This is all right just can't get the rest!

This is all right just can't get the rest!

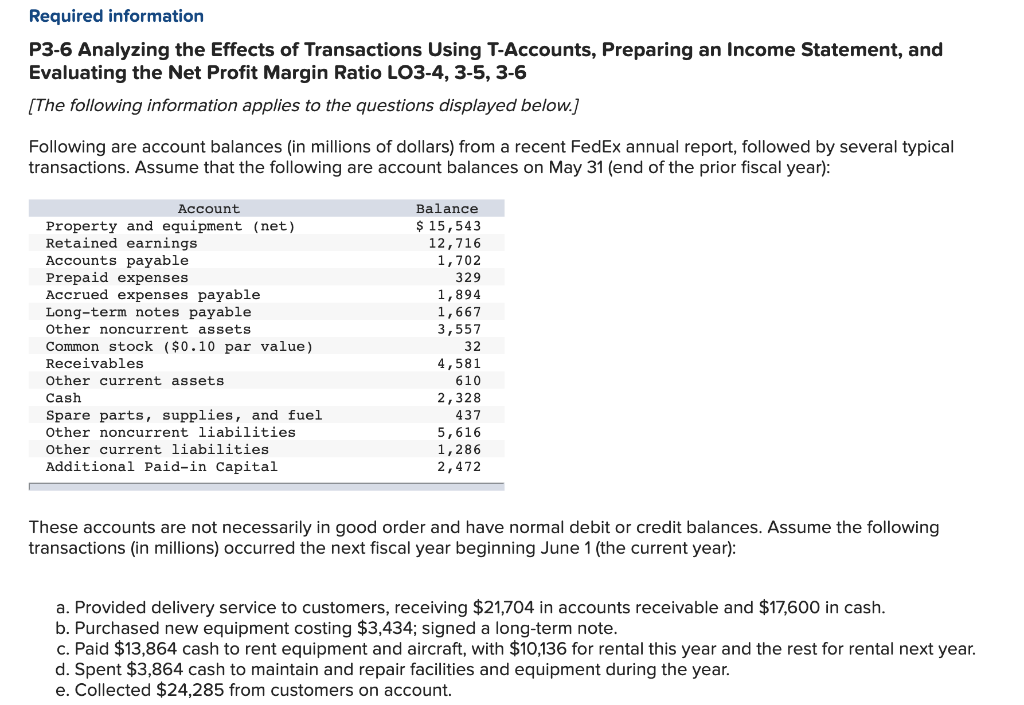

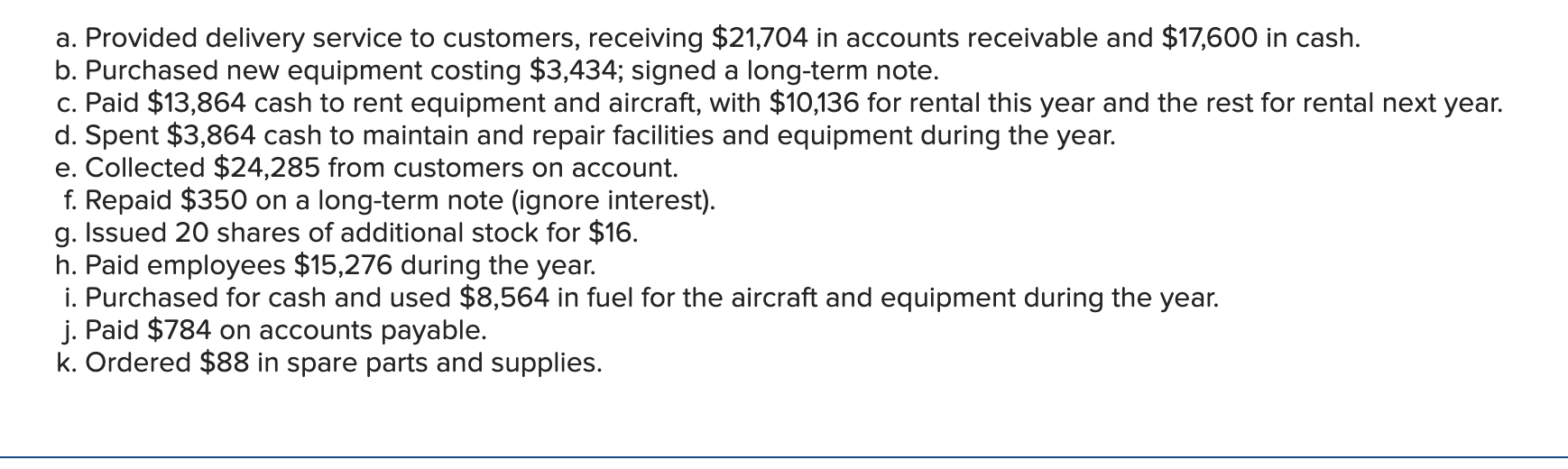

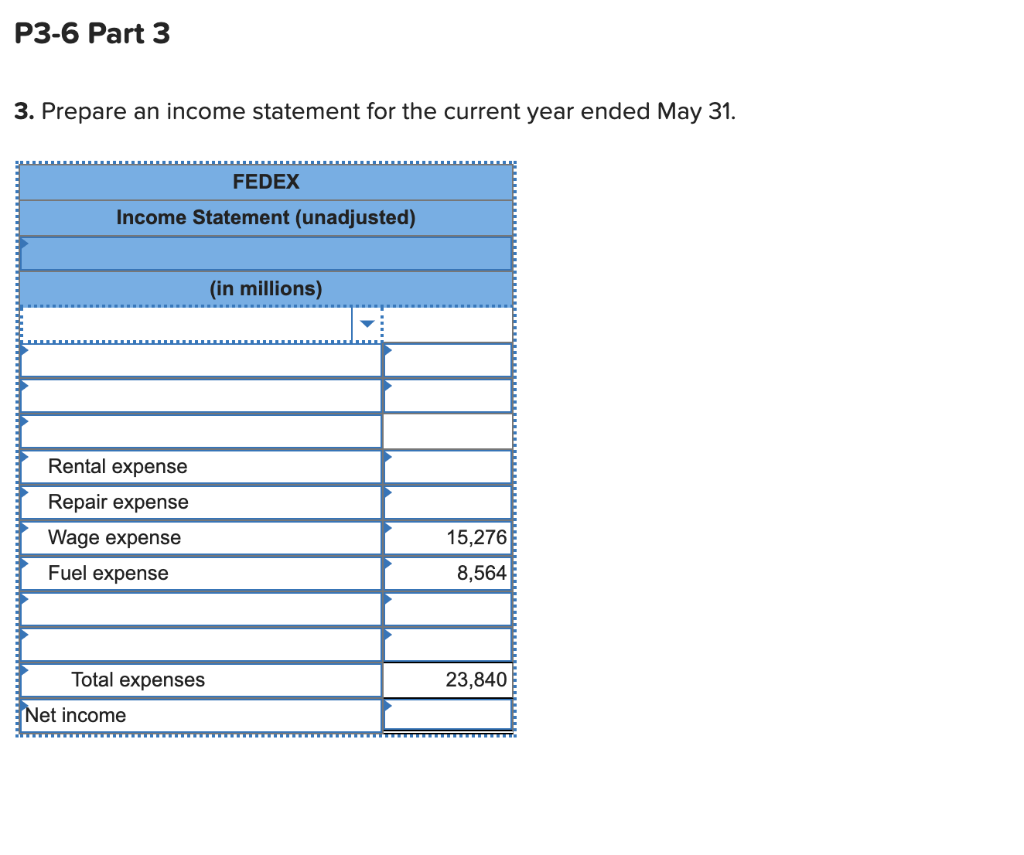

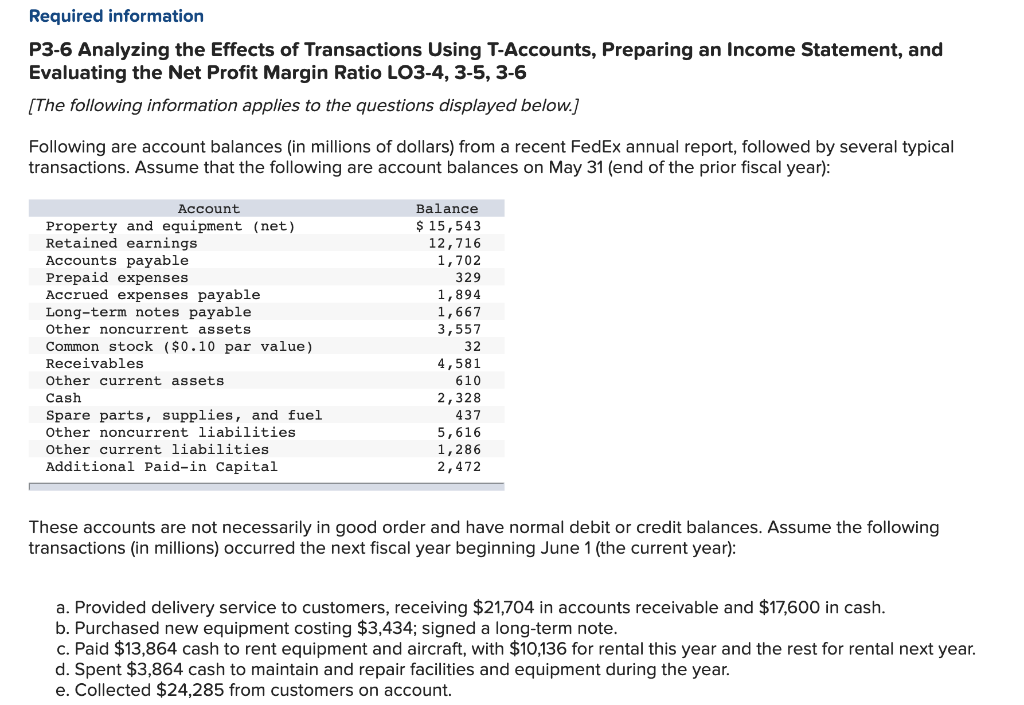

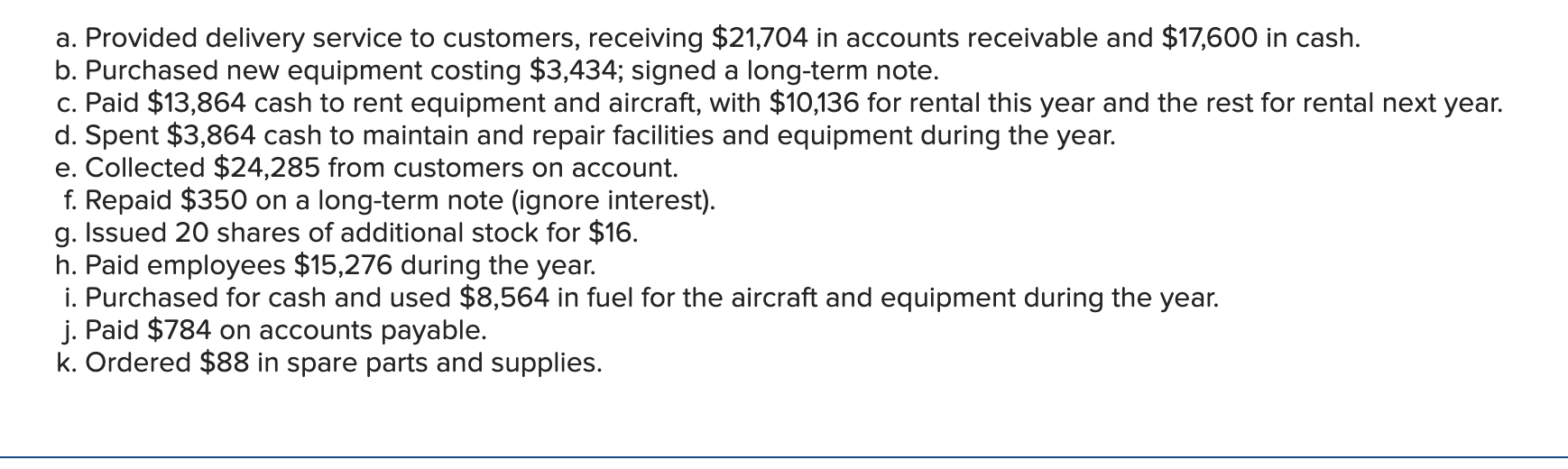

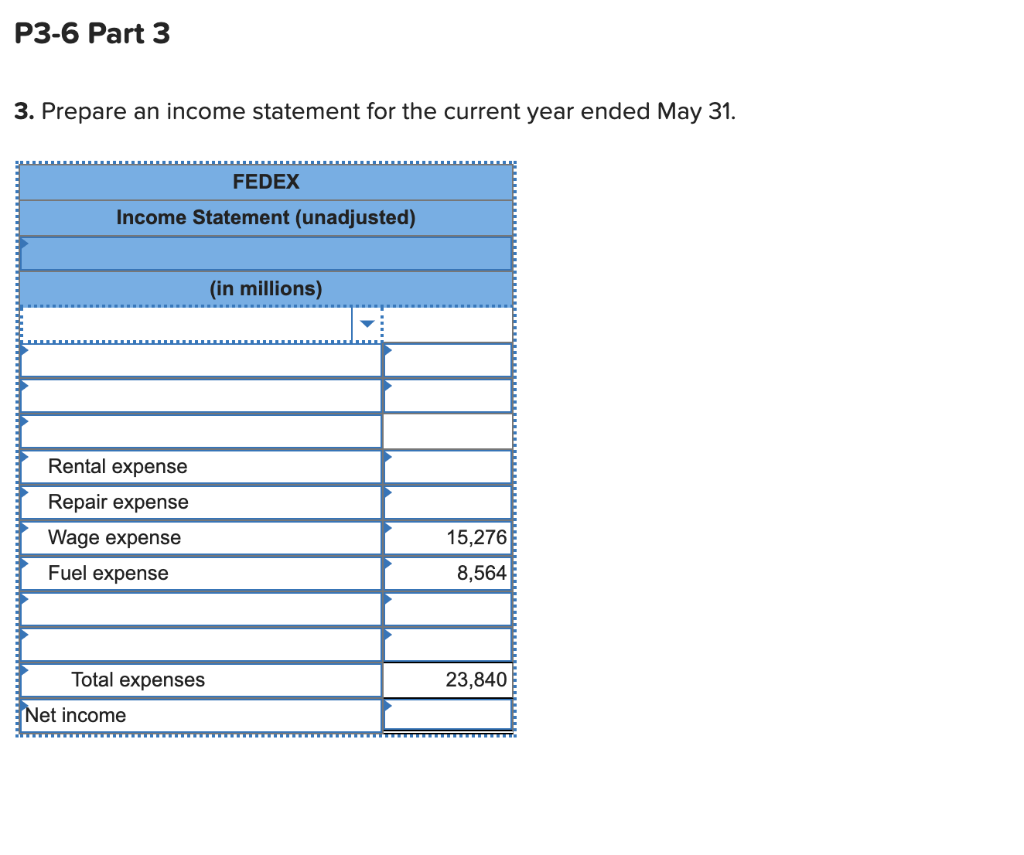

Required information P3-6 Analyzing the Effects of Transactions Using T-Accounts, Preparing an Income Statement, and Evaluating the Net Profit Margin Ratio LO3-4, 3-5, 3-6 [The following information applies to the questions displayed below.] Following are account balances (in millions of dollars) from a recent FedEx annual report, followed by several typical transactions. Assume that the