Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information about the question. Suppose the interest rate on Fed Funds is 0.1%. Yields on Treasury bonds with 1, 2, and

This is all the information about the question.

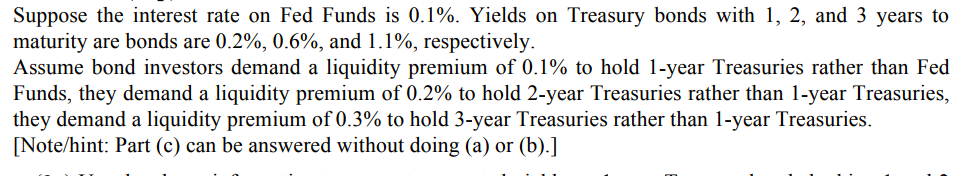

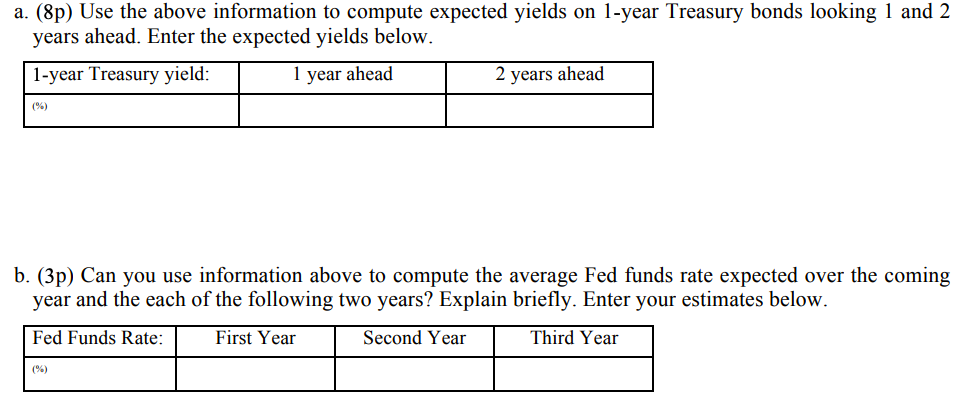

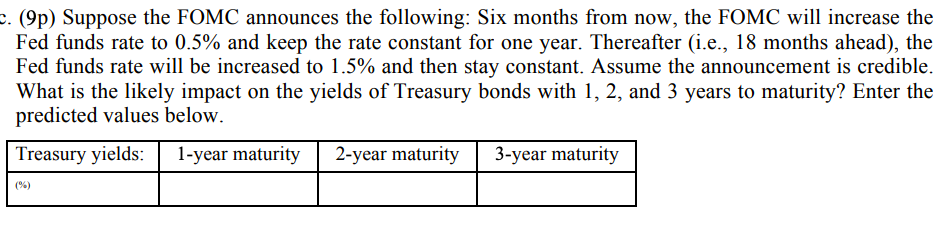

Suppose the interest rate on Fed Funds is 0.1%. Yields on Treasury bonds with 1, 2, and 3 years to maturity are bonds are 0.2%, 0.6%, and 1.1%, respectively. Assume bond investors demand a liquidity premium of 0.1% to hold 1-year Treasuries rather than Fed Funds, they demand a liquidity premium of 0.2% to hold 2-year Treasuries rather than 1-year Treasuries, they demand a liquidity premium of 0.3% to hold 3-year Treasuries rather than 1-year Treasuries. [Note/hint: Part (c) can be answered without doing (a) or (b).] a. (Sp) Use the above information to compute expected yields on 1-year Treasury bonds looking 1 and 2 years ahead. Enter the expected yields below. 1-year Treasury yield: 1 year ahead 2 years ahead (%) b. (3p) Can you use information above to compute the average Fed funds rate expected over the coming year and the each of the following two years? Explain briefly. Enter your estimates below. Fed Funds Rate: First Year Second Year Third Year (%) c. (p) Suppose the FOMC announces the following: Six months from now, the FOMC will increase the Fed funds rate to 0.5% and keep the rate constant for one year. Thereafter (i.e., 18 months ahead), the Fed funds rate will be increased to 1.5% and then stay constant. Assume the announcement is credible. What is the likely impact on the yields of Treasury bonds with 1, 2, and 3 years to maturity? Enter the predicted values below. Treasury yields: 1-year maturity 2-year maturity 3-year maturity (%) Suppose the interest rate on Fed Funds is 0.1%. Yields on Treasury bonds with 1, 2, and 3 years to maturity are bonds are 0.2%, 0.6%, and 1.1%, respectively. Assume bond investors demand a liquidity premium of 0.1% to hold 1-year Treasuries rather than Fed Funds, they demand a liquidity premium of 0.2% to hold 2-year Treasuries rather than 1-year Treasuries, they demand a liquidity premium of 0.3% to hold 3-year Treasuries rather than 1-year Treasuries. [Note/hint: Part (c) can be answered without doing (a) or (b).] a. (Sp) Use the above information to compute expected yields on 1-year Treasury bonds looking 1 and 2 years ahead. Enter the expected yields below. 1-year Treasury yield: 1 year ahead 2 years ahead (%) b. (3p) Can you use information above to compute the average Fed funds rate expected over the coming year and the each of the following two years? Explain briefly. Enter your estimates below. Fed Funds Rate: First Year Second Year Third Year (%) c. (p) Suppose the FOMC announces the following: Six months from now, the FOMC will increase the Fed funds rate to 0.5% and keep the rate constant for one year. Thereafter (i.e., 18 months ahead), the Fed funds rate will be increased to 1.5% and then stay constant. Assume the announcement is credible. What is the likely impact on the yields of Treasury bonds with 1, 2, and 3 years to maturity? Enter the predicted values below. Treasury yields: 1-year maturity 2-year maturity 3-year maturity (%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started