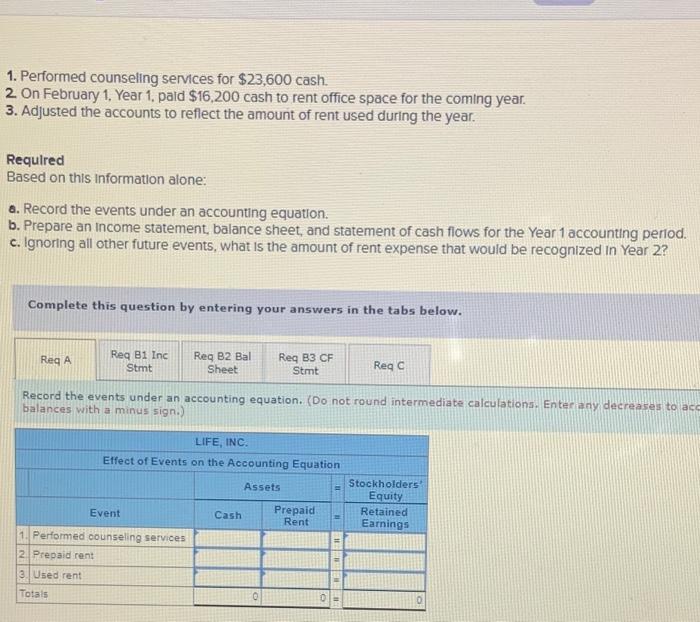

1. Performed counseling services for $23,600 cash. 2 On February 1, Year 1. paid $16,200 cash to rent office space for the coming year. 3. Adjusted the accounts to reflect the amount of rent used during the year. Required Based on this information alone: a. Record the events under an accounting equation. b. Prepare an Income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2? Complete this question by entering your answers in the tabs below. Reg A Reg Bi Inc Stmt Reg B2 Bal Sheet Reg B3 CF Stmt Reg C Record the events under an accounting equation. (Do not round intermediate calculations. Enter any decreases to acc balances with a minus sign.) LIFE, INC. Effect of Events on the Accounting Equation Assets Stockholders Equity Retained Earnings Event Prepaid Rent Cash 1. Performed counseling services 2. Prepaid rent 3.Used rent Totals 10 1. Performed counseling services for $23,600 cash. 2 On February 1, Year 1, paid $16,200 cash to rent office space for the coming year. 3. Adjusted the accounts to reflect the amount of rent used during the year. Required Based on this information alone: a. Record the events under an accounting equation. b. Prepare an Income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized in Year 2? Complete this question by entering your answers in the tabs below. Req A Req B1 Inc Stmt Reg B2 Bal Sheet Reg B3 CF Stmt Reqc Prepare an income statement for the Year 1 accounting period. (Do not round intermediate calculations.) LIFE, INC Income Statement For the Year Ended December 31, Year 1 S 0 Based on this information alone: a. Record the events under an accounting equation. b. Prepare an Income statement, balance sheet, and statement of cash flows for the Year 1 accounting period. c. Ignoring all other future events, what is the amount of rent expense that would be recognized In Year 2? Complete this question by entering your answers in the tabs below. ReqA Req B1 Inc Stmt Reg B2 Bal Sheet Req B3 CF Stmt ReqC Prepare a balance sheet for the Year 1 accounting period. (Do not round intermediate calculations.) LIFE, INC Balance Sheet As of December 31, Year 1 Assets 5 Totalt Liabilities Stockholders Equity Total stockholders' equity Total abilities and stockholders equity $ $ 0 a. Record the events under an accounting equation. b. Prepare an Income statement, balance sheet, and statement of cash flows for the Ye c. Ignoring all other future events, what is the amount of rent expense that would be re Complete this question by entering your answers in the tabs below. Req B1 Inc Req B2 Bal Req A Req B3 CF Stmt Sheet Reg C Stmt Prepare the statement of cash flows for the Year 1 accounting period. (Do not round interm outflows with a minus sign.) LIFE, INC Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flows from operating activities: $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash 0 Ending cash balance s 0