following are account balances on May 31 (end of the prior fiscal year): Account Property and equipment (net) Retained earnings Accounts payable Prepaid expenses Accrued expenses payable Long-term notes payable Other noncurrent assets Common stock ($0.10 par value) Receivables Other current assets Cash Spare parts, supplies, and fuel Other noncurrent liabilities Other current liabilities Additional Paid-in Capital Balance $ 15,543 12,716 1,702 329 1,894 1,667 3,557 32 4,581 610 2,328 437 5,616 1,286 2,472 These accounts are not necessarily in good order and have normal debit or credit balances. Assume the following transactions (in millions) occurred the next fiscal year beginning June 1 (the current year): a. Provided delivery service to customers, receiving $21,704 in accounts receivable and $17,600 in cash. b. Purchased new equipment costing $3,434; signed a long-term note. c. Paid $13,864 cash to rent equipment and aircraft, with $10,136 for rental this year and the rest for rental next year. d. Spent $3,864 cash to maintain and repair facilities and equipment during the year. e. Collected $24,285 from customers on account. a. Provided delivery service to customers, receiving $21,704 in accounts receivable and $17,600 in cash. b. Purchased new equipment costing $3,434; signed a long-term note. c. Paid $13,864 cash to rent equipment and aircraft, with $10,136 for rental this year and the rest for rental next year. d. Spent $3,864 cash to maintain and repair facilities and equipment during the year. e. Collected $24,285 from customers on account. f. Repaid $350 on a long-term note (ignore interest). g. Issued 20 shares of additional stock for $16. h. Paid employees $15,276 during the year. i. Purchased for cash and used $8,564 in fuel for the aircraft and equipment during the year. j. Paid $784 on accounts payable. k. Ordered $88 in spare parts and supplies. P3-6 Part 3 3. Prepare an income statement for the current year ended May 31. FEDEX Income Statement (unadjusted) (in millions) Rental expense Repair expense Wage expense 15,276 8,564 Fuel expense Total expenses 23,840 Net income

This is all right just can't get the rest!

This is all right just can't get the rest!