Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the info I was given. 6. On January 1, 2020, the City of Conor leases a large piece of construction equipment with

This is all the info I was given.

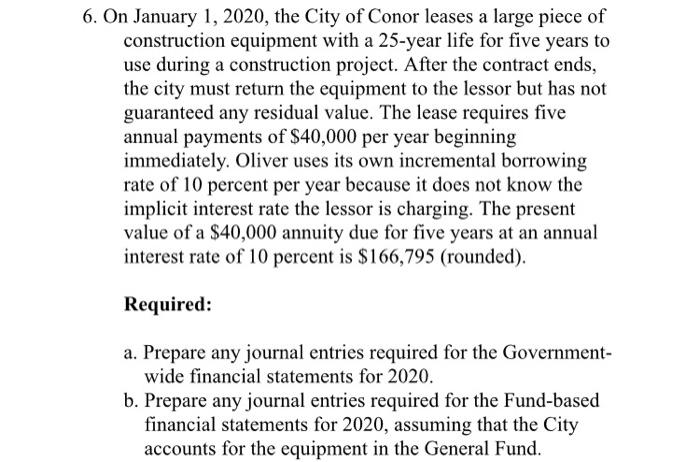

6. On January 1, 2020, the City of Conor leases a large piece of construction equipment with a 25-year life for five years to use during a construction project. After the contract ends, the city must return the equipment to the lessor but has not guaranteed any residual value. The lease requires five annual payments of $40,000 per year beginning immediately. Oliver uses its own incremental borrowing rate of 10 percent per year because it does not know the implicit interest rate the lessor is charging. The present value of a $40,000 annuity due for five years at an annual interest rate of 10 percent is $166,795 (rounded). Required: a. Prepare any journal entries required for the Government- wide financial statements for 2020. b. Prepare any journal entries required for the Fund-based financial statements for 2020, assuming that the City accounts for the equipment in the General Fund. 6. On January 1, 2020, the City of Conor leases a large piece of construction equipment with a 25-year life for five years to use during a construction project. After the contract ends, the city must return the equipment to the lessor but has not guaranteed any residual value. The lease requires five annual payments of $40,000 per year beginning immediately. Oliver uses its own incremental borrowing rate of 10 percent per year because it does not know the implicit interest rate the lessor is charging. The present value of a $40,000 annuity due for five years at an annual interest rate of 10 percent is $166,795 (rounded). Required: a. Prepare any journal entries required for the Government- wide financial statements for 2020. b. Prepare any journal entries required for the Fund-based financial statements for 2020, assuming that the City accounts for the equipment in the General FundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started