Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all part of 1 question bon von You Own abondays 120 in annual rest with a $1.000 a value in 10 year. You

This is all part of 1 question

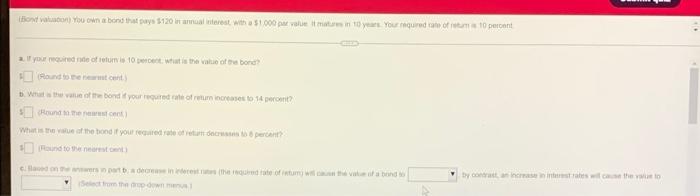

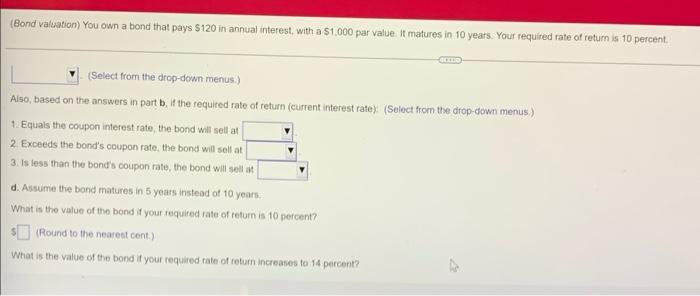

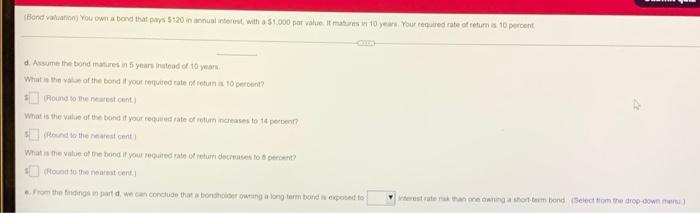

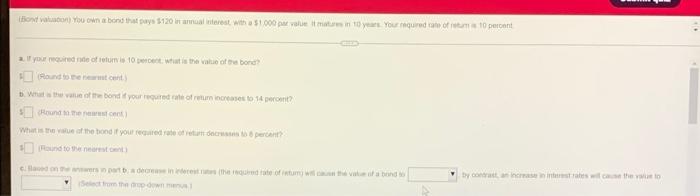

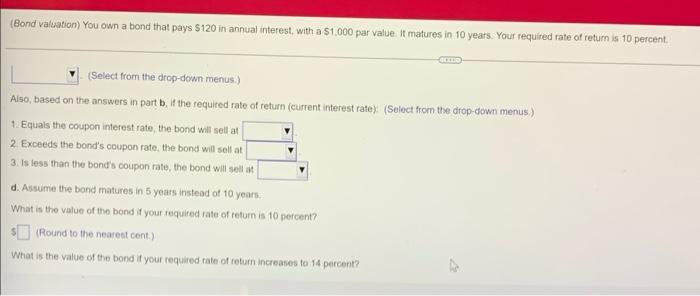

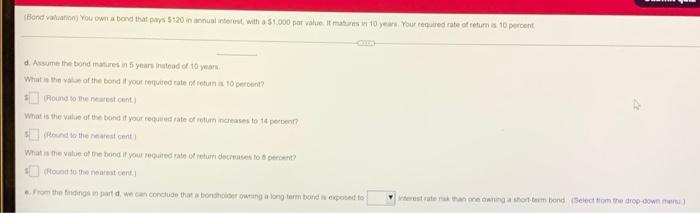

bon von You Own abondays 120 in annual rest with a $1.000 a value in 10 year. You quedat percent 2. If your credite of our 10 percent. What is the value of the bone ot Houd to be remont Wat is the value of the bond it your required to return increased to 14 percent Hunden What the value of the bondit your recreate or decertant and tot by contraste strated (Bond valuation) You own a bond that pays $120 in annual interest, with a $1,000 par value. It matures in 10 years. Your required rate of return is 10 percent (Select from the drop-down menus.) Also, based on the answers in part bit the required rate of return (current interest rate) (Select from the drop-down menus.) 1. Equals the coupon interest rate, the bond will sell at 2 Exceeds the bond's coupon rate, the bond will sell at 3. is less than the band's coupon rate, the bond will sell at d. Assume the bond matures in 5 years instead of 10 years. What is the value of the bond if your required rate of return is 10 percent? s(Round to the nearest cent.) What is the value of the bond if your required rate of return increases to 14 percent? Bond van You own abond that pays $120 art with a $1.000 par voie it 10 years Your recured rate of retums 10 percent d. Assume the bond matures in 5 years instead of 10 year What is the of the bond if you required to returns 10 percent? Pound to the nearest out What is the value of the bond if your request rate of returns to 14 per and to the reartcort What is the value of bond if your required to retum decreto per Round to the nearestent From the findings in partea conclude that bothering a long term bonds exposed to Verstraat in orbem bond Select from the dropdown

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started