Answered step by step

Verified Expert Solution

Question

1 Approved Answer

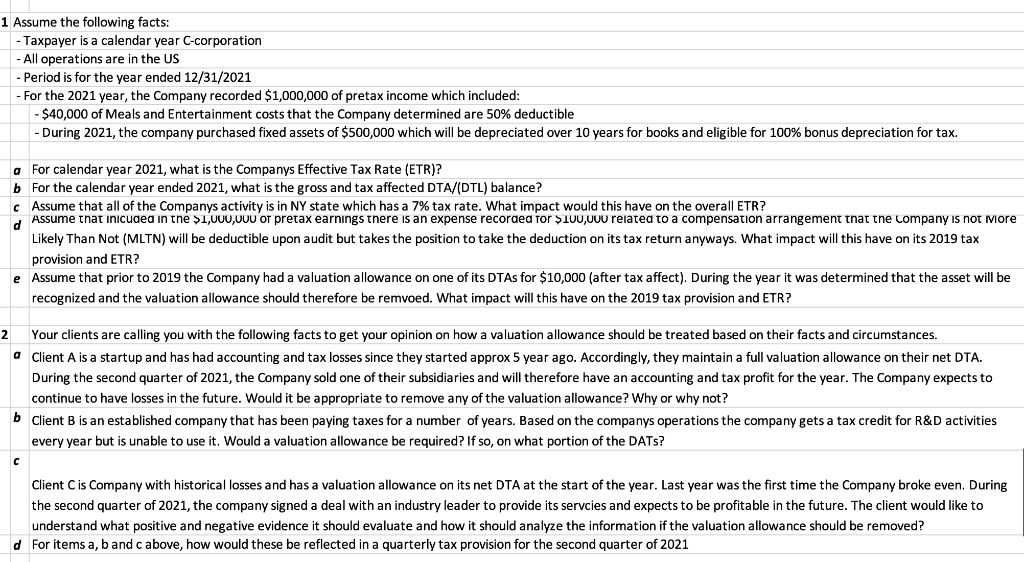

this is all the information given 1 Assume the following facts: - Taxpayer is a calendar year C-corporation - All operations are in the US

this is all the information given

1 Assume the following facts: - Taxpayer is a calendar year C-corporation - All operations are in the US - Period is for the year ended 12/31/2021 - For the 2021 year, the Company recorded $1,000,000 of pretax income which included: - $40,000 of Meals and Entertainment costs that the Company determined are 50% deductible - During 2021, the company purchased fixed assets of $500,000 which will be depreciated over 10 years for books and eligible for 100% bonus depreciation for tax. a For calendar year 2021, what is the Companys Effective Tax Rate (ETR)? b For the calendar year ended 2021, what is the gross and tax affected DTA/(DTL) balance? Assume that all of the Companys activity is in NY state which has a 7% tax rate. What impact would this have on the overall ETR? Assume that inicuded in the $1,000,000 or pretax earnings there is an expense recordea for $100,000 related to a compensation arrangement that the company is not more Likely Than Not (MLTN) will be deductible upon audit but takes the position to take the deduction on its tax return anyways. What impact will this have on its 2019 tax provision and ETR? e Assume that prior to 2019 the Company had a valuation allowance on one of its DTAs for $10,000 (after tax affect). During the year it was determined that the asset will be recognized and the valuation allowance should therefore be remvoed. What impact will this have on the 2019 tax provision and ETR? 2 Your clients are calling you with the following facts to get your opinion on how valuation allowance should be treated based on their facts and circumstances. a Client A is a startup and has had accounting and tax losses since they started approx 5 year ago. Accordingly, they maintain a full valuation allowance on their net DTA. During the second quarter of 2021, the Company sold one of their subsidiaries and will therefore have an accounting and tax profit for the year. The Company expects to continue to have losses in the future. Would it be appropriate to remove any of the valuation allowance? Why or why not? b Client B is an established company that has been paying taxes for a number of years. Based on the companys operations the company gets a tax credit for R&D activities every year but is unable to use it. Would a valuation allowance be required? If so, on what portion of the DATS? Client Cis Company with historical losses and has a valuation allowance on its net DTA at the start of the year. Last year was the first time the Company broke even. During the second quarter of 2021, the company signed a deal with an industry leader to provide its servcies and expects to be profitable in the future. The client would like to understand what positive and negative evidence it should evaluate and how it should analyze the information if the valuation allowance should be removed? d For items a, b and c above, how would these be reflected in a quarterly tax provision for the second quarter of 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started