Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all the information given USE THE INFORMATION ON THE FOLLOWING PAGES TO CALCULATE THE TWO VALUATIONS. TYPE YOUR ANSWERS BELOW AND RESPOND TO

this is all the information given

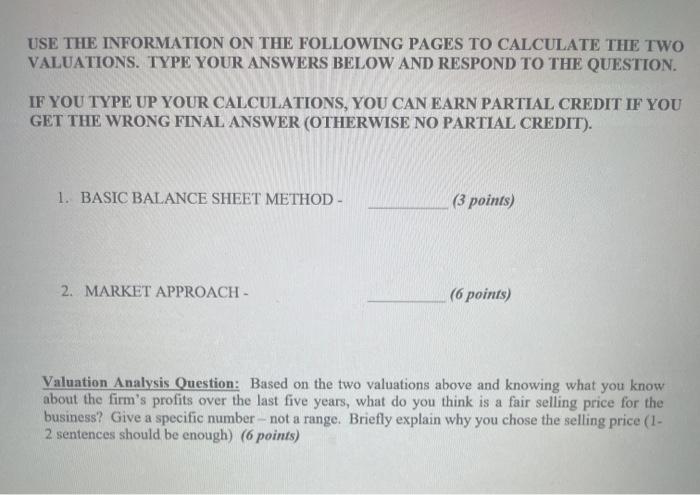

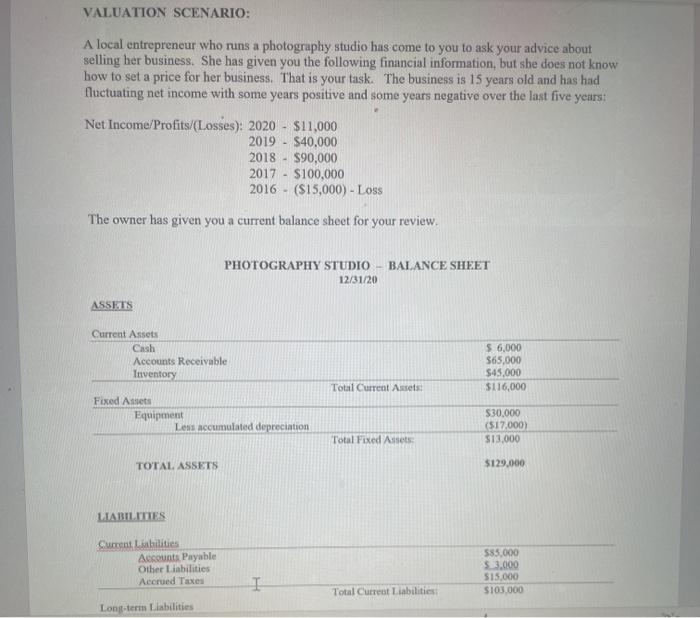

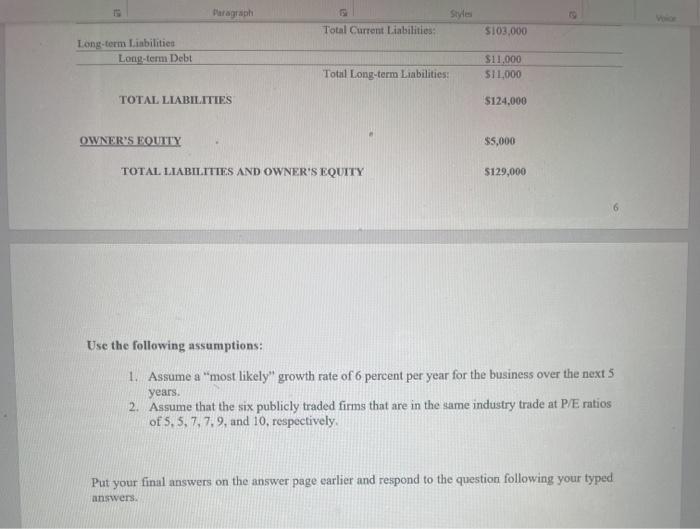

USE THE INFORMATION ON THE FOLLOWING PAGES TO CALCULATE THE TWO VALUATIONS. TYPE YOUR ANSWERS BELOW AND RESPOND TO THE QUESTION. IF YOU TYPE UP YOUR CALCULATIONS, YOU CAN EARN PARTIAL CREDIT IF YOU GET THE WRONG FINAL ANSWER (OTHERWISE NO PARTIAL CREDIT). 1. BASIC BALANCE SHEET METHOD - (3 points) 2. MARKET APPROACH - (6 points) Valuation Analysis Question: Based on the two valuations above and knowing what you know about the firm's profits over the last five years, what do you think is a fair selling price for the business? Give a specific number - not a range. Briefly explain why you chose the selling price (1- 2 sentences should be enough) (6 points) VALUATION SCENARIO: A local entrepreneur who runs a photography studio has come to you to ask your advice about selling her business. She has given you the following financial information, but she does not know how to set a price for her business. That is your task. The business is 15 years old and has had fluctuating net income with some years positive and some years negative over the last five years: Net Income/Profits/(Losses): 2020 - $11,000 2019 - $40,000 2018 - $90,000 2017 - $100,000 2016 - ($15,000) - Loss The owner has given you a current balance sheet for your review. BALANCE SHEET PHOTOGRAPHY STUDIO 12/31/20 ASSETS Current Assets Cash Accounts Receivable Inventory $ 6,000 $65.000 $45.000 $116,000 Total Current Assets Fixed Assets Equipment Less accumulated depreciation $30,000 (517.000) $13,000 Total Fixed Assets TOTAL ASSETS $129.000 LIABILITIES Current Liabilities Accounts Payable Other Libilities Accrued Taxes 585,000 53,000 $15.000 S103.000 Total Current Liabilities Long-term Liabilities Paragraph Styles Total Current Liabilities: S103.000 Long-term Liabilities Long-term Debt $11,000 $11,000 Total Long-term Liabilities: TOTAL LIABILITIES $124.000 OWNER'S EQUITY $5,000 TOTAL LIABILITIES AND OWNER'S EQUITY $129,000 Use the following assumptions: 1. Assume a "most likely" growth rate of 6 percent per year for the business over the next 5 years. 2. Assume that the six publicly traded firms that are in the same industry trade at P/E ratios of 5,5,7,7,9, and 10. respectively, Put your final answers on the answer page earlier and respond to the question following your typed answers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started