Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THIS IS ALL THE INFORMATION I AM GIVEN. I cannot give any additional information because I have none. You can see in the image that

THIS IS ALL THE INFORMATION I AM GIVEN. I cannot give any additional information because I have none. You can see in the image that there is nothing else to the problem.

THIS IS ALL THE INFORMATION I AM GIVEN.

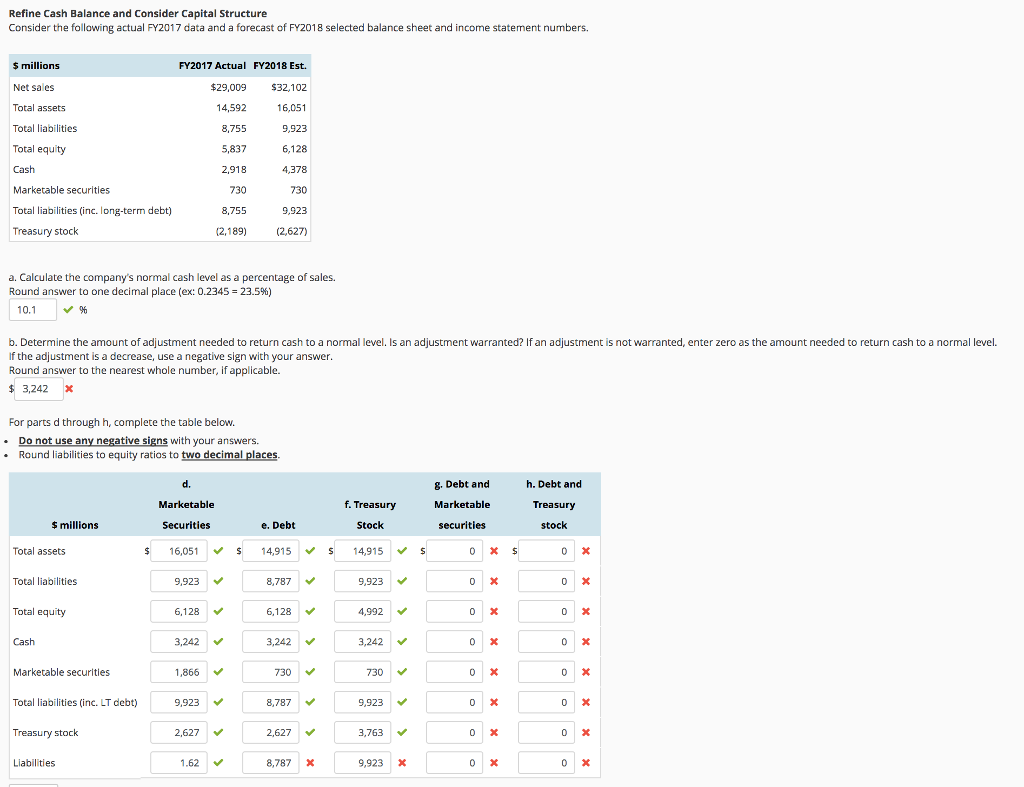

Refine Cash Balance and Consider Capital Structure Consider the following actual FY2017 data and a forecast of FY2018 selected balance sheet and income statement numbers. $ millions Net sales Total assets Total liabilities Total equity Cash Marketable securities Total liabilities (inc. long-term debt) Treasury stock FY2017 Actual FY2018 Est 32,102 16,051 9,923 6,128 4,378 730 9,923 (2,627) $29,009 14,592 8,755 5,837 2,918 730 8,755 (2,189) a. Calculate the company's normal cash level as a percentage of sales. Round answer to one decimal place (ex: 0.2345-23.5%) 10.1 b. Determine the amount of adjustment needed to return cash to a normal level. Is an adjustment warranted? If an adjustment is not warranted, enter zero as the amount needed to return cash to a normal level If the adjustment is a decrease, use a negative sign with your answer Round answer to the nearest whole number, if applicable. 3,242 X For parts d through h, complete the table below. .Do not use any negative signs with your answers. Round liabilities to equity ratios to two decimal places d. Marketable Securities g. Debt and Marketable securities h. Debt and Treasury stock f. Treasury s millions e. Debt Stock Total assets $16,05114,915 S14,915 Total liabilities 9,923 6,128 3,242 8,787 9,923 4,992 3,242 730 9,923 3,763 Total equity 6,128 Cash 3,242 730 8,787 Marketable securities 1,866 Total liabilities (inc. LT debt) 9,923 Treasury stock 2,627 2,627 Liabilities 1.62 8,787 9,923 XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started