this is all the info provided for this question. please take best educated guess at solving even if its wrong. thank you!

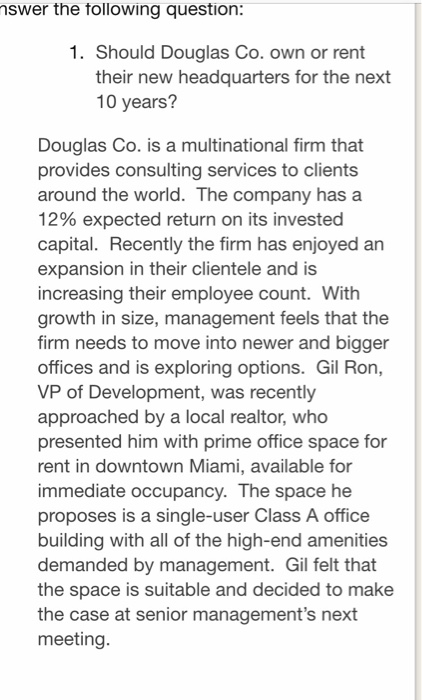

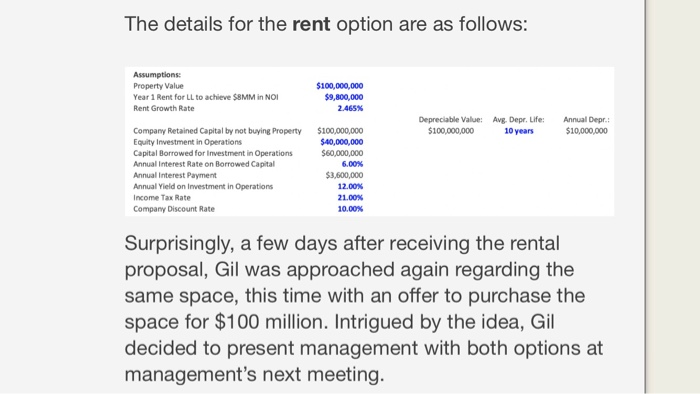

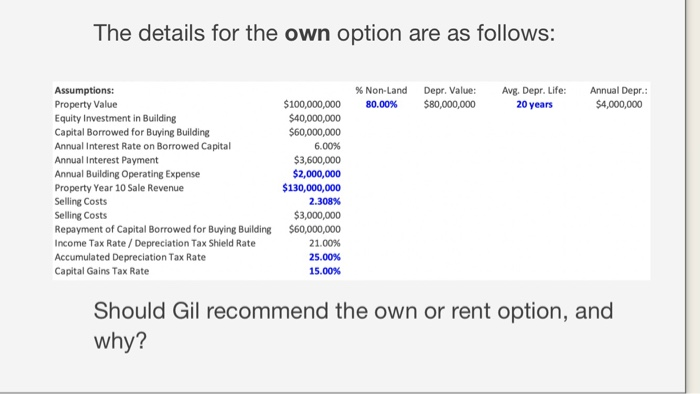

nswer the following question: 1. Should Douglas Co. own or rent their new headquarters for the next 10 years? Douglas Co. is a multinational firm that provides consulting services to clients around the world. The company has a 12% expected return on its invested capital. Recently the firm has enjoyed an expansion in their clientele and is increasing their employee count. With growth in size, management feels that the firm needs to move into newer and bigger offices and is exploring options. Gil Ron, VP of Development, was recently approached by a local realtor, who presented him with prime office space for rent in downtown Miami, available for immediate occupancy. The space he proposes is a single-user Class A office building with all of the high-end amenities demanded by management. Gil felt that the space is suitable and decided to make the case at senior management's next meeting. The details for the rent option are as follows: Assumptions Property Value Year 1 Rent for LL to achieve SSMM in NOI Rent Growth Rate $100,000,000 $9,800,000 2.465% Depreciable Value: Avg. Depr. Life: $100,000,000 10 years Annual Depr.: $10,000,000 Company Retained Capital by not buying Property Equity Investment in Operations Capital Borrowed for investment in Operations Annual Interest Rate on Borrowed Capital Annual interest Payment Annual Yield on Investment in Operations Income Tax Rate Company Discount Rate $100,000,000 $40,000,000 $60,000,000 6.00% $3,600,000 12.00% 21.00 10.00% Surprisingly, a few days after receiving the rental proposal, Gil was approached again regarding the same space, this time with an offer to purchase the space for $100 million. Intrigued by the idea, Gil decided to present management with both options at management's next meeting. The details for the own option are as follows: % Non-Land 80.00% Depr. Value: $80,000,000 Avg. Depr. Life: 20 years Annual Depr.: $4,000,000 Assumptions: Property Value Equity Investment in Building Capital Borrowed for Buying Building Annual Interest Rate on Borrowed Capital Annual Interest Payment Annual Building Operating Expense Property Year 10 Sale Revenue Selling Costs Selling Costs Repayment of Capital Borrowed for Buying Building Income Tax Rate / Depreciation Tax Shield Rate Accumulated Depreciation Tax Rate Capital Gains Tax Rate $100,000,000 $40,000,000 $60,000,000 6.00% $3,600,000 $2,000,000 $130,000,000 2.308% $3,000,000 $60,000,000 21.00% 25.00% 15.00% Should Gil recommend the own or rent option, and